By Grayscale Investments.

In today’s market, higher hash rate and decreasing bitcoin prices have led to lower revenues and profitability for miners. Miners who are continuing to mine profitably have either low leverage, lower energy costs, or both. Leveraged miners have begun to face financial challenges due to shrinking profitability which we anticipate will persist into 2023. We believe this may provide opportunities to purchase equipment as miners liquidate assets in order to meet debt obligations.

Historical Context and Phases of the Mining Cycle

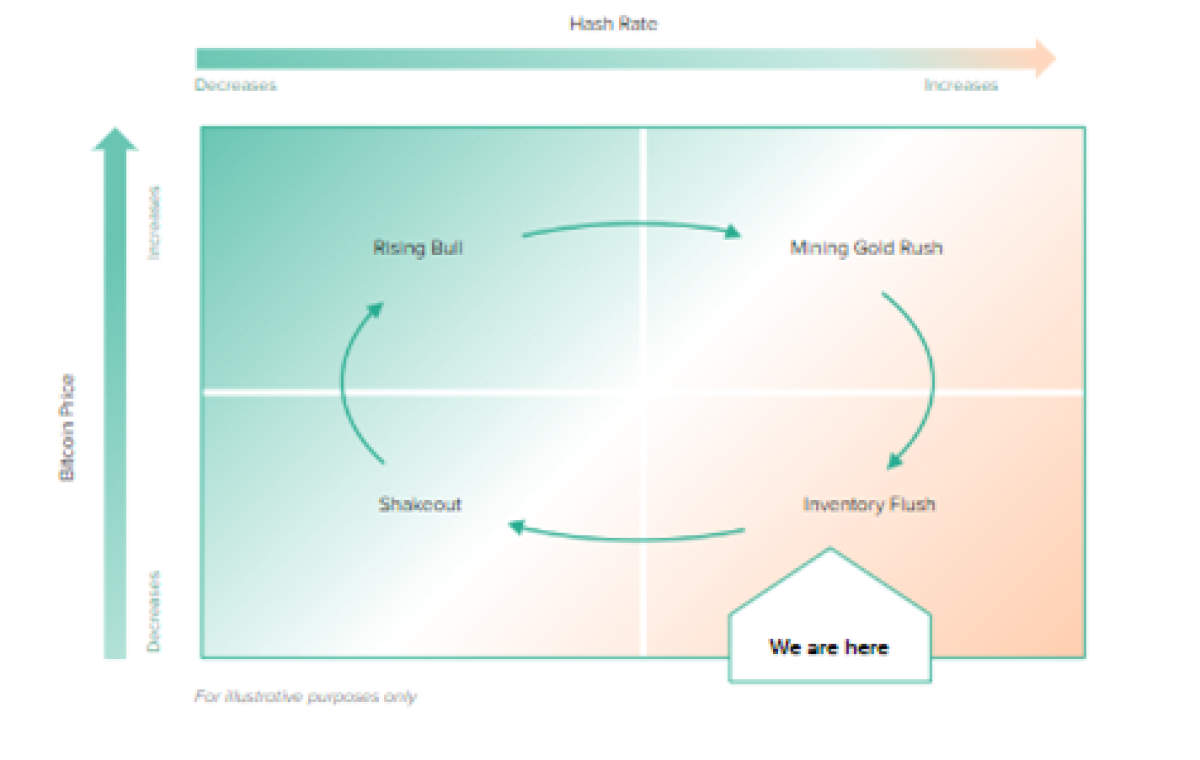

Taking a step back, Bitcoin mining has historically been cyclical, with four phases. Each phase has distinct price trends, impacts mining hardware supply & demand, and generates varying sentiment across the mining industry.

Let’s examine them. The below chart highlights these four phases of the cycle based on bitcoin price and network hash rate. Hash rate is the combined measure of all miners’ computational power used to mine bitcoin, measured in hashes per second. The higher the hash rate, the higher the combined computing power of all miners at a given time.

For illustrative purposes only

Source: https://www.aniccaresearch.tech/blog/the-alchemy-of-hashpower-part-ii

The four phases are:

1. Rising Bull Market: The price of bitcoin rises faster than hash rate grows

2. Mining Gold Rush: Hash rate growth increases, while bitcoin price continues to rise

3. Inventory Flush: The price of bitcoin drops, while hash rate continues to grow

4. Shakeout: Hash rate and bitcoin price both fall

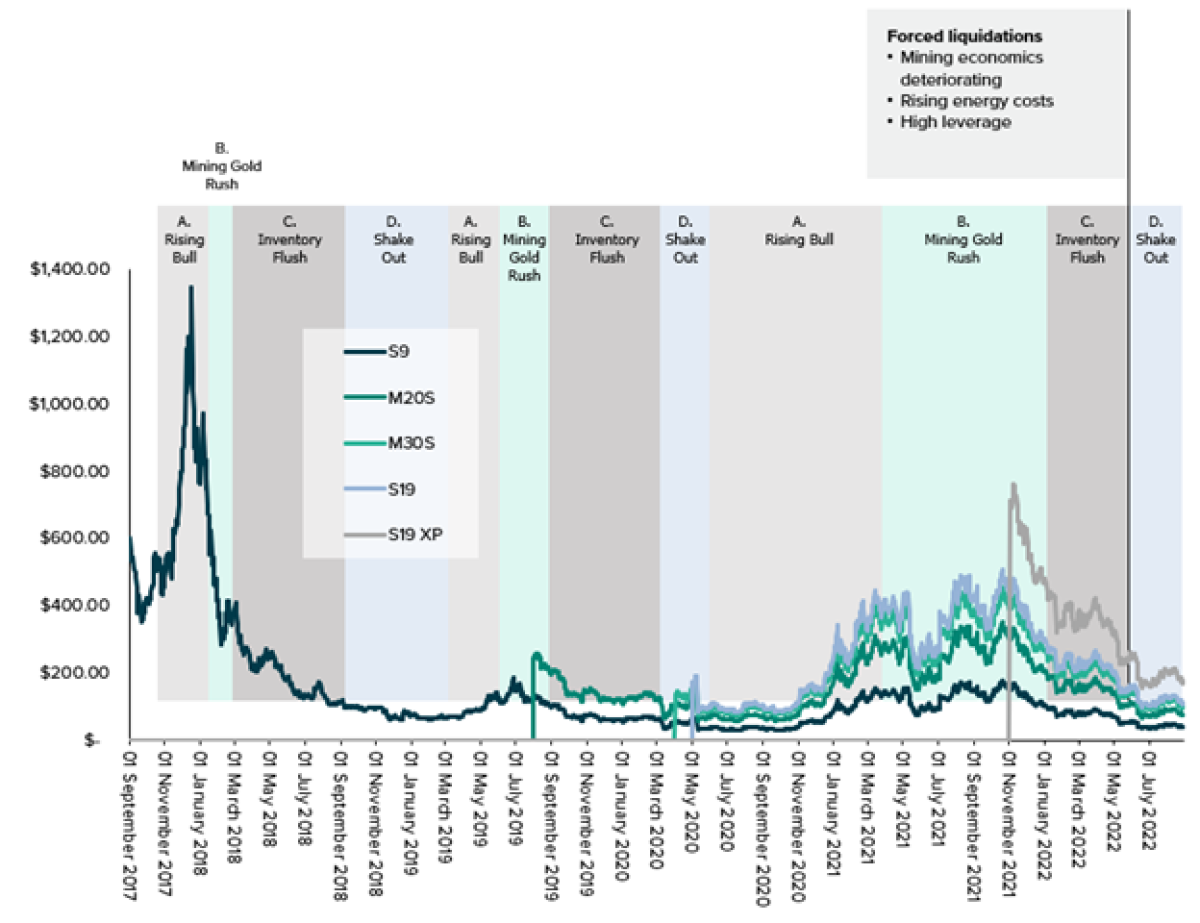

To date, investment success in the mining ecosystem has varied depending upon which stage of the cycle capital is deployed. Historically, deploying capital in a “Shakeout” phase and exiting in a “Mining Gold Rush” phase is most profitable. Conversely, deploying capital in a “Mining Gold Rush” stage is historically the least profitable, as this becomes an overcrowded and expensive investment. The below chart illustrates the historical revenue in each of the four phases through May 2022.

Mining Machine Revenue ($/mWh)

Source: CoinMetrics, Glassnode, Anicca Research, Foundry Research

The Bitcoin mining industry can be uniquely flexible — if energy prices in one area or from one energy source increase, miners can relocate to find cheap excess power. For example, miners can use excess emissions from gas flaring to power their equipment, simultaneously reducing overall emissions. We believe Bitcoin mining, like Bitcoin itself, is resilient and able to adapt to continually changing conditions. Mining provides investors with access to the infrastructure that supports the largest digital asset — and today’s market may present key opportunities for investors.

The Opportunity

Against this backdrop, well-positioned investors may be able to take advantage by buying equipment at low prices while investing in the infrastructure of Bitcoin and ultimately providing liquidity to the ecosystem. Grayscale has created a new vehicle — Grayscale Digital Infrastructure Opportunities LLC – offering institutions and accredited investors the opportunity to take advantage of these market cycles, with the intention of buying equipment at distressed prices and profitably mining bitcoin, to aim to provide quarterly distributions of profits to investors. Interested accredited investors can learn more at https://grayscale.com/gdio/.

More content from Grayscale: Ten Times Bitcoin Bounced Back

Footnotes:

1 https://www.aniccaresearch.tech/blog/the-alchemy-of-hashpower-part-ii

2 Grayscale Digital Infrastructure Opportunities LLC (“GDIO”) is an operating business and is not a registered investment company under the Investment Company Act, and Grayscale believes that GDIO is not required to register under such act. Consequently, investors do not have the regulatory protections provided to investors in investment companies. Further, GDIO is not a registered investment adviser or broker-dealer. GDIO does not provide investment, legal or tax advice.

GDIO will not hold or trade in commodity interests regulated by the CEA, as administered by the CFTC. Furthermore, Grayscale believes that GDIO is not a commodity pool for purposes of the CEA, and that Grayscale is not subject to regulation by the CFTC as a commodity pool operator or a commodity trading adviser in connection with the operations of GDIO. Consequently, investors will not have the regulatory protections provided to investors in CEA-regulated instruments or commodity pools.

3 As defined by Rule 506 of Regulation D under the Securities Act of 1933. To qualify as an accredited investor, an individual must earn more than $200,000 a year (or $300,000 per year with a spouse or spousal equivalent), have a net worth over $1 million either alone or together with a spouse or spousal equivalent, excluding their primary residence, or hold in good standing their Series 7, Series 65, or Series 82 professional certifications. Entities must have $5 million in liquid assets or all beneficial owners must be Accredited Investors.