About the CAIA Curriculum

The global investment landscape has undergone a profound transformation since the inception of the CAIA Charter Program. And with it, a redefining of the very nature of institutional investing and reshaping the role of alternative investments within portfolio construction. As a professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, the CAIA Association has incorporated this evolution within the CAIA curriculum.

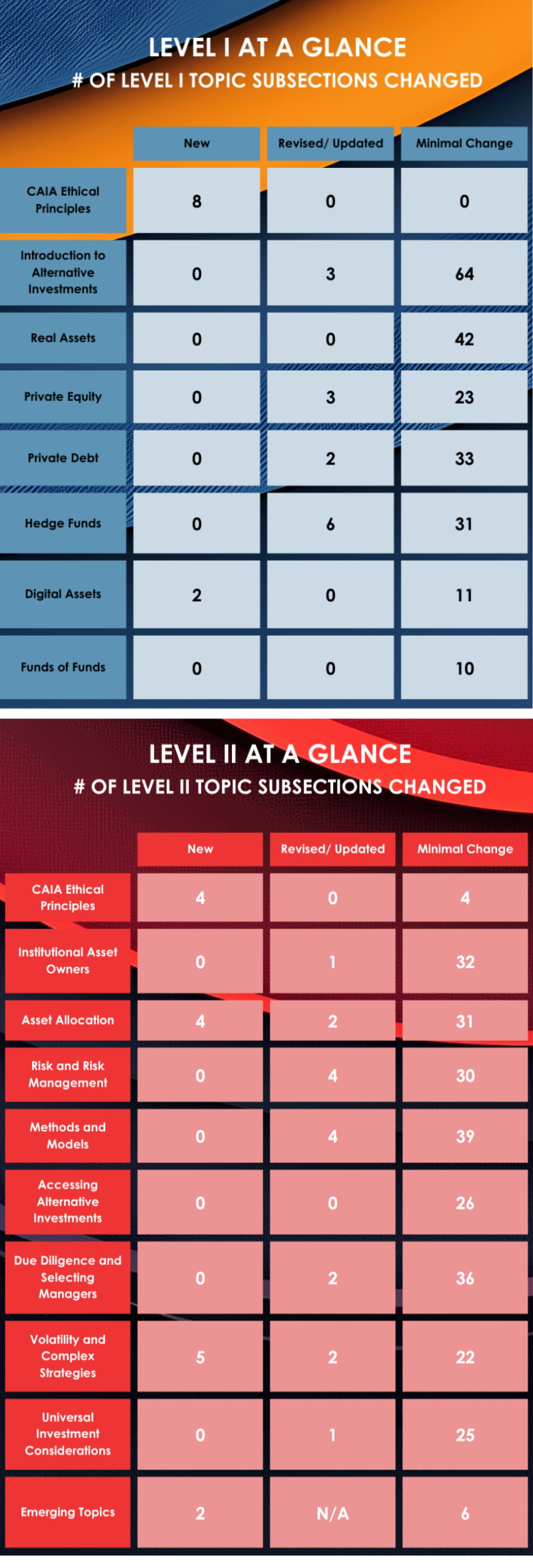

It is updated annually, with revisions resulting in roughly 10-20% change in exam content. This revision process ensures the curriculum will reflect the most relevant and up-to-date industry analysis, tools, and best practices.

The CAIA Association releases the revised curriculum at the start of the registration period in October for the following year. This updated curriculum then applies to the two exam cycles in that calendar year. For example, updated curriculum for 2026 exams is released in October 2025 and should be studied for the March 2026 exam and the September 2026 exam.

It is important to note that exams are based exclusively on the curriculum

associated with that exam year. Use of prior editions is not recommended.

Next is here. An Evolution in Learning

Beyond a singular focus on individual investment strategies, today’s investment professionals must wield a holistic proficiency encompassing an array of disciplines. From portfolio construction and thematic investing trends to geopolitical shifts, regulatory intricacies, and technological innovations, the modern investment landscape necessitates the multi-dimensional approach found within the CAIA curriculum.

For Level I, the curriculum takes a bottom-up approach to the alternative investments industry. The readings offer detailed insights into the variety of institutional-quality strategies spanning the alternatives universe. Upon completing Level I, Candidates should have working knowledge of the relevant strategies available for investment, along with the basic tools to evaluate them.

The Level II curriculum takes a top-down approach and provides Candidates with the skills and tools to conduct due diligence, monitor investments, and appropriately construct an investment portfolio. In addition, the Level II curriculum contains Emerging Topic readings; articles written by academics and practitioners designed to further inform and provoke the Candidate’s investment management process.

For additional details about the Level I and Level II curriculum - including learning objectives and keywords to support your studies, please review the Level appropriate Curriculum Companion.