What is true without question is this: Herbalife (NYSE: HLF) sells nutritional and skin care products through an international MLM network. Another truth: the company is headquartered in Los Angeles, incorporated in the Caymans. Beyond that, things get controversial.

What is true without question is this: Herbalife (NYSE: HLF) sells nutritional and skin care products through an international MLM network. Another truth: the company is headquartered in Los Angeles, incorporated in the Caymans. Beyond that, things get controversial.

The intense controversy is whether the MLM has crossed over the rather fuzzy line we discussed in Part 1 of this essay, the boundary line of illegal pyramid scheming. This became news more than two years ago, in May 2012, soon after David Einhorn asked pointed questions during HLF’s May 1 earnings call.

But Einhorn’s involvement was something of a flash, not a long-lasting light bulb.

It wasn’t until December of that year that Ackman entered the picture. He was from the start much more explicit in his pyramid-scheme accusations that Einhorn had been.

On December 19, 2012, Ackman let the world know that he was shorting Herbalife, and promised a detailed account of why. On the morning of December 20, he spoke at the Ira Sohn Conference and presented a long-form version of what Einhorn had merely hinted. Ackman called Herbalife “the best managed pyramid scheme in the history of the world.” Eventually even the best-managed schemes come unraveled, though, and Ackman said he was betting big that this one would soon.

This created another serious downward move. Before Ackman spoke HFL was still roughly at the level to which Einhorn’s questions had consigned it. It had closed December 18th at $42.50.

Stock Price History

On December 19th, as noted above, Ackman gave the world his bottom line, and HLF closed that day at $37.34.

On December 20th, Ackman gave his detailed presentation, and HLF closed at $33.70.

On December 24th, HFL hit its nadir, closing at $26.06.

Also on this day before Christmas, Tracy Coenen posted her excellent discussion of the issue on her “Fraud Files” blog.

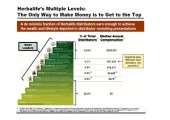

The diagram at the top of this entry is one that is used both in Ackman’s presentation and in Coenen’s discussion. Not coincidentally, it takes the form of a pyramid. Coenen uses it to stress that no amount of retail sales by a distributor “will get him or her to the top, because to get there you have to have ‘royalty override points’” – which you can only get by through recruiting.

Yet the stock immediately began a steady though unrushed move upward. A year later, it was moving back and forth across the $80 line.

Now, as we mentioned in Part I, it is testing the waters in the low $50s. But Ackman wants to persuade us it is headed to $0.

Not Just One Chain Letter

Here is another fact: simple pyramids aren’t sustainable for very long. Chain letters collapse within weeks or months, not in a slow process that takes decades. Herbalife has been around since 1980, and even its listing on the NYSE is now nearly a decade old.

So: if Herbalife is illegally chain-letter-like, something else is going on. One possibility is that we should see Herbalife not as a single chain letter but as a series thereof. Each product launch is the start of another chain, and since a new letter gets going just as an older one falters, the umbrella under which they are all launched [excuse the mixed metaphor] remains in place. Is that it?

The stock price, then, isn’t the valuation of a chain letter, but it is the valuation of a rather creative and long-lived scheme to keep creating new chain letters.

My own best guesses are as follow:

1) If Ackman’s plan is to get HLF to zero by getting regulators and enforcement authorities to see HLF as he does, the plan is in rather desperate straits. They haven’t done so over the last year and a half, and it seems quite unlikely they are going to have a sudden conversion any time soon;

2) If Ackman believes that the business model is unsustainability and will collapse of its own weight, and if he is prepared for a really long wait on that presumption (analogous to the wait he sustained in the matter of MBIA) then his odds are somewhat better. As even Madoff discovered, it can be tricky for even the best juggler to keep all the balls in the air decade after decade, and some forthcoming crisis could yet cause them all to spin out of the control of the Herbalife execs; but

3) On that scenario too, the situation is a bit iffy. Many are the rational bets made too soon.

Personally, I would not push my chips in along with Ackman’s on this. But I wish him well.