By Stephen Lawrence, Senior Investment Strategist for The Vanguard Group.

How Team Diversity Could Improve Fund Performance

“There is no ‘I’ in ‘team’”, so goes the popular adage. Teams perform better when everybody contributes fully. But, if a team is lacking in diversity, does that also have an impact on performance? This question is particularly relevant to the investment management industry. That’s why I choose to research the relationship between the gender mix among portfolio teams and performance across actively managed U.S. equity funds. In my recently published study “Diversity Matters: The Role of Gender Diversity on US Active Equity Fund Performance,” I find that diversifying teams by gender is associated with meaningful improvement in fund performance. A notable insight for investment professionals and investors alike.

While efforts to improve diversity in asset management have started to build solid talent pipelines, the diversity gap remains large, particularly regarding gender. To that point, my study found that on average only 1 in 7 investment professional seats from 2008 to 2021 were occupied by a woman (Source: eVestment). Furthermore, the book Undiversified: The big gender short in investment management, written by Ellen Carr and Katrina Dudley, note that this drops to 1 in 10 as employees rise to the rank of portfolio manager.

In regard to performance, my analysis showed that funds that lacked any gender diversity, 97% of which were all male teams and 3% of which were all female teams, underperformed their benchmark by 12 basis points per year on average. Meanwhile mixed gender funds, that is a fund with at least one male and one female on the investment team, outperformed by 10 basis points on average.

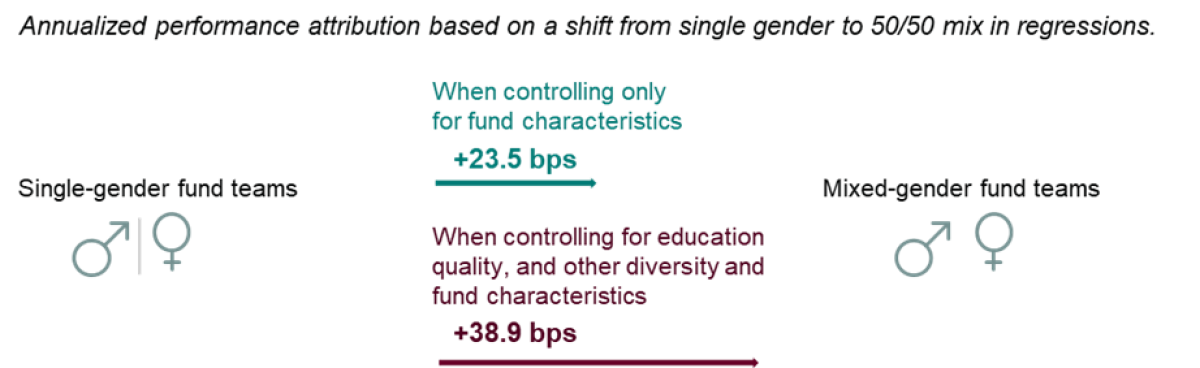

Isolating the impact of gender on fund performance by controlling for other aspects of diversity such as education and fund characteristics, provides an estimate of the benefits of gender diversity. Notably, when controlling for team and fund characteristics, my analysis uncovered that a shift from a single gender to a gender balanced team could account for as much as 38.9 basis points of performance over the subsequent year.

Leveraging Natural Language Processing to Capture Diversity Data

Previous studies of fund team diversity have either looked to the gender of the named portfolio managers or relied on self-reported statistics, neither of which give a consistent picture of the true diversity across the active fund management industry.

To ensure a more complete picture of team composition, I leveraged over 33,000 biographies from eVestment representing the investment teams of 2,669 U.S. active equity funds from 2008--2020. I then employed natural language processing to parse the biography text and extract key information such as preferred pronouns and educational background to identify the gender and qualifications of each team member.

eVestment is a comprehensive database in its coverage of investment team members because it includes information on analysts, traders and other investment professionals directly associated with the success of the fund. Most investment professionals have biographies on file, even if the fund management company has not divulged demographic data about the team or the individuals.

Combining Biographic and Performance Data to Demonstrate the Value of Gender Diversity

Biographical information can be aggregated up to a fund level and combined with other features of a fund to provide a rich dataset of factors that might influence fund performance. As such, I looked at the subsequent 1-year performance (in excess of the fund’s benchmark) for actively managed U.S. equity mutual funds monthly from 2008 to 2021 and regressed those returns on characteristics of the fund, the team, and the team diversity to explain differences in performance.

When looking at the impact of gender diversity, controlling for general fund characteristics, a shift from single-gender teams to gender-balanced teams results in a 23.5 basis point performance improvement.

Controlling for the educational quality of the team further enhances this relationship. I used Ivy League schools as a proxy for quality of education as an unambiguous representation that has an enduring tie to rigorous degree programs and selective student acceptance. When controlling for education quality and all other fund and team characteristics, gender-balanced teams outperform single-gender funds by 38.9 basis points.

Source: Vanguard, “Diversity Matters: The Role of Gender Diversity on US Active Equity Fund Performance,” available on SSRN. Data from eVestment, LLC.

Implications for the Investment Management Industry

This research provides strong evidence that team composition, in particular gender diversity, has an impact on team and fund performance. For investors, it suggests value in understanding the team behind a fund. For investment managers themselves, with women comprising only about 1 in 7 U.S. active equity investment professionals, it provides an impetus to revisit diversity and potentially unlock unrealized performance.

Further research can be done to better understand the mechanisms that drive performance in diverse teams. This paper focused on gender diversity because the information was readily available and the underrepresentation of women in investment management is well documented. But other dimensions of diversity, such as ethnic and racial composition, are well worth exploring.

For those looking to engage their colleagues in a conversation on the importance of gender, this research provides some much-needed evidence: when it comes to investment performance, diversity matters.

© The Vanguard Group, Inc., used with permission

This post is adapted from the paper, “Diversity Matters: The Role of Gender Diversity on US Active Equity Fund Performance” available on SSRN.

About the Author:

Stephen Lawrence, PhD, is the Head of Indexing Research in the Vanguard Investment Strategy Group.

His research into the performance of active and passive investments incorporates insights from financial economics, data science and machine learning. Previously at Vanguard, he was Head of Investment Management Fintech Data Science where he oversaw data science applications of new structured and unstructured data sources into the investment process. Prior to joining Vanguard, Dr. Lawrence was Head of Quantextual Research at State Street Bank where he led a machine learning product team. Prior to that he led FX and Macro flow research for State Street Global Markets. Stephen holds a B.A. in Mathematics from the University of Cambridge and a Ph.D. in Finance from Boston College. He is also a TED speaker with a 2015 talk titled “The future of reading: it’s fast”.