By Junaid Ghuari, CIO & Co-Founder · Pareto Technologies, Sean McElrath is a Co-Founder of Pareto Technologies and Jacob ("Jack") Kleinman.

The proliferation of renewable energy presents opportunities for cheap and sustainable power. However, numerous obstacles, including intermittency, energy storage, and grid interconnection currently jeopardize the widespread or exclusive adoption of these cheap energy resources that are now below the prices of traditional fossil fuels. Cryptocurrency mining, once seen as a scapegoat for rising energy usage, has the potential to boost energy project feasibility, increase electricity access, and power energy-intensive cryptocurrency networks on renewable power.

THE EVOLUTION OF RENEWABLE ENERGY SOLUTIONS

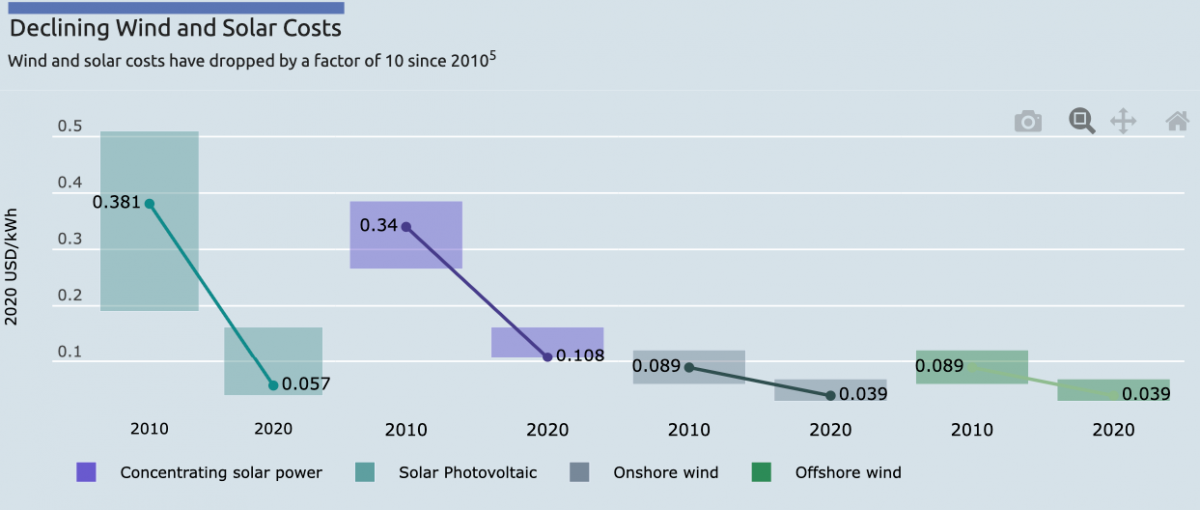

Over the past decade, the landscape of renewable energy has rapidly changed, and solar and wind power have greatly expanded across the U.S. The Levelized cost of energy (LCOE) has fallen substantially for numerous renewable energy sources, and many options are cheaper than the existing fossil fuels that still yield most of our power. These sources offer a practical, green, and more efficient alternative to the status quo. Solar energy has followed a Moore’s law-type trajectory. Since 2010, costs have dropped by a factor of 10, and in the last decade, solar has seen an average annual growth rate of 42%. In sun-rich geographies, seemingly improbable low prices are becoming common, as recent bids on energy contracts in Portugal and the UAE have been as low as 1.6 and 1.3 cents per kWh respectively, leaving the traditional fossil fuel range of 5 to 12 cents in the dust.

Figure 1: A visualization of the rapid decline in cost of solar energy as innovation continues to surge in the field.

As technology further improves, so will efficiency and scalability. Relatively minimal upkeep costs coupled with production-based tax credits have the potential to spur greater adoption, and this reality is already playing out across the United States. The near-zero marginal cost of energy can also greatly increase supply to the grid during peak-energy generation events, as increased power can be generated from near-zero additional production costs (e.g. cloudless or windy days). Even without incorporating subsidies into the picture, the EIA sees new onshore wind and solar photovoltaic projects as cheaper alternatives to both natural gas and coal-fired power plants.3 With subsidies expected through 2030 under the Biden administration’s climate and infrastructure plans, the future is ripe for renewable solutions.

PROBLEMS FACING RENEWABLE SOLUTIONS

Despite the innovation within renewable energy over the past decade, obstacles impede the widespread and complete adoption of these technologies. While the levelized cost of energy is low enough to justify their widespread usage, the necessity of baseload power pricing of utilities, and grid congestion have inhibited this transition away from more costly and environmentally damaging sources of electricity.

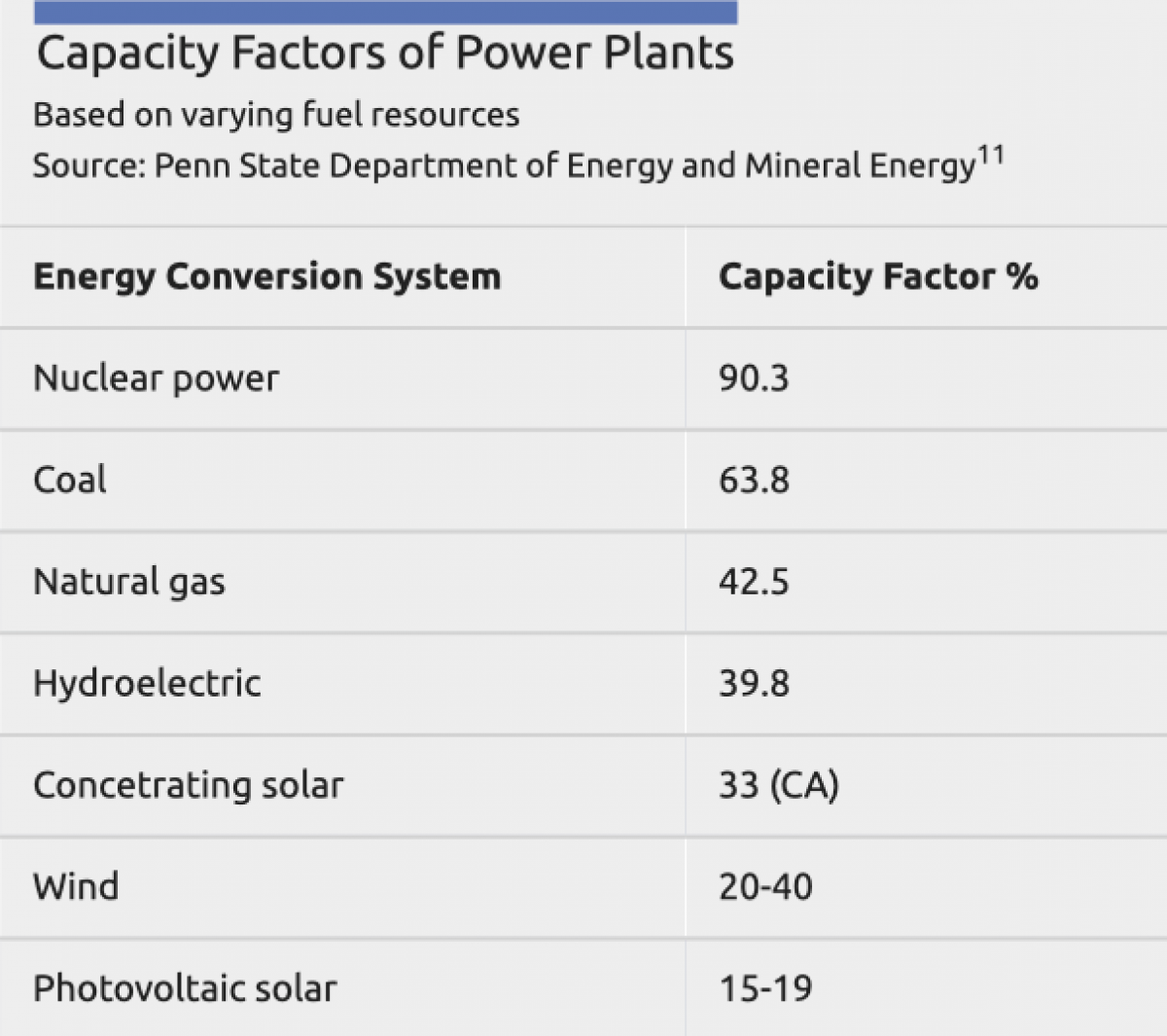

Figure 2: While solar and wind power have grown in efficiency, concerns about baseload energy persist. Traditional, reliable sources are significantly better at providing a stable electricity supply to the grid.

A principal concern with renewable energy is the lack of consistency that power sources supply. One cannot count on it being sunny or windy to power society, and solutions such as geothermal and hydroelectric power are not practical in all geographic areas. Access to running water, dams, or easily tappable geothermal reservoirs are limited around the globe. More traditional sources of energy such as coal and natural gas, although less efficient, are heavily used because of their favorable relationships with utility providers that stem from the ability to produce a consistent and fully reliable energy load or baseload energy.

One of the principal concerns with renewable energy is the lack of consistency that power sources supply. One cannot count on it being sunny or windy to power society, and solutions such as geothermal and hydroelectric power are not practical in all geographic areas. Access to running water, dams, or easily tappable geothermal reservoirs are limited around the globe. More traditional sources of energy such as coal and natural gas, although less efficient, are heavily used because of their favorable relationships with utility providers that stem from the ability to produce a consistent and fully reliable energy load, or baseload energy.

While solar and wind power have grown in efficiency, concerns about baseload energy persist. Traditional, reliable sources are significantly better at providing a stable electricity supply to the grid. Here we can see that the baseload capacity of renewable energy lags significantly behind fossil fuels and nuclear power.

While storage mechanisms seem like a solution to the intermittency and excess energy from wind and solar power, there are currently limited industrial-grade energy storage solutions to combat this phenomenon. Now, the most efficient way to store energy is not with batteries, but instead through pumped hydroelectric power, a process in which excess energy is used to pump water above a dam, where it can then be released to produce electricity at times where excess generation is necessary or profitable.

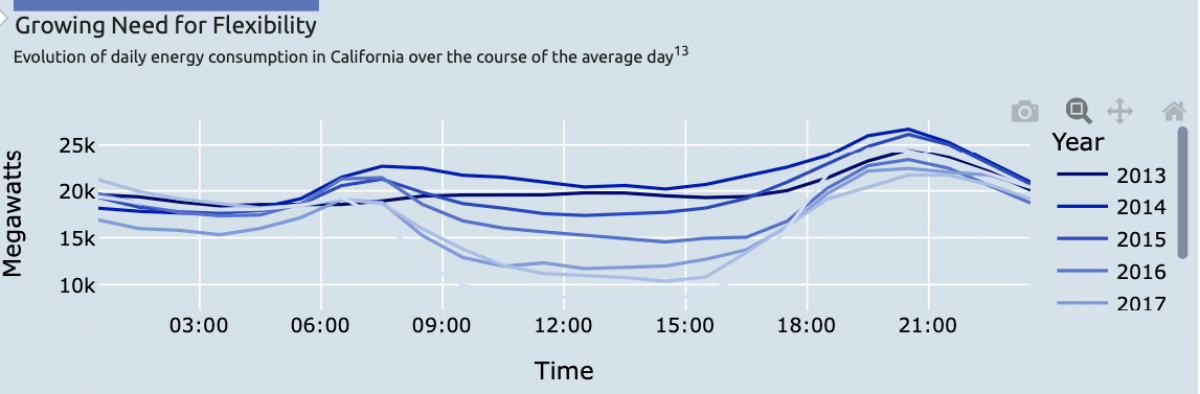

Figure 3: This image Illustrates the evolution of daily energy consumption in California over the course of the average day. Increased demand, particularly for heating and cooling, has led to more extreme variations in the electricity demanded by hour.

While the approach uses considerable power to carry the water uphill, pumped hydroelectric power still accounts for 95% of utility-scale energy storage around the globe because of its scale, cost, and lower dissipation rate when compared to batteries designed for industrial storage. The United States only has 22.9 gigawatts of pumped storage, and of this, 50% is concentrated within the states of California, Virginia, South Carolina, and Michigan. Solar and wind power hotspots such as the Midwest and southwest are noticeably missing from this picture, and this region is also widely devoid of grid connections to the rest of the U.S., making it difficult to store or transport cheap excess electricity from the regions. Furthermore, nearly all of the pumped hydro storage in the U.S. was created during the 1970s, and this legacy infrastructure is not able to fully address the problem of efficiently storing excess renewable energy across the United States.

While projects have been proposed by large energy developers in the Hoover Dam among other regions, the scale and efficiency of these projects is still not enough to eliminate the necessity of traditional baseload power from the picture Industrial-grade lithium-ion batteries are also improving, but the technology lacks efficient long-term storage potential and is not feasible to be a sole solution to the industrial energy storage problem.

Grid congestion presents another difficult roadblock. The intermittent nature of wind and solar creates periods of excessive energy generation along with the accompanying lows. The outdated electricity grid across the United States is often unable to handle these surges, and in turn, congestion issues often increase energy prices, even when it is produced in excess.10 A Berkeley lab tracked grid congestion and found that an astonishing 200 gigawatts of delayed solar and wind power, energy that has been set in the queue and is waiting for grid connection, occurred at 3 grid interconnection points alone. This creates a scenario where energy is being wasted, and the rapid expansion of solar and wind is outpacing the growth in electricity transmission infrastructure. Energy projects are wasting cheap, green energy because of the three outdated and centralized grids that are the backbone of American energy distribution.

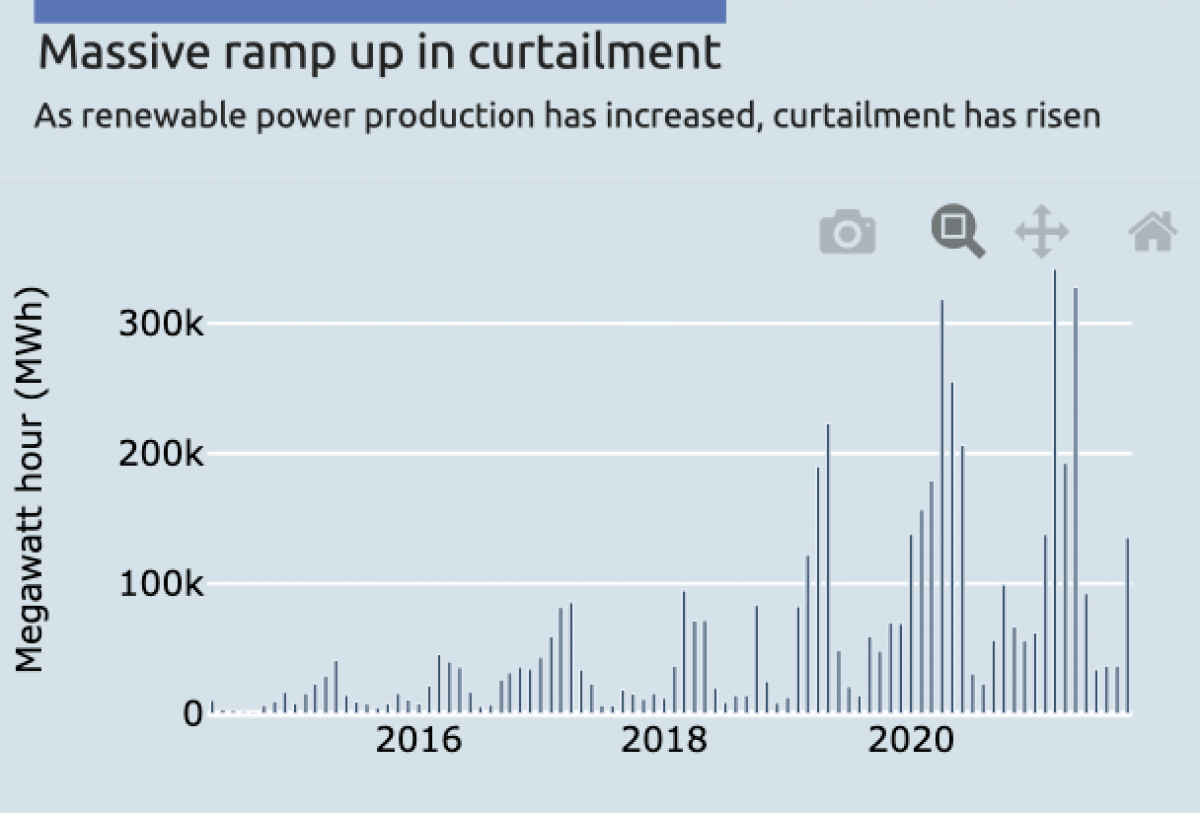

Even in scenarios where projects are connected to the grid, transmission costs for the legacy power grid will rise as much as 50% during periods of excess generation, curtailing the incentive for energy production. Curtailment, the economic disincentivizing of energy production by grid operators to balance supply and demand, further underscores the monopolistic power that energy producers are forced to contend with. Smart grids, a concept based around transforming the electric power grid into an automatic or even AI-based system, have the potential to better distribute energy, decrease transmission costs, and better connect the country. While the United States is exploring transitioning to a smart grid by propositions including controllable load balancing the current scenario of an east coast, west coast, and Texas grid impedes the feasibility of widespread intermittent renewable energy.

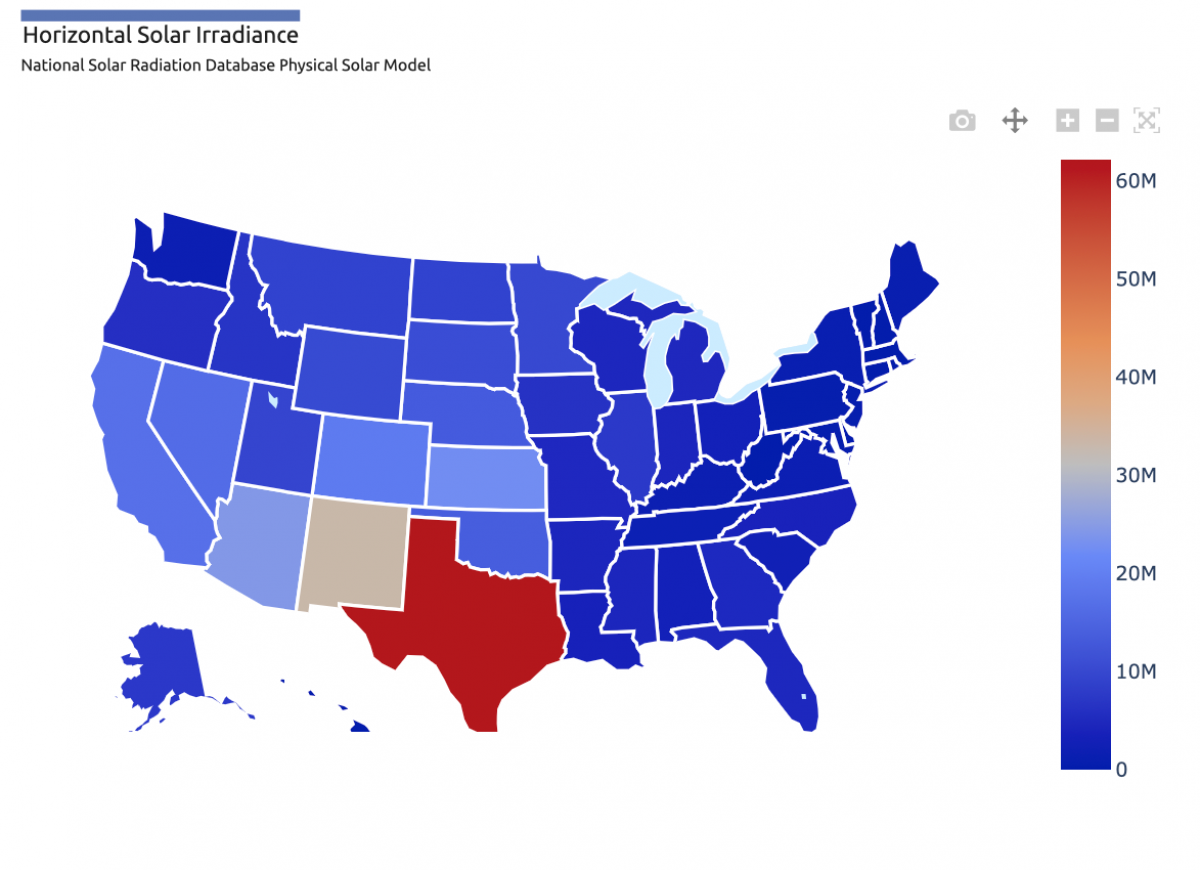

Figure 4: This map illustrates the solar energy potential across the United States. The extreme concentration in the southwest coupled with the nation's centralized grid make the distribution of renewable energy difficult in the short run.

A final factor that has both decreased the feasibility of new renewable energy projects and the profitability of existing ones is the near monopsony possessed by utility providers. With very low marginal costs of production and a handful of regional suppliers at most, solar and wind projects are often forced to sell energy at low and in some cases financially unsustainable prices because of the lack of associated options or competition with other projects. While solar energy has become much more efficient, the profitability when selling to utility providers has remained relatively flat as innovation has been met with falling contract prices. Power purchase agreements, commonly known as PPAs, often lock energy suppliers into fixed contracts for extended timelines, decreasing profitability, and even in some cases, project feasibility. In a scenario where companies have other outlets than selling to a monopolized market, there would be a greater incentive for projects to start and expand. While a decentralized grid will once again create a more egalitarian solution, there are numerous intermediate steps necessary for this to become a reality.

On top of these efficacy-oriented problems, the United has an archaic framework for adopting and boosting the output of renewable energy. New entrants are forced to pay the necessary sums to upgrade grid capacity, it is nearly impossible to receive approval for new transmission lines because of geographical regulation, and since most utility providers are regulated monopolies, they see little need for change to the status quo. Because of these measures, the United States government has not been able to see similar success to nations like Vietnam, which went from 0 to 25% solar in a span of only three years. The United States has solar and wind resource but has not effectively leveraged it yet.

THE ROLE CRYPTOCURRENCY MINING PLAYS IN ACCELERATING A RENEWABLE ENERGY FUTURE

Despite recent negative press during the summer of 2021 about the environmental impact of blockchain-based networks, Cryptocurrency mining has the potential to address the weaknesses in the current framework in a renewable energy solution and accelerate its adoption. This has been proven not only in concept, but also in practice globally. By incorporating cryptocurrency mining operations to renewable energy projects, developers can increase their profitability and pricing power while helping to power blockchain networks on sustainable sources.

Bitcoin, contrary to popular belief, continues to rely on renewable energy sources for large portions of the network’s hash rate. Because of the focus on cheap electricity and no necessity of a constant baseload, miners are attracted to sources with extremely low levelized costs of energy, which often are solar, wind, hydroelectric, and geothermal power. For instance, in China, once a global hub for mining, it was cost-efficient for miners to move all their operations to the coast during the rainy season to run on “virtually free” hydroelectric power, which greatly increased profitability.

The same is true for Iceland, where geothermal energy powers a sizable portion of global mining. Energy is the largest cost input into the mining process and slight changes in electricity prices can be the difference between success and failure for an industrial mining operation. Even domestically in the US, crypto mining operations are frequently tied to renewable sources, particularly in regions such as Texas and New York.

When a solar or wind project becomes operational, auxiliary Bitcoin mining operations can be housed either on site or nearby. Energy that cannot be sold to the grid or could be used more efficiently for mining can be routed to on-site mining operations. To mine bitcoin, “miners” process verified transactions on the blockchain and receive a reward for discovering the random and unique hashing pattern before others. To solve these problems, high-tech graphics processing units (GPUs) and application-specific integrated circuits (ASICs) are commonly used in order to complete these transactions. While the only marginal cost associated with mining a bitcoin comes in the form of electricity, the necessity of constant cooling and rapid operation conjure massive electricity bills. Low-cost energy is essential to stay profitable in the long term. Electricity generation that would otherwise increase grid congestion and have transaction costs high enough to disincentivize production can now be utilized as a second revenue stream or a source of profit before a firm is connected to the grid. This approach only adds to the bottom-line profitability and helps power an energy-intensive field sustainably.

Figure 5: As renewable power production has increased, curtailment has risen, as utility providers have strong economic incentives to prevent increased volumes of renewable energy from entering the grid.

Having both cryptocurrency mining and energy production as revenue streams can allow energy companies to vary their focus based on the current profitability of each option. Usually, energy projects have limited choice on what they can do with their energy output, allowing a select few utility providers to have high degrees of pricing power.

While low marginal and levelized costs of electricity give the utility provider leverage in determining pricing, an alternate revenue stream derived from cryptocurrency mining creates a price floor and increased bargaining power for energy providers. If utilities insist on charging exceptionally low rates, energy projects could turn to low-cost cryptocurrency mining for profitability.

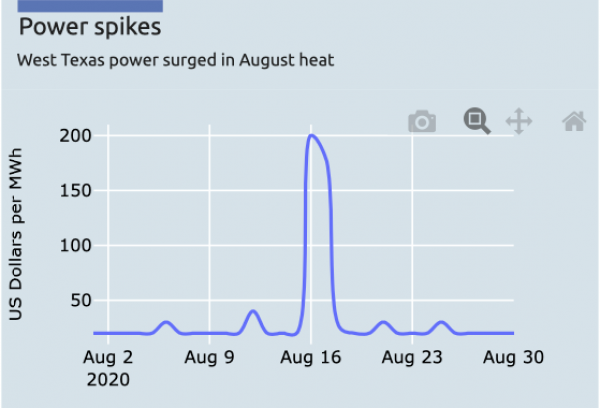

There are already projects taking advantage of arbitrage opportunities within the renewable energy space. In Texas, Layer1, a cryptocurrency mining operation partially backed by Peter Thiel entered long-term energy purchase agreements with utility companies in order to mine bitcoin. Because of the low overnight demand and plentiful wind energy, the operation was able to cheaply, and in some cases, even freely mine. During peak energy demand, such as cloudy, windless days, the project sold back its low-cost contract to the utility provider for nearly a 700% return on investment on electricity prices because of the operation’s extremely low overhead costs. Instances like this show inefficiencies within the current energy framework and how a combination of mining and energy generation can mitigate some of the current problems plaguing the renewable energy landscape. During the current energy supply crisis, the empowerment and emergence of more renewable energy projects can help combat global warming while increasing grid supply in affected regions. After an economic recovery from the Coronavirus pandemic, energy production has been insufficient to meet the rapid increases in demand.

Fossil fuel prices have risen dramatically over 2021, and China has even been forced to issue emergency power cuts across numerous provinces. An influx of renewable energy to the grid not only alleviates this stress but prevents the revamping of retired fossil fuel plants as seen throughout the globe.

A scenario that incorporates mining into new projects increases the energy production from renewable sources, which can even begin to address the challenge of baseload energy, as a greater number of renewable sources will allow for increased electricity production throughout the day. More projects and innovation increase access to continual power derived from renewable sources, and a greater supply of renewable energy further accelerates the transition to a smart-grid-based energy distribution network in the United States. A smart grid system further compounds the impact renewable energy can make through both environmental and economic channels as the issues of grid congestion and transmission costs subside.

THE CASE AGAINST BITCOIN MINING

Critics argue that it is a stretch to connect bitcoin mining to the increased success and expansion of renewable energy. Both the energy and cryptocurrency industries are rapidly changing, and the uncertainties about the regulation of both fields coupled with volatile prices, uncertain liquidity, and changing mining difficulty can jeopardize project success.

Bitcoin possesses volatility that can massively magnify or limit returns, and at the same time, the market often does not have the liquidity to accommodate large transactions without price impact. Profit has the potential to fluctuate significantly by day, and as seen over the summer of 2021, where many Chinese miners were forced into mass-sell offs. Fiat-quoted exchange rates can fluctuate significantly because of slippage.

While volatile price action and liquidity have been principal concerns associated with bitcoin mining, stability has increased over time as the asset has appreciated in value. As the market continues to mature, volume and liquidity will continue to increase, which alleviates some of the risks associated with high volatility. More cryptocurrency miners, as can be spurred by the integration with energy projects, only mitigates these concerns further by increasing both the volume and liquidity of the market. Furthermore, miners can actively participate in futures markets in order to hedge risk and increase both predictability and profitability.

While historically, the cryptocurrency derivatives markets during these nascent stages have been a place for speculation, energy producers can effectively utilize the futures market, in particular, to hedge price risk and standardize returns to a greater extent than trading on the spot market. Evidence has shown that between 2017 and 2020, the futures market has been used mainly for speculation, but as the futures market has grown by 500% during 2021, significantly more hedging has taken place. A greater futures market volume with use-cases geared towards hedging risk will act to further dampen the volatility of the asset itself and increase market efficiency. Energy producers can harness excess energy for bitcoin mining to earn stable revenue because of the ability to hedge price risk in the futures market. Bitcoin mining can effectively act as a revenue diversification against curtailment and allows wasted power to be turned into a second source of income.

Another common concern is the unpredictability of subsidies for renewable energy in the future, and how a mining-focused renewable energy producer may not be able to capitalize on the same tax breaks that generators who sell to the public receive. There are no current examples of how the subsidy landscape would look for energy producers who directly mine cryptocurrencies. When Google purchased a Finnish wind farm to run proprietary data centers, another controllable load resource, instead of producing for the grid, the company received no subsidies. However, subsidies have generally come in the form of tax credits for production, and there has been no clear indication that electricity generated for proprietary use will be excluded. Furthermore, wind and solar power have reached a level of efficiency where the levelized cost of energy is already low enough for profitability regardless of whether Biden’s extension of solar and wind subsidies to 2030 stays in place.

Mining difficulty also poses a risk. Over the past decade, mining a Bitcoin, (effectively being the first to process a complex transaction verification) has become increasingly difficult. Retail miners are increasingly struggling to compete with higher powered industrial players. While having the best technology available is important, the scale that energy projects would mine at is already advantageous in an increasingly competitive mining environment. Additionally, the number of bitcoin received from processing a transaction drops in half approximately every four years in events referred to as halvings. This phenomenon sounds like a hindrance to profitability, as short-term mining profits decrease, but the price in the year following halvings has increased by significantly more than the comparative drop in reward in all three instances to date. The concerns associated with cryptocurrency mining can be successfully mitigated. If utilized with appropriate hedging, bitcoin mining has the potential to be a steady and predictable revenue stream to complement distribution to the grid or the pause for grid connection.

LONG-TERM PROSPECTS AND LANDSCAPE

As innovation continues, renewable energy will undoubtedly have a larger global presence, both in cryptocurrency mining and electricity production.

Recently, there has been an increased focus on the role bitcoin can play as a reserve asset, and countries including El Salvador, Venezuela, and Iran have taken steps in this direction. A scenario where excess energy can be used to mine the reserve asset makes economic sense and helps spur initiatives to increase energy production, access, and transportation. At Pareto, we believe this can play an important role in protecting the Bitcoin network’s hash rate and security, and in turn, lead to a more stable value which allows for the currency to be more effective as a reserve asset.

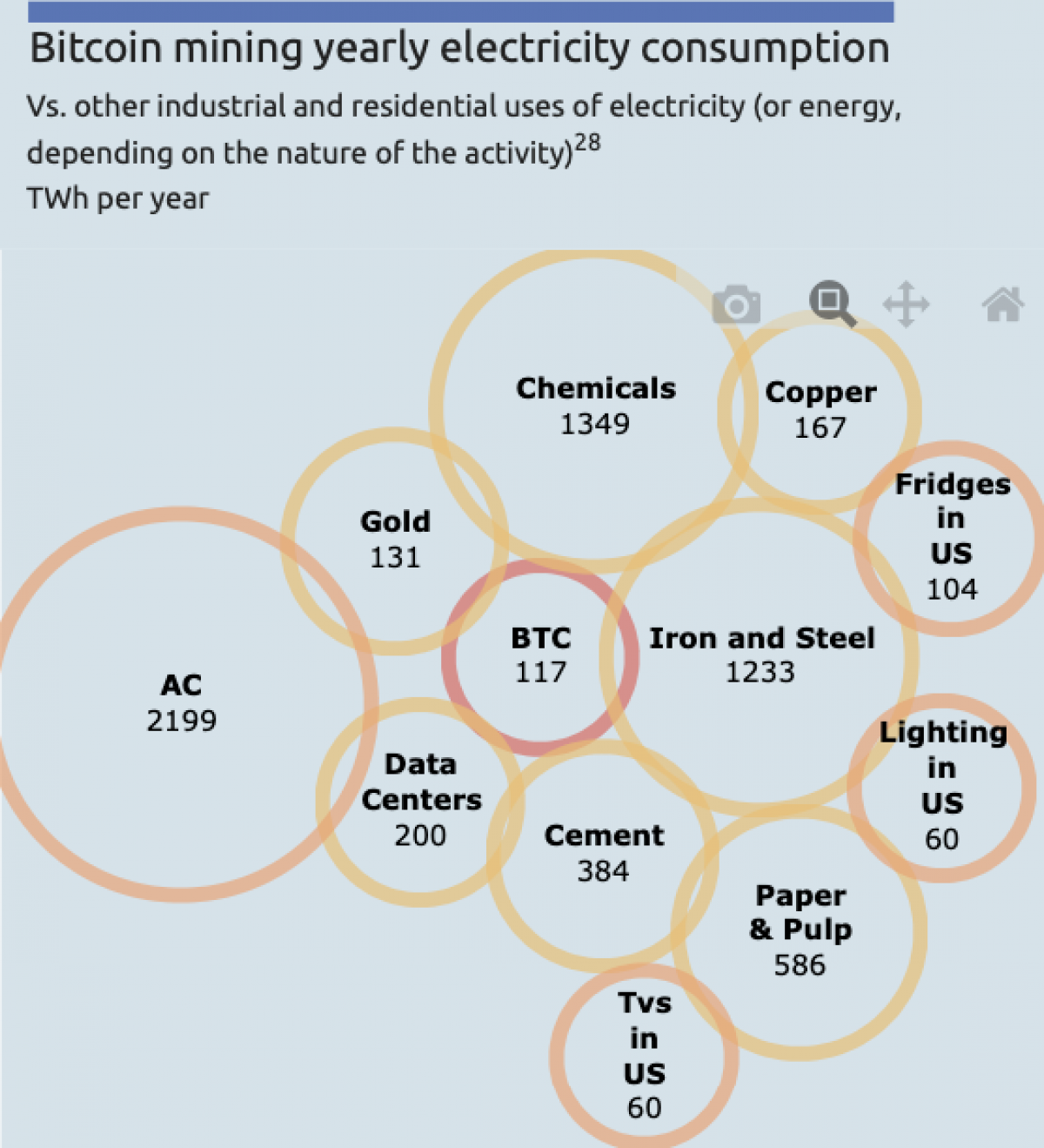

The world is becoming increasingly energy-dependent. The need for electricity to power operations ranging from data centers to residential heating and cooling to corporate infrastructure will only increase.

With many operations able to be hosted at locations separate from the energy production source, the increase in renewable energy generation that is supported by cryptocurrency mining creates a greater abundance of low-cost clean power sources that can be utilized commercially. As the market share of demand-side interest that can be matched with cheaper supply increases, cheap and renewable energy can increasingly be used to power controllable load resources. As a greater number of decentralized energy projects reach fruition, the network of accessible power can expand around the globe and improve the lives of millions through zero-marginal cost use cases including carbon capture and water desalination. As smart-grids that power controllable load resources become increasingly prevalent, the challenges from intermittency will become an issue of the past, and the world can capitalize on the abundant and sustainable energy resources around us.

While recent updates point in the direction of widespread low-cost electricity, energy projects can maintain high levels of profitability mining cryptocurrencies even after a decentralized grid becomes a reality. When Bitcoin mining stops around 2140, the projected time when the last bitcoin will be mined, other opportunities will remain in the field. Cryptocurrency mining equipment would still effectively be utilized to mine other tokens or simply process transactions on the Bitcoin network. Furthermore, we take the stance that there is compelling evidence showing bitcoin has the potential to act as a reserve currency, paving the way to a future in which excess energy can be used to power sovereign mining operations on a national scale.

With a continued improvement and adoption of renewable energy sources, the levelized cost of energy will continue to fall, and cryptocurrency mining will only speed up this process. With greater amounts of low-cost energy that can be distributed with diminished concerns over baseload, energy prices will decrease for consumers, and energy-intensive businesses will become more feasible. An asset that was once accused of accelerating climate change may play a role in stopping it by helping to empower clean and low-cost solutions. Once cost thresholds are reached, impactful and energy-intensive processes such as desalination and carbon sequestration can become widely adopted. Bitcoin has a role financially in the future of the globe, but also has the potential to spread its impact across disciplines.

References:

“Arcane Regulations Slow America's Energy Shift.” Arcane Regulations Slow America's Energy Shift - Austin Vernon's Blog. Accessed October 29, 2021. https://austinvernon.site/blog/renewablesregulatory.html.

“Base Load Energy Sustainability.” Penn State Department of Energy and Mineral Energy. Accessed October 29, 2021. https://www.e-education.psu.edu/eme807/node/667.

“Bitcoin Miner Is Scoring a 700% Profits Investment Selling Energy to the Grid.” Bloomberg.com. Bloomberg. Accessed October 29, 2021. https://www.bloomberg.com/news/articles/2020-09-01/bitcoin-miner-is-sco….

“Electricity Generation - Energy Information Administration.” Accessed October 29, 2021. https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf.

Environmental and Energy Study Institute (EESI). “Fact Sheet: Energy Storage (2019).” Environmental and Energy Study Institute. Accessed October 29, 2021. https://www.eesi.org/papers/view/energy-storage-2019.

“Google Buys into New Finnish Wind Energy in Renewables Search.” Reuters. Thomson Reuters, September 11, 2018. https://www.reuters.com/article/us-alphabet-renewables-finland/google-b….

Hayes, Adam. “What Happens to Bitcoin after All 21 Million Are Mined?” Investopedia. Investopedia, October 22, 2021. https://www.investopedia.com/tech/what-happens-bitcoin-after-21-million…

Holmes, Frank. “Bitcoin Mining Uses a Higher Mix of Sustainable Energy than Any Major Country or Industry.” Forbes. Forbes Magazine, July 7, 2021. https://www.forbes.com/sites/greatspeculations/2021/07/06/bitcoin-minin….

IEA. “World Energy Outlook 2019 .” IEA, October 1, 2021. https://www.iea.org/reports/world-energy-outlook-2019.

“Levelized Cost of Energy and of Storage 2020.” Lazard. Accessed November 1, 2021. https://www.lazard.com/perspective/lcoe2020

“The Duck Is Learning to Fly in California and Hawaii.” Regulatory Assistance Project, December 23, 2016. https://www.raponline.org/blog/duck-learning-fly-california-hawaii/.&nb…;

“Most Pumped Storage Electricity Generators in the U.S. Were Built in the 1970s.” U.S. Energy Information Administration. Accessed October 29, 2021. https://www.eia.gov/todayinenergy/detail.php?id=41833.

Murray, Brian. “The Paradox of Declining Renewable Costs and Rising Electricity Prices.” Forbes. Forbes Magazine, June 17, 2019. https://www.forbes.com/sites/brianmurray1/2019/06/17/the-paradox-of-dec….

“New Data Tool from Berkeley Lab Tracks Proposed Projects in Interconnection Queues.” New data tool from Berkeley Lab tracks proposed projects in interconnection queues | Electricity Markets and Policy Group, August 4, 2020. https://emp.lbl.gov/news/new-data-tool-berkeley-lab-tracks-proposed.&nb…;

“Power Worth Less Than Zero Spreads as Renewable Energy Floods the Grid.” Bloomberg.com. Bloomberg. Accessed October 29, 2021. https://www.bloomberg.com/news/articles/2018-08-06/negative-prices-in-p….

“Pumped Storage Hydropower.” Energy.gov. Accessed October 29, 2021. https://www.energy.gov/eere/water/pumped-storage-hydropower.

“PV PPA Prices.” Electricity Markets and Policy Group. Accessed October 29, 2021. https://emp.lbl.gov/pv-ppa-prices.

“Renewable Energy Curtailment 101: The Problem That's Actually Not a Problem at All.” Union of Concerned Scientists, June 25, 2019. https://blog.ucsusa.org/mark-specht/renewable-energy-curtailment-101/.&…;

Roberts, David. “A National US Power Grid Would Make Electricity Cheaper and Cleaner.” Vox. Vox, June 20, 2020. https://www.vox.com/energy-and-environment/2020/6/20/21293952/renewable….

“Sichuan Defers China's Bitcoin Crackdown to Exploit Excess Hydropower.” South China Morning Post, June 8, 2021. https://www.scmp.com/tech/tech-trends/article/3136357/sichuan-takes-len….

“Solar Industry Research Data.” SEIA. Accessed October 29, 2021. https://www.seia.org/solar-industry-research-data.

“Solar's Future Is Insanely Cheap (2020).” Ramez Naam, July 25, 2021. https://rameznaam.com/2020/05/14/solars-future-is-insanely-cheap-2020/.

“U.S. Energy Information Administration - EIA - Independent Statistics and Analysis.” Accessed October 29, 2021. https://www.eia.gov/todayinenergy/detail.php?id=41833.

“Vietnam's Extraordinary Rooftop Solar Success Deals Another Blow to the Remaining Coal Pipeline.” Institute for Energy Economics & Financial Analysis, January 12, 2021. https://ieefa.org/ieefa-vietnams-extraordinary-rooftop-solar-success-de….

“Volcanoes to Power Bitcoin Mining in El Salvador.” Big Think, September 30, 2021. https://bigthink.com/the-present/volcano-bitcoin-mining-geothermal-ener…;

“Volume of Bitcoin Futures.” The Block Crypto. Accessed November 3, 2021. https://www.theblockcrypto.com/data/crypto-markets/futures/volume-of-bi…

“Where Solar Is Found.” U.S. Energy Information Administration . Accessed October 29, 2021. https://www.eia.gov/energyexplained/solar/where-solar-is-found.php.

About the Authors:

Junaid Ghauri leads all investment and operational aspects of the firm. Prior to founding Pareto Technologies, he was the Chief Technology Officer of Mark Labs where he architected advanced data analytics solutions for a wide range of firms in the financial services industry and managed a team of software engineers and data scientists. Prior to Mark Labs, Mr. Ghauri was the Chief Executive Officer and founder of Emerta, a digital marketing firm that provided data-driven marketing solutions to its clients by harnessing industry-grade predictive analytics techniques.

Junaid has also worked at both domestic and international governmental agencies such as NASA and ICFO, being at the frontlines of applied science. Junaid holds a Master of Science degree in Computational and Applied Mathematics from Johns Hopkins University and a Bachelor of Science degree in Physics from George Washington University.

Sean McElrath is a Co-Founder of Pareto Technologies, where he functions as the firm’s Chief Technology Officer. Prior to founding Pareto Technologies, Sean worked as a lead software engineer for Mark Labs and InphoChain where he architected large-scale data analytics and distributed ledger technology systems. Prior to that, he served as the founder and CEO of Hallway Social Learning Network, an online education technology company.

Sean attended the University of Virginia where he received a Bachelor of Science in Computer Science. He has over 7 years of experience as a full stack developer and has extensive experience developing algorithmic trading systems and blockchain architectures and applications.

Jacob Kleinman ("Jack") is a Junior at Brown University studying applied mathematics and economics with an interest in the role cryptocurrencies and blockchain projects can take in shaping the future. At Brown, Jack is a portfolio manager for the Brown Socially Responsible Investment Fund, the largest such fund in the nation, and a member of Blockchain at Brown.

Jack has been with Pareto since his freshman year, working on several projects and publishing multiple research reports. Professionally, Jack also has internship experience within private equity and investment banking but finds himself drawn to cryptocurrency because of the rapid pace of innovation and continued learning opportunities the field presents.