By Shreekant Daga, CAIA, CFA, FRM | Associate Director, Liaison Office, India | CAIA Association

Sporting incidents at times draw similarities to financial matters. The below write-up compares and contracts one of the most famous cricket test matches and a Wall Street bet with a financial investment lens. The blog post takes form of a transaction document and covers the journey of how the two performed with concluding remarks on hits and misses.

The term sheet

Tenure

A cricket test match gets played over the course of five days with six hours of play time each day. This format means a team cannot lose or win a test match in the matter of a few moments. Instead, due to the length of time, the test match requires a certain degree of physical and mental strength. Similarly, the bet between Buffett and Protégé Partners was for a period of ten years, rather than a shorter time horizon such as a few months

Market conditions

A cricket pitch, or the surface on which the game is played, is prepared by the host team. This allows the host team to set the initial term of the game by preparing the pitch to their liking. In this case, the Indian team preferred slow and dusty tracks which are optimal for Rank Turners (a type of cricket pitch) as the play continues. The non-host team comprised of a strong group of players would be able to tackle such foreign conditions.

If we apply this analogy to “Buffett’s bet”, Buffett is analogous to the host team, where his preparation of the pitch was betting that the S&P 500 would outperform a hand-picked portfolio of hedge funds, making a major call on the broad equity markets. On the other hand, portfolio diversification is a similar attempt to prepare for varied market conditions by reducing volatility.

Composition of a portfolio

Each cricket team has 11 players. The team consists of specialists (batman/bowler/wicket keeper) and generalists (known as all-rounders in cricket). Like a cricket team, a portfolio also consists of investments in several asset classes. Asset classes can also be broadly divided into traditional and alternatives. Traditional assets which widely are defined as stocks, bonds and cash are in a way comparable to specialists in cricket given their strong correlations to their specific market comparable and also the fact that they have specific market comparable. S&P 500 index is an investment in equity whereas hedge funds are an alternative investment class. The bet in a similar analogy to cricket was a competition of a team of specialists versus generalists. Buffett believed that the markets are operating in relatively strong Efficient Market Hypothesis (EMH) and there wasn’t much alpha that could be generated to justify large fees.

The return

It is 11th March 2001 and the Australian cricket team walked onto the pitch at Eden Gardens in Kolkata, looking to better their current existing test record of 16 consecutive wins. To many, the Australian team was not just invincible but rather the conqueror. Playing India at home was the final frontier of their dominance.

In 2007, Warren Buffett, who for a long time been an advocate of low-cost index product, invited hedge fund managers in an open statement to take the other side of a bet that a S&P 500 Index Fund will outperform hedge funds over a subsequent 10-year period. Protégé Partners accepted the challenge and the wager was set to $ 1 million which would be donated to the charity of the winner’s choice. Both parties to the million-dollar bet had put $320,000 each into a zero-coupon bond, which would grow to $1 million at maturity. Protégé Partners selected five hedge funds to eliminate specific risk. The bet reflected a broader contest between the low-cost index product industry and the high fee bearing hedge fund industry.

The performance – Part 1

The Australian captain, on winning the toss, made the decision to bat first and were in the backseat by day close. The Australian team came fighting and finished on a strong position by mid-day with an above average score and brought India to bat in the later part of the day. Day 2 was turning out to be a disaster for the Indian team as the play continued. Indian team had lost 8 out of their 10 wickets of their 1st innings by close of day. A cricket test match has 10 wickets and 2 innings for each side. If Australia were in the back seat at the end of Day 1 then India were now in the boot!

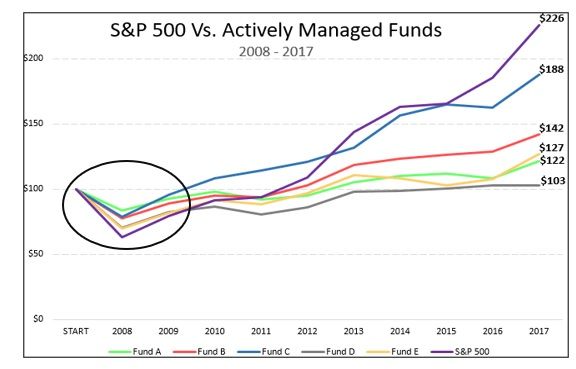

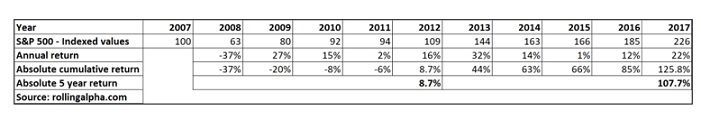

Similarly, the bet between Buffett and Protégé Partners was entered in 2007, just before the Great Financial Crisis. For the first two years Buffett’s call underperformed all five of the hedge funds selected by Protégé Partners.

From a cricket team’s perspective, staying the course is important. Patience, stamina, and a friendly home pitch advantage would come into play only as the game progresses. If solvency can sustain market insanity or outrage, then the better days are just round the corner.

These concepts can be applied to an investor as well. Over time, it is important to stick with the rationale of selecting the investment. In the case for Buffett, the thesis for the bet was that after loading hedge fund’s huge management and performance fees over a large period, there wouldn’t be alpha for the investor in the hedge fund.

The performance – Part 2

The first innings for Australia had concluded by two thirds of day two and for India had concluded early on day three. The Australian team were ahead by a huge margin. In normal course the Australian team would have come to bat but given the lead in the game there is an optional covenant to bring the Indian team to bat one more time (follow-on) before coming back to bat if required. Follow-on suggests the margin of superiority but should be exercised only when there is enough in the tank since it is physically and mentally challenging. To draw a comparison, it is like running 2 races on the same day rather than one each day. Another element was that the climate was not very conducive for the Australian team given that it was summer in India which means it was hot and Australia on the other side predominantly has cool weather. Lastly if the Australian team did not win soon enough then as time progressed it was going to get more and more difficult given the rank turner nature of pitch which would assist the Indian team. In the parlance of the upward/downward sloping forward curve, while the investor loses theta the premium/discount keeps getting steeper.

The Australian team had misjudged. It is notorious in finance that asset allocation is more important than security selection to generate returns in the longer run. The Australia team had made a strategic blunder to enforce follow-on as their players were too tired to continue to field for such long period of time if there was grit by the Indian team. This is an example similar to having poor asset allocation leading to financial mismanagement to attain goals. India drove home the advantage and by the end of day four were close to a position of being invincible in that match.

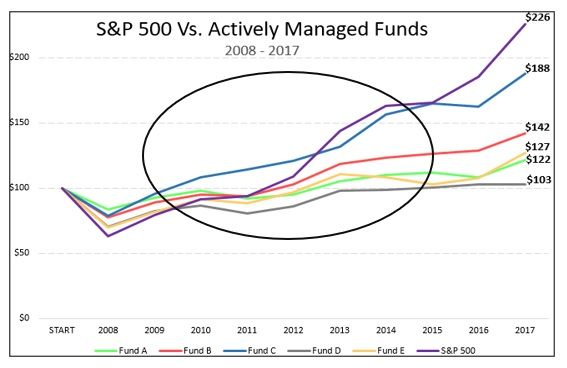

S&P 500’s relative run from 2009 to 2014 had put the curtains on the bet in some way. None of the selected hedge funds had performed better than the index. The difference in returns were looking too big to cover over the next three years.

The proceeds of the wager were going to a charity. The current investment in the bond covered the amount but Buffett and Protégé partners believed that the markets were bullish given that they had generated sub 2% percent annual return over the last 5 years. In the larger interest of the charity, in 2012, both parties to the million-dollar wager agreed to sell the bond and invest the wager in Berkshire Hathaway (which would invest in the market). The reallocation was carried out so that a larger sum be provided to the charity. At the end of the 10-year period the charity which Buffett supported was richer by $2.27 million versus the $1 million which would have come from the zero-coupon bond if not for the reallocation.

The performance – Part 3

The score at the end of day four was adequate to push for a result. The Indian team continued to bat on day five to cover the remotest risk of losing. A draw would have also broken the winning streak of the Australian team. This also meant that if India wins, it will be by a big margin. In a way this was maximizing the outcome with downside protection. After around an hour India declared their innings to bring Australia to bat. Declaration in cricket is a statement to say that the declaring team has enough on the board to have change between the bat and the ball. The game was now in India’s favour since the Australian team were on the wrong side of fatigue and to say the Indian team was now driving home the home conditions advantage of a now rank turner pitch.

The Australian team collapsed in around four hours and losing the match with close to an hour of play remaining. India had a comprehensive win. Drawing a parallel to a company valuation it is important to note that value unlocking is not a linear process. Catalysts and triggers are part of larger valuations just like large wins. Just like a buy or sell trade, in cricket an action or inaction is at the expense of the other. The Australian team made a few mistakes in the second half of the game such as over judging the physical capability of their team, underestimating the grit of the Indian team given the first innings collapse and not factoring in the pitch condition on day five.

As for the bet, the difference in return for S&P 500 versus the five funds had exploded with none of the hedge funds having a return closer to the return of the index. The returns from 2013 start to 2017 end stood at 107.7% which translates into an annual return of a whopping 15.7% CAGR! Sound investing philosophies can be put to trial in the short run but will certainly win the suit in the longer run.

The takeaway

Now in order to sum-up, lets carefully observe what worked and why for each of the two illustrations. In the cricket match, Australia made a strategic error to continue to field. The Indian team showed determination, resilience, and long-term focus, whereas Australia were aggressive early on and found themselves overstretched. The Indian team knew the ground conditions and the fact that the pitch would eventually deteriorate to serve their spinners, and so they played for the long-term.

While Buffett’s belief that alpha is tough to find and is not very large over a long period of time was vindicated by the end of the bet, hedge fund managers stayed true to their name and hedged market risk when it was needed most… at the beginning. When the larger market (S&P 500) was down, hedge funds protected the downside.

The gap between the broad market and the five hedge funds was wide in the up market, but during a period when hedging risk wasn’t really needed. It is important to note that if the horizon of bet was three years then the conclusion of the bet is in favour of Protégé partners. The long term is about the process and not the outcome. The difference between a trader and investor is horizon. A trader is tactical whereas the investor is about the strategy. A trader optimizes prevailing inefficiency whereas the investor optimizes the economic cycle.

The bet was for a period of 10 years where the market was pre-dominantly upward and in the words of Ted Seides (Protégé Partners co-founder) “doubling down on a bet with Warren Buffett for the next 10 years would hold greater-than-even odds of victory." A case in point is also about the selection of the five hedge funds and the timing of their (mis)performance. Protégé Partners flagship fund returned 95% from 2002 to 2007, net of fees versus 64% for the S&P 500. There is a wide gap between the returns of the best hedge funds and the average funds. Hedge funds are supposed to hedge market risks and shouldn’t be expected to outperform passive beta if passive beta is what is prevailing. A hedge fund diversifies across risk patterns but if risks don’t become severity, a fundamental question on diversification is raised. In those situations, you can’t really expect to play cricket with a football team!