By Evgeny Denisenko, CFA, FRM, CAIA, Managing Principal at Apolis S.A.M.

In a low-interest rate environment, investors across the globe have been grappling with the same existential problem: how to earn an adequate return on their investments while at the same time not expose their portfolios to excessive risk-taking? Although this question probably best belongs to the philosophical realm and there is no consensus on this issue, asset allocators have been increasingly switching their focus to alternative asset classes.

This trend should come as no surprise – loose monetary policies and unprecedented in size QE programs across developed markets have invariably given birth to pricing anomalies in traditional asset classes, making them on some level even riskier than private markets. In this “new normal” environment, private debt has the potential to become an integral part of alt-oriented portfolios and an optimal solution for yield-seeking investors.

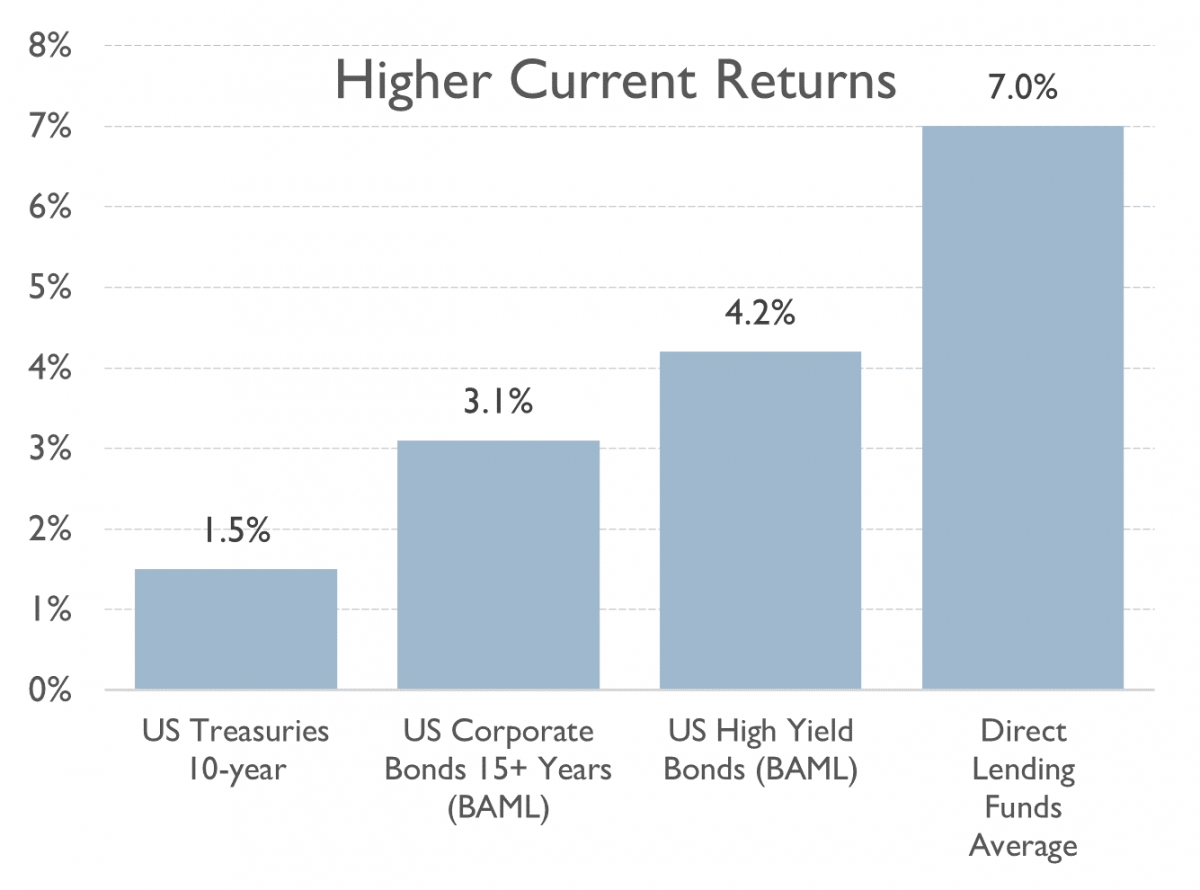

In fact, direct lending has historically produced higher absolute and risk-adjusted returns when compared to bonds and traded loans (1). This phenomenon reflects several factors. First, private markets are structurally illiquid, and the illiquidity premium is always priced in, regardless of the timing of an investment.

Second, borrowers in private markets pay a premium to alternative lenders in exchange for both flexibility and faster analysis and decision-making. Borrowing from the public, on the other hand, usually takes more time and entails issue costs, which in turn reduces potential profits. Private markets are also less efficient than public ones. Therefore, investors in private markets increase their chances of finding underpriced investment opportunities.

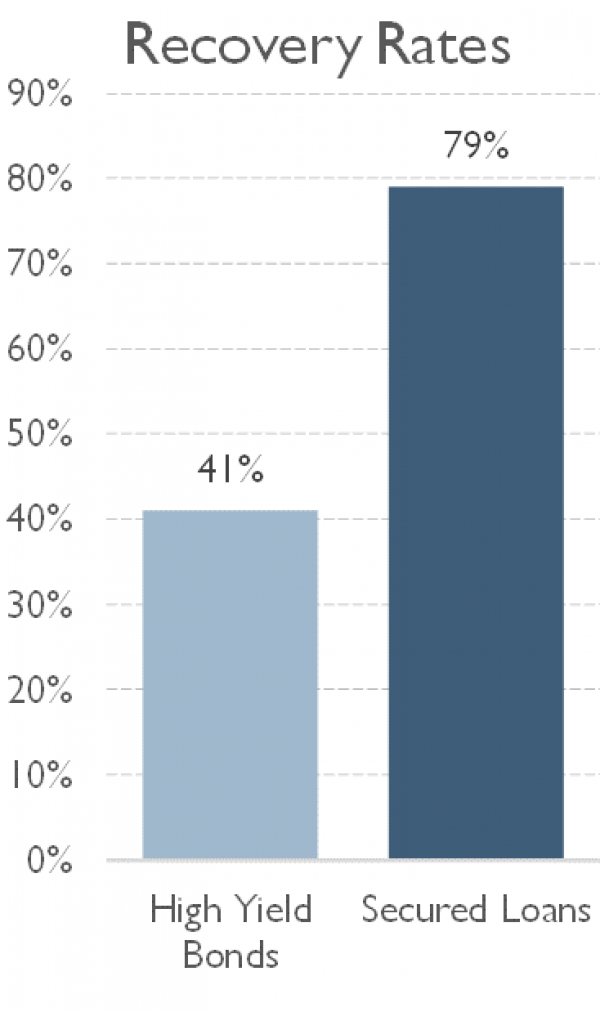

From a risk perspective, secured private loans have had lower default rates and higher recovery ratios relative to high yield bonds (2). In addition, private loans can provide credit risk protections such as personal guarantees, cash collateral accounts, contract revenue assignment, and others. Such protection measures can rarely be found in publicly traded instruments.

Where to find a pocket of opportunity investing in private debt

An evolving regulatory framework, banking industry consolidation and its changing lending practices have created supply-and-demand imbalances in small to mid-cap markets as traditional lenders have shifted their attention to larger companies. The majority of alt lenders (private credit funds and increasingly family offices) have targeted the mid-market, where the lower end appears to be the sweet spot in terms of competition and risk-adjusted returns.

However, as private debt has been gaining popularity among investors, the increasing flow of new capital into the market has led to a deterioration in deal terms across the spectrum of strategies and started to suppress expected returns. To find a worthwhile deal, lenders are therefore increasingly forced to consider opportunities where certain financial, structural, or ownership characteristics require profound industry knowledge. It also helps to have a personal connection to the management of a prospective borrower and a deep understanding of a particular situation. In the end, however, investors that are not spooked by the complexity of such deals are usually well rewarded – total returns may reach mid-teens or higher for senior secured and unitranche loans.

One area in particular where appealing deals can be found is acquisition finance, where quick execution is paramount, while deal complexity requires an in-depth understanding of all aspects of a transaction within a very limited timeframe. Traditional lenders, meanwhile, are becoming increasingly reluctant to engage in M&A financing, clearing the way for specialized alternative lenders.

Another area of opportunity is growth financing. Asset-light companies operating in rapidly developing industries often do not have a large degree of optionality when it comes to securing vital capital for expansion. Therefore, a private loan is still a cheaper solution than the second-best alternative – equity raise – even when companies are required to offer lenders returns in high-teens.

Geography is an additional factor that plays an important role in the capital allocation process. Each country’s legal framework contributes to the determination of borrower’s risk profile and can substantially impact the loan pricing. Jurisdictions such as North America, UK, Northern Europe and Singapore are good places to pursue a private lending strategy, although the USA and Canada arguably stand out in terms of the combination of achievable high risk-adjusted returns and the ease of asset repossession and enforcement.

It is important to note that the European market is far from homogenous. Some countries like Germany and Denmark have a friendly lending regime with a good set of legislation to streamline execution and protect lenders in case of default. Other countries such as France have a rigid legal framework that effectively renders the repossession process ineffective and time-consuming. Interest rate differential can also undermine the region’s attractiveness. One can argue that a more dovish monetary policy in Europe pushes prices for all financial assets higher compared to those across the Atlantic.

From a sector perspective, companies operating in high growth and rapidly consolidating industries can afford a higher cost of capital. Technology, IT, e-commerce, and SaaS companies benefit from positive secular trends in their respective industries. However, not all the market players – even those that have a strong balance sheet and robust business models – have access to traditional sources of capital. For example, third-party seller aggregators on Amazon and other e-commerce platforms, operating in a niche market that only began to thrive a couple of years ago, have been cash-flow positive early on but are nevertheless forced to pay mid-teen coupons on their senior secured loans.

Digital economy aside, excess returns are also achievable in some traditional sectors like services that have asset-light companies undergoing rapid consolidation. For example, HVAC and restoration industries in the U.S. are still fragmented, leading a number of both listed and private equity-backed firms to attempt to consolidate smaller players, including family-owned firms. Alt-lenders can capitalize on this trend by offering flexible capital to the acquisitive platform companies and introducing equity kickers, MOIC targets and penalties for early refinancing into loan agreements. If one of these clauses gets triggered, investors stand to substantially increase their total returns.

How can one achieve equity-like returns by investing in private debt?

Asset allocators typically associate private debt with low-return strategies, and there are compelling reasons for that. A typical senior deal, whether asset-backed or cash flow-based, would yield approximately 4-5% p.a. Given that according to some measures the current inflation rate in the U.S. is over 4%, investors are therefore barely breaking even in real terms. To compare, the top quartile net IRR of private equity strategies across all vintages for the last 10 years is approximately 15% (3). That said, investors often overlook the potential of private debt strategies to deliver returns that are comparable to those of top-performing PE funds, once certain conditions are met.

These conditions can be broadly grouped as follows:

1) Having exposure to positive ‘black swan events, such as a borrower’s better-than-expected operating performance, early refinancing or M&A. This can be secured through upside participation in the form of zero-cost warrants, early repayment fees, equity call options, revenue-sharing agreements, and/or small allocation to preferred shares. While these features are generally unavailable in credit facilities for established players operating in fully formed industries, disruptive companies that are rapidly gaining market share or firms in developing industries usually have less bargaining power and are more accommodating regarding equity kickers. However, it does not necessarily mean that these companies are at a start-up stage – on the contrary, they may very well have robust cash flow generation, strong balance sheet, and capacity to organically pay down their debt.

Penalties for early refinancing merit a special mention as a driver of excess return. They can take the form of the minimum MOIC targets or make-whole call provisions, triggered by a change of control or by the borrower itself, once a cheaper and/or more flexible financing option becomes available. It often makes perfect economical sense for borrowers to pay lofty premiums to extinguish expensive credits to get cheaper capital (and more of it), rather than stick to the original facility which might limit the company’s ability to maneuver and grow.

Further bolstering their prospects, private lenders that have sufficient industry expertise can cherry-pick those deals where the borrower is a likely acquisition target. In that case, it is effectively not the borrower that ends up paying the upside on the debt but the future acquirer. This helps explain why high-flying companies are willing to offer this feature as a deal sweetener.

2) Transacting in structurally underpriced verticals such as cannabis and crypto can also produce equity-like returns. U.S. cannabis operators are struggling to secure credit via regular channels since cannabis is still not legalized at the federal level and not all investors are willing to assume the risk of a reversal of the trend toward legalization. Admittedly, the sector is rather difficult for investors that have no prior experience with it, as most companies are not yet generating cash and industry knowledge is needed to identify those with competitive advantages and stellar management teams. Still, the opportunities are definitely there. Recently, a US cannabis producer with a leading regional market share sought out a senior secured credit backed by a first pledge over its production facilities and inventory, while willing to pay a mid-teens cash interest rate. In another example, a Canada-based medical cannabis grower was looking for a senior secured facility to finish construction of its greenhouses, which were 75% complete at the time. The company paid close to 20% interest on this one-year bridge loan.

The crypto industry is another “theme du jour” that remains somewhat controversial among investors. While assuming exposure to crypto trading seems rather risky from a creditor standpoint, verticals such as crypto mining and crypto services look more appealing from a risk-adjusted return perspective. The absence of a global regulatory framework, high volatility, and limited visibility into the prospects for cryptocurrencies naturally tend to put off many investors. In fact, even those crypto mining companies that are in top 2% globally with respect to their marginal costs cannot tap into cheap financing sources. Despite having robust cash flows since inception, high margins, manageable CAPEX, and low indebtedness, such firms may end up paying mid to high-teens interest and sharing equity upside with prospective lenders.

Another example of a promising niche within the cryptocurrency sector is crypto ATM operators. Providing quick, simple, and convenient access to crypto-assets, some operators manage to achieve EBITDA margins close to 50% in their first years of operation. Still, in order to secure debt financing, they have to offer equity-like returns on borrowed funds to incentivize potential investors.

Conclusion

Private credit strategies are often measured up against high risk and high return asset classes that have a similar liquidity profile. Many investors, therefore, tend to choose the latter, based on the low absolute return expectations of the former. However, by picking the right sectors and verticals and appropriately structuring loan agreements, investors can potentially achieve returns comparable to those of top quartile private equity funds.

From a risk perspective, senior credit sits on top of the capital structure and represents a contractual obligation of the borrower. This allows investors better visibility on exits and incoming cash flows and also provides for additional mechanisms of capital protection that are typically not available in publicly traded fixed income. Taken together, the risk and return characteristics of certain private credit strategies add up to a compelling opportunity for investors.

Footnotes

- Source: Bloomberg, Preqin

- Source: S&P Capital IQ

- Source: Cambridge Associates

About the Author:

Evgeny Denisenko is the founder of a private investment office Apolis S.A.M. Evgeny was previously responsible for managing the family’s direct private equity investments in Russian biotech, logistics, and real estate sectors. Evgeny started his career as an investment banking analyst at Sberbank CIB. He studied at Moscow State University and holds CFA, FRM, and CAIA charters.

Apolis S.A.M: Based in Monaco, Apolis S.A.M. is a single-family office whose main focus is private credit. In addition to its LP commitments to private debt funds, Apolis is managing a GP co-investment program, with approximately 30 private credit deals funded since 2018. Our “sweet spot” is 1st lien senior secured loans, often with additional upside through preferred equity and warrants. We have done both asset-based and cash flow-based deals in North America, Europe, developed Asia and emerging markets. Having chosen an industry generalist approach, we were able to achieve diversification across sectors with a focus on cycle-neutral borrowers.