By Shreekant Daga, CAIA, CFA, FRM, Associate Director and Authorized Signatory for CAIA India LO.

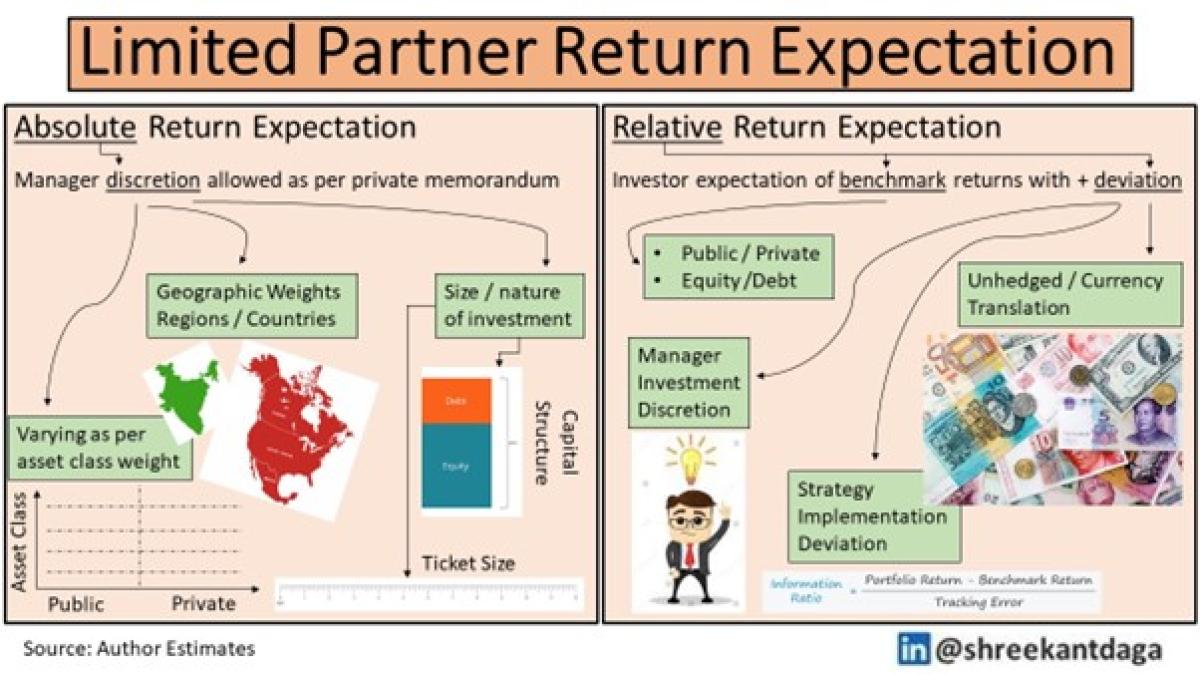

Capitalism is objective oriented with a unidirectional focus on making money and we can colour the shiny edge green or pink if it achieves a few other objectives along the way. A GP raising funds from a LP quotes the expected return in either a relative manner or absolute.

While investments transcend geographies more easily than people the performance of global GPs outside their (near) domiciles have not been encouraging. A parallel can be drawn with an emerging investment destination – India.

Case description:

Indian startup investing is categorised with heavy presence of domestic/Indian funds at early/VC stage whereas heavy presence of foreign funds at late stage.

Over the last decade, the Indian startup ecosystem has grown several folds. Amongst the many reasons is the government support through favourable taxation for employment generating entities and presence of global GPs having the ability to tear large cheques.

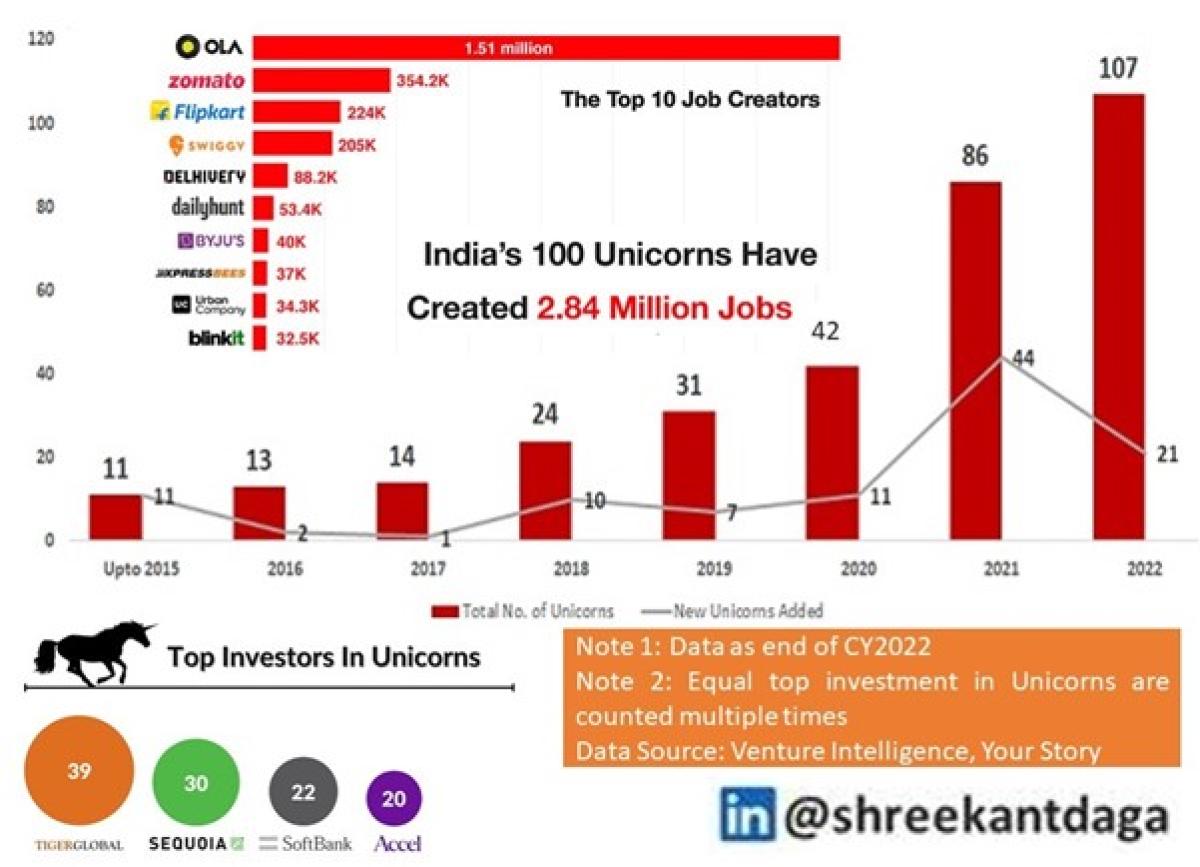

According to a study, India’s top 100 unicorns have created 2.84 million direct jobs, but this has been coupled with foreign anchor investors which account for 100% presence in these unicorns. These global GPs have placed a great emphasis on IDD and ODD since the decision making is highly centralised within the investment committee.

Such is the centralisation that the anecdotes, practice, and parameters are adopted from markets where the GP is domiciled.

Example Investment Due Diligence (IDD): Cash burn to gain market share without having a vision for profitable unit economics doesn’t work in India since the domestic customer is price sensitive and global sector metrics comparison will yield an IDD error in India in the longer run.

Example Operational Due Diligence (ODD): Tipping as a practice is not common and especially so amongst founders and reading into the founder’s behavioural traits basis that, is a mistake in understanding the founder mindset.

Much of the talent pool by the global GPs look for candidates with global exposure. This makes the language and conversation easier for the investment committee of the GP. The approach also has the challenge that the domestic colleague has global exposure but lacks domestic experience required to guide investments as a subject matter expert.

The above reasons have meant that the performance of the global GPs in India is subdued. Less than 20% of Indian unicorns have reported profitability.

A private equity asset management firm in India is registered as a Category II fund under the Alternative Investment Fund regulations and hence performance tracking and proxies are easier to form. These category II firms with FY14 and FY15 vintage which are near close to returning money back to the LPs have underperformed the broad blue-chip index. The poor performance of the global GPs isn’t surprising especially given the manner of operations.

Globally there has been an encouragement for DEI initiatives and wrapped under a deeper conscience to encourage voices which can potentially change the investment outcomes. The funding of startups has also seen a slowdown with a narrative of funding winter which has resulted in only one unicorn added in India until October 2023.

For investments to succeed in high growth emerging markets, the hypothesis points out that large/global GPs need to delegate responsibility and power to the colleagues in the emerging markets. Question is not on the ability to learn/relearn but the dilemma to trust and delegate in a highly centralised current environment.

Is the global GP now ready to truly invest (not allocate) globally?

About the Author:

Shreekant Daga is a CAIA, CFA and FRM charter holder. Shreekant pursued Bachelor’s in Management from Narsee Monjee College and later did his Master’s in Management from Jamnalal Bajaj Institute of Management Studies (JBIMS). He also holds a Master’s in Commerce from Mumbai University. He is an alumnus of Bombay Stock Exchange Training Institute, having completed the certificate program on capital markets. He has also acquired several certificates from the National Stock Exchange in Financial Markets.

Prior to joining CAIA Association, Shreekant had gathered experience in Structured Finance. His experience encompasses investment banking in debt capital markets, handling stressed assets, global RMBS deal evaluation, securitization, stress assets rating and mutual fund rating. Shreekant has worked with organizations such as ICICI Bank, Deutsche Bank Group and India Ratings and Research (Fitch Ratings). In mid-2018, he joined the Chartered Alternative Investment Analyst (CAIA) Association, the international leader in alternative investment education and provider of the CAIA designation, as Associate Director at India liaison office wherein he looks after India operations.

Shreekant has been a visiting faculty at JBIMS and has taught subjects such as Fixed Income, Global Markets & Financial Institutions and Structured Finance. He has been involved in mentoring students at his alma mater for their year-long projects. He has also graded final year MSc students of Mumbai University on their year-long projects. He has also featured in newspapers, magazines, press releases and article on the web. His name also features on the list of educational professionals on the MHRD website. True to the cross function that he maintains with education and industry, Shreekant has 4 research papers presented and published at international forums and journals respectively.