by David Moreno, CFA, Indexes Manager, EPRA

Emerging markets often present a unique blend of challenges and opportunities for investors. While marked by volatility and political uncertainties, these markets offer avenues for diversification and growth, especially in the listed real estate sector. The FTSE EPRA Nareit Emerging Index reflects these dynamics, showing an increasingly diverse geographical representation and opening interesting opportunities in markets like Brazil and Greece. In this article, we present the recent evolution of this index and delve into the evolving real estate landscapes of these two countries and their growing significance in the global market. See a full report on EPRA’s website, available here.

Emerging markets in the FTSE EPRA Nareit Global Index series

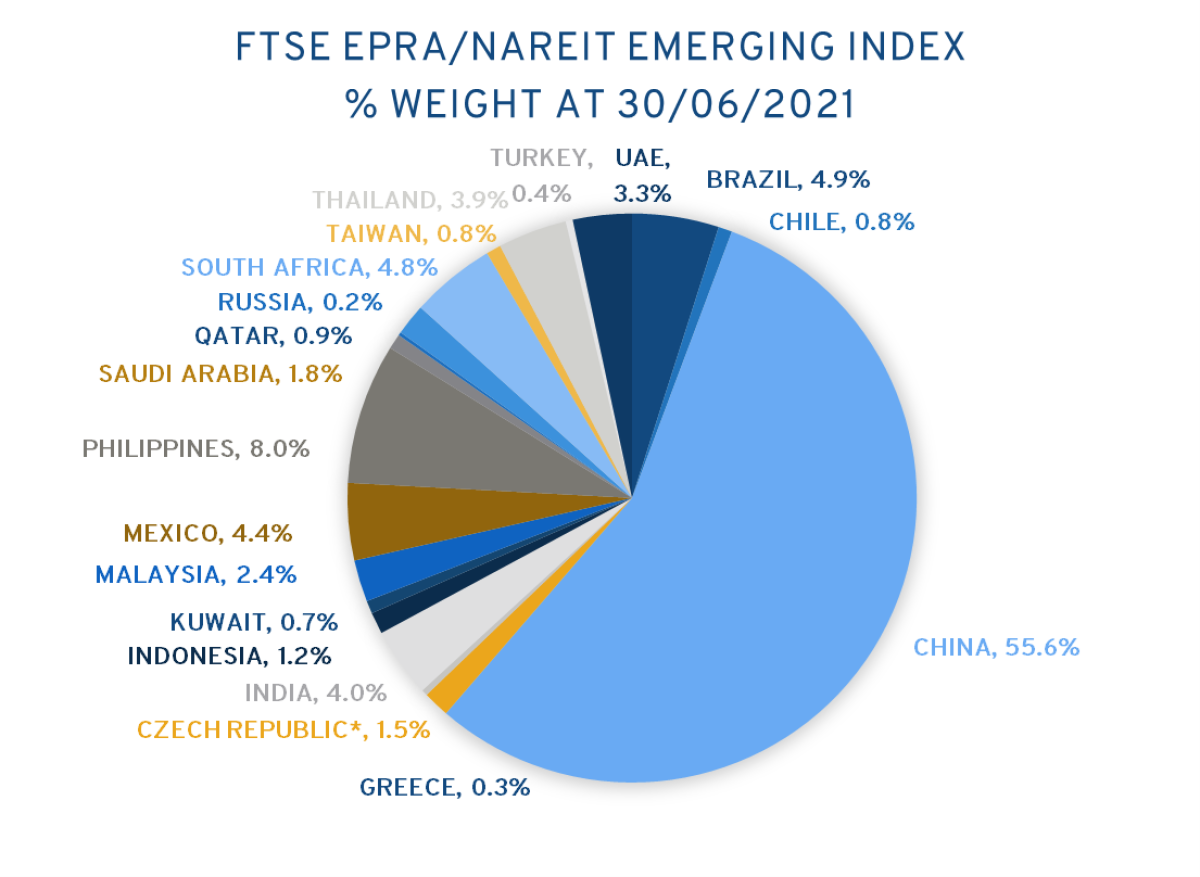

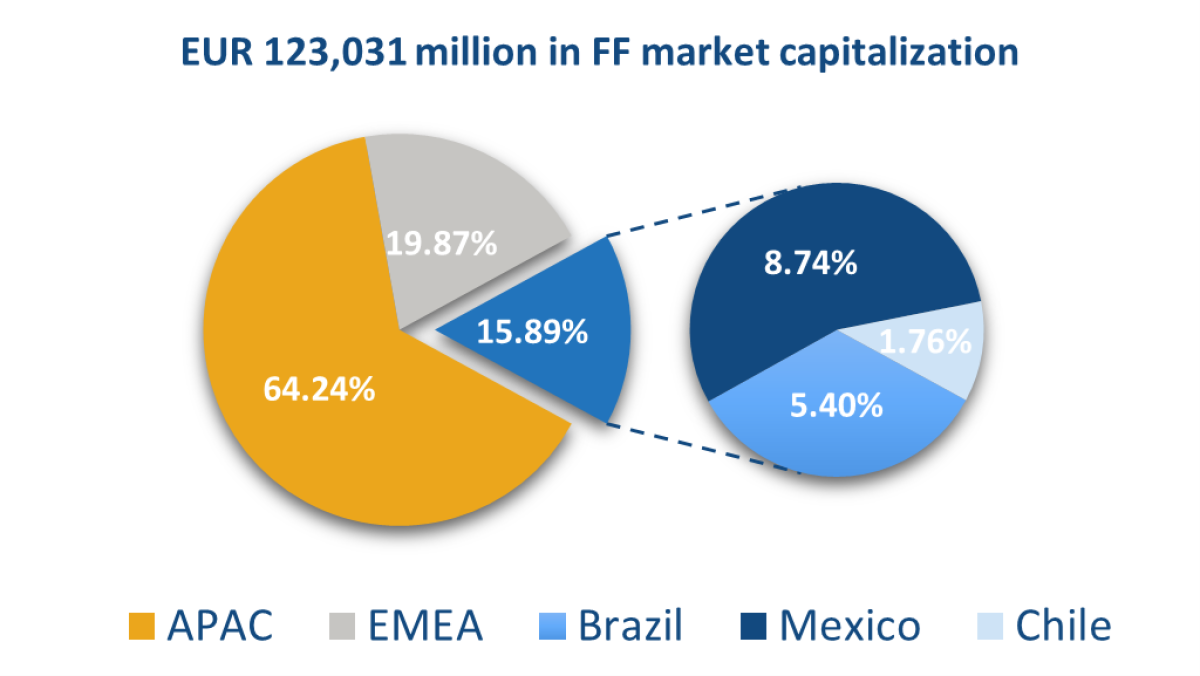

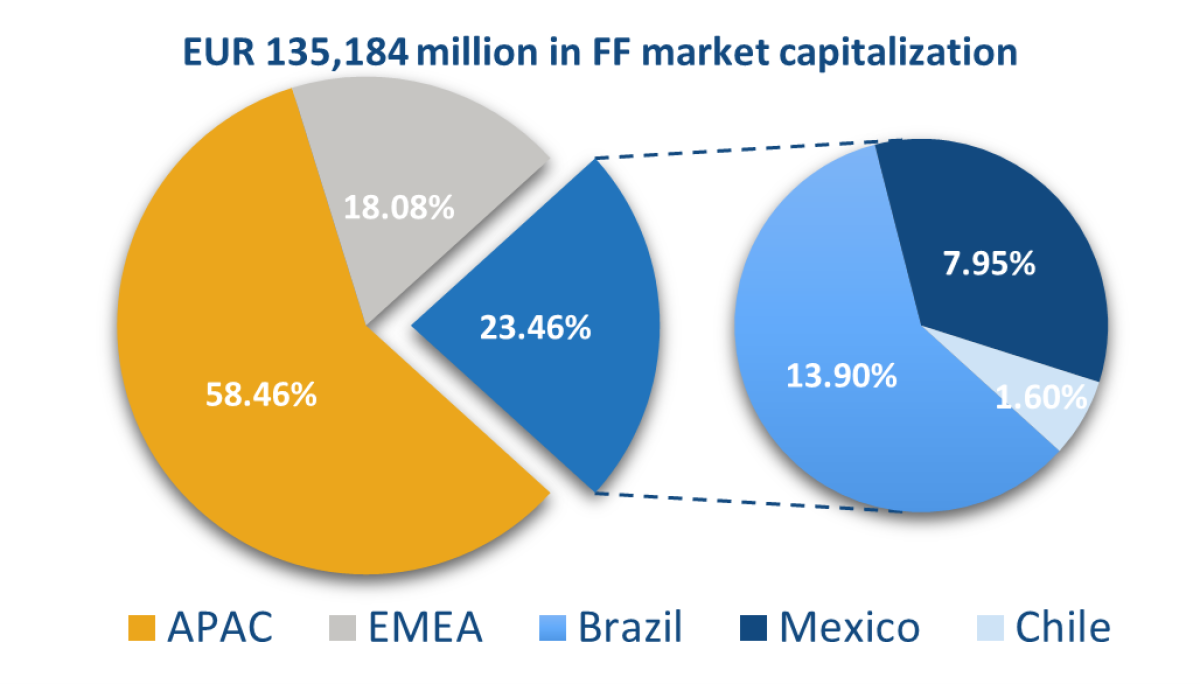

As of October 2024, the FTSE EPRA Nareit Emerging Index represented 7.38% of the global index and comprised 126 constituents with a free float market capitalization of €122 billion. Though traditionally dominated by Asia-Pacific countries, the emerging index's landscape is shifting. Emerging Americas and EMEA regions now collectively account for over 35% of the index weight, marking a gradual diversification away from Asia. During the first ten months of the year, the FTSE EPRA Nareit Emerging Index showed a total return in EUR of 5.34%, with Middle East/Africa and Asia Pacific regions as outperformers, reaching YTD returns of 27.4% and 8.27%, respectively.

FTSE EPRA Nareit Emerging Index: Country Performance in EUR

Source: EPRA

However, the last three years showed an outstanding annualized total return of 17.7% in the Americas region and 11.1% in the EMEA region, counting 30 additions and 26 deletions in the two regions. Simultaneously, China lost -19.5% in annual terms, with 40 deletions and just 10 additions, suffering the impact of a deep crisis in the housing sector. As a result, during the last three years, there was an evident improvement in geographical diversification across the index. This shift underscores the importance of examining regions like Brazil and Greece, where macroeconomic resilience and policy reforms are fostering new opportunities.

FTSE EPRA NAREIT Emerging Markets Index: Weights by country

|

|

Source: EPRA

Brazil: The rising star in the REIT global context

The Brazilian REIT regime, locally known as Fundo de Investimento Imobiliário (FII), has evolved significantly since its inception in 1993. Initially limited to single-asset funds, subsequent reforms have improved liquidity, transparency, and investor protection. Between 2016 and 2020, Brazil’s interest rate cuts created a favourable environment for REIT growth, culminating in a diverse real estate market in terms of property sectors and strategies, driven predominantly by retail investors.

Key highlights of the Brazilian REIT market:

As of July 2024, there were 955 FIIs in Brazil, with 534 listed on the local exchange (B3), compared to FIIs 264 back in 2015, 127 of which were listed.

These funds represent €28 billion in market capitalization, representing a CAGR of 22% since 2015 and showcasing a diverse investment landscape spanning traditional real estate, fixed-income securities, funds of funds, and hybrid strategies.

Notably, the market is dominated by retail investors, with over 2.5 million individuals actively participating in the market.

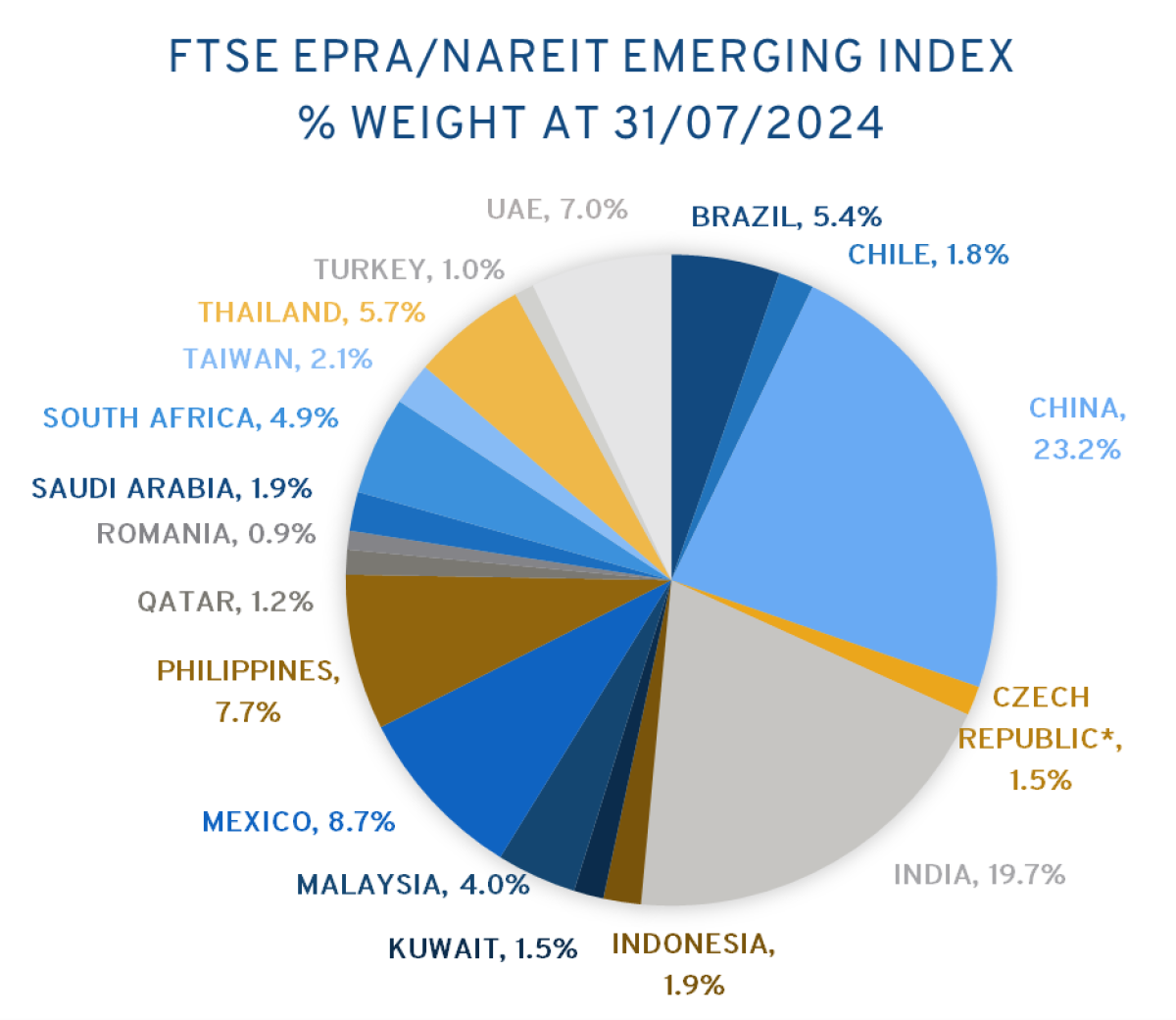

Understanding the significant growth demonstrated by this market in the last decade, EPRA ran a simulation to determine the possible impact from the inclusion of these REITs in the FTSE EPRA Nareit Emerging Index. Among this large pool, 284 listed funds were selected by EPRA based on the availability of information, assets under management, and nature of their investment mandates. The screening process found 53 funds that could potentially satisfy all the criteria for inclusion in the Emerging Index, representing approximately EUR 12.2 billion in market capitalization (average of EUR 230 million).

Hypothetically, if all 53 funds were included, the index’s market capitalization would increase by nearly 10%, with Brazil’s weight rising from 5.4% to 13.9%. This would shift the geographical balance of the index, enhancing its representation of the Americas and increasing its diversification across property sectors, where around 67% of these funds are focused on industrial, hospitality, and office properties.

Current Emerging Index composition | Projected Emerging Index composition |

|

|

Source: EPRA

Challenges: overcoming barriers to global integration

Despite its growth and potential, the Brazilian REITs face some challenges in achieving global recognition:

Language barriers: Most funds report exclusively in Portuguese, complicating the integration of international investors and index inclusion.

Liquidity constraints: Some funds struggle to meet the liquidity thresholds required for global benchmarks.

Regulatory complexities: Navigating the nuances of Brazil’s tax and legal frameworks can deter foreign investors.

Addressing these challenges will require concerted efforts from fund managers, regulators, and industry stakeholders. Initiatives to standardize reporting practices and enhance market transparency are critical steps in this journey. Such efforts are worthwhile - as Brazil aligns more closely with international standards, its real estate market will likely attract greater foreign investment, diversifying its investor base and creating opportunities for several stakeholders.

Greece: resilience and new opportunities in real estate

After having navigated a deep economic crisis around 10 years ago, Greece is witnessing a resurgence in its real estate sector. Driven by foreign investments and policy reforms, the market has seen substantial growth in recent years, substantially supported by foreign investments. Programs like the Golden Visa have spurred residential market activity in cities like Athens and Thessaloniki. Recent changes to investment thresholds aim to sustain local economic stability while attracting high-value investments.

The Greek listed real estate market

As of October 2024, the Greek real estate market comprises 12 listed companies with a total market capitalization of EUR 5 billion. This includes 9 REITs with a market capitalization of EUR 3.3 billion and 3 non-REITs with a market capitalization of EUR 1.7 billion. However, access to the market is limited due to a lower free float, which stands at EUR 1.2 billion, representing 24% of the total market capitalization.

From April 1st, 2004, to March 31st, 2016, Greece was part of the FTSE EPRA Nareit Developed Index universe. During this period, three companies were included in the index. However, following the Greek debt crisis, FTSE Russell downgraded Greece to an Advanced Emerging Market due to restricted market accessibility, deteriorating financial market quality, and economic and political instability. As of September 2021, after the deletion of the last constituent, Greece no longer has any companies included in the FTSE EPRA Nareit Emerging Markets Index.

The Greek real estate market is currently characterized by cautious optimism, driven by strategic expansions, some successful IPOs since 2022, and a strong focus on sustainable investments. The market's growth potential remains high, particularly in sectors like logistics, green offices, and urban regeneration, which are expected to continue attracting both domestic and international investors. Therefore, new market players have a chance to grow in a dynamic market, currently moving from a recovery phase into the expansion phase in a long real estate cycle that offers plenty of opportunities.

Source: EPRA

Challenges to Global Index inclusion:

Most Greek companies struggle to meet the size and liquidity criteria for the FTSE EPRA NAREIT Global Index.

Despite recent upgrades to Greece’s sovereign credit rating, the reclassification to Developed Market status remains an ongoing process, contingent on further economic and regulatory improvements.

Conclusions:

While Brazil’s real estate market benefits from its scale and diverse investment options, Greece offers a compelling narrative of recovery and strategic growth. Both countries highlight the transformative potential of macroeconomic stability and policy reforms in emerging markets. For global investors, these markets present opportunities to diversify portfolios while gaining exposure to high-growth sectors such as logistics and sustainable development.

As emerging markets like Brazil and Greece continue to stabilize and mature, they are becoming integral to the global real estate narrative. Overcoming barriers such as financial reporting, regulatory misalignments, and liquidity constraints will unlock further growth and international investment. By seizing these opportunities, investors can not only diversify geographically but also capitalize on the innovation and growth opportunities that these markets offer.

Disclaimer

Any interpretation and implementation resulting from the data and finding within remain the responsibility of the company concerned. There can be no republishing of this document without express permission from EPRA.

About the Contributor

David joined EPRA in 2016 and is in charge of analysing the evolution of listed Real Estate in Europe and managing the FTSE EPRA Nareit Global Index series. He also has more than five years of experience as fixed income strategist and corporate finance analyst. David is an Economist from Universidad del Rosario (Colombia) and has a joint Master degree in Quantitative Economics from Université Paris I Pantheón-Sorbonne (France) and Financial Engineering from Universitá Ca’Foscari di Venezia (Italy). He has been a CFA charter holder since 2019.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/