By Grant Murgatroyd, senior writer EMEA at Preqin

Private equity weathered the COVID-19 storm and activity in Europe accelerated in 2021

The surprising thing about the impact of COVID-19 on private equity in Europe is how little impact it had, at least in terms of headline fundraising and deal numbers. In private equity there was a slight decrease in the number of successful closes of funds with a Europe focus in 2020 compared to the previous year (272 vs 279). However, as Preqin data shows, there was a sizeable jump in aggregate capital raised to hit a record €128bn, up from €103bn the year before. Transaction levels also held up, with a slight decrease in the number of deals (2070 vs 2024) and larger decrease in aggregate value (from €121bn to €102bn).

Activity slowed dramatically in the second quarter, as COVID-19 spread, and travel and meeting restrictions were imposed. Stock markets plunged and economic activity saw an unprecedented slowdown. Lackluster quarter-on-quarter GDP growth across the EU of less than 1% through 2018 and 2019 turned to a 3.5% fall in Q1 2020 and an 11.7% drop in Q2 2021. However, this was followed by a sharp 12.6% rebound in Q3 2021, according to Eurostat.

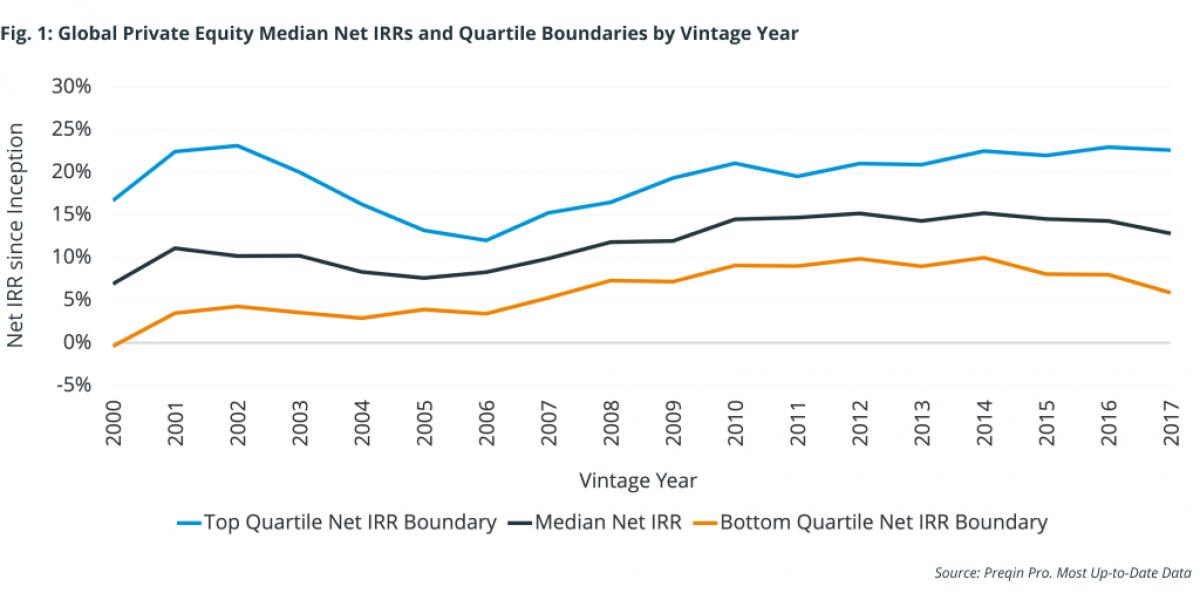

Historically, the best performing private equity vintages have come in the years following a market correction, with poorer performance in the 2-3 years preceding the correction. This pattern was seen during the technology boom and bust in 2000, and through the Global Financial Crisis (GFC) (Fig. 1).

Of course, no two crises are the same. Several factors contributed to the strong performance of post-GFC vintages, including lower entry multiples, low interest rates. There was also reduced competition stemming from a slowdown in capital into the asset class caused by structural factors, including the denominator effect – which occurs when declining valuations in other assets, notably public equities, lead to an overallocation to private equity, because valuations of private companies do not adjust as quickly. This means many limited partners cannot commit to new funds because they are already overallocated to the asset class.

Worldwide, private equity funds raised $213bn in 2009 and $183bn in 2010, sharply down from the $4123bn raised in 2008, according to the Preqin 2021 Global Private Equity & Venture Capital Report. The cycle of declining and then recovering returns begins earlier and lasts longer, with median net IRRs on global private equity funds dipping to a low of 7.6% for 2005 vintage funds, which had invested during the boom, before recovering to 11.8% in 2008, 12% in 2009, 14.5% in 2010, and 14.7% in 2011.

As the pandemic raged in Q2 2020, analysis by Preqin predicted changes in fundraising and investment activity, as well as in LP cashflows, but concluded that the impact would be short lived. Preqin did not expect the denominator effect to have a marked impact on fundraising through the pandemic. “Yes, there is a major short-term impact, but LPs and GPs are thinking long term and continuing to invest in alternative assets,” Mark O’Hare, CEO of Preqin, said at the time.

As the numbers outlined earlier show, those predictions were on the money. Restrictions on physical meetings slowed fundraising and transactions activity, but as 2020 progressed LPs and GPs got increasingly comfortable with completing investments in the virtual world.

In the turbulent second quarter, GPs focused their attention on triaging portfolio companies, stepping in to support those experiencing difficulty and taking advantage of opportunities when they appeared, for example with digital transformation. There was also a significant shift in communications between GPs and LPs, with the glitzy annual investor meeting replaced by frequent and more detailed reporting on online platforms. To reassure LPs that their capital was in good hands, GPs provided more granular and up-to-date information on portfolio company performance, both in financial and KPI terms. This is likely to have a lasting impact on GP to LP reporting as, having had a taste, LPs will continue to demand more timely and detailed reports going forward.

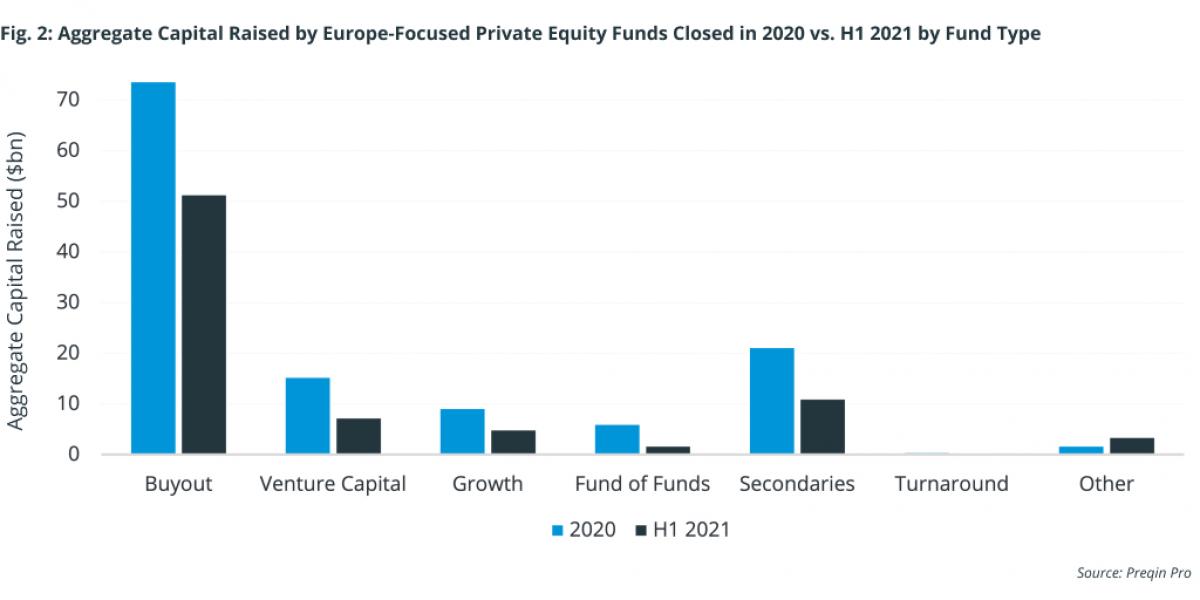

As investors adapt to life after COVID-19, the private equity industry finds itself in a strong position. Preqin’s new report, Alternative Assets in Europe, provides a detailed analysis of the changed landscape and how it will affect all investors. Fundraising for Europe-focused funds is on track to break records, with €51bn raised for buyouts, the largest private equity strategy, in H1 2021, a faster run rate than 2020, when €74bn was raised in the year (Fig. 2).

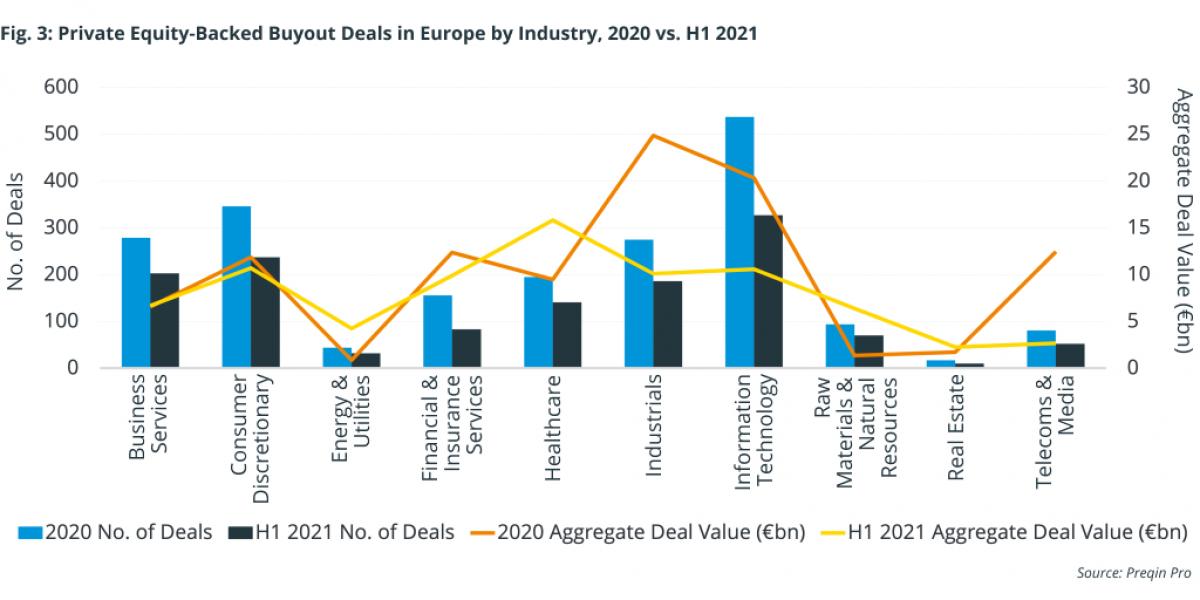

Investment activity has also increased, with 1,341 buyouts with a combined value of €79bn completed in H1 2020, compared to 2,024 with a value of €102bn in the whole of 2020. In the venture capital segment, the number of recorded deals in H1 2021 is down at 1,314 (though this dataset has a time lag) from 3,316, but their value is up at €41bn, a total that has already exceeded the €33bn of investments in 2020. Private equity investors in Europe have been active across the continent, with increased investment rates across a wide range of sectors, including business services, consumer discretionary, energy & utilities, financial & insurance services, healthcare, industrials, information technology, raw materials & natural resources, real estate, and telecoms & media (Fig. 3).

Private equity ownership shortens the reporting lines between company management, shareholders, and investors. This makes it particularly effective in times of rapid change. And there is no doubt that the world is in a particularly transformative phase, with the recovery from COVID-19, digital transformation, and the climate crisis necessitating significant changes in business practices. If private equity funds step up to the plate, they have an opportunity to generate good returns for their investors and drive positive change in the business practices of the companies they own.

About the Author:

Grant Murgatroyd is senior writer, EMEA, at Preqin. He has been a financial journalist for 30 years, focused on private equity for more than 20 of those. He launched private equity magazine Real Deals in 1999, was editor of Corporate Financier and Limited Partner, and an author on the book Private Equity 4.0. Grant joined Preqin in July 2020. He led the Future of Alternatives 2025 digital series, which won a Gold Medal at the Financial Communications Society’s 2021 Awards.

Preqin is the Home of Alternatives, providing indispensable data, analytics, and insights for alternative assets professionals around the globe from offices in London, Birmingham, New York, Dallas, Singapore, San Francisco, Hong Kong, Chicago, Tokyo, Sydney, Dubai, Bangalore, Manila, and Guangzhou. For more information, visit www.preqin.com

Visit our Future of Alternatives 2025 hub at www.preqin.com/future