By Shreekant Daga, CAIA, CFA, FRM – Associate Director of Industry Relations, India at CAIA Association & Guowei Jack Wu, CFA – Director of Content, APAC at CAIA Association Through August-September 2020, CAIA Association hosted a 10-part educational webinar series titled 10 Lessons in Finance. The event brought together academics from leading business schools (JBIMS, IIM A, IIM B, IIM C, SPJIMR, FMS, and ISB) and senior industry leaders. Two broad themes emerged from the various questions raised by participants:

- How does the India alternative investment industry compare with the global alternative industry?

- What does the future of India’s alternative investment industry look like?

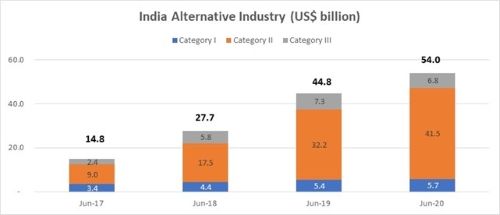

In this note, we will attempt to provide information on both. UNDEVELOPED RELATIVE TO GLOBAL INDUSTRY BUT GROWING According to our recent flagship publication, alternative investments represent approximately $13 trillion (or 12%) of the global investible market, consisting of hedge funds/liquid alternatives, private equity, real assets, and structured products. By 2025, CAIA Association members expect the industry to grow to 18-24% of global investible market. In recent years, the global alternative industry has grown at a rapid pace, driven by a need to enhance returns and increase diversification. This growth is also supported by external conditions such as lower interest rates, declining pension funding ratio, the maturation of emerging markets, and a structural change in capital formation. India’s alternative investment industry is underdeveloped relative to the rest of the world. Asset under management (AUM) for alternative investments is estimated to be $54 billion[1] as of June 2020, which translate to less than 4% of India’s public market capitalization[2] as of March 2020. There are several possible reasons for the small size of India’s alternative investment industry, but we think there are two key explanations. First, the minimum investment size for investors is high. The investment size for investors starts from Rs 1 crore (US$135 thousand) which puts these investments out of reach for most investors despite a large population of potential participants. Second, traditional asset classes in India still offer relatively high returns. A bank fixed deposit can yield 5.00%-6.75%, and a local denominated AA bond can yield as high as 8 to 9%. While Private Equity funds can offer 16% to 19% returns (as measured by IRR), they do so with a much higher risk profile. However, the industry has experienced strong growth momentum in recent years. In May 2012, SEBI introduced the Alternative Investment Funds (AIF) regulation to bring all investment funds under the regulatory oversight of Securities and Exchange Board of India (SEBI). Naturally, there was high growth from a low base in the early years as funds registered themselves under the new regime. Over the proceeding eight years, the industry grew over 20% year over year, eventually increasing $9.2 billion in a single year from 2019 to 2020 as shown in the chart below. A growing India alternative industry  Source: Compiled by CAIA Association SEBI has compartmentalized Alternative Investment funds into three major categories. As of June-2020, Category II is the largest with around 77% of total industry AUM, followed by Category III with 13% and Category I with 11%. INDIA’S GROWTH STORY BY CATEGORY Category I covers early stage funding, and has five main components:

Source: Compiled by CAIA Association SEBI has compartmentalized Alternative Investment funds into three major categories. As of June-2020, Category II is the largest with around 77% of total industry AUM, followed by Category III with 13% and Category I with 11%. INDIA’S GROWTH STORY BY CATEGORY Category I covers early stage funding, and has five main components:

- Venture Capital

- Social Ventures

- Small Medium Enterprises (SME)

- Infrastructure

- Other socially desirable sectors.

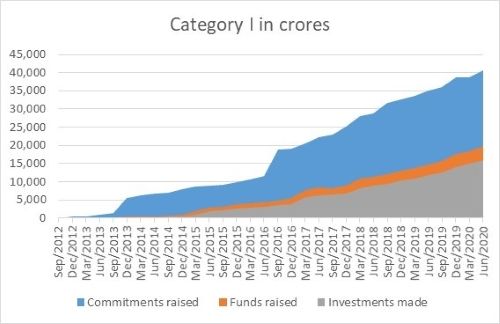

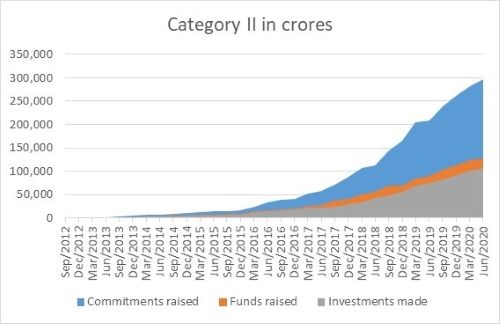

Within this Category I, infrastructure is the largest component accounting for almost 69% of total commitments, followed by venture capital with around 22% of total commitments. The other components which have some social elements - social ventures, SME, and other socially desirable sectors – together account for less than 10% of total commitment.  Data: Compiled by CAIA Association Category II covers Private Equity. This is by far the largest component of India alternative industry accounting for 77% of the total industry AUM. Funds within this category are close-ended funds.

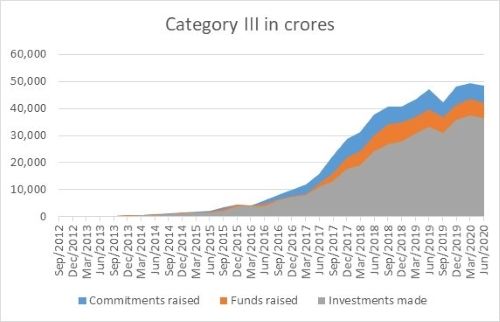

Data: Compiled by CAIA Association Category II covers Private Equity. This is by far the largest component of India alternative industry accounting for 77% of the total industry AUM. Funds within this category are close-ended funds.  Data: Compiled by CAIA Association Lastly, Category III covers hedge funds. This category employs diverse and complex trading strategies with leverage.

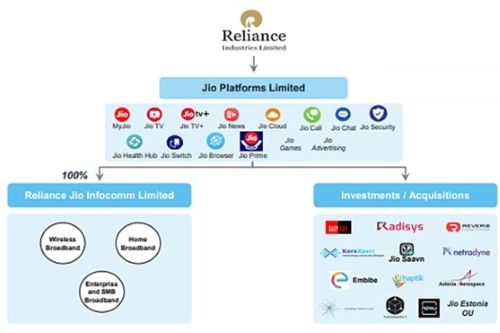

Data: Compiled by CAIA Association Lastly, Category III covers hedge funds. This category employs diverse and complex trading strategies with leverage.  Data: Compiled by CAIA Association India’s AIF definitions have two deviations from conventions followed by major alternative industry data providers. First, real assets and structured products are not considered to be part of the alternative investment industry. Thus, India’s AIF focuses mainly on venture capital, private equity, and hedge funds. Second, India’s AIF definition also includes Social Venture, SME funds, and funds that promote socially desirable sectors. RECENT DEVELOPMENTS Two recent developments give some support to the potential growth of India’s alternative investment industry. First, India’s Private Equity space took the spotlight when Reliance’s Jio Platforms Ltd raised an amazing US$20 billion within a few months, despite the global COVID-19 outbreak. The investors include notable blue-chip investors and tech giants in the United States. Second, the startup space received a boost when the Reserve Bank of India recently decided to categorize startups under the Priority Sector Lending. Jio Platforms Ltd (Jio Platforms) Jio Platforms is the digital services company setup by Reliance Industries, one of the largest companies (by revenue) in India. Jio Platforms offers a wide range of digital services to its customers, including entertainment, education, healthcare, and social networking. But at its core is Jio, the telecommunication company launched in 2016, which quickly defeated competitors to become India’s market leader with roughly 400 million subscribers. Amazing fund raising of US$20 billion within three months, despite COVID-19 pandemic

Data: Compiled by CAIA Association India’s AIF definitions have two deviations from conventions followed by major alternative industry data providers. First, real assets and structured products are not considered to be part of the alternative investment industry. Thus, India’s AIF focuses mainly on venture capital, private equity, and hedge funds. Second, India’s AIF definition also includes Social Venture, SME funds, and funds that promote socially desirable sectors. RECENT DEVELOPMENTS Two recent developments give some support to the potential growth of India’s alternative investment industry. First, India’s Private Equity space took the spotlight when Reliance’s Jio Platforms Ltd raised an amazing US$20 billion within a few months, despite the global COVID-19 outbreak. The investors include notable blue-chip investors and tech giants in the United States. Second, the startup space received a boost when the Reserve Bank of India recently decided to categorize startups under the Priority Sector Lending. Jio Platforms Ltd (Jio Platforms) Jio Platforms is the digital services company setup by Reliance Industries, one of the largest companies (by revenue) in India. Jio Platforms offers a wide range of digital services to its customers, including entertainment, education, healthcare, and social networking. But at its core is Jio, the telecommunication company launched in 2016, which quickly defeated competitors to become India’s market leader with roughly 400 million subscribers. Amazing fund raising of US$20 billion within three months, despite COVID-19 pandemic

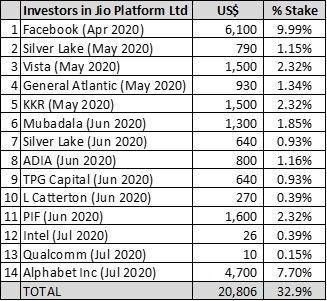

Source: Compiled by CAIA Association From April 2020 to July 2020, Jio platforms raised $20+ billion through an approximate 33% stake sale to 13 foreign investors through convertible preference shares. So why have the investors invested into the Jio platform? Some astute observers have pointed the strategic value of merging Facebook-owned Whatsapp and JioMoney. Others have pointed out that data is the new oil, and the 400 million and growing subscriber base has tremendous value. Finally, Jio’s proven formula of collecting tiny subscription fees from its enormous subscriber base and turning a profit is another good reason. We took the opportunity during our 10 series educational webinar to ask the business school thought leaders their opinions of Jio Platforms fund raising strategies. Most (50%) believe investors are betting on the India large market and its growth story. Others believe the sponsor - Mukesh Ambani – is also a key reason why investors are backing Jio Platforms. Regardless of the reason, India tech and private companies are clearly a top priority for many private equity investors, and US tech giants. Startups under preview of Priority Sector Lending (PSL) Banks in India operating in the retail market need to look at lending holistically. The Reserve Bank of India (central bank) has made it mandatory for banks to lend to certain sectors. These sectors are collectively grouped and are known as the priority sector. Priority sector lending requirements are often not met, and hence these banks are required to maintain balances either with government agencies or to purchase portfolios by meeting the said lending requirements. The Asset Backed Security (ABS) market in India is in existence predominantly due to PSL requirements.

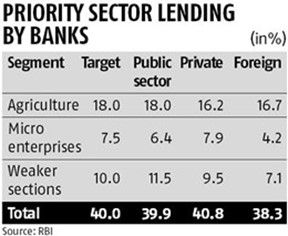

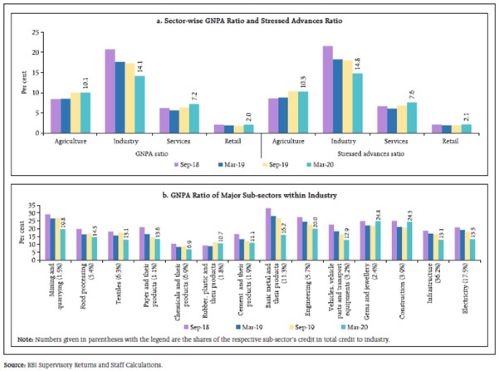

Source: Compiled by CAIA Association From April 2020 to July 2020, Jio platforms raised $20+ billion through an approximate 33% stake sale to 13 foreign investors through convertible preference shares. So why have the investors invested into the Jio platform? Some astute observers have pointed the strategic value of merging Facebook-owned Whatsapp and JioMoney. Others have pointed out that data is the new oil, and the 400 million and growing subscriber base has tremendous value. Finally, Jio’s proven formula of collecting tiny subscription fees from its enormous subscriber base and turning a profit is another good reason. We took the opportunity during our 10 series educational webinar to ask the business school thought leaders their opinions of Jio Platforms fund raising strategies. Most (50%) believe investors are betting on the India large market and its growth story. Others believe the sponsor - Mukesh Ambani – is also a key reason why investors are backing Jio Platforms. Regardless of the reason, India tech and private companies are clearly a top priority for many private equity investors, and US tech giants. Startups under preview of Priority Sector Lending (PSL) Banks in India operating in the retail market need to look at lending holistically. The Reserve Bank of India (central bank) has made it mandatory for banks to lend to certain sectors. These sectors are collectively grouped and are known as the priority sector. Priority sector lending requirements are often not met, and hence these banks are required to maintain balances either with government agencies or to purchase portfolios by meeting the said lending requirements. The Asset Backed Security (ABS) market in India is in existence predominantly due to PSL requirements.  The data below is aggregated through the sector and is as of January 2019. As noticeable, private banks have lent to the priority sector in an excess of the headline 40% requirement. The concept of PSL certificates (PSLC) was issued several years back to incentivize banks overachieving the PSL requirement and to incentivize overall lending in that direction. In the case of PSLC, the loans would still be on the books of the original lender, and the deficient bank would only be buying a right for the accounting entry. Adjusted net bank credit of 40% to the priority sector has largely been underserved despite the tools available. The reason for lower allocations is due to the high NPAs and the absence of collateral in the sector.

The data below is aggregated through the sector and is as of January 2019. As noticeable, private banks have lent to the priority sector in an excess of the headline 40% requirement. The concept of PSL certificates (PSLC) was issued several years back to incentivize banks overachieving the PSL requirement and to incentivize overall lending in that direction. In the case of PSLC, the loans would still be on the books of the original lender, and the deficient bank would only be buying a right for the accounting entry. Adjusted net bank credit of 40% to the priority sector has largely been underserved despite the tools available. The reason for lower allocations is due to the high NPAs and the absence of collateral in the sector.  In August 2020, the Reserve Bank of India brought startups under the purview of PSL. This should reduce the cost of funding for startups given the assumed negative drag due to PSL and the perceived better risk profile of startups. Just as PSLC, if units of funds investing in startups are considered PSL, and are allowed to be traded, that would improve the liquidity risk profile of the funds, which would ultimately benefit new businesses and startups. Currently, units of funds investing in startups (Category I) are not tradeable. These units go through a quarterly valuation for fee calculation, accounting, and reporting. The speakers of 10 Lessons in Finance were asked if quarterly trading windows and the natural inclusion of these units as PSL, create a demand for these investment units and ultimately benefit startups. The thought being to determine the relevance and impact of money flowing through the fund conduit, ultimately, to startups. The response was equally split:Half agreed that the quarterly trading window will enable greater capital access for startups while the other half pointed that there are too many variables involved to form a conclusive opinion. Both speakers seemed to reject the idea that quarterly trading windows will certainly not improve access to capital for startups. CONCLUSION Will the trajectory of India alternative industry follow that of the global trend and take greater share of India investable universe? Given the current state of the industry, and the recent developments, we believe it will, and the business school professors think so too. In fact, 71% think that the alternative industry will exhibit strong growth and will take greater share of India’s investable universe. We believe there are several factors to contribute to this growth: the growth of High Net Worth wealth in India, current low penetration levels of alternative products, and increases in allocations from domestic institutional investors. But this growth is not without its challenges: the lack of robust regulatory framework and the need for superior risk adjusted performance relative to the traditional asset class products. [1] Data extracted from https://www.sebi.gov.in/statistics/1392982252002.html on Sept. 9, 2020. Exchange Rate at US$1 = INR 71.43 [2] Data extracted from https://www.nseindia.com on Sept. 16, 2020.

In August 2020, the Reserve Bank of India brought startups under the purview of PSL. This should reduce the cost of funding for startups given the assumed negative drag due to PSL and the perceived better risk profile of startups. Just as PSLC, if units of funds investing in startups are considered PSL, and are allowed to be traded, that would improve the liquidity risk profile of the funds, which would ultimately benefit new businesses and startups. Currently, units of funds investing in startups (Category I) are not tradeable. These units go through a quarterly valuation for fee calculation, accounting, and reporting. The speakers of 10 Lessons in Finance were asked if quarterly trading windows and the natural inclusion of these units as PSL, create a demand for these investment units and ultimately benefit startups. The thought being to determine the relevance and impact of money flowing through the fund conduit, ultimately, to startups. The response was equally split:Half agreed that the quarterly trading window will enable greater capital access for startups while the other half pointed that there are too many variables involved to form a conclusive opinion. Both speakers seemed to reject the idea that quarterly trading windows will certainly not improve access to capital for startups. CONCLUSION Will the trajectory of India alternative industry follow that of the global trend and take greater share of India investable universe? Given the current state of the industry, and the recent developments, we believe it will, and the business school professors think so too. In fact, 71% think that the alternative industry will exhibit strong growth and will take greater share of India’s investable universe. We believe there are several factors to contribute to this growth: the growth of High Net Worth wealth in India, current low penetration levels of alternative products, and increases in allocations from domestic institutional investors. But this growth is not without its challenges: the lack of robust regulatory framework and the need for superior risk adjusted performance relative to the traditional asset class products. [1] Data extracted from https://www.sebi.gov.in/statistics/1392982252002.html on Sept. 9, 2020. Exchange Rate at US$1 = INR 71.43 [2] Data extracted from https://www.nseindia.com on Sept. 16, 2020.

Interested in contributing to Portfolio for the Future? Drop us a line at content@caia.org