By Qayyum Rajan, CFA, is CEO of ESG Analytics - a software platform that uses NLP and alternative data to provide dynamic, real time ESG insights for companies and investment funds.

As we enter the ‘inflation common knowledge game’ - I’ve been thinking about what we can learn from alternative data as we chart this next journey in the world.

The big question - is inflationary temporary? As we will see - thats not really the right question.

So what is the right question? We can start with what we know. We know that with the era of Covid, we have seen global supply chains get absolutely hammered, causing increased prices across the globe. We know that it is not just a back to normal, as some countries become more isolated/self sufficient and companies adapt to new conditions. We know that US CPI is printing > 7% which is unsustainable.

US CPI - note similarities to the 10 year

The NY Fed just put out some research breaking down the sources of inflation - which shows a relatively consistent trend across durables, nondurable and services.

So the question they propose, is … how much of inflation is persistent, and how much is broad based? If a company can get away with charging more, you can imagine that they will do everything they can to keep it there! But that might apply to more to some segments like services, or non basic goods - like clothings and apparel, whereas certain basic goods like milk or others that are closest to a low level commodities might return to a normal area, once shipping and supply comes back to earth.

The null hypothesis here is that rather than being in a consistently increasing inflationary environment, we have entered a state where due to external shocks, we are seeing a rapid rise in core inflation, but that the growth from here on out will be muted (i.e we will NOT grow at 7% for the next few years, but rather have a big jump - as we are now, and then keep much of that increase stable and a normalized rate). This muteness going forward will be, in my opinion, a combination of policy response from central banks and federal governments, private investment and businesses trying to holding on to the prices increases - to the extent that they can.

One data source I like to look at is shadow stats, which tracks the CPI index as if it was calculated using the same methodology as when it came out in 1990.

What ShadowStats aims to show is that basically - the methodology of CPI has changed over time, and what started off as a measure of the cost of living - turned into something else entirely. And if you use the same methodology as the previous decades (many of these ‘calculation changes’ were after 1980/1990) what you find is that inflation has been systematically depressed vs the ShadowStats figures. This is one way to say that prices have been increasing over time - more significantly than we think.

The inflation conversation has been happening for a while, pre covid actually - but in the shadows, only now is it really front and centre - which means that it is normalized - or rather it has become ‘common knowledge’.

Beyond CPI - which can be flawed, how do we tangibly track these price increases to back up this data? Alternative data sources like price increases is one way.

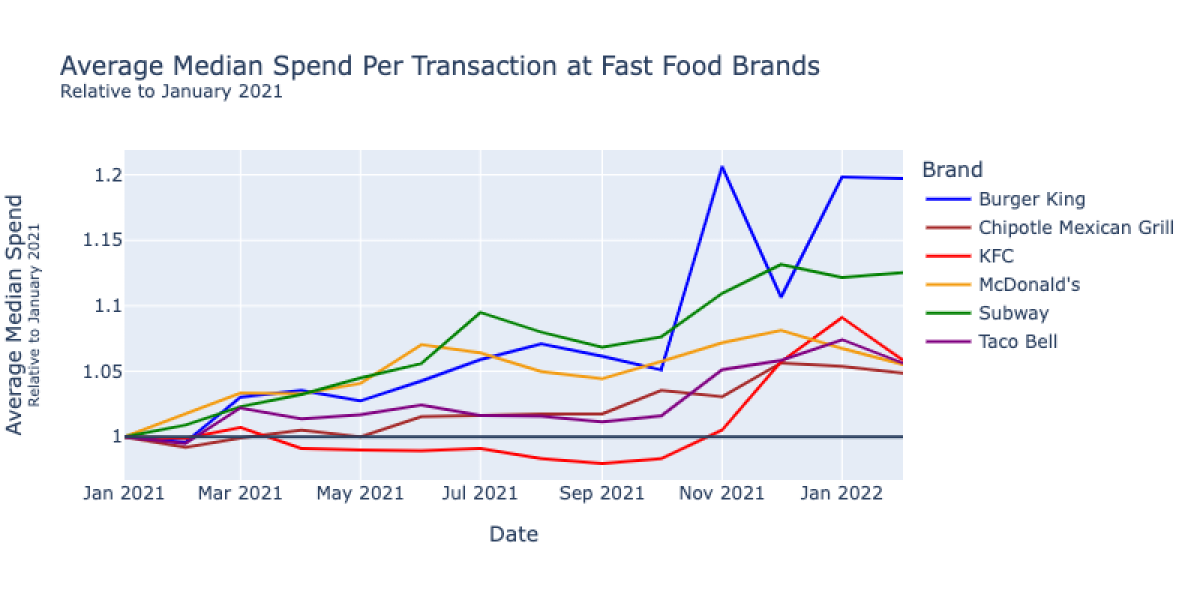

This chart shows fast food prices over the last year, which have increased a median of 5%.1

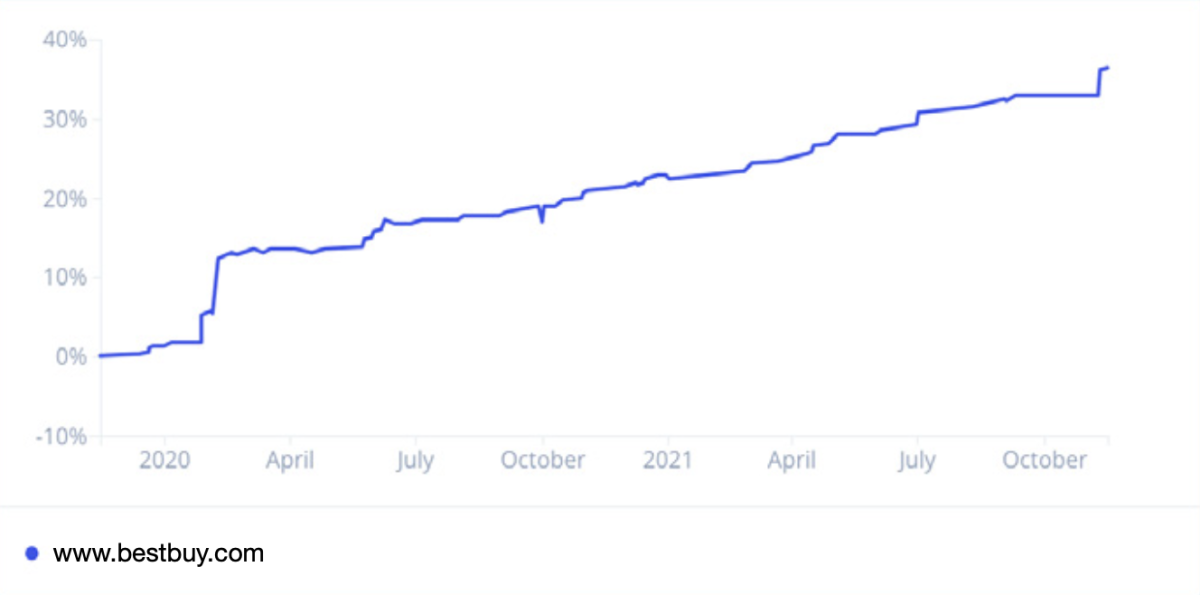

These two charts are from the end of last year - slightly dated, but paint the picture

This is the average price of all products at Best Buy for the 48 months prior to November 2021 - and increase of 36%. Likely many are a result of chip shortages, but you could imagine that this will not be decreased in lockstep given a reduction in chip prices and/or shipping costs - but that will also depend on the competitive aspect (i.e everyone needs to raise and keep prices consistent).

Rents have increased by an impressive 22% year-on-year for residential listings on AvalonBay Communities, a publicly-traded REIT that invests in apartments in New England, New York City, Washington D.C., Seattle, and California.2

As Ben Hunt, who runs Epsilon Theory have said - Inflation is now ‘common knowledge'.

Common knowledge is something that we all believe everyone else believes.

“The classic example of the Common Knowledge Game is the fable of The Emperor’s New Clothes. Everyone in the crowd possesses the same private information — the Emperor is walking around as naked as a jaybird. But no one’s behavior changes just because the private information is ubiquitous. Nor would behavior change just because a couple of people whisper their doubts to each other, creating pockets of public knowledge that the Emperor is naked. No, the only thing that changes behavior is when the little girl (what game theory would call a Missionary) announces the Emperor’s nudity loudly enough so that the entire crowd believes that everyone else in the crowd heard the news. That’s when behavior changes. That’s when behavior changes FAST."

For months now, Missionaries large and small have been saying that inflation is here and inflation is well-embedded. But when the most powerful Missionary in the world, Jay Powell, says that inflation is no longer “transitory” … well, now everyone knows that everyone knows that inflation is here to stay.

And when everyone knows that everyone knows that inflation is here to stay, ALL businesses can raise prices to maintain margins without fear of competitive pressure or customer pushback.”3

I think this is just on point.

Based on the alt data, which confirms the price raises to consumers - how do we reconcile this? The testing of the initial hypothesis will say that we get a spike, as we have done, and at least in the short -medium term (assuming the US doesn’t implode in that time aka the dollar end game - a topic for another day), we will see policy come and temper - and of course this cannot influence all prices. Something along these lines:

Supply chain shocks → Generalized inflation that scares everyone → Opportunity to raise prices → Consumer demand and policy intervention + supply chain recalibration/solutions → Prices stabilize or even reduce a bit, to continue towards more stable growth → Until the next supply/demand shock or currency crisis

Like anything, the world is reflexive. The players in the game influence the game as it happens - and thats always the unpredictability of the game. First principles doesn’t work when we are thinking about the effects of the effects.

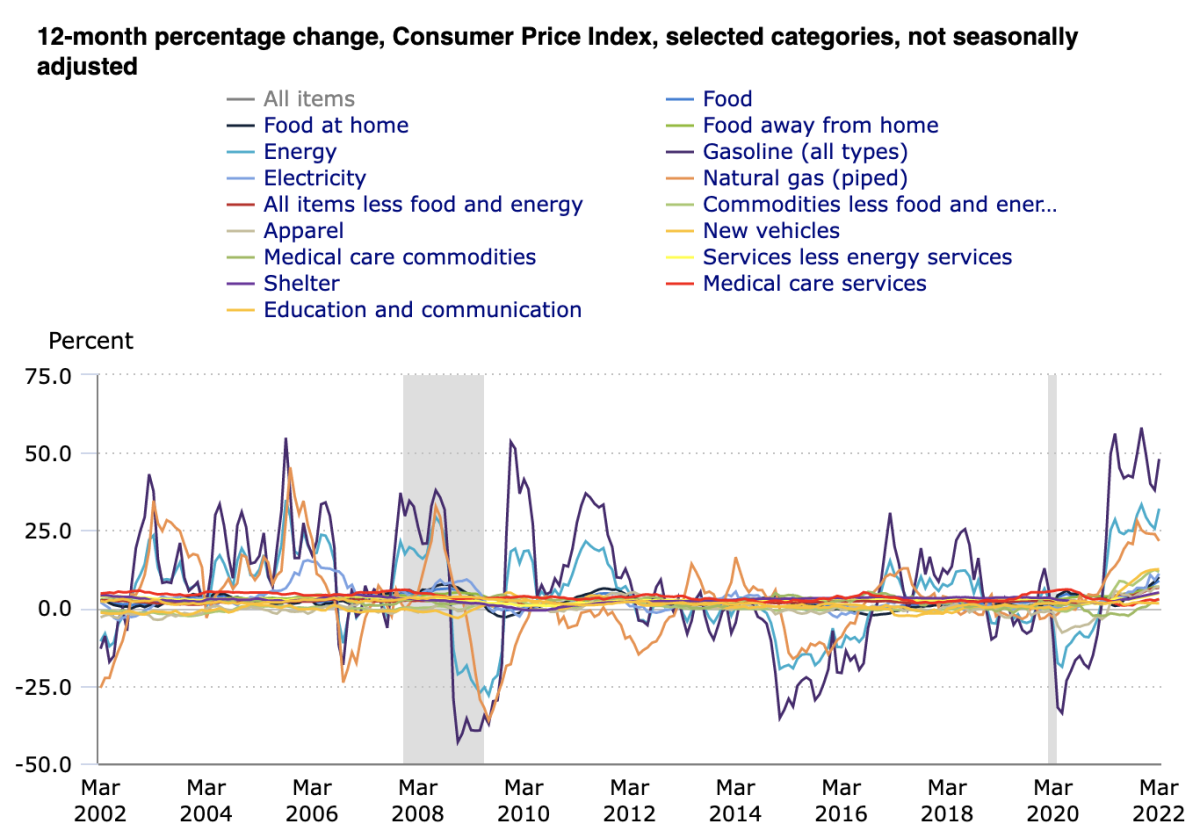

Let’s look at the breakdown. From the US Bureau of Labor Statistics, this tracks the traditional CPI basket:

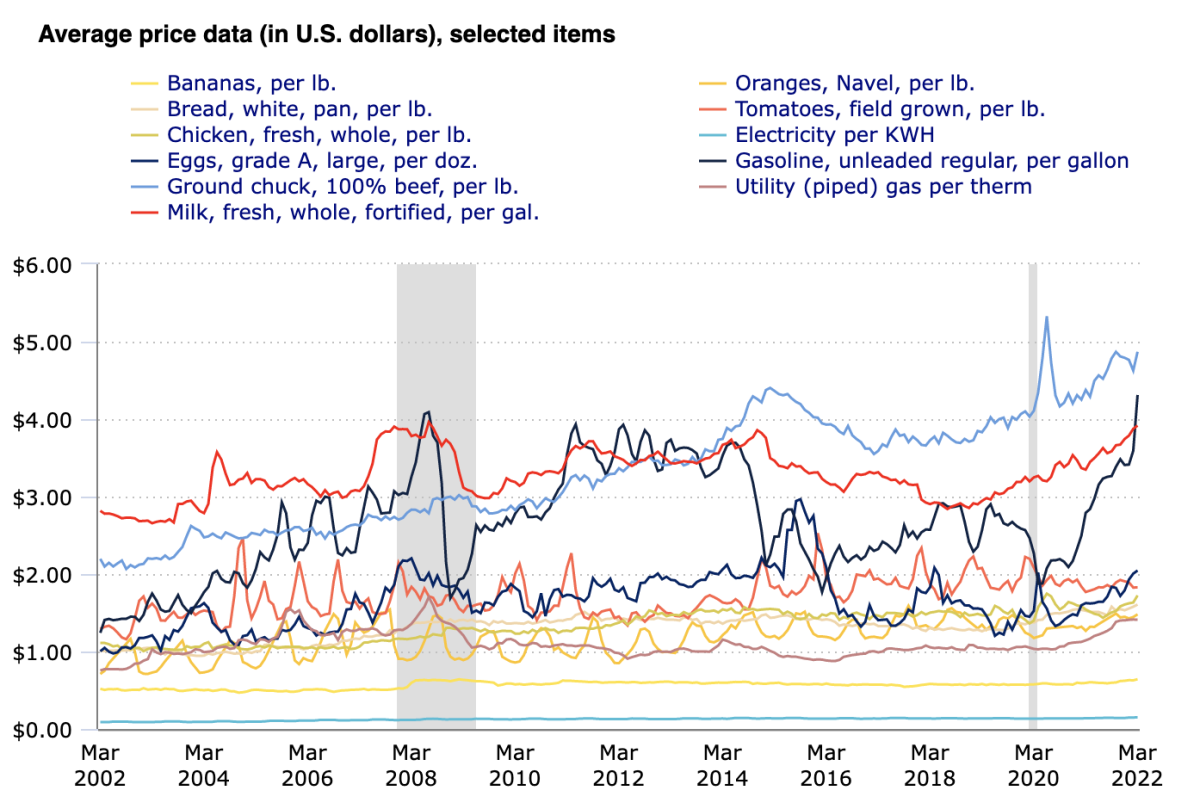

And breaking it down into individual prices…

Basically - the core of this is that while everything in general is shooting for the moon, but there are key outliers:

-

Energy - up 32% in March (within Energy you had fuel up 78% and Gasoline up 48% - yikes)

-

New Vehicles - up 12.5% in March

-

Food - up 8.8% in March

-

Commodities less food and energy - up 11.7% in March

-

Apparel - up 6.6% in March

With wars, energy manipulation and semiconductor shortages - some of those big ones are really like that for a reason, but all a result of factors that can come down swiftly. The world is just not sustainable at those points - the question is really one of timing and catalysts.

My thoughts go to food, where beef, milk and eggs have been key commodities impacted - but commodities that are staples that need to be addressed for some basic human needs. These kinds of items are less apt to fall under a shrinkflation scenario, given their standardization, and require some sort of level for general consumer use as key inputs.

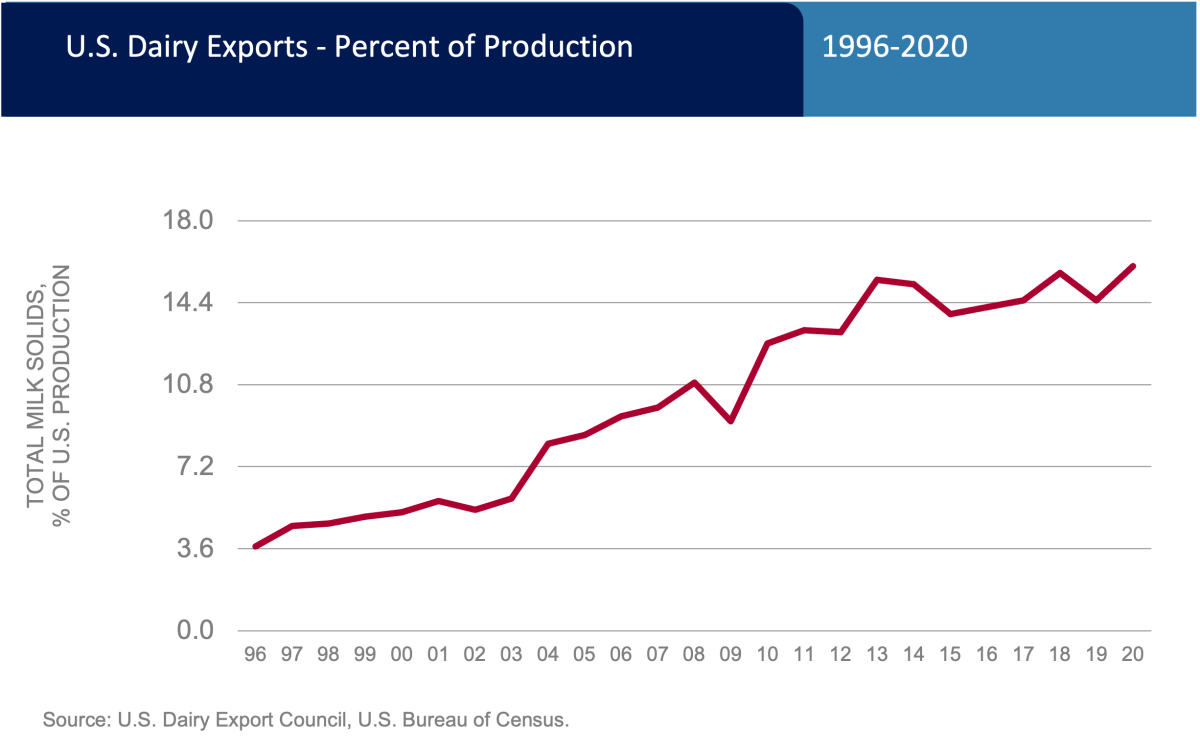

Dairy is something that caught my eye as I started investigating the rise and fall in milk prices in 2007-2008. This was a result of increased global demand from China, Australia, India and others for dairy products - with their local markets being ill equipped, and a falling dollar resulting in a massive increase in dairy exports as a % of production. This was then further emphasized with rising corn prices which drove up prices of feed - reducing farmer profit and cementing price increases.4

After this, with a stronger dollar emerging, and the 2008 recession - extra surplus flooded the market, resulting in a big reduction in prices.

So here we are in 2022, with supply shocks here once again, driving up prices significantly to prices not seen from the 2007 mark. Many producers are increasing investment in infrastructure to keep up with demand, and government entities and private sector are going to be doing what they can to keep things in equilibrium.5

Potentially, we could see more things being done to stabilize prices of lower level commodities over the short-mid term compared to to other industries such as apparel, which may be able to sustain higher prices, pass them on to consumers and keep them there with a double benefit of reduced costs as the supply chain wheels get progressively greased.

Looking into milk futures (e.g Class III Milk Futures) or consumer brands (e.g Hersheys and Mondelez) that use Milk as a key input could be a prudent exercise, and a launch point to think about just which price increases might be less persistent over the long term.

Answer this question correctly, and the future is mapped out.

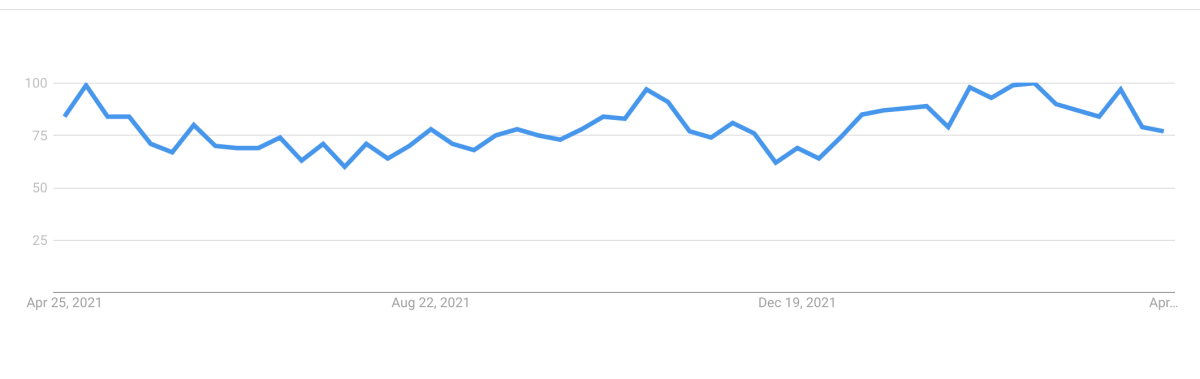

Searches for ‘milk price’ last 12 months:

Alternative Economics | Qayyum Rajan, CFA | Substack

Footnotes:

1 Source: https://www.safegraph.com/blog/inflation-trends-safegraph-spend

2 Source - Thinknum Inflation insights (November)

3 https://www.epsilontheory.com/inflation-and-the-common-knowledge-game

4 https://www.supermarketnews.com/meat/dairy-futures

5 https://www.producer.com/news/u-s-dairy-support-may-come-too-late-for-s… and https://www.fb.org/market-intel/milk-check-outlook-high-milk-prices-won…

Original Link: Inflation - got milk? - by Qayyum Rajan, CFA (substack.com)

About the Author:

Qayyum Rajan, CFA ('Q') sits at the intersection of finance and technology, as an avid economist, data scientist and technology executive.

Q began his career in banking, portfolio management and investment funds before entering the programming and data science world. He was then bitten by the entrepreneurship bug and went on to co-found a global fintech company which focused on automating securities issuance using blockchain technology.

Subsequently, he joined the digital and emerging technologies consulting division at one of the big 4, before becoming the founder and CEO of ESG Analytics, a startup that focuses on applying AI to the environmental, social and governance industry. ESG Analytics was recently acquired by The RepTrak company where Qayyum is now the Global Head of ESG Analytics.

Qayyum is a CFA Charterholder and was recent recipient of the Top 30 Under 30 award in British Columbia. He also sits on the Fintech advisory committee for the BC Securities Commission (BCSC).