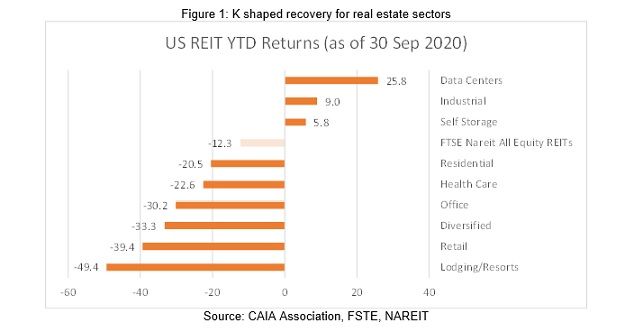

By Wu Guowei Jack, CFA – Director of Content, APAC at CAIA Association The COVID-19 pandemic has had a devasting toll on human life, and has impacted economies and industries globally. The effect on real estate is significant, as real estate can be considered a service sector that fulfills end-user demand. But the sectors within real estate have not been equally affected. So which are the sectors that have shown to be more resilient during the pandemic and could potentially provide downside protection to a real estate portfolio? It is important to determine whether the negative impacts we have already experienced are short term and temporary in nature, or if they are part of longer lasting structural changes in real estate demands. Recently, CAIA Association and MSCI Real Estate discussed some of the long-term trends in real estate, as well as the pandemic’s impact on various real estate sectors. In this article, I explore two perspectives to further understand the pandemic’s effect. K-SHAPED RECOVERY FOR THE REAL ESTATE SECTORS The S&P 500, a key US stock market index, has made a V-shaped recovery and has since posted a YTD return of 7.9%[i]. Other US indexes have also rebounded. This robust recovery shown by US equity markets is largely fueled by the unprecedented central bank stimulus and government fiscal policies. Importantly, the recovery is led by the technology sector, while many other sectors continue to languish. In this environment, the US Real Estate Investment Trusts (REITs) have recovered half of their losses. For example, FSTE Nareit All Equity REITs index recorded YTD return of -12.3% at end Sept. 20 from -23.4% at end March 20. However, the shape of an upturn for the real estate sectors is a K-shaped recovery as shown in Figure 1. Some bright spots like Data Centers, Industrial and Self-Storage are on the road to recovery, but sectors like Retail and Hospitality are among the most battered.  The global trend is similar to that of the US. Figure 2 shows World IMI indexes which measure the global listed real estate sectors. The Industrial sector had a strong recovery, followed by the Residential sector with a modest recovery. Office, Retail, and Hotel sectors are still languishing below their levels at the start of 2020.

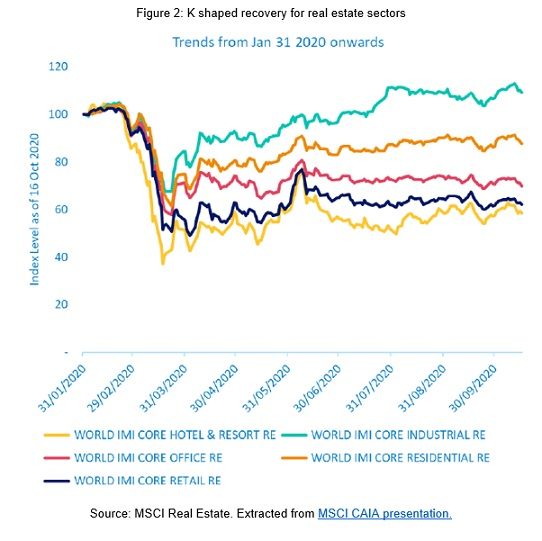

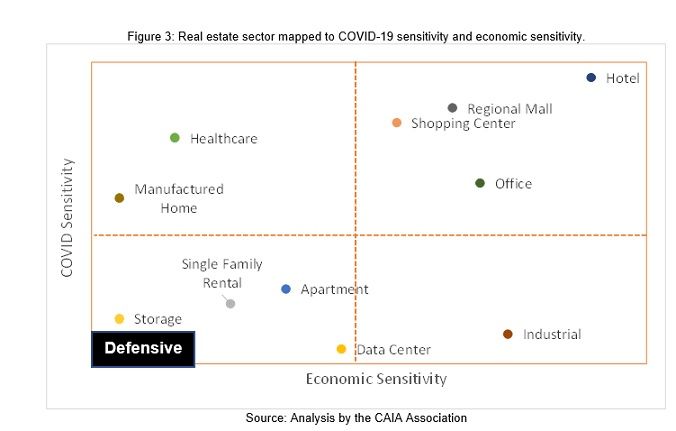

The global trend is similar to that of the US. Figure 2 shows World IMI indexes which measure the global listed real estate sectors. The Industrial sector had a strong recovery, followed by the Residential sector with a modest recovery. Office, Retail, and Hotel sectors are still languishing below their levels at the start of 2020.  Extracted from MSCI CAIA presentation Other than hunting for COVID-resistant real estate sectors, it is important to think about each real estate sector’s sensitivity to economic cycles, which happens more frequently than global pandemics. Figure 3 shows the various real estate sectors, mapped according to economic sensitivity[ii] and to COVID-19 sensitivity[iii]. The sectors in the lower left quadrant can be considered the more defensive as these sectors are less sensitive to both COVID-19 and to economic growth. Self-storage, single family, apartments, and data centers generally fall within this quadrant. Thus, performance hinges more on each sector’s respective real estate supply and demand cycles. On the other hand, the sectors in the upper right quadrant are more exposed to economic growth and COVID-19. In addition, the respective real estate cycle will amplify the real estate sector performance.

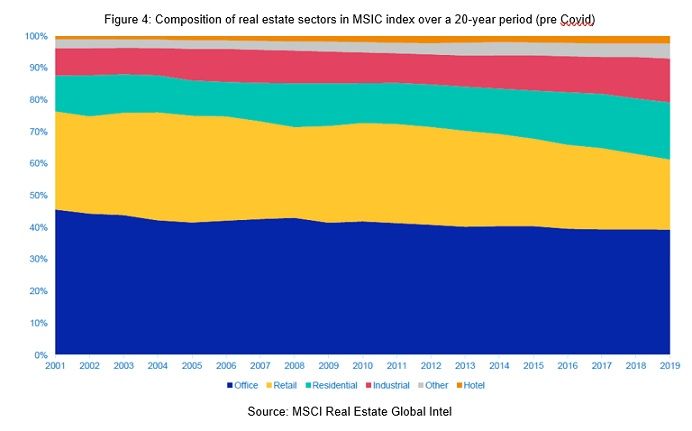

Extracted from MSCI CAIA presentation Other than hunting for COVID-resistant real estate sectors, it is important to think about each real estate sector’s sensitivity to economic cycles, which happens more frequently than global pandemics. Figure 3 shows the various real estate sectors, mapped according to economic sensitivity[ii] and to COVID-19 sensitivity[iii]. The sectors in the lower left quadrant can be considered the more defensive as these sectors are less sensitive to both COVID-19 and to economic growth. Self-storage, single family, apartments, and data centers generally fall within this quadrant. Thus, performance hinges more on each sector’s respective real estate supply and demand cycles. On the other hand, the sectors in the upper right quadrant are more exposed to economic growth and COVID-19. In addition, the respective real estate cycle will amplify the real estate sector performance.  While there are some signs of recovery from COVID-19 downturn, the recovery is likely to be protracted and uneven. Real estate sectors that are sensitive to COVID-19 are unlikely to see economic activities return to pre pandemic levels until the world has declare a win in the fight against COVID, particularly the travel-related and contact intensive sectors. TAKING THE LONG-TERM VIEW In a time of uncertainty and a ‘new normal’, it is prudent to take a step back to consider the long-term view on real estate. What are some secular trends that were already in motion prior to the global pandemic? Has the COVID-19 downturn simply accelerated a trend in motion? I would argue that COVID-19 downturn has accelerated existing trends in the real estate sectors. Before the COVID-19 downturn, Residential, Industrial and niche sectors were already showing positive structural trends. The data is shown in Figure 4. The sectors that have grown over time are:

While there are some signs of recovery from COVID-19 downturn, the recovery is likely to be protracted and uneven. Real estate sectors that are sensitive to COVID-19 are unlikely to see economic activities return to pre pandemic levels until the world has declare a win in the fight against COVID, particularly the travel-related and contact intensive sectors. TAKING THE LONG-TERM VIEW In a time of uncertainty and a ‘new normal’, it is prudent to take a step back to consider the long-term view on real estate. What are some secular trends that were already in motion prior to the global pandemic? Has the COVID-19 downturn simply accelerated a trend in motion? I would argue that COVID-19 downturn has accelerated existing trends in the real estate sectors. Before the COVID-19 downturn, Residential, Industrial and niche sectors were already showing positive structural trends. The data is shown in Figure 4. The sectors that have grown over time are:

- Residential (green area): The escalating affordability gap in major cities has made renting a home more attractive than buying. Governments have responded by creating incentives for rental housing. As a result, new multi-family markets have emerged. For example, in Asia-Pacific, Japan is a more mature multi-family market, but new markets are emerging in China and in Australia.

- Industrial (red area): Increased e-commerce has driven demand for industrial real estate. Previously, logistic network was about efficiency in delivering goods from point to point. Now, logistic network also need resilience to handle disruption in the supply chain. Companies are building additional capacity instead of just-in-time models. Furthermore, these are no longer simple sheds. Occupiers are investing in technology to automate operations and to increase utilization of the industrial property, driving up rentals and, in turn, increasing the capital value of the property.

- Others (grey area): These are the niche real estate sectors such as healthcare (global aging population), student accommodation (co-living/education), and data centers (5G networks). Although this base is small, there is a trend of niche real estate evolving and becoming mainstream.

The unloved sector is clearly Retail (yellow area):

The unloved sector is clearly Retail (yellow area):

- After facing onslaught of e-commerce and changing consumer behaviour in last decade, some retail buildings have been converted to alternate uses such as residential, or last-mile logistics. But this conversion trend is limited as property is subjected to regulation and specifications. The stronger trend is the rise of experiential retail where retail property provides a more engaging experience for consumers. In addition, the other trend is the development of multi-channel where a hybrid of online and offline model has increased in popularity.

To understand more about the long-term structural factors in the real estate sectors you can check out the following further readings:

- Apartments: Aberdeen Standard Investments points out that favourable national tax policies and regulations have resulted in selected European markets and US markets with mature and established institutional residential property markets.

- Industrial: Prologis estimates that the retail to logistics conversion opportunity is less than 3% of annual logistics construction in the top US markets.

- Others: CBRE highlights the factors that drive niche real estate sectors, notably the long secular trend of technology, demographics, and society.

This is the first part of a multi-part series on the real estate market in the time of COVID-19. Next, I will provide an in-depth examination of the tattered Hospitality and Retail sectors to uncover their paths to recovery and how they might emerge in a more robust manner. [1] As of 15 Oct 2020. Extracted from MarketWatch.com [1] Measured by their beta relative to S&P 500 beta [1] Measured by YTD returns relative to S&P 500 Connect with Wu Guowei Jack, CFA, Director of Content at CAIA Association on LinkedIn, Twitter, or via email.

Interested in contributing to Portfolio for the Future? Drop us a line at content@caia.org