By Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP, Managing Director, Head of UniFi by CAIA™ and Steve Novakovic, CAIA, CFA, Managing Director, CAIA Curriculum.

This Regime Will Self Destruct In …12 Months?

Since March 2022, when CAIA Association last held our large annual conference, ALTSLA, things have changed quickly in the investment world. Equity markets were still on a bull run, interest rates were near record lows, and a recent spike in inflation was considered transitory. Fast forward one year later, after one of the worst years for a balanced U.S. 60/40 portfolio in decades, we have entered a regime in capital markets that perhaps hasn’t been seen since the Cold War.

In addition to the conference itself, CAIA Association also had the privilege of hosting one of its allocator roundtables consisting of institutional asset owners across the U.S. with over $1.4 trillion of combined assets. This year's roundtable topic focused on Venture Capital, an asset class that has grabbed headlines recently, with the recent fall of Silicon Valley Bank, but also one that continues to gather interest from asset owners seeking attractive returns.

Light the Fuse: An Allocator’s Perspective on Venture Capital

“Every two or three million years, some natural catastrophe devastates all life on Earth. But life goes on. And what little remains is made stronger. Put simply, world destruction is an unpleasant, but necessary part of evolution.”

- Mission: Impossible – Ghost Protocol

The venture world has experienced some headline-grabbing events this year, so not surprisingly, investment returns were top of mind. Based on academic research, LPs can be reassured that venture returns add value to a portfolio, even for investors in median funds. Further performance persistence is, in fact, a reality in venture investing, meaning LPs don’t have to be in those select few top decile funds to benefit.

For LPs that don’t have exposure to name brand venture funds, what is the best way to approach the venture market? First, don’t give up hope on those top-tier venture funds. Current market conditions mean there will be LPs that may lack capacity to continue committing at prior levels. The VC industry is not saturated, and there are still plenty of areas for firms to grow into without sacrificing returns. There will always be a need for capital by VCs and areas of growth in the industry. New LPs will be needed to help fill that capital void.

Realistically, LPs won’t be able to build a portfolio exclusively around top-tier managers. Instead, taking a barbell approach is recommended. First, build a farm team of seed funds. In today’s market, seed funds lead the industry, getting the first look at start-ups and developing strong relationships with larger venture capital firms. Which brings us to the other half of the barbell – large asset management venture firms. These firms can invest across the spectrum and can capture returns from Series A to late stage.

When choosing funds, academic research shows that the primary return drivers in venture capital are skill, fund size, and network. More recently, research shows the importance of gender diversity among decision-makers. On average, GPs with greater gender diversity exhibit higher performance over time.

Your Mission, Should You Choose to Accept It …

“We’ve just rolled a snowball and tossed it into Hell. Now we’ll see what chance it has.”

- Mission: Impossible II

The remainder of the conference, with over 1,300 attendees, focused on a variety of topics discussed by esteemed panelists and punctuated by several prominent keynote speakers including 44th U.S. Vice President Dan Quayle, former California Governor Gray Davis, former U.S. Secretary of the Treasury Jacob Lew, former Member of the House of Representatives from Maryland John Delaney, CEO of ARK Invest Cathie Wood, and others.

Throughout the two-day event, one overarching theme was clear — after a decade of TINA and equity market dominance, every asset class must once again compete for their place in a diversified portfolio.

Of course, the sentiment from the panel discussions was that more “alternatives” are better than less. With more options, asset owners have an opportunity to be more thoughtful about balancing diversification and generating attractive absolute return for their constituents.

That said, with interest rates at their highest levels since before the global financial crisis, allocators are thinking through the changing fundamental risk and return drivers of many asset classes. In a decade of free money, many of us haven’t had to think about these risks, but that has changed since as recent as a year ago.

We’ll walk through some of them now.

Cash: As short-term interest rates skyrocketed, the opportunity set in traditional fixed income (and cash!) is wider and the hurdle rates for other assets are higher. For the first time in years, cash is a viable alternative to other asset classes.

Real Estate: Within real estate, the day of reckoning is coming but will be lagged and take time as investors need to wait for lease roll dates and debt maturities to arrive. There is an estimated $1.5 trillion of commercial real estate (CRE) debt coming due within the next 18-24 months. With rising cap rates and declining net operating income (NOI), property values will be down (currently estimated at 25%), meaning new equity will need to be infused to recapitalize properties. This creates a great opportunity for transitional lending.

Private Credit: Broadly within credit markets, volatility is up and creating opportunities for investors both on the long and short side. This makes for a great market for security selection as managers are seeing plenty of mispriced securities relative to their risk profile. Within the senior secured market, yields are rising to 10% to 12%. While investors may be underwriting their direct lending portfolio to generate a 12% to 14% return but end up making 16% over the next three years.

Private Equity: While we covered venture earlier, the topic of private equity carried throughout many discussions. The fall of Silicon Valley Bank and a rough 2022 has opened an opportunity for buyers in a tough market. Regarding buyout equity strategies, caution was a bit more warranted. As interest rates have gone up, and credit conditions have tightened, we should expect two things: potentially less leverage in buyout transactions, and more conservative capital structures.

Geopolitics: That’s the Wrong Door!

“Easy way to remember…blue is glue.” “And what is red?” “Dead.”

- Mission: Impossible – Ghost Protocol

Another common discussion was the state of the political climate, both in the United States and abroad. Whether it was the raging ESG debate between red and blue state governors in the U.S., or the role of China and Russia on a global scale, the theme of the conference was instability.

After a multi-decade progression towards globalization, we seem to be reversing the trend. While no one can predict the future, many investors in the room haven’t experienced this before. In fact, a few discussions referenced the fact that the playbook of today mirrors one of nearly 40 years ago.

A Total Portfolio Approach

“We’ll burn that bridge when we get to it.”

- Mission: Impossible – Fallout

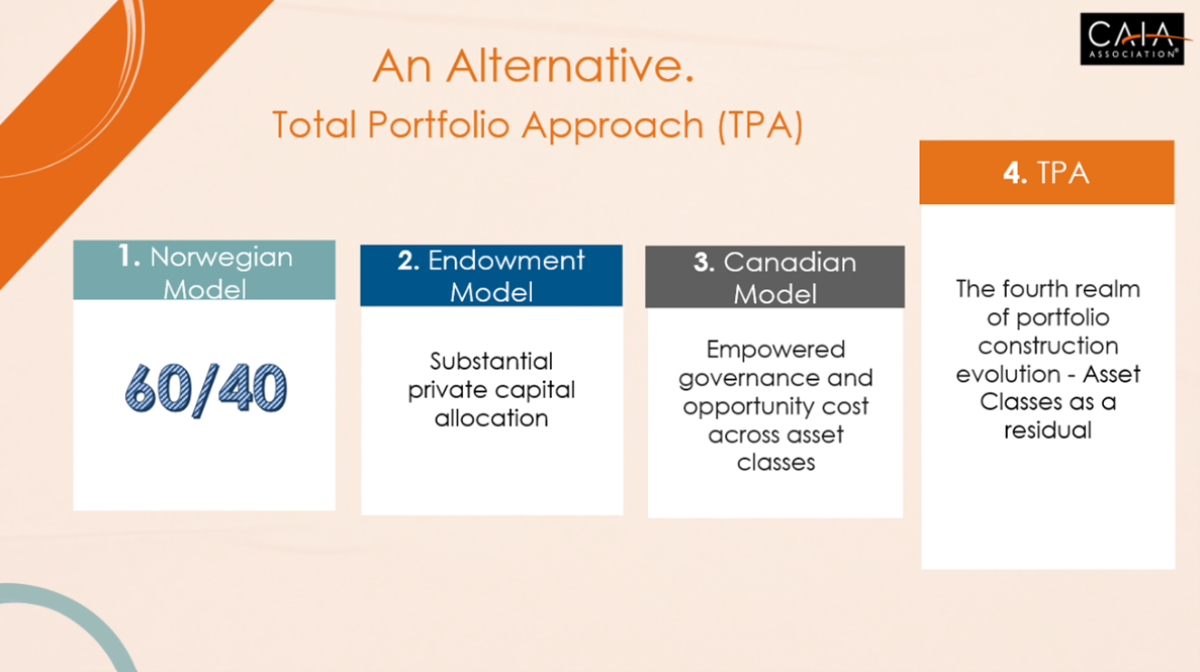

Finally, ALTSLA2023 marked CAIA Association’s introduction of a growing approach to asset allocation, known as the Total Portfolio Approach (TPA). TPA has been implemented by CPP Investments, GIC, Future Fund, and NZ Super. While not widely adopted outside of those four institutions, the discussion at the conference was highly productive.

The issues? Burning old processes and bridges, realigning culture, and shifting the mindset of board governance.

About the Authors:

As Managing Director and Head of UniFi by CAIA™ , Aaron Filbeck CAIA, CFA, CFP®, CIPM, FDP oversees content and product strategy for the UniFi by CAIA™ Program. Prior to this, Aaron was responsible for the strategic direction of CAIA Association's content agenda, thought leadership, and member education initiatives, and supported content development for the CAIA Charter Program. His work has been published by Oxford University Press and The Journal of Investing, and covers topics such as ESG/sustainable investing, liquid alternatives, commodities, and asset pricing/factor investing. He is a frequent writer and speaker on these topics. Aaron’s practitioner experience lies in private wealth management, where he served as portfolio manager, overseeing asset allocation, portfolio construction, and manager research efforts for high-net-worth individuals and institutional retirement plans.

He earned a B.S. with distinction in Finance and a Master of Finance from Penn State University. He holds the Chartered Alternative Investment Analyst (CAIA), Chartered Financial Analyst (CFA), Certificate in Investment Performance Measurement (CIPM), Financial Data Professional (FDP) designations, is a CERTIFIED FINANCIAL PLANNER™, and holds the CFA Institute's Certificate in ESG Investing. He is a Past President of CFA Society Columbus and serves on the CFA Society Philadelphia Programs Committee. Aaron is an adjunct professor and serves on multiple advisory boards for Penn State University.

Steve Novakovic, CAIA, CFA is the Managing Director, CAIA Curriculum for CAIA Association. In this role, he is responsible for managing the CAIA Charter curriculum, ensuring the content remains relevant and reflects current trends in the institutional asset allocator space. He joined CAIA Association in 2022 and has been a Charterholder since 2011. Prior to CAIA Association, Steve was a faculty member at Ithaca College in Ithaca, NY, where he taught a variety of finance courses including: Cryptocurrencies, Alternative Asset Management, and Wealth Management, among others. Before entering academia, he worked at his alma mater, Cornell University, (B.S. 2004, MPS 2006) in the Office of University Investments. In his time at Cornell University, Steve invested across a variety of asset classes for the $6 billion endowment. His twelve years at Cornell generated substantial insight into endowment management and fund investing across the alternatives and traditional landscape.