By John Bowman, CFA, Senior Managing Director, CAIA Association

The retirement crisis “plague” existed well before COVID-19. And yet, in a time that should have fostered unity for protection of human dignity and spirit, we’re perhaps more divided than ever.

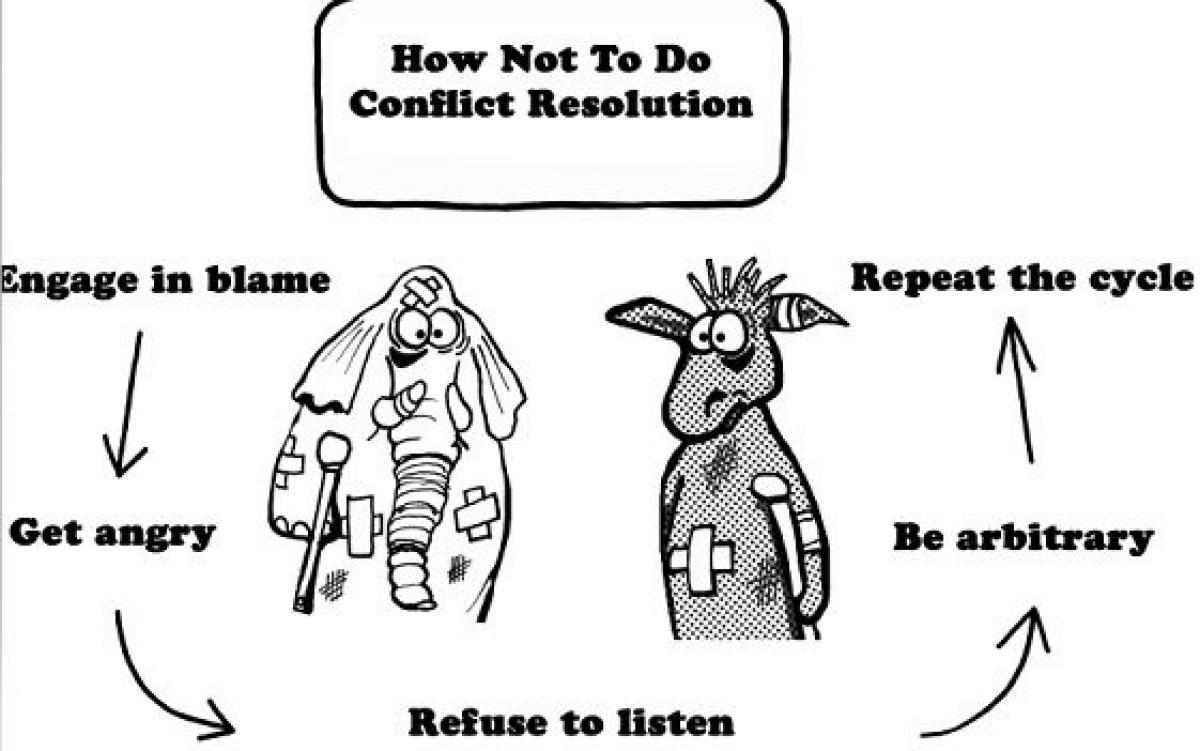

We’ve completely lost our ability to conduct civil discourse; our profession must not deteriorate down a similar path. Yet, social media posts, articles, and op-eds are increasingly filled with confrontational vitriol to describe private capital as “looting, vulturous, preying, tax dodging, crooks, high on their cocaine of carried interest.” This hyperbole has been on full display as the parade of commentary coming from securities regulators and the market’s subsequent response, seems enveloped with partisan divisiveness – ”Trump’s DOL” or “Biden’s SEC.” This dramatic rhetoric is unfair, irresponsible journalism, and frankly, self-absorbed click-bait. We are better than this!

Politicians, whatever their creed, come and go; professionals are here to stay. Investors are owed a balanced and honest assessment of these industry-defining trends, because neither side of the aisle will get this all right. Regardless of who occupies 1600 Pennsylvania Ave and the derivative seats at the SEC and DOL, it is our role to protect the investor. Professions represent a collective that has committed to a higher purpose of protecting and serving the public good. They are self-reflective, self-policed, and self-educated, resulting in a public warranty that denotes trust, expertise, and license to practice. And that duty raises our gaze above childish name calling and herd behavior to one that starts and ends with the primacy of our clients’ wellbeing.

With that respectful exhortation as our guiding light, let’s examine some of the more high profile debates out of Washington:

Fiduciary Duty – The oxygen of a profession is trust. You can’t steward someone’s future without a relationship built on integrity. I have been arguing for a “one profession, one standard” model for the financial services industry for years. The 2016 DOL regime’s attempt at a uniform fiduciary standard was far from perfect but possessed the tenets to eliminate most of the conflicts of interest that plague investment advice. Most importantly, I argued we must publicly distinguish those who embrace fiduciary responsibility from those who merely acknowledge it.

Those who don't want to abide by the fiduciary rules of the Investment Advisers Act should be required to call themselves salespeople. Professions must have clear boundaries, and a clear distinction in titles is an important step in setting those boundaries.

The SEC’s newly minted Regulation Best Interest (Reg BI) falls far short of a one profession, one standard fiduciary rule. It retains ambiguity between brokers and investment professionals, does not emphatically elevate client interest’s above the firm’s, allows for a proliferation of conflicts and self-dealing (so long as they are disclosed), and only requires transaction interpretation of one’s duty versus a relationship of ongoing advice.

Access to Alternative Investments - In early June 2020, the DOL issued a statement leaving it to each 401k fiduciary to assess the suitability, fit, and reasonableness of including private investments in target date funds. More recently, the SEC revised the definition of an accredited investor (by a vote along partisan lines), replacing the binary and dated income and net worth test with a multi-factor approach centered on education.

Constructing a portfolio that provides income, inflation protection, capital preservation, and uncorrelated cash flows is foundational for every long-term investor. Alternative investments play a complementary role to publicly traded securities in achieving this diversification with the additional benefits of downside protection and less volatility. Capital formation has shifted with abandon to the private markets recently and shows no signs of reversing. Companies are choosing to stay private longer as the benefits of the IPO are largely satisfied in the private markets. Continuing to pretend that public equity and debt markets alone are a fair proxy for the global economy is foolhardy.

That said, the most sophisticated institutional investors have trouble navigating private markets. How do we expect retail investors to manage?

That’s why our argument for democratization is always incumbent upon a call for higher levels of education. Professional gatekeepers (plan sponsors, advisors, wholesalers) must be properly trained and equipped both intellectually and ethically to understand the risk profile and idiosyncrasies of these instruments. Education should equal access. Unfortunately, the new amendment stops well short of this premise. As the professional body for alternative investments, CAIA Association stands ready to help ensure the public is properly served through the administration of an industry educational standard.

Environmental, Social, and Governance (ESG) –ESG factors may be more episodic than traditional financial inputs, but it is incontrovertible that some, such as climate change, present material threats. The probability and magnitude of these threats can have substantial influence on companies’ predicted future cash flows, and the ability for the fiduciary to deliver on investment outcomes.

Eugene Scalia articulated this well in the DOL’s recent proposal, emphasizing that investment decisions must be “based solely on pecuniary factors that have a material effect on the return and risk of an investment based on appropriate investment horizons and the plan's articulated funding and investment objectives” and that ESG considerations may be treated as such.

Unfortunately, Scalia has gone on to create a false dichotomy between retirement security and values-based investing. ESG has never been about social engineering but rather how values impact value, which is completely consistent with ERISA guidelines.

There is a growing body of evidence that demonstrates strong correlation between ESG integration and financial performance. Ignoring ESG factors would be as derelict to fiduciary duty as disregarding a product launch from a competitor, a substantive revision to corporate tax law or a major demographic shift. Sadly, I suspect this proposal stems more from partisanship than protecting retirement security.

Given the framework in which they are forced to operate, it’s no surprise that the SEC and DOL have fallen victim to the partisan rancor that poisons our country’s discourse. But this is even more reason for the investment industry to take an unbiased view of these subjects. Engagement around these issues will ultimately contribute to a more diverse industry that celebrates a variety of viewpoints and perspectives in its decision making.

I implore us all to strip off our pre-suppositions and party affiliation and put on the jersey of the impartial professional that seeks to elevate the public’s interest above all else, otherwise we’ll end up with each party counting its “wins” while America’s retirees are counted out.

John Bowman, CFA, is Senior Managing Director for CAIA Association.