By Keith Black, Ph.D., CAIA, CFA, FDP, Managing Director/Program Director of FDP Institute.

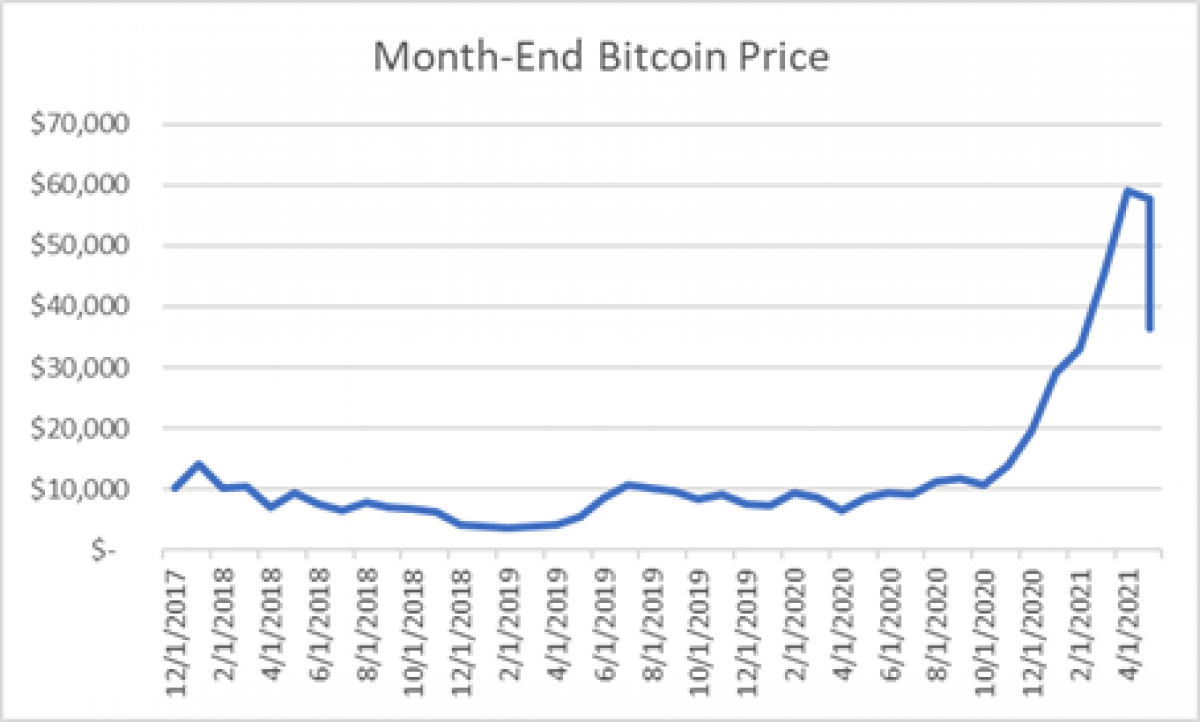

While many speculators and tech/crypto entrepreneurs may have most or all of their financial assets in cryptocurrencies, most investors are advised to invest a small portion of their asset allocation into digital assets. A 2020 study by Bitwise notes that, assuming quarterly rebalancing, adding between 1% and 2.5% Bitcoin (BTC) to a portfolio of 60% stocks and 40% bonds from 2014 to March 2020 added 1% to 2.3% to annual returns without a significant increase in portfolio volatility or drawdown. Over that time period, the price of BTC rose from $755 to $6,479, with a high price during that period of $19,397. An allocation of over 5% allows the high volatility of BTC to overwhelm the rest of the portfolio and substantially increase volatility and drawdown statistics.

Adding BTC to a Stock and Bond Portfolio

|

Volatile Assets and Diversification Return

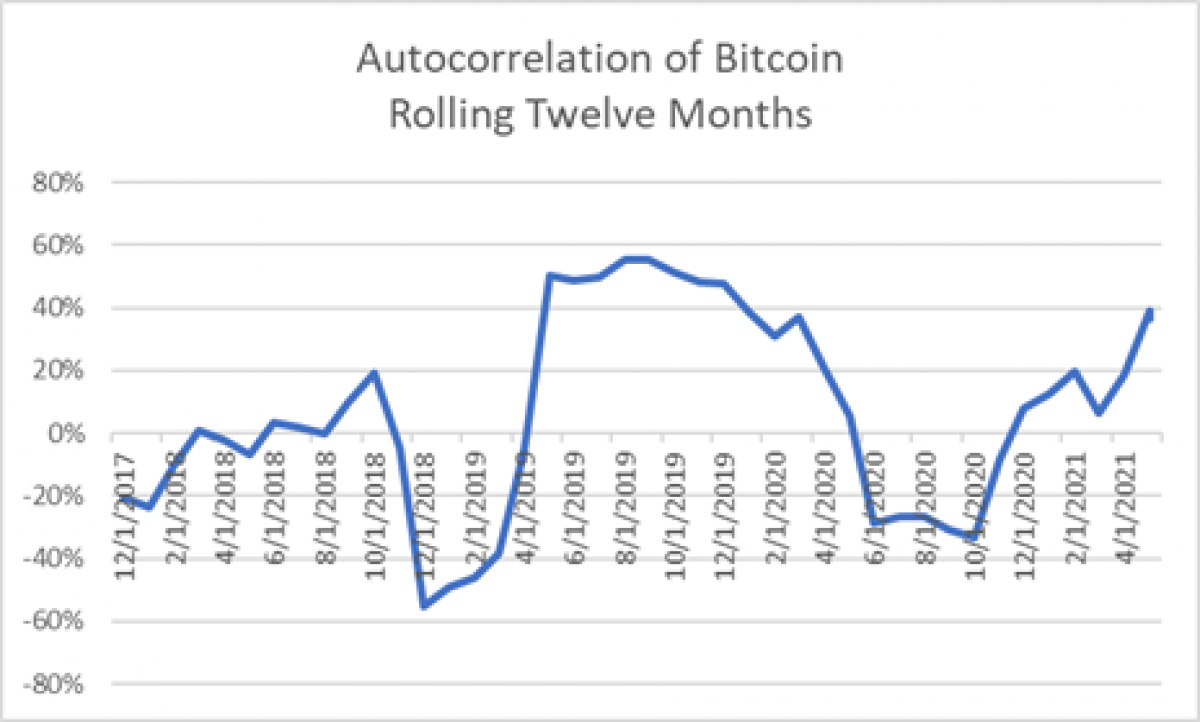

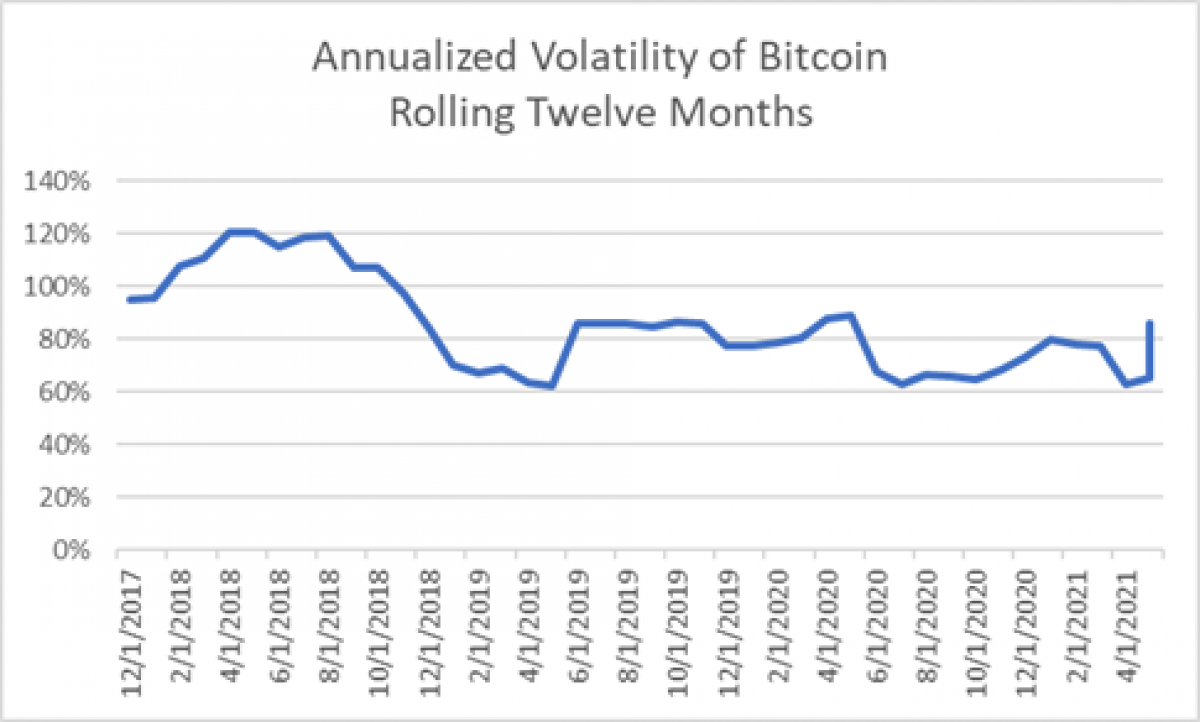

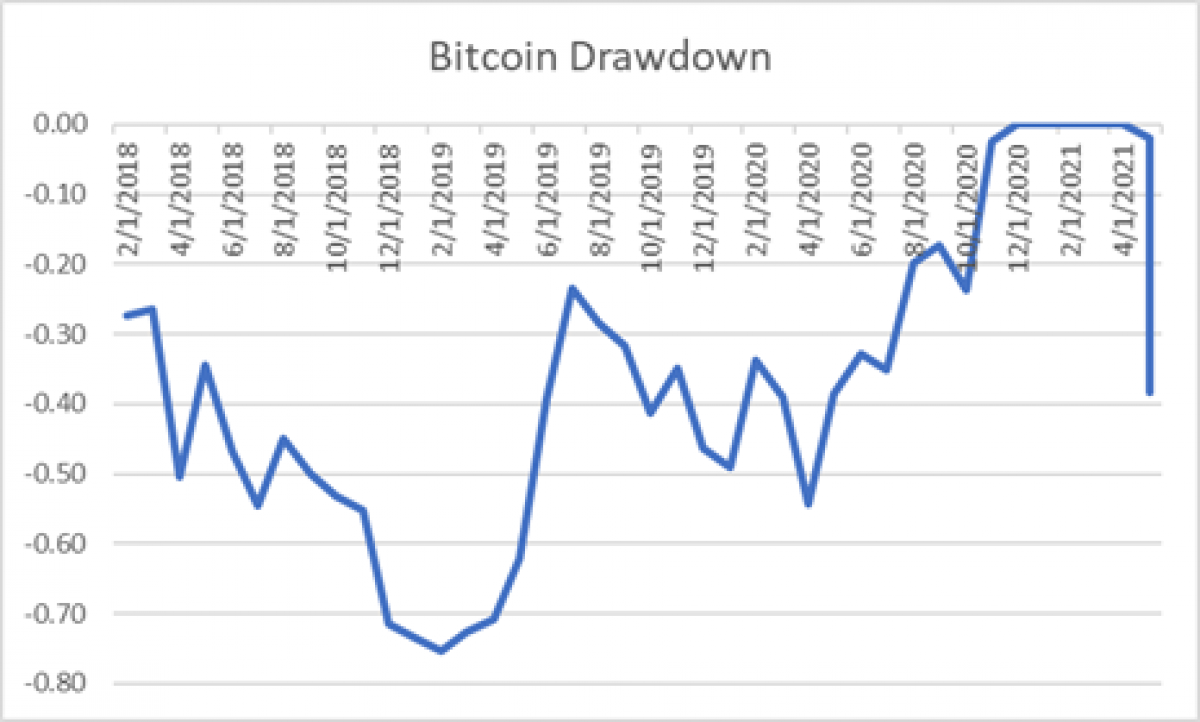

When assets steadily rise in value without significant price drawdowns, it is better for investors to buy-and-hold. When assets are mean reverting, they may have a high volatility of prices, but often return to a specific, or mean, price level. When autocorrelation is negative, asset prices are mean reverting, while prices are trending when autocorrelation is positive. The exhibits show that Bitcoin has a high volatility of prices with at least five drawdowns exceeding 30% since 2017 and has experienced strong periods of mean reversion. Annualized volatility of monthly BTC prices is often 60% to over 100%, while daily volatility is significantly higher. To the extent that digital asset prices have a low correlation to stock and bond holdings in the portfolio, diversification may be even stronger.

Diversification return is the excess return earned when investors regularly rebalance holdings in highly volatile assets, especially when the volatile asset has a low correlation of returns to other assets in the portfolio. Rebalancing is accomplished by selling a portion of the assets in the portfolio that have outperformed and by buying a portion of the assets in the portfolio that have underperformed. Regularly returning a specific asset to a specific allocation, such as 1% to Bitcoin, can add value to the portfolio while reducing the risk that any specific allocation achieves an undesirably large weight in the portfolio. More frequent rebalancing adds value when assets are volatile and mean reverting, while less frequent rebalancing or buy-and-hold investing will add value when assets have low volatility or continue to make new highs without significant price drawdowns.

Bitwise notes that, due to the high volatility of BTC and its low correlation to traditional assets, frequent rebalancing has added substantial value to a stock and bond portfolio.

Investors who added 2.5% BTC to a 60/40 portfolio at its high price of $19,397 in December 2017 and aggressively rebalanced that position until BTC reached $6,479 in March 2020 saw an increase in portfolio return and Sharpe ratio, even in a time when the price of BTC fell by two-thirds. For a more recent example of volatility and rebalancing opportunity, we note that BTC traded at $52,000, $63,000, $48,000, $58,000, $33,000, and $40,000 in that order between March 25 and June 14, 2021.

In summary, adding a volatile asset class that is relatively uncorrelated to other major asset classes has proved beneficial for investors but future performance characteristics will depend on the relative influence of momentum (trend) and mean reversion (when the trend changes direction).

About the Author:

Keith Black has over thirty years of financial market experience, serving approximately half of that time as an academic and half as a trader and consultant to institutional investors.

He currently serves as Managing Director and Program Director for the FDP Institute. Prior to joining the FDP Institute, Keith served as Managing Director of Content Strategy for the CAIA Association, and previously at Ennis Knupp + Associates, Keith advised foundations, endowments and pension funds on their asset allocation and manager selection strategies in hedge funds, commodities, and managed futures. Prior experience includes commodities derivatives trading, stock options research and Cboe floor trading, and building quantitative stock selection models for mutual funds and hedge funds. Dr. Black previously served as an assistant professor and senior lecturer at the Illinois Institute of Technology.

He has contributed to the CFA Digest, and has published in The Journal of Wealth Management, The Journal of Trading, The Journal of Investing, and The Journal of Alternative Investments, among others. He is the author of the book “Managing a Hedge Fund,” as well as co-author of the second, third, and fourth editions of the CAIA Level I and Level II curriculum. Dr. Black was named to the Institutional Investor magazine’s list of “Rising Stars of Hedge Funds” in 2010.

Dr. Black earned a BA from Whittier College, an MBA from Carnegie Mellon University, and a PhD from the Illinois Institute of Technology.

He has earned the Chartered Financial Analyst (CFA) designation and was a member of the inaugural class of both CAIA and FDP members.