By Keith Black, Ph.D., CAIA, CFA, FDP, Managing Director/Program Director of FDP Institute.

While the prices of digital assets change on a daily basis, at the time of this writing, the universe had a market capitalization of $1.6 trillion. That includes approximately $670 billion in Bitcoin (BTC, at $35,000), $315 billion in Ether (ETH, at $2,660), and $66 billion in top decentralized finance (DeFi) tokens such as Chainlink, Uniswap, Aave, and Synthetix. Coinmarketcap.com tracks the market capitalization of over 10,000 cryptos in real-time, with a market cap of about $600 billion for all cryptos beyond the six named here. Bitcoin dominance is at 41% of the market cap of all crypto assets, 19% in Ether, leaving 40% of the value in the other 10,000 assets. 75 digital assets have market capitalizations exceeding $1 billion and approximately 300 have a valuation over $100 million. Thousands of these digital assets are likely to have zero value in the long run, so due diligence on each investment is important.

The valuation of digital assets is highly uncertain. While some people think the entire space is worth nothing and others think it is worth trillions more than the current market cap, the annualized price volatility exceeding 100% on many digital assets shows the continued ambiguity of valuation. Some liken bitcoin to digital gold and compare its role as a store of value to the $9.3 trillion market capitalization of yellow metal (at $1,800 per ounce).

DeFi tokens are building new protocols for borrowing and lending as well as options and futures trading on digital assets. Centralized and decentralized exchanges are building large businesses facilitating the trading of digital assets. If the DeFi sector can build a substantial financial business, perhaps the sector might reach or exceed the market capitalization of a large bank, such as JP Morgan ($430 billion at $140 per share).

While some financial market participants think that the magical Internet money has no value, others are starting to use traditional market metrics to value the space. Using the trailing twelve-month revenue to miners, stakers, and liquidity providers, many of these crypto-assets have annual revenues exceeding $200 million. In the last year, bitcoin miners had revenues above $1.1 billion, fees paid on the Ethereum blockchain exceeded $4 billion, while the decentralized exchanges of Sushiswap and Uniswap had combined revenue of over $1 billion. Using a price-to-sales multiple, some believe that these projects are indeed worth billions of market capitalization. With revenues on some of these projects growing above 100% per quarter, Compound, Aave, Uniswap, and Sushiswap recently traded at 3 to 13 times trailing four-quarter revenues.

Trailing Twelve Month Revenue to Miners, Stakers, and Liquidity Providers, May 2021

Source: TokenTerminal.com

Digital Assets as Alternative Businesses

Beyond the digital assets specifically focused on building an alternative financial ecosystem, some digital assets track the performance and value of real-world businesses. These may be viewed as publicly traded venture capital investments in those operating businesses. Basic Attention Token ($1 billion market cap) is awarded to users of the Brave web browser, which competes with Google Chrome by enhancing privacy and paying Internet users to view advertisements. Filecoin tokens ($5.3 billion) are paid by users of globally distributed cloud storage, competing with Amazon Web Services and Microsoft Azure. Binance ($53 billion) is the world’s most valuable crypto exchange. The valuation of Binance increased sharply at the time of Coinbase’s direct listing (now $48 billion) on Nasdaq.

Of course, not all coins and tokens will have value, as they are not backed by a strong user network or an operating business. Metrics to gauge projects include the number of users or active addresses or the number of software developers currently adding value to the project. Many digital asset projects will publish a white paper, or a business plan, showing how they will deploy money invested in a specific project. Before trading, investors are encouraged to verify the progress that has been made toward those goals or if the right team is in place to work toward those goals. Digital assets without a white paper, development team, or network of users are less likely to grow and maintain significant valuation.

What’s the Relationship Between Bitcoin Mining and Its Stock-to-Flow Valuation?

Two key value propositions for bitcoin are the strict monetary policy that only allows the distribution of 21 million coins and the strong network of users. An increasing number of corporate treasuries are moving a significant portion of their cash balances into bitcoin, including Square, Tesla and Microstrategy. Recent legislation in El Salvador approved bitcoin as legal tender.

Bitcoin miners are a globally distributing group who employ computing power to secure the bitcoin network through cryptography. Every ten minutes, a new block of transactions is published. The current reward is 6.25 bitcoins, winner take all. That is, the first mining group to solve the cryptographic puzzle in each ten-minute period gets a reward currently valued at $200,000. Over time, that reward has been declining. From its 2009 inception to November 2012, the reward was 50 BTC. From November 2012 to July 2016, the reward was 25 BTC. The second halving in July 2016 reduced the reward to 12.5 BTC, while the most recent in May of 2020 halved the reward to 6.25 BTC. The next halving will take place in approximately October 2024 and halvings will continue until the 21 million supply of BTC is exhausted in 2140.

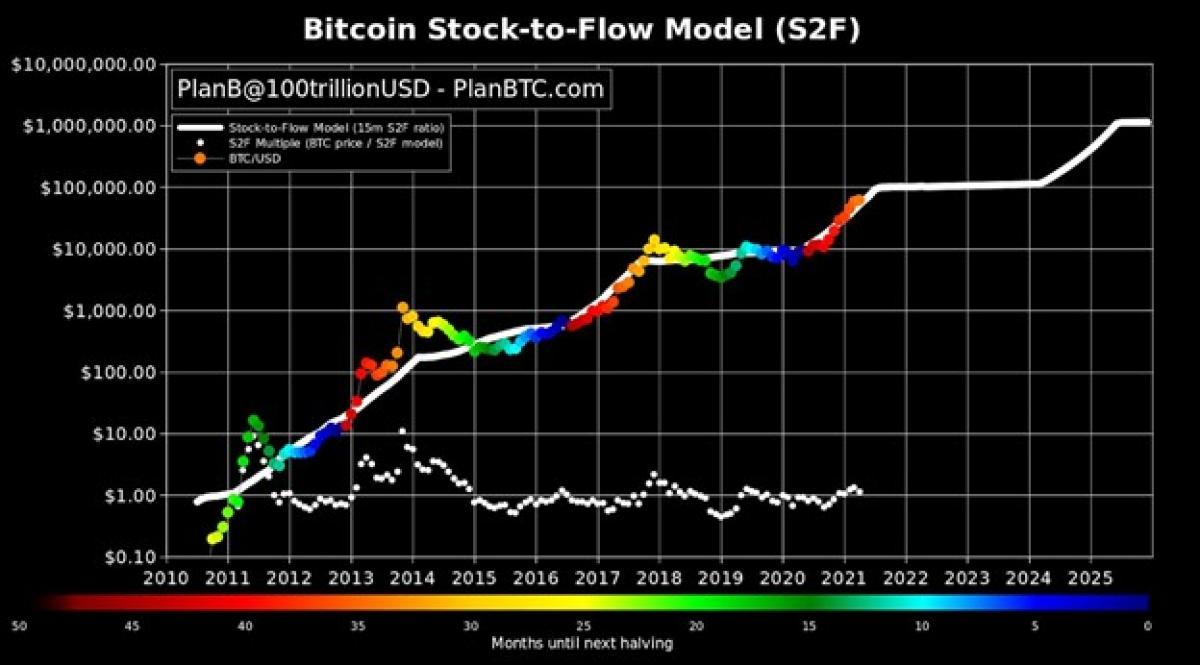

Bitcoin Stock-to-Flow Valuation Model

Souce: Forbes. https://www.forbes.com/sites/stevenehrlich/2021/04/29/demystifying-bitc…

As shown in the exhibit, Bitcoin has historically had a strong rise in prices in the year after halving (red and yellow), with the value of BTC falling after the rise, perhaps two years after halving (green). Like other scarce commodities, BTC may be valued based on supply and demand. With a limited supply, some believe that growing demand will continue to increase the price of Bitcoin. As each halving reduces the speed at which the new supply of coins is minted, believers in the stock-to-flow model predict that growing demand will increase the price of BTC to $100,000 and beyond. That is, the attraction of BTC is its limited supply, which is in stark contrast to the massive fiscal and monetary stimulus of global central banks that is continuing to sharply increase the money supply of fiat currencies. Strong believers in cryptocurrency state that this inexorable increase in the supply of fiat currencies will lead to inflation and debasement in value, leaving only digital assets with strong monetary policy as a store of value.

Will Bitcoin Be Used for Everyday Spending Like the US Dollar?

Bitcoin is a digital currency primarily used as a trading vehicle and a store of value; but the significant volatility and taxable nature of BTC make it impractical for everyday spending like a fiat currency. In the US, digital assets are taxable, with short-term gains taxes applied to positions held less than twelve months and long-term gains taxes applied to positions held over twelve months. Transactions are taxable when digital assets are sold or converted into another digital asset. A consumer using BTC to buy groceries and gas on a regular basis might have hundreds of taxable transactions each year, and there is a concern about the cost of clearing each transaction.

In the long run, the value is based on its scarcity and the number of investors who believe that it has value. In the short run, the value is determined by technical analysis and sentiment largely derived from social media posts. A significant portion of the discussion on digital currencies takes place on YouTube and Twitter, where an influencer can strongly move the price of a crypto in either a positive or negative direction based on the sentiment of their comments.

What Is a Smart Contract?

While bitcoin is designed as a trading vehicle and store of value, assets on the Ethereum blockchain are powered by smart contracts. Smart contracts are programs stored on a blockchain that run when predetermined conditions are met. They typically are used to automate the execution of an agreement so that all participants can be immediately certain of the outcome, without any intermediary's involvement or time loss. A computer protocol will process all the transactions in a contract; hence, middlemen are not required for executing the transactions. They are a faster, cheaper, and more secure way of executing and managing agreements.

These smart contracts may access digital applications (dApps) that provide services such as borrowing and lending, futures and options, or insurance. Uniswap is a decentralized exchange (DEX) that is built on top of the Ethereum blockchain. Fees for the execution of the smart contracts can be paid in ether (ETH) and there is no limit to the ingenuity of applications that can be enabled through the use of smart contracts. While some liken bitcoin to digital gold as a store of value, ether is likened to digital oil or a raw material that facilitates commerce.

The terms of a financial agreement can be directly written into the lines of code. Users are encouraged to review the code before interacting with a dApp, or ensure that the smart contract has been audited by a team experienced in blockchain and smart contract software design. Some smart contracts have been published with software bugs that allowed the contract to be exploited and value to be lost.

Why Are Digital Currencies Shifting from Proof-of-Work to Proof-of-Stake?

Proof-of-work is the original crypto consensus mechanism pioneered by Bitcoin and used by Ethereum 1.0. Virtual miners around the world race to be the first to solve a math puzzle, the winner gets to update the blockchain and is rewarded by the network with a predetermined amount of crypto.

The alternative way to secure a blockchain is called proof-of-stake and is employed by Ethereum 2.0, Cardano, Tezos, Binance, Polkadot, Stellar, Cosmos, Atmos and other newer cryptocurrencies. Proof-of-stake blockchains employ a network of “validators” who contribute — or “stake” — their own crypto in exchange for a chance of getting to validate new transactions, update the blockchain, and earn a reward. The network selects a winner based on the amount of crypto each validator has staked in the pool and the length of time they’ve had it there — literally rewarding the most invested participants. Once the winner has validated the latest block of transactions, other validators can attest that the block is accurate. When a threshold number of attestations have been made, the network updates the blockchain.

Why the change? Energy consumption is the major difference between the two consensus mechanisms. Proof-of-stake blockchains don’t require miners to spend electricity on duplicative processes competing to solve the same puzzle so it’s a less energy-intensive process. While the community of hundreds of thousands of bitcoin miners running redundant ledgers makes the blockchain extremely secure, there are concerns about the energy usage of the miners. Bitcoin miners may use as much as 0.5% of the world’s electricity and emit more than 0.1% of greenhouse gas emissions. This energy usage may be larger than that of entire countries, such as the UAE, Netherlands, or Argentina. Recently, attention has been focused on this energy usage, with a drive-by some market participants to increase the use of renewable energy and reduce the use of electricity generated by fossil fuels. Bitcoin miners are frequently located in areas with very low electricity prices, and often seek out innovative solutions such as moving mining machines to areas with abundant hydroelectric power during wet seasons and moving back to another location when that power is not available. There is an increasing amount of bitcoin mining in Texas, some of which are generating electricity using flare gas that would otherwise emit methane into the atmosphere. Of course, bitcoin enthusiasts like to point out that the environmental impact of bitcoin mining is less than that of gold mining, or investment bankers traveling the world by air. While the portion of bitcoin miners in China once exceeded 65% of the global population, negative publicity regarding this environmental impact has led regional Chinese governments to evict miners to improve their provincial emissions.

While the Ethereum blockchain is currently managed through a proof-of-work process, there are hopes that Ethereum 2.0 will soon arrive and transition to a more environmentally friendly proof-of-stake process. Proof-of-stake can also more easily scale to accommodate the vast number of transactions that decentralized finance (or DeFi) protocols can generate. It overcomes limitations in scalability that would eventually need to be overcome as smart-contract compatible blockchains, NFT minting and sales, have surged in popularity.

Proof-of-stake validators can lose some of their stake via a process called slashing if their node goes offline or if they validate a ‘bad’ block of transactions. If that sounds like too much work or complexity, crypto owners can participate by staking pool run by someone else — and earn rewards for crypto that would otherwise be sitting around. This process is referred to as delegating, and tools offered by exchanges by Coinbase can make it simple and seamless.

Summary

The universe of digital assets has increased from below $500 billion to over $1.5 trillion in just the last 18 months. The strong returns to many assets as well as the potential to earn yields higher than in the traditional bond market and banking system are likely to continue to attract new investors and increased investment into the space. However, there are significant risks in these investments, including valuation and volatility risks, technology and cybersecurity risks, regulatory risk, and the risk that a new and innovative digital asset will make a current project less valuable by switching the preferences of a large portion of the user network.

[i] Black, “Reaching for Yield in Decentralized Finance,” allaboutalpha.com

Schär “Decentralized Finance: On Blockchain- and Smart-Contract Based Financial Markets,” Federal Reserve Bank of St. Louis.

About the Author:

Keith Black has over thirty years of financial market experience, serving approximately half of that time as an academic and half as a trader and consultant to institutional investors.

He currently serves as Managing Director and Program Director for the FDP Institute. Prior to joining the FDP Institute, Keith served as Managing Director of Content Strategy for the CAIA Association, and previously at Ennis Knupp + Associates, Keith advised foundations, endowments and pension funds on their asset allocation and manager selection strategies in hedge funds, commodities, and managed futures. Prior experience includes commodities derivatives trading, stock options research and Cboe floor trading, and building quantitative stock selection models for mutual funds and hedge funds.

Dr. Black previously served as an assistant professor and senior lecturer at the Illinois Institute of Technology. He has contributed to the CFA Digest and has published in The Journal of Wealth Management, The Journal of Trading, The Journal of Investing, and The Journal of Alternative Investments, among others. He is the author of the book “Managing a Hedge Fund,” as well as co-author of the second, third, and fourth editions of the CAIA Level I and Level II curriculum. Dr. Black was named to the Institutional Investor magazine’s list of “Rising Stars of Hedge Funds” in 2010.

Dr. Black earned a BA from Whittier College, an MBA from Carnegie Mellon University, and a Ph.D. from the Illinois Institute of Technology. He has earned the Chartered Financial Analyst (CFA) designation and was a member of the inaugural class of both CAIA and FDP members.