By Megumi Kimoto, CAIA, a financial translator for alternative investment professionals.

By “culture,” I mean “how a people in a place or organization think, act, or work.”

Some cultural elements positively influence the likelihood of the success of start-up companies. Therefore, venture capitalists would want to know which cultural factors to look for and which to be wary of in a region or country.

Qualitative analysis of regional cultures by AnnaLee Saxenian

Professor AnnaLee Saxenian pioneered the study of cultural impact on venture firms. In her book, she focused on the regional cultures of Silicon Valley and Boston’s Route 128, concluding that their cultures explain why Silicon Valley outperformed the Boston area during the 1980s. Her findings include the following:

In Silicon Valley

- People joined horizontal, informal, and non-exclusive social networks across divisions, firms, associations, and universities to share information, exchange ideas, and collaborate.

- The atmosphere within a firm was democratic. Companies had flat structures with few stratus differences. Employees at all levels participated in open communication and teamwork. They were evaluated based on merit, regardless of degrees, age, race, or position.

- The management style was characterized by trust in individual motivation, professional autonomy, and generous employee benefits. Individual initiative was prized. Employees were expected to create their own ways of contributing to the company’s success. Competition among individuals was intensive.

- Risk-taking was glorified. People gave the highest regard to those who started firms. They wanted to join a small company or start-up rather than an established company. There was little shame in failing in business.

- Engineers had a stronger commitment to one another and to the cause of advancing technology than to individual companies or industries. Job-hopping was the norm. Employees often left for new opportunities with the blessings of top management and the understanding that if it didn’t work out, they could return.

In the Route 128 region

- Secrecy and territoriality ruled relations between companies and individuals. They didn’t talk to their competitors. Companies had distant, distrustful, or antagonistic relations with local institutions. A business network was confined to a traditional business elite that shared political and social views. Large corporations were autarkic, only using internal skills, technologies, and other resources.

- Corporate hierarchies ensured that authority remained centralized and information tended to flow vertically. There was a social hierarchy as well. Layers of protocol and perquisites existed to symbolize superiority and establish the boundary lines. Managers and executives were typically in their fifties and sixties who created formal, bureaucratic organizational structures and decision-making or operating procedures.

- People identified themselves by family roots, class background, and ethnic ties.

- Stability was valued over experimentation and risk-taking. If you failed, everybody would be worried. Unless you proved yourself many times over, you would not get any financing.

- Corporate loyalty governed relations. Job-hopping was unacceptable. People tended to ostracize departed employees.

Those are descriptions of two different regional cultures. But, what about national cultures? Do they also impact the success of venture firms? To answer that question, I looked into data. My findings are in the next section.

Quantitative analysis of national cultures

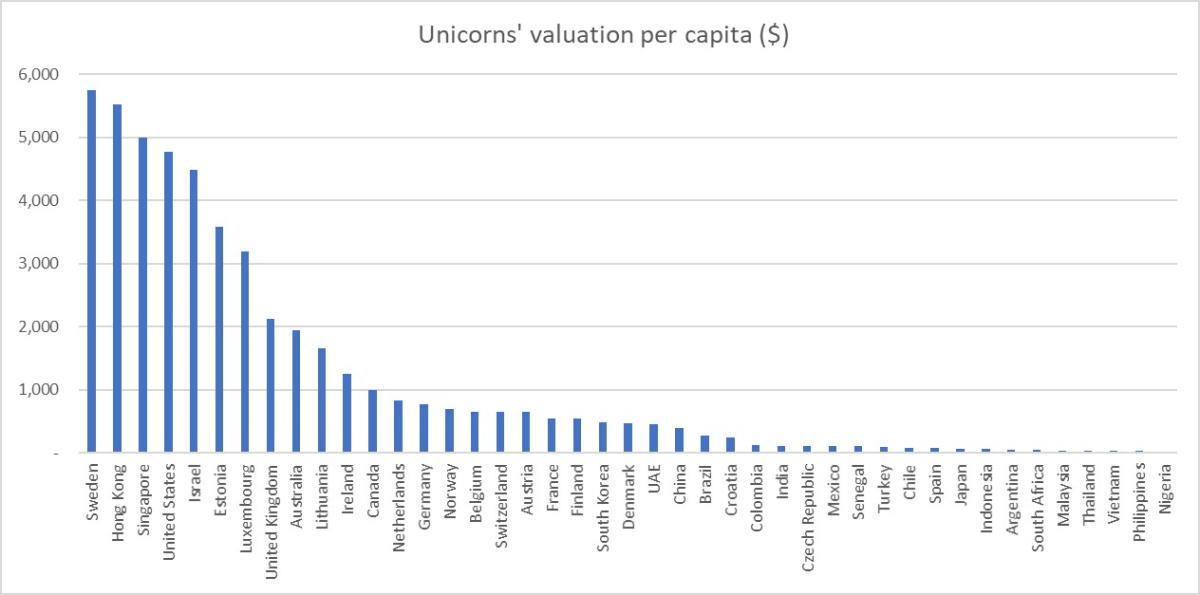

I assume that countries with venture-friendly cultures should produce more unicorns. Here, I define a unicorn as a private company with a valuation over $1 billion. I used CB Insights’ database that contains a list of unicorns. The total value of unicorns in each country can be used as a proxy of the nation’s degree of venture success. I used per capita value to eliminate the influence of population.

Source: Unicorn value: CB Insights. Population: the United Nations. Excluding Bermuda and including Hong Kong.

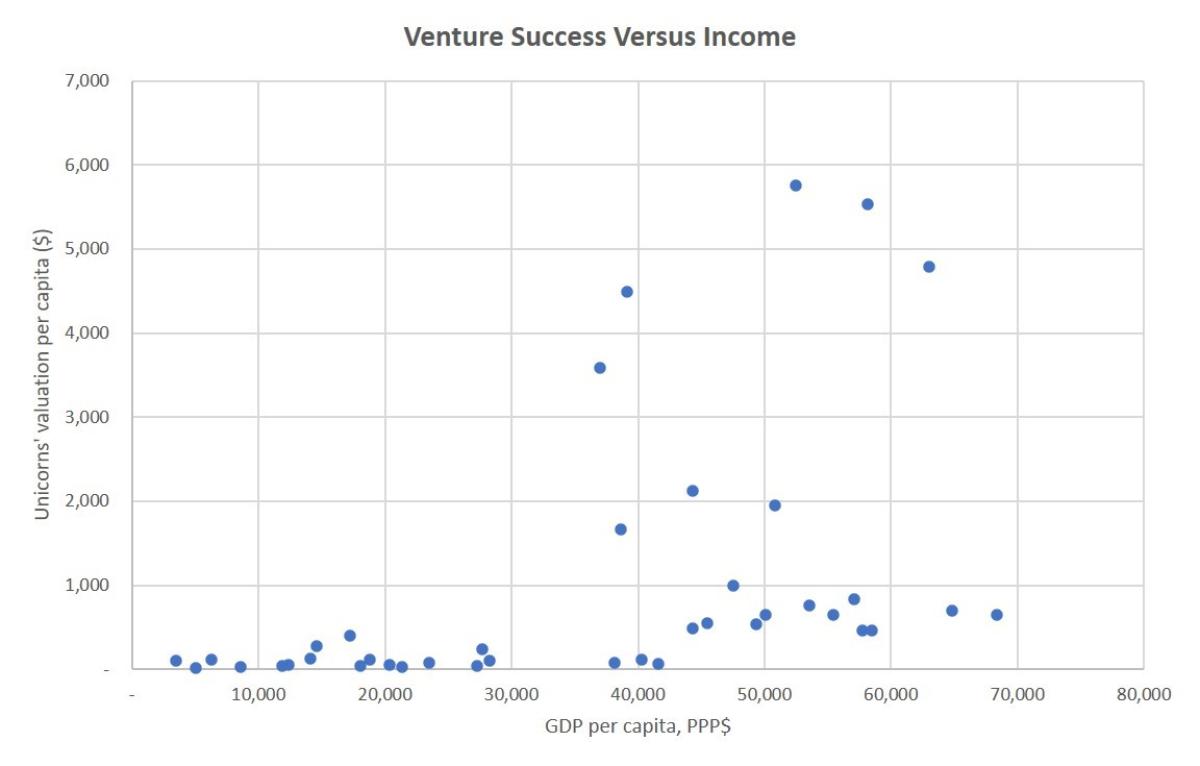

I suspected venture activities are affected by income levels. After all, affluent nations have many more rich people who can afford to bet their money on risky ideas. The chart below confirms this.

Source: Unicorn value: CB Insights. Population: the United Nations. Income: The World Intellectual Property Organization.

As expected, venture firms do not flourish where the per capita income is below $30,000. Those countries are Senegal, Nigeria, India, the Philippines, South Africa, Indonesia, Colombia, Brazil, China, Thailand, Mexico, Argentina, Vietnam, Chile, Malaysia, Croatia, and Turkey. (Although China and India produce unicorns of massive value in aggregate, their value is small per capita.) More affluent countries – those above $30,000 income levels - show divergence.

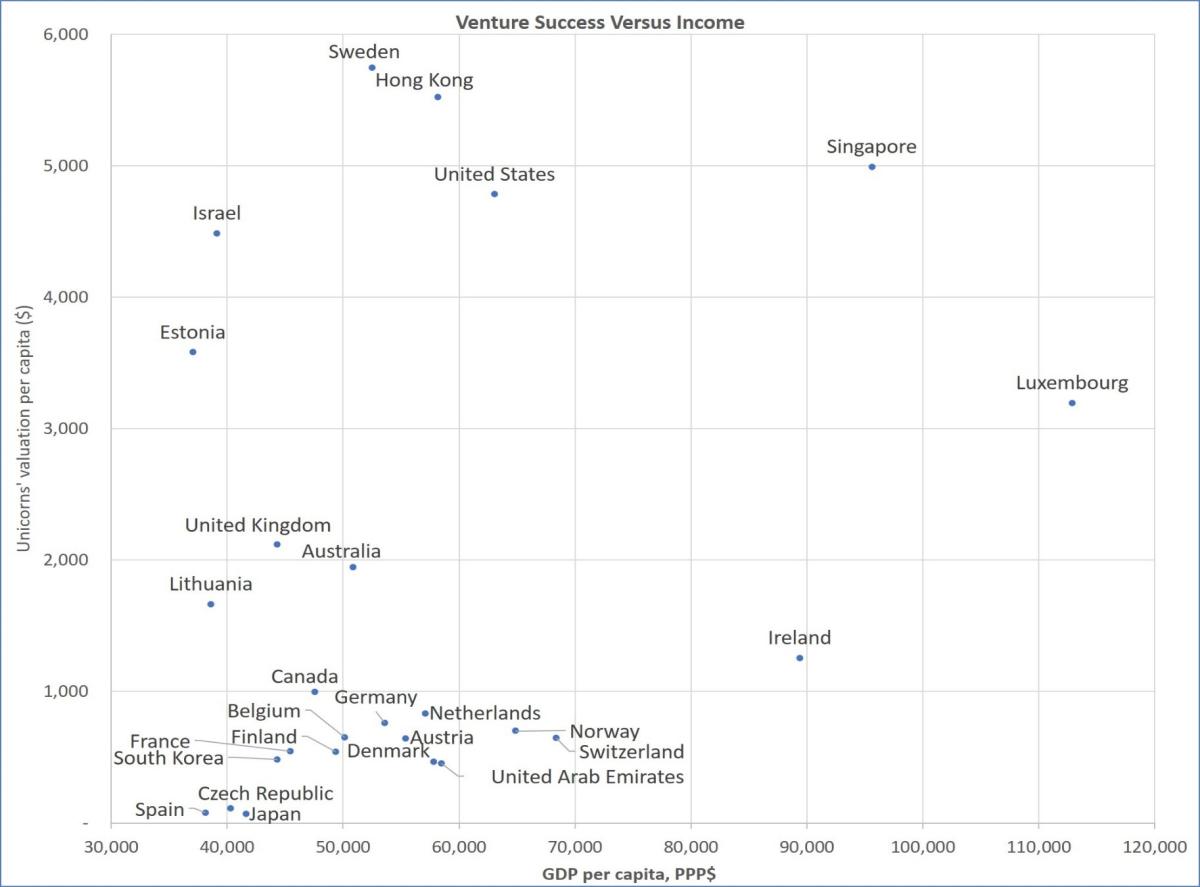

Source: Unicorn value: CB Insights. Population: the United Nations. Income: The World Intellectual Property Organization.

Do cultures explain the variation in unicorn value? To answer that, I used Geert Hofstede’s model of national cultures. His model measures a national culture by six dimensions – power distance, individualism, masculinity, uncertainty avoidance, long-term orientation, and indulgence. These dimensions are defined in his book as follows:

Power distance

In small-power-distance countries, subordinate and dominant members are interdependent; they want to consult with each other. Subordinate members can express disagreement with the dominant members without being afraid. In large-power-distance countries, subordinate members want to depend on dominant members who are autocratic or paternalistic. Subordinate members would not approach or contradict dominant members directly.

Individualism

In individualistic countries, the interests of the individual prevail over the interests of the group. Individual characteristics define a person. Children get an education to be independent both practically and psychologically. In collectivist countries, the interests of the group prevail over the interests of the individual. People expect their group to protect them against the hardships of life. They owe lifelong loyalty to their group.

Masculinity

In a masculine society, emotional gender roles are distinct; men should be assertive, tough, and focused on material success, whereas women should be more modest, tender, and concerned with the quality of life. In a feminine society, those gender roles overlap; both men and women should be modest, tender, and concerned with the quality of life.

Uncertainty avoidance

In uncertainty-avoidant countries, people feel threatened by situations or relations that are ambiguous, unknown, or unpredictable. They need to have written or unwritten rules which they do not break. Changing jobs is not popular. They are rewarded for accuracy. Difference means danger.

In uncertainty-accepting countries, people are rewarded for originality. The difference triggers curiosity. Ambiguity and chaos are sometimes praised as conditions for creativity.

Long-term orientation

long-term orientation means the fostering of virtues oriented toward future rewards—in particular, perseverance and thrift. Short-term orientation stands for the fostering of virtues related to the past and present—in particular, respect for tradition, preservation of “face,” and fulfilling social obligations.

Source: Unicorn value: CB Insights. Population: the United Nations. Individualism: Hofstede’s model.

Indulgence

Indulgence stands for a tendency to allow relatively free gratification of basic and natural human desires related to enjoying life and having fun. Its opposite pole, restraint, reflects a conviction that such gratification needs to be curbed and regulated by strict social norms.

Presumably, venture-friendly countries should have the following cultural aspects: lower power distance for the ease of sharing information; higher individualism for encouraging personal initiatives; lower uncertainty avoidance for taking greater risks and producing disruptive innovation; and higher long-term orientation for breaking out of traditions. The role of masculinity and indulgence, however, is not obvious.1

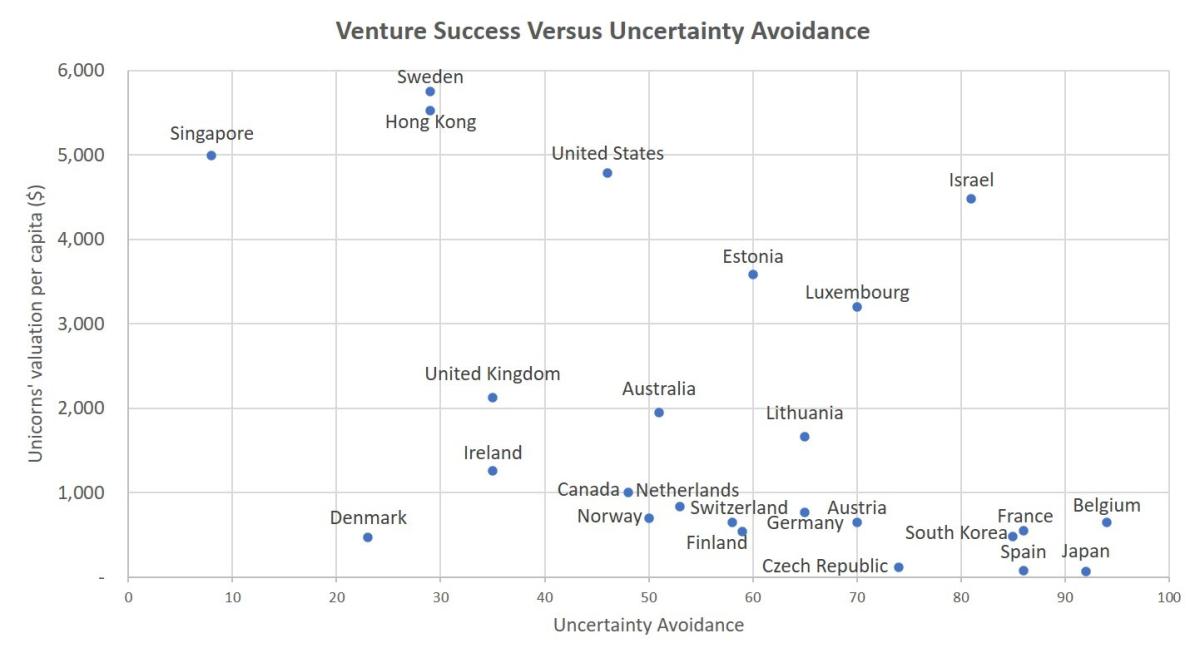

Given the small sample size of 26, I did not do regression analysis. The chart below shows the relationship between venture success and uncertainty avoidance, which seems negative.

Source: Unicorn value: CB Insights. Population: the United Nations. Uncertainty avoidance: Hofstede’s model.

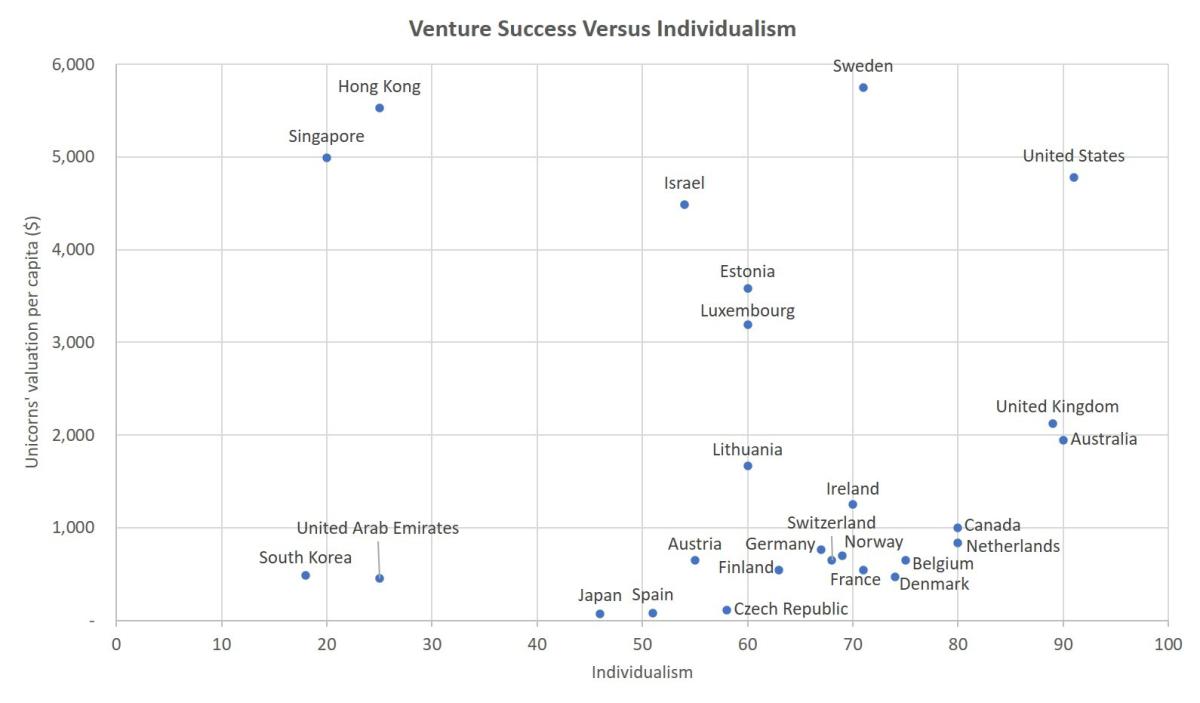

The chart below shows the relationship between venture success and individualism, which seems ambiguous. All you can say is that affluent countries are more individualistic.

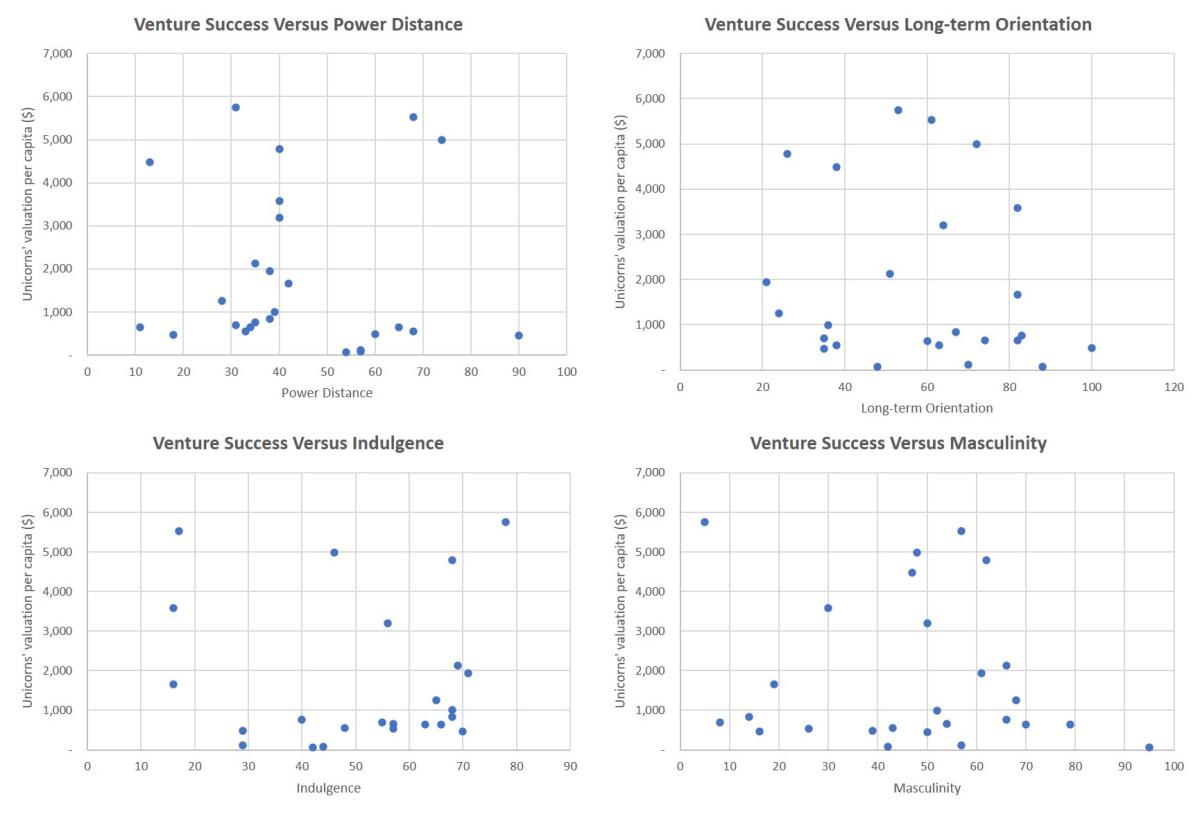

The charts for other cultural factors show no clear patterns.

Source: Unicorn value: CB Insights. Population: the United Nations. Horizontal axis values: Hofstede’s model.

Case study: Japan

Japan is highly uncertainty-avoidant. A study commissioned by its government concludes that the nation needs to revitalize the economy by creating new businesses and industries.

But entrepreneurs are facing difficulty there; they have a small chance of exit by selling their company to large corporations. According to the same study, large Japanese corporations are typically autarkic and risk-averse. They distrust and disrespect Japanese start-ups, which they believe are run by people who are unemployable by large companies.

With this mindset, large Japanese corporations heavily invest in foreign startups. This creates opportunities for global players, given the nation’s venture capital investment of 2.5 billion dollars in 2019.

Implication for investment

Some things don’t change or are slow to change. Cultures are one of them. I believe venture capitalists can exploit cultural gaps–for instance, by selling their stakes to entrepreneurship-starved countries. Like everything else, culture can be arbitraged.

If Ricardo’s theory of comparative advantage holds, everybody is better off if each country does what it does best. I hope this applies to venture capital investment, too.

------------------------------------------------------------------------------------------------------------------------------------

Note 1. Actually, such correlations were confirmed by studies done by Handoyo (2018) and Espig et al. (2021). Their studies, however, did not focus on venture capital.

About the Author:

Megumi Kimoto is a document translator in Japan. For 30 years, she facilitated communication between the Japanese and people from all over the world, including the US, the UK, France, Luxenberg, Australia, Hong Kong, and Singapore.

For more about her service, visit https://www.kimoto-alternative-investment-translations.com/