By Matthew Craig, a senior consultant at CoreData Research, an independent research consultancy.

After lying dormant for decades, inflation has roared back into life in the last few months. For institutional investors, accustomed to very low interest rates, supportive central bank policies and rising asset values, higher inflation is both a shock and, in their own estimation, a very significant risk to their portfolios.

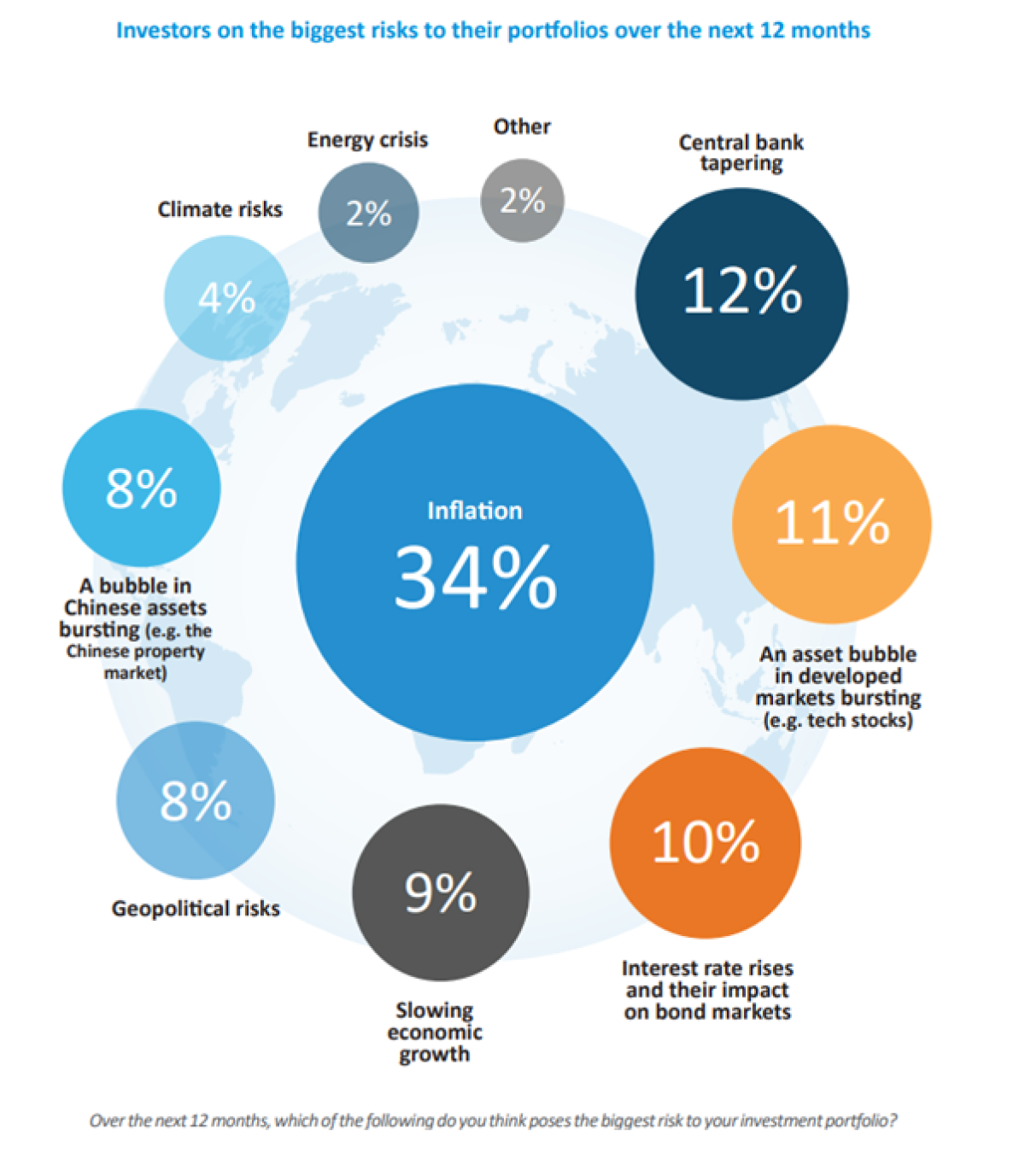

A survey of nearly 400 institutional investors found that over a third (34%) gave inflation as the biggest threat to their portfolios in the next 12 months. This is almost three times the next biggest risk, central bank tapering (12%), while 11% picked an asset bubble in developed markets bursting as the biggest risk. Slightly fewer investors picked out interest rate rises (10%), slowing economic growth (9%) and geopolitical risks (8%).

Looking at these findings a few months on, investors are facing a near-perfect storm of the risks they fear. At the time of the survey, inflation in the USA (as measured by the CPI index) was 6.2%; by June 2022 it reached 9.1%. Inflation in the UK is expected to hit double digits later this year and similar or higher rates of inflation are widespread globally. In response to rising inflation, central banks, led by the US Federal Reserve, are ending expansionary policies and raising interest rates, which in turn is likely to slow growth and bring recession. And, of course, geopolitical risks came to the fore in 2022, following Russia’s invasion of Ukraine. Given the worsening outlook, it is not surprising that 2022 saw bubbles in technology stocks and cryptocurrency burst, as markets reacted to a deteriorating macroeconomic and geopolitical outlook. For institutional investors, these flashing red lights for various risks could mean a severe stress-test for their investment portfolios. How will approaches that worked when times were good cope with much tougher conditions?

Depending on their investment mission and factors such as their risk tolerance and their resources and expertise, institutional investors have developed different portfolio models that fit their needs. For example, many endowments and foundations follow the approach set out by David Swensen at Yale, of diversifying away from listed equities and bonds, with allocations to a range of alternative and real assets, in search of more diversified returns. In recent years, this approach has been very successful in generating some very impressive return numbers[1]. This approach is popular with institutional investors; 30% of investors said that the ‘endowment model’ gave the best chance of good risk-adjusted returns over the medium to long-term. This was ahead of the conventional 60/40 portfolio split between equities and fixed income in that ratio, which a fifth (20%) of investors selected. Other portfolio models, such as allocating by risk factors (18%), or to a number of discrete investment buckets based around themes such as long-term income, liquid assets or de-risking (13%), were less popular.

One notable investment approach, pioneered by some very large Canadian institutions, involves making significant direct investments in assets such as private equity, real estate and infrastructure. This approach has its admirers, but only 16% of investors think this offered the best chance of good risk-adjusted returns over the medium to long-term. However, this rose to 22% among corporate pension plans and to 33% among public or government pension plans. This is logical, as the ‘large Canadian’ portfolio model is designed for very large institutions with a long-term outlook but also a desire to lessen their exposure to listed market volatility. These investors have the scale and resources needed to build in-house teams capable of managing direct investments in asset classes such as private equity and real estate, and to negotiate favorable terms when they decide to invest.

For the past decade or so, two key trends for institutional investors have been diversification into a wider range of assets, particularly private markets and real assets, and a search for yield, in the face of very low interest rates from conventional fixed income assets. An environment of higher inflation and interest rates, as well as a recession, could challenge these trends. It could also cause many investors to address their approach to risk management. In a comment on the findings on what investors see as the best portfolio design, Professor Andrew Clare, chair in asset management at the City University of London, said his preference would be for a wide mix of asset classes, somewhere between the large Canadian model and the endowment model. On risk management, he added: “UK pension funds normally have a hedging program in place. Even if looks broadly like a 60:40 portfolio, behind the scenes derivatives are doing a lot of risk management”.

Key elements in portfolio design

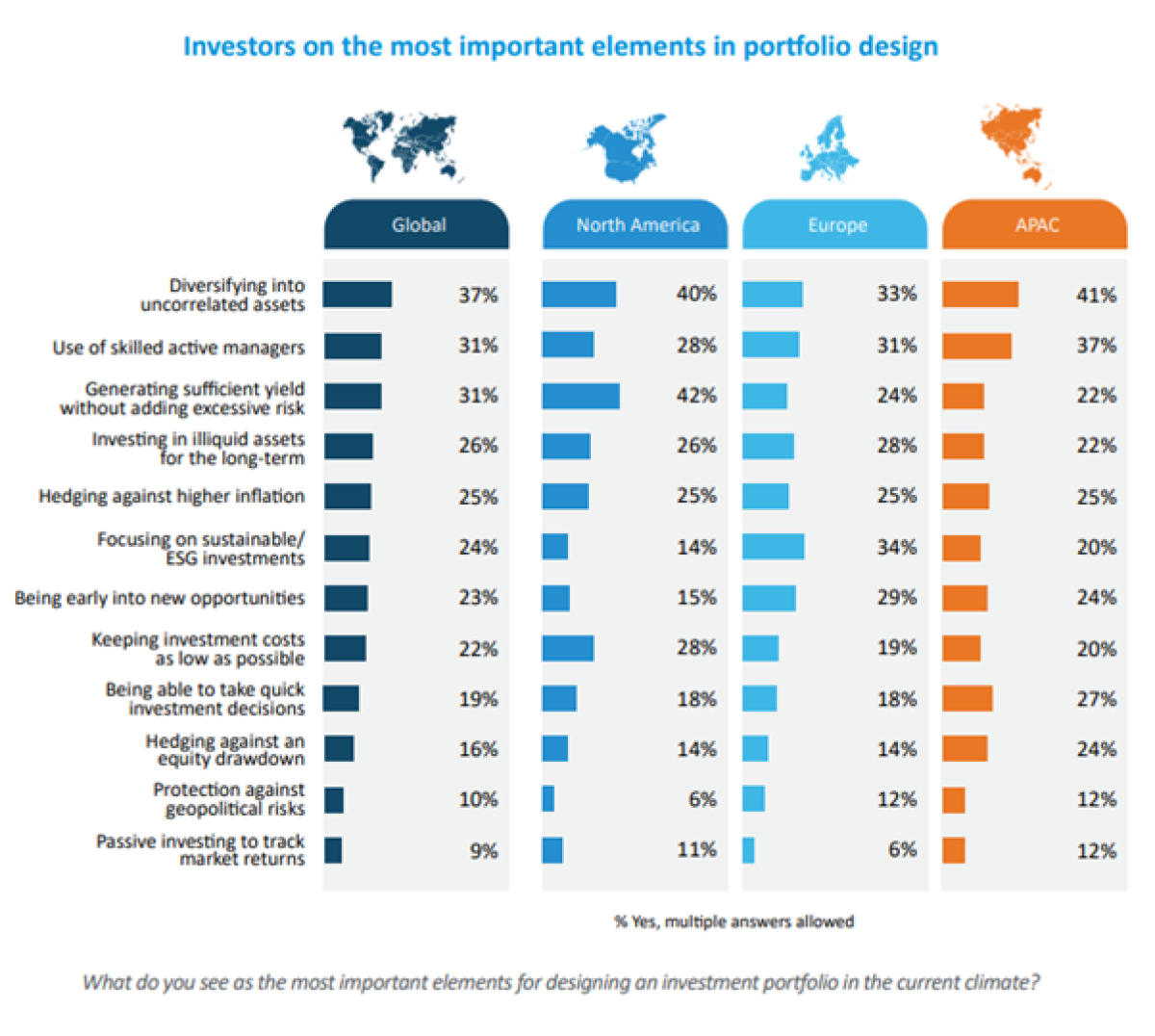

Given the dramatic changes to the investment landscape, it will be fascinating to see if there are changes to how investors view the most important elements in portfolio design over the next year or so. Diversifying into uncorrelated assets is seen as the most important element by 37% of institutional investors, ahead of the use of skilled active managers (31%) and generating sufficient yield without adding excessive risk (also 31%). And while 26% gave investing in illiquid assets for the long-term as an important element in portfolio design, a quarter (25%) put hedging against higher inflation as a key element.

The high score given to diversifying into uncorrelated assets is consistent with the popularity of the endowment model of portfolio design, which features diversification into different asset classes. And this approach often means investors want to use skilled active managers, not necessarily as stock-pickers, but because manager expertise is needed to build and manage portfolios in assets such as private equity, hedge funds, infrastructure or real estate. The very low interest rates we have seen for many years also meant that investors were often focused on finding yield without adding excessive risks, hence the importance given to this element of portfolio design. The relative importance of hedging against inflation shows that inflation has been a concern for some time and could lead to increased allocations to equities, floating rate fixed income and commodities, as these assets are often seen as inflation hedges.

Relatively few investors saw hedging against an equity drawdown (16%) or protection against geopolitical risks (10%) as being among the most important elements for portfolio design. For institutional investors, one question here is whether they feel the costs of a tail risk hedging program are worthwhile. Depending on their past experiences, the possible costs of hedging against downside risks and their comfort with hedging techniques, investors may stick with diversification and active management as their principal risk management tools or look at protect against downside risks with hedging strategies.

Some clear regional differences were seen in views on the key elements in portfolio design. For instance, focusing on sustainable or ESG investments is seen as a key element in portfolio design for over a third of investors (34%) in Europe, compared to only 14% in North America and 20% in Asia Pacific. This shows that for a variety of reasons, from the demands of internal and external stakeholders to a belief that ESG factors can enhance risk-adjusted returns, investors in Europe are much more likely to embed ESG or sustainability criteria in their portfolio design. Investors in the Asia Pacific region are more likely to see being able to take quick investment decisions (27% vs. 19% overall) as important for portfolio design. And North American investors (42% vs. 31% overall) are more likely to want to ensure their portfolios generate sufficient yield without adding excessive risk.

These regional differences do not extend to hedging against higher inflation, where a strong consensus exists across the different regions, with exactly 25% in each region seeing this as an important element. But nearly as many investors in Asia Pacific (24%) see hedging against an equity drawdown as an important element in portfolio design, which is far more than their peers in North America and Europe (both 14%).

With higher inflation, it is inevitable that central banks will raise interest rates. This could reduce the importance of generating sufficient yield without adding excessive risk, which 31% of investors gave as an important element in portfolio design, rising to 42% in North America. This reflected the prevalence of very low interest rates for a long period, forcing investors to look beyond conventional fixed income. But with interest rates now moving upwards, we might see traditional fixed income assets come back into favor with institutional investors. If investors can obtain yields of around 3% on government bonds, or around 5% on US investment grade debt and 9% on high-yield debt, then the hunt for yield will be less of an issue. In this scenario, the importance of skilled active managers remains, as investors need to hedge against inflation and manage the risks of default in a fixed income portfolio.

Investing in illiquid assets for the long-term was seen an important element of portfolio design by 26% of investors. This could be partly a reflection of the low inflation, low interest rate environment, which encouraged investors to lock up capital for longer periods in pursuit of higher returns. In a more volatile investment climate, investors might think again about this approach. Another issue here is that returns from assets such as private equity, real estate and infrastructure might also adjust in a new environment, with a higher risk-free rate on core fixed income. Against this, the shift from public to private markets has been a significant move, based in structural changes to capital markets and other factors. Another factor here, if there is a prolonged market downturn, is that liquidity could become a pressing issue for investors, making it harder for them to lock up funds for long periods.

In summary, institutional investors are now having to adjust to a new investment world of higher inflation and interest rates, with uncertainty leading to greater volatility and instability. Estimates of how this could last vary widely, which could create dilemmas over the necessity for a strategic review. Diversification will remain a key aim for most investors, while finding sufficient yield could be less of a priority in portfolio design. After enjoying some spectacular returns in recent years, many investors will be acutely aware that the principle of mean reversion implies lower future returns. If this happens on a significant scale, then those investors who have found ways to ride out volatile markets will be in a stronger position than those exposed to the full force of higher risk factors, from inflation to slower growth, bursting asset bubble bursting, or central banks taking away the punch bowl.

The results were covered in “Investing in a Time of Rising Inflation”. To obtain a copy, please email matthew.craig@coredataresearch.com

Footnotes:

[1] Investing in a Time of Rising Inflation, January 2022, CoreData Research

About the Author:

Matthew Craig joined CoreData Research in March 2019 as a senior consultant, helping produce quantitative and qualitative research on how investors view a wide range of investment topics, such as the use of alternative assets and private markets, sustainability and ESG investing, portfolio design, fiduciary management, asset allocation, digital technology and other topics.

Prior to joining CoreData, Matthew worked for over 20 years as a financial journalist, mainly covering pensions and investments. This included spells at Euromoney Institutional Investor, as European content director for an online investor network, and at Financial Times Business, as editor-in-chief of Pensions Week and Pensions Management, as well as launch editor for the Pensions Gym, an online tool for investment and pensions education.

During his career as a journalist, Matthew won various awards for journalism, including Trade/Professional Magazine of the Year for Pensions Management in the Personal Finance Media Awards 2000, the ABI Pensions Journalist of the Year in 2005 and the Outstanding Contribution to Institutional Journalism in the State Street Press Awards 2009.

Outside work, Matthew is a keen cyclist, cricketer and a trustee for the Blue Elephant Theatre in Camberwell, London.