By William J. Kelly, CAIA, Founder & Managing Member, Educational Alpha LLC

Anyone familiar with the London Underground will know this phase well. While the meaning of Mind The Gap is quite clear to anyone stepping on or off the Tube, it really is a case study in risk management. Most of us understand (quite literally!) the downside risk, the trade-offs between never getting on or off the train, and the tolerance of this risk depending upon which car and/or train station you opt to board, as the gap is not evenly distributed.

These were some of the very same reasons why CAIA Association used this metaphor for their first PR campaign almost a decade ago when they co-opted (for a small fee!) the primary billboard in the Bank Street station on the Central Line in London. In addition to the basics of risk management, they were pointing out the challenges when one chooses to stretch their asset allocation choices beyond what is offered within the public markets. Then and now, CAIA was all about democratizing education before product. The imperative was to think more broadly about accessing uncorrelated risk premia, and the CAIA mandate was to wrap that process in education, due diligence, transparency, and informed consent.

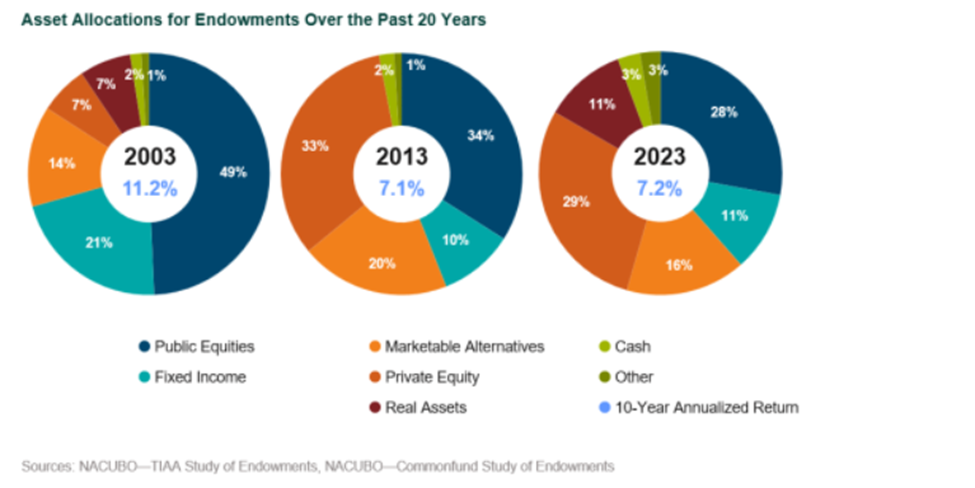

The institutional investor was very well positioned to embrace an asset allocation approach that widely became known as the Endowment Model, where big institutions thought more about matching the duration of their liabilities to the investment opportunity set in front of them. As they went about building the very best risk adjusted portfolios, a significant part of the asset allocation would find its way into the various buckets collectively known as alternative investments, most often within the private capital verticals.

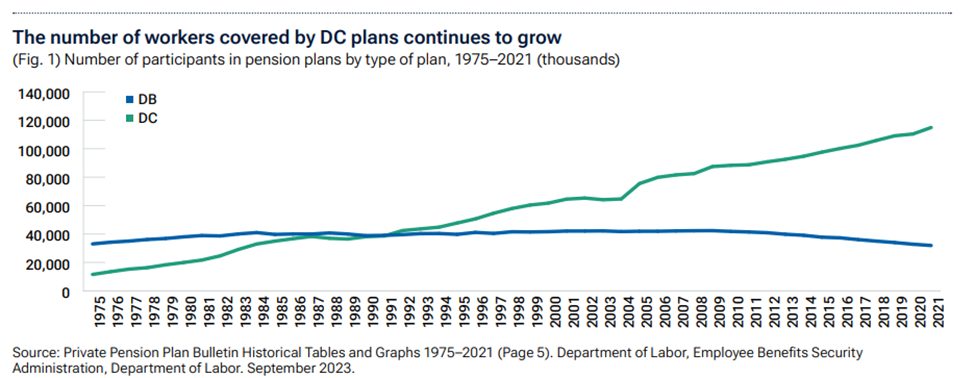

While this approach remains in play (and is now graduating to a Total Portfolio Approach for many of the largest asset owners), two secular and related trends have converged. Trend one is the simple fact that the defined benefit retirement contract is moving toward extinction everywhere, other than in the public services space. The vast majority of us are now responsible for our own retirement planning, including the sole discretion to make the very important decisions around asset allocation and the navigation of myriads of investment and longevity risks for ourselves and our dependents.

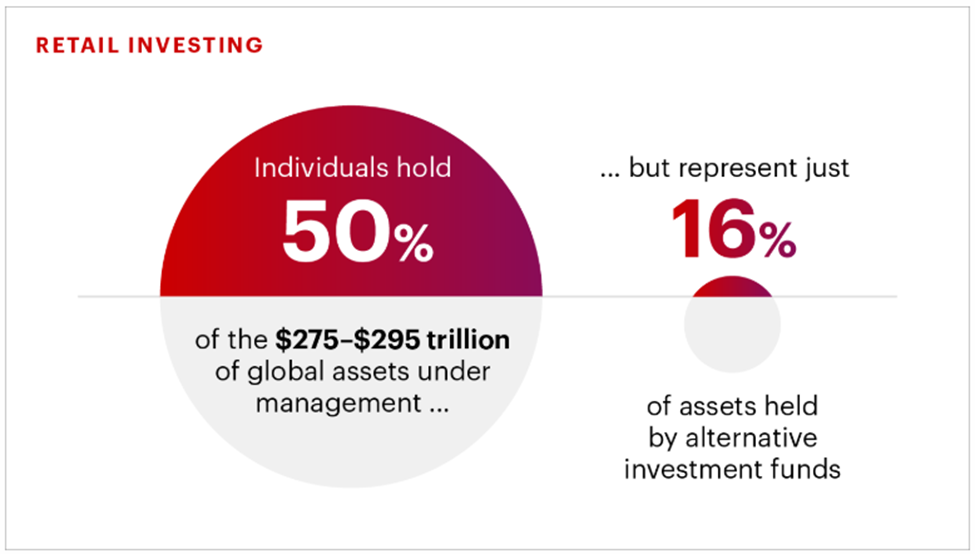

Trend two is very much a byproduct of the first. This so-called defined contribution retirement structure has now been in play for over four decades, and no surprise here, it has been the catalyst for why the individual asset owner has now overtaken her institutional counterpart within the total AUM pie.

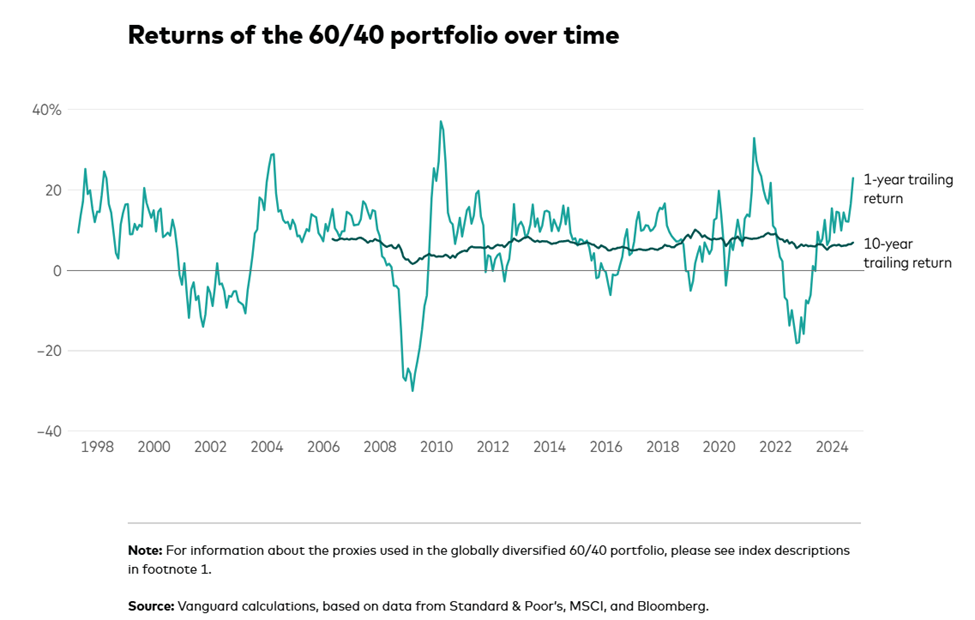

This is why democratization has become a siren song aimed at individual investors with very low-to-no allocation to alternatives. To that same end, you might also feel that 60/40 way of investing is being cast as somewhere between quaint and dead, and a drawdown of 18% for the proxy index in 2022 was a great prop to feed this narrative.

The 60/40 index is a very tough bogey to beat. Despite the aforementioned carnage in 2022, that same benchmark index was up 17% and 15% (respectively) in 2023 and 2024, and closed out the last ten years at an annualized return of 6.9%, which is exactly where it has been (on average) since the 1990’s.

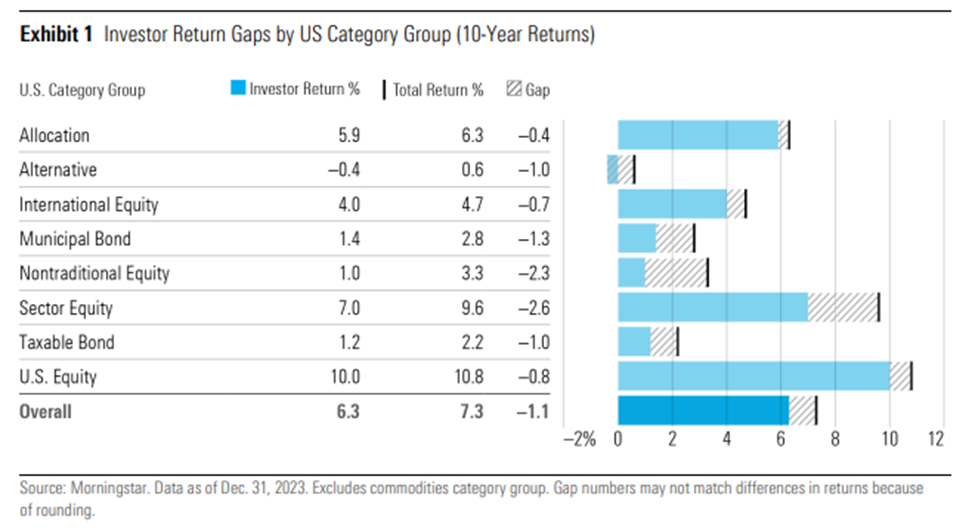

To complete this narrative, let us take a closer look at the publicly traded investment options available to all investors and a different kind of gap, which we need to mind and look to fix as well. According to Morningstar (and their shared love of certain ‘entitled’ slogan), we see that over these same rolling 10 year periods, that the average individual investor market-(mis)times their way to a 100+ basis point shortfall to what the market gave them had they stayed fully invested.

No doubt the prior ‘Rolling 60/40’ chart shows the need for great conviction and fortitude to ride out some of the extremes, particularly given what happened in the late aughts around the time of the GFC. That more painful period aside, we still have not done a wholesome enough job of helping the average investor understand the concept and power of a long-term (and diversified) investment plan, and that shortcoming continues to cost her 100 basis points per annum.

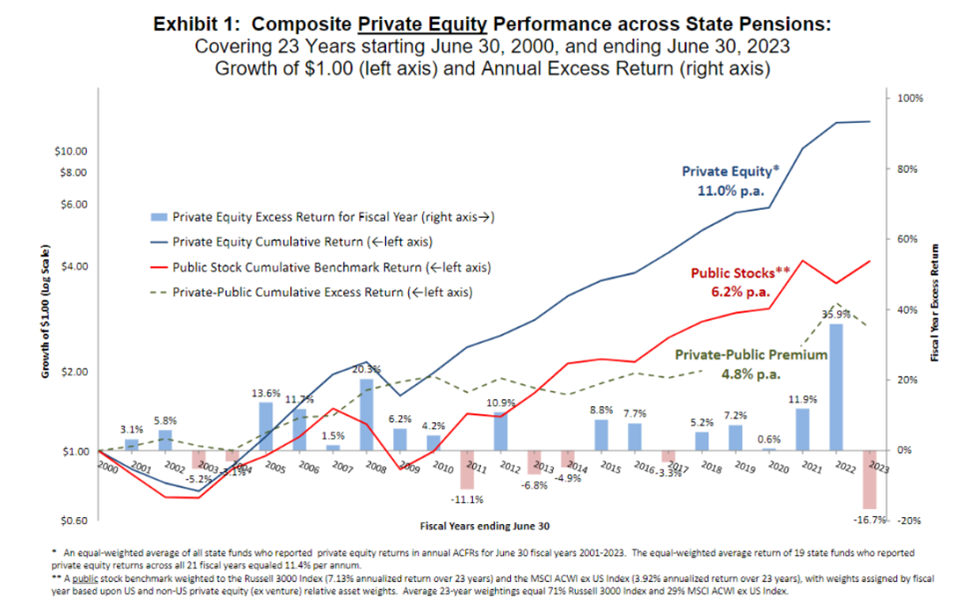

Let us now take that same 100 BPs gap and put it through the democratization time machine. If we tell individual investors that the historical long-term (per annum) premium of PE over public equity is about 500 BP, that is a number that it is supported by a series of facts and assumptions from a variety of reputable sources as one can see below.

For the same investor to get the equivalent of 100 basis points upside capture that they are already leaving on the table according to Morningstar, it would require an eye-popping 20% allocation to PE (20% of 500 BPs) before we even contemplate fees, the leaky retail wrappers, and the many assumptions that go into making TWR comparable to IRR… and by the way, past performance is not a guarantee of future results.

This essay is by no means meant to throw shade on the private markets, as those with outsized wealth have often made it in that very vineyard, which is replete with innovation and opportunity. It is also a fact that capital formation is increasingly happening in these same private markets across the entirety of the capital stack. The Gap we all need to mind here is one of education, and unless we can democratize that first, the average investor might just be better served accumulating their wealth in the public markets, wrapped in a comprehensive and long-term plan where the easier gap is minded and closed.

Seek education, diversity of both your portfolio and people, and know your risk tolerance. Investing is for the long term.

About the Contributor

William (Bill) J. Kelly, CAIA is the Founder and Managing Member of Educational Alpha, LLC where he writes, podcasts, and speaks on a variety of investment related topics, focused on investor education, transparency, and democratized access to differentiated risk premia. Previously he was CEO of CAIA Association since taking this leadership role in 2014 until his retirement in 2024. Prior to that, Bill was the CEO of Boston Partners, and CFO and COO of The Boston Company Asset Management, a predecessor institutional asset manager. In addition to his current role, Bill is also the Chairman and lead independent director for the Boston Partners Trust Company and serves as an independent director for the Artisan Partners Funds, where he is also Chair of Audit Committee and a designated Audit Committee Financial Expert. He is also currently an Advisory Board Member of the Certified Investment Fund Director Institute within the IOB (Dublin) which strives to bring the highest levels of professionalism and governance to independent fund directors around the world. Bill began his career as an accountant with PwC where he earned his CPA (inactive).

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/