By Giuliana Bordigoni, Adrian Chang, Adi Mackic, Sophie Rossini, and Kate Straker Introduction Diversification is the cornerstone of a systematic manager’s strategies: greater diversification means a larger pool from which to capture different return streams. Driven by recent rule changes, China offers access to some of the world’s most liquid markets: in September 2020, a long-anticipated rule change was announced by the China Securities Regulatory Commission (‘CSRC’), effective 1 November, 2020. This rule change will gradually expand the investment scope of a Qualified Foreign Institutional Investors [1] (‘QFII’) license to include, amongst others, futures contracts and private investment funds. This new development potentially opens investment opportunities for offshore investors which hitherto have only been accessible to onshore Chinese investors. It complements existing offshore access routes such as Stock Connect, Bond Connect, and China Interbank Bond Market (‘CIBM’) and facilitates greater access to China’s domestic capital markets for offshore investors. All of these changes should be a good thing for investors in systematic strategies, in our view. In this article, we discuss the size of Chinese financial markets, their diversification potential in comparison to their global counterparts and summarise how to access them. Finally, relying on our seven years of experience of trading onshore markets, we explore whether trading these markets using well-known investment strategies may provide attractive return and diversification characteristics when compared with commonly traded global markets. Size of China’s Financial Markets China, currently the world’s second-largest economy as measured by GDP, has seen enormous economic growth over the last 30 years, growing from USD397 billion in 1990 to USD14.9 trillion by the end of 2020 [2], an average annual growth rate of 13.2%. This growth has translated to its financial and commodity markets.

Commodities

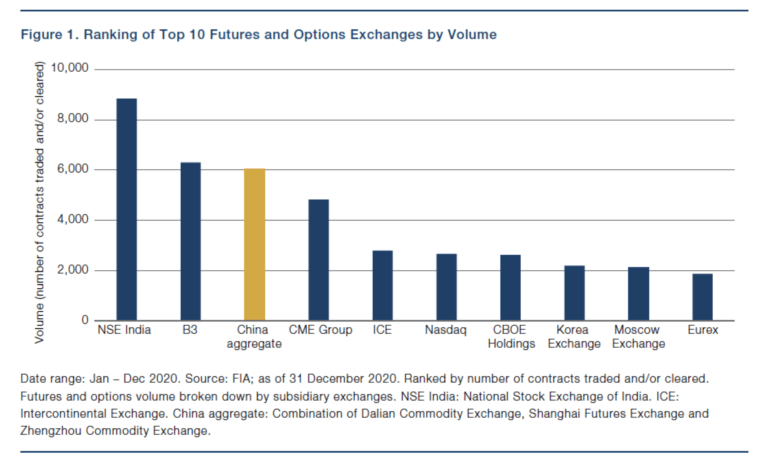

Following major economic reforms in 1978, a shift to urbanisation and industrialisation, as well as rising per capita incomes, have led to increased demand for commodities such as agricultural produce, energies, and metals. Commodity futures, originally established to meet the hedging needs of farmers and producers, nowadays serve a bigger role in the Chinese economy through improved pricing and transparency. Commodity futures are traded across the nation’s three commodity exchanges: the Dalian Commodity Exchange (‘DCE’), the Shanghai Futures Exchange (‘SFE’), and the Zhengzhou Commodity Exchange (‘ZCE’). In terms of their size relative to global exchanges, China’s commodity exchanges rank third in aggregate in the top 10 largest futures and options exchanges by volume (Figure 1). It is worth noting that not all exchanges listed in Figure 1 solely trade commodities or at all, unlike the DCE, SFE, and ZCE.

As of February 2021, 63 commodity futures were listed across the DCE, SFE, and ZCE. This list is continually growing, with the most recent addition being in January 2021 when China, the world’s top pork consumer and producer, launched its first physically delivered live-animal futures contract. Moreover, as part of its pledge to become carbon neutral by 2060, China plans to launch carbon emission futures on a still-to-be-developed futures exchange in Guangzhou.

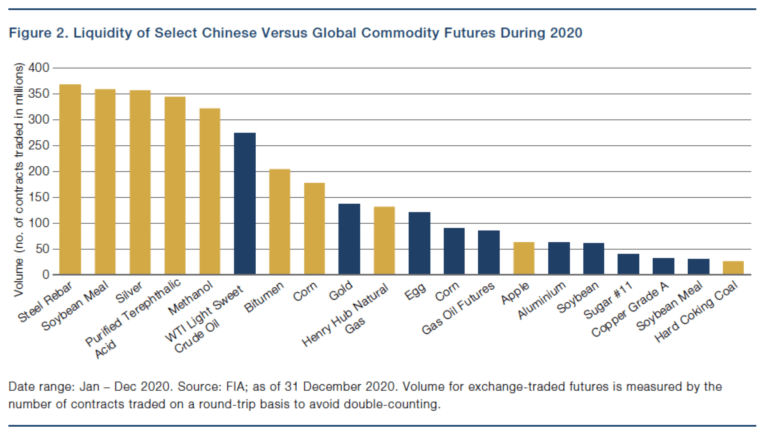

Volumes at the market level, as measured by number of contracts traded, also compare favourably versus global commodity futures. Figure 2 shows a selection of the most-traded Chinese commodity markets (yellow bars) versus global commodity markets (blue bars). In 2020, the top five traded commodity futures markets in the world were Chinese commodities. Our selected list highlights an additional appealing feature of Chinese markets, namely, the pool of commodities includes unique futures markets that do not exist elsewhere, for example, apple, bitumen, and egg futures.

Equities and Bond Markets

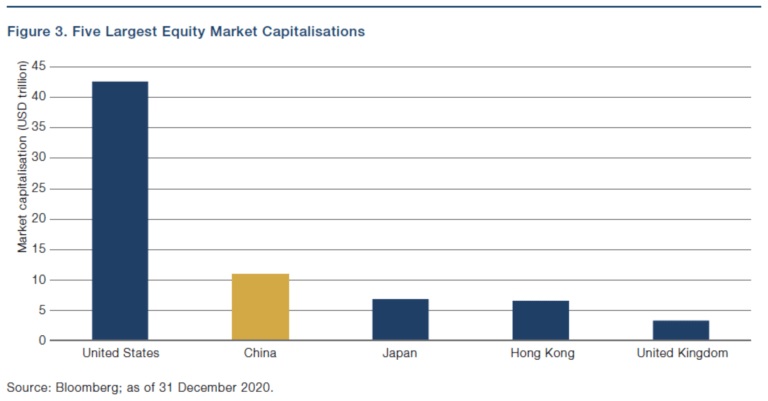

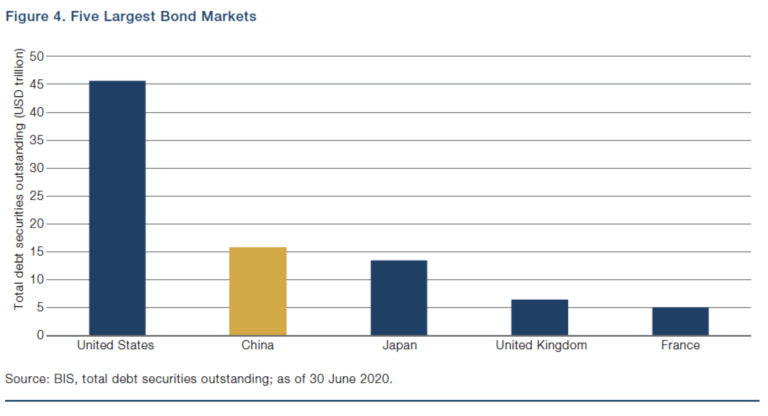

China is also a major player in traditional asset classes, such as equities and bonds. Figure 3 below highlights the five largest equity market capitalisations by country as at the end of 2020. Having ended 2020 with a new all-time high of USD10.9 trillion, the Chinese equity market solidified its status as the world’s second-largest, lagging only that of the United States. In bonds, China holds the title of world’s second-largest as well, once again behind the United States, measured as total debt securities outstanding according to data published by the Bank for International Settlements (‘BIS’, Figure 4).

Furthermore, foreign participation in onshore Chinese equity and bond markets has seen remarkable growth in the last three years. Volumes through offshore access routes into Mainland China A-shares (Northbound Stock Connect) and the domestic bond market (China Interbank Bond Market), have tripled and doubled, respectively, between January 2018 and October 2020. [3] Much of this growth can be attributed to the Index inclusion of China A-shares in MSCI indices, as well as the inclusion of China in various global bond indices such as the Bloomberg Barclays Global Aggregate Index and JP Morgan’s Emerging Market Bond Index. More passive flows are expected, however, as FTSE Russell’s World Government Bond Index is set to begin phasing in a 5.7% ultimate weighting to China starting October 2021.

Diversification Arguably, the most appealing characteristic of Chinese financial markets is their diversification potential in comparison to their global counterparts. Below, we show this is indeed the case and the effect is persistent across asset classes.

Commodities

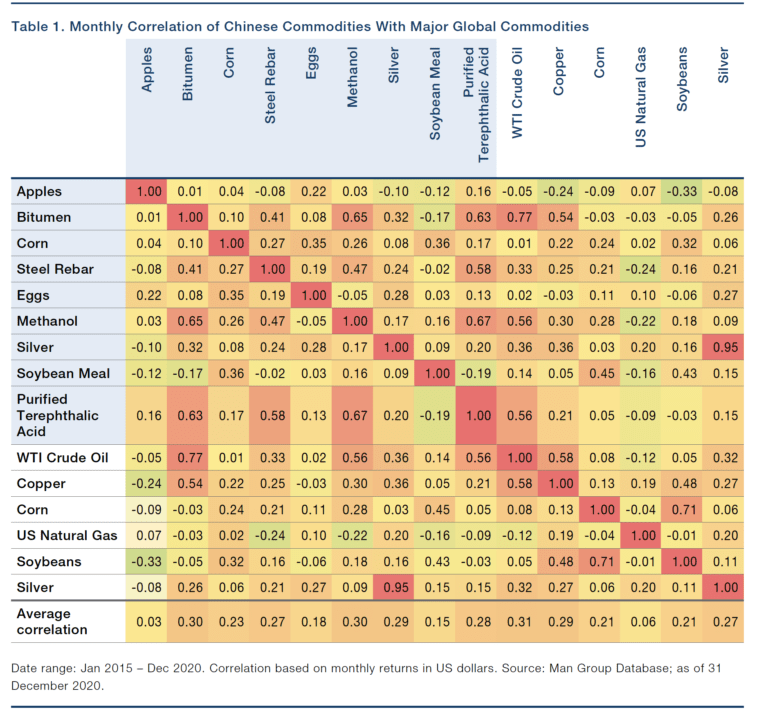

The likes of bitumen and eggs futures mean that a large portion of commodity markets listed on Chinese exchanges are one of a kind. However, these unique markets are only truly relevant from an alpha perspective if they exhibit a low correlation to global commodity markets. This is confirmed in Table 1, which shows the correlation between the Chinese commodities listed in Figure 1 and major commodity markets traded outside of China. Chinese commodity names are highlighted in light blue.

Apples and eggs are unique agricultural markets. However, even corn, for example, only has a 0.24 correlation with its US counterpart, as a result of differing local growing conditions and the cost of transport and substitution. Strikingly, it is not even its most correlated market. Examples of higher correlation include bitumen and silver. Bitumen, used for road surfacing and roofing, is a highly viscous residue resultant from petroleum distillation and naturally has some higher correlation to the likes of gasoline and crude oil. It is worth noting that some Chinese commodities not listed in Table 1 – such as Chinese crude oil – also have a higher correlation to their global counterparts.

Equities

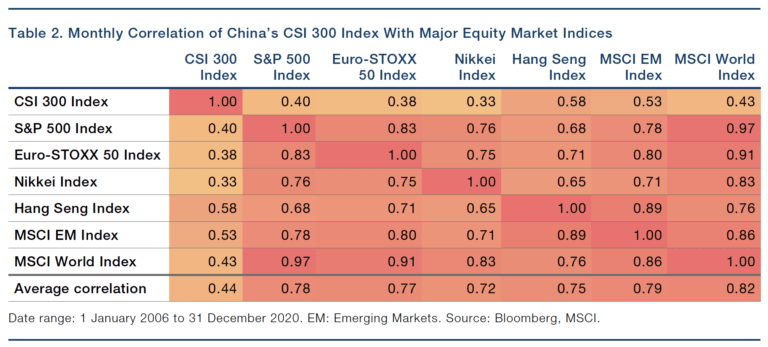

Table 2 shows the correlation between major global equity indices since 2006. The correlation between China’s CSI 300 and other major equity indices is less than 50% on average. It is also worth noting that the correlation between non-Chinese equity indices is high, ranging from 0.65 to 0.93.

Bonds

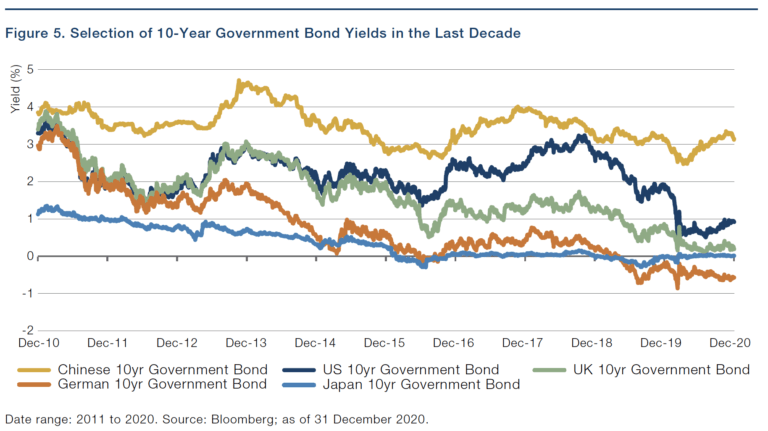

With developed market bond yields at very low levels, foreign investors may find Chinese bonds appealing. As Figure 5 illustrates, Chinese bonds neither show the reduction in yields seen across developed markets, nor their current absolute levels of 1% or less.

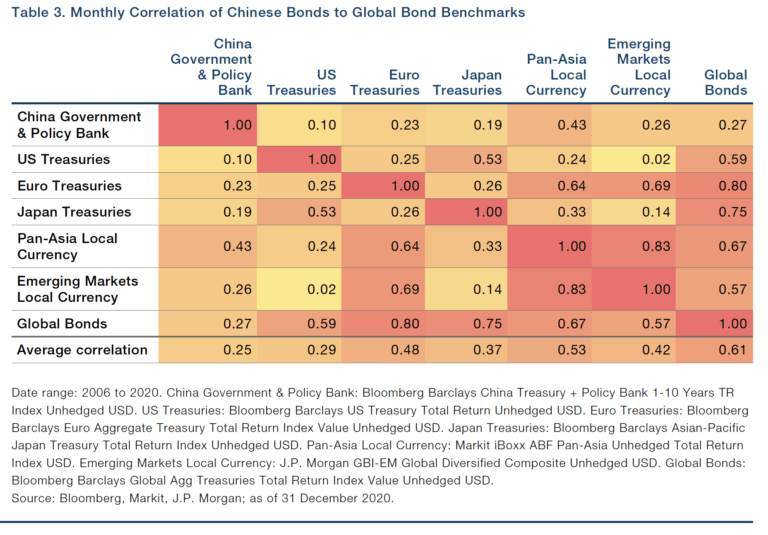

These observations explain the low average correlation between Chinese and other bonds in Table 3. Furthermore, Chinese bonds show a low correlation with developed and emerging market bond indices. Its highest correlation is with Pan-Asia Local Currency, which is not surprising given China represents around 25% of the index.

Access to China’s Financial Markets With the clear advantage of accessing a diverse and liquid set of Chinese markets, it is perhaps no surprise that, even before QFII, there have been a range of access routes available to offshore investors. In this section, we highlight the main routes, discuss what changes QFII access may bring, and offer some insights based on our experience having traded these Chinese markets from an onshore perspective since 2014.

Commodities

The newly expanded QFII investment scope announced late 2020 was arguably most exciting for the commodities asset class. Under QFII, contracts need to be submitted for approval by the exchanges and approved by the CSRC. At the time of writing, a total of 20 commodity markets have been submitted for CSRC approval for QFII access by the exchanges, although no commodity futures have so far been approved. Foreign investors can also trade so-called internationalised commodity futures contracts without a QFII. Crude oil was the first contract to internationalise in 2018 in China’s effort to strengthen its pricing power in the commodities markets it dominates. Currently, a total of seven international contracts are available for trading, with the most recent addition being palm olein in December 2020. Despite these developments around international contracts, the QFII route is expected to offer a larger universe of markets.

Equities

Cash Equities

Access to China’s mainland equity markets has improved since the launch of the QFII scheme in 2002. Chinese A-shares, stocks traded on the Shanghai and Shenzhen stock exchanges, are currently accessible via QFII and Stock Connect. With respect to QFII, license holders can access a much broader set of cash equities, compared with the Stock Connect programmes. As at 31 December, 2020, the number of companies listed on the Shanghai and Shenzhen stock exchanges totalled 4,233, including large cap, small/mid cap, and tech boards such as China’s ChiNext and STAR Markets. Meanwhile, stocks available via the Stock Connect programmes are limited to only 1,468 A-shares (as at 31 December). Both QFII and Stock Connect routes permit shorting, although in our experience, borrow costs can be prohibitive and may render some investment strategies impractical.

Futures

QFII grants license holders access to stock index futures, such as the CSI 300 index; although currently, this is permissible for hedging purposes only.

Bonds

Cash Bonds

Cash bonds can currently be accessed by foreign investors via CIBM Direct and Bond Connect, with the former being the onshore inter-bank market, accessible to a limited set of specialised foreign institutions, and the latter accessible more broadly via Hong Kong. Both CIBM Direct and Bond Connect offer access to onshore Chinese bond markets which are broadly classified into the following groups: local government bonds, policy bank bonds, corporate bonds, and central government bonds. CIBM Direct, however, allows access to a broader range of instruments such as repos and interest rate swaps as well as offering greater choice in counterparties than Bond Connect. Man AHL has been trading cash bonds onshore through CIBM Direct since 2020 primarily because of its relatively lower costs, but QFII will open up this route for offshore investors as well.

Futures

The use of Chinese cash bonds in alternatives investing is somewhat constrained as they require being fully funded and therefore are limited to unlevered use. Futures would offer a clear advantage here, but while in scope under the recently broadened QFII investment rules, bond futures are not expected to be approved for trading through QFII until at least 2022. It also remains uncertain whether, once approved, bond futures would only be permissible for hedging purposes as is the case with stock index futures.

Potential Investment Strategies Previous sections have established that Chinese markets are large, liquid and exhibit a low correlation to their global counterparts, and this holds whatever asset class is being discussed. Further, it appears that QFII will provide the most encompassing access route to offshore investors given its breadth of market access across all asset classes and lower trading costs. In the remainder of this section we highlight two investment strategies we believe could potentially offer attractive uncorrelated alpha.

Commodities Momentum

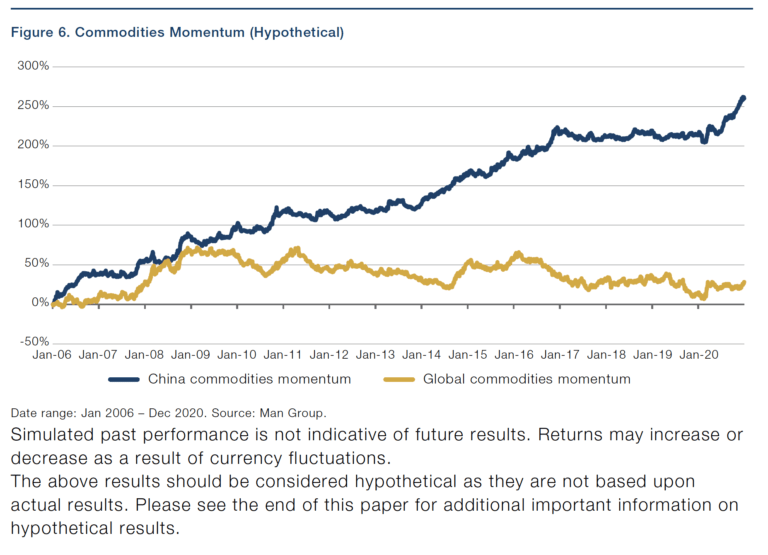

We first focus on momentum, a strategy we have been trading well over 30 years. We focus on commodity futures because of the doubts expressed to short equity and bond futures under QFII in the immediate future. We also use the assumption that all Chinese commodity contracts are approved and include only Chinese and global commodity contracts that fit our internal liquidity criteria. In this universe of 37 Chinese and 14 global commodity markets, we apply a binary model based on a 10- and 40- day moving average crossover, and target a return volatility of 15%. We exclude any management and performance fees, however, expected trading costs are included. Figure 6 illustrates that Chinese commodity markets exhibit far more consistent alpha generation, outperforming global commodities in 13 years out of 15.

Balanced Multi-Asset

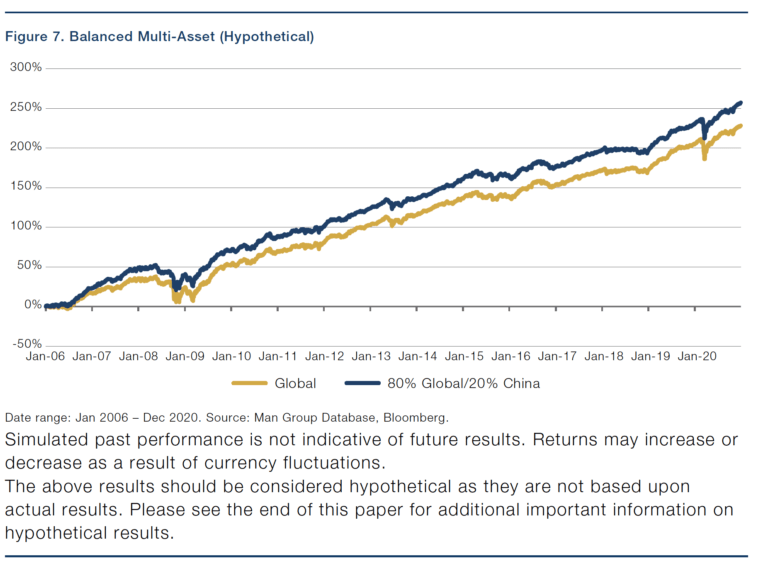

Equity and bonds markets are accessible through offshore routes although shorting proves impractical in our experience. Because of this, we find it worthwhile exploring a long-only balanced multi-asset portfolio with a risk allocation of 60% to equities and 40% to bonds. We use a risk-adjusted approach as notional allocations to an equity/ bond portfolio tend to favour equities due to their higher volatility contribution. This is particularly important when investing in Chinese markets as the annualised volatility of the CSI 300 Index in China has been around 28% since 1 January, 2006, while MSCI World Index achieved an annualised volatility of 18% over the same timeframe.

In China we use the CSI 300 Index and the CSI Aggregate Bond Index as a proxy for equities and bonds, respectively, while the global portfolio uses the MSCI World Index and Bloomberg Barclays Global Aggregate Bond Index. Additionally, it is reasonable to assume an institutional investor may not have a standalone allocation to China but rather include as a diversifier to an existing global portfolio. Because of this, we compare a global 60/40 portfolio versus a portfolio with 80% weight to global and 20% to China. Both portfolios have been adjusted to 10% volatility and are shown gross of management and performance fees and excluding trading costs. Highlighted in Figure 7, the blended 80% Global/20% China portfolio outperforms the global version by 2.3% per annum. Meanwhile, the correlation between the China and Global portfolios was 0.23 over the 15-year period. These observations make the case that a modest allocation to China could benefit traditional equity/bond portfolios.

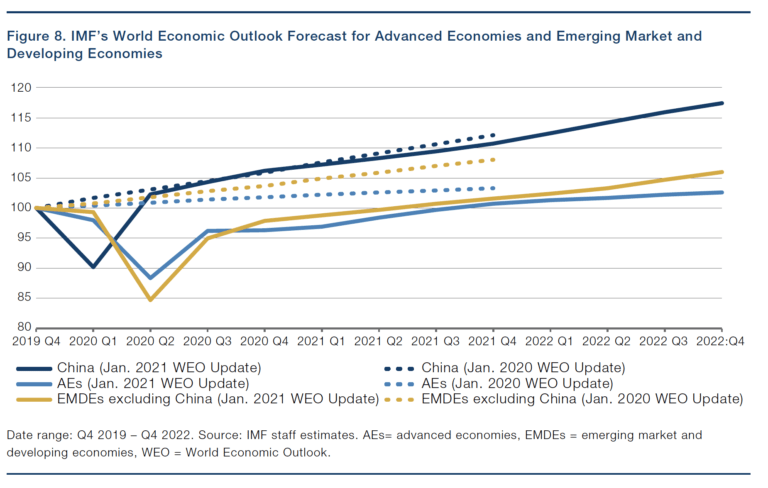

China’s Response to the Pandemic Furthermore, in the current uncertain market environment, China’s economy, the world’s second-largest behind the United States since 2010 [4], has shown superior resilience to the pandemic than others. Figure 8 shows the International Monetary Fund’s January 2021 projections (solid lines) compared with the year before (dotted lines) of major economy groups and China. While advanced economies (‘AEs’) and emerging market and developing economies (‘EMDEs’) saw GDP declines in 2020, China’s GDP grew by 3.2%, aided by responsive government actions through effective lockdown measures, increased public investment to offset private sector capital spending as well as liquidity injections to ease banks’ access to funding. Figure 8 illustrates that, in addition to our historic observations that Chinese markets have offered great diversification to investors, there is good evidence to suggest that this diversification is likely to persist in the years to come.  Conclusion Recent regulatory changes have opened the door even wider for foreign investors to access onshore Chinese markets. Access to China’s domestic capital markets continues to be relaxed while investors with a QFII license are well-positioned to benefit from greater access, lower trading costs, and further potential expansion of the permissible instruments. Whether it is equities, bonds, or commodities, China is already one of the largest markets in the world. Furthermore, traditional assets such as equities and bonds have so far exhibited a low correlation to global benchmarks while commodity markets tend to be unique to China. An alternative investment strategy such as momentum on commodities appears to be diversifying and exhibits high alpha potential while a well-managed, long-only China equity/bond portfolio is both a great diversifier and potential return enhancer in global equity/bond portfolios. This research was originally published by Man AHL in April 2021. Read the original post here. Endnotes 1. QFII is a certification programme launched in 2002 by the Chinese government, allowing foreign or offshore institutional investors to invest in exchange-traded China A-shares, bonds and fixed income products traded in the China inter-bank bond market, among other instruments as permitted under QFII rules, directly within China’s domestic markets. 2. GDP quoted at current prices in US dollars. Source: IMF. 3. Source: HKEX Investor Presentation, November 2020.

Conclusion Recent regulatory changes have opened the door even wider for foreign investors to access onshore Chinese markets. Access to China’s domestic capital markets continues to be relaxed while investors with a QFII license are well-positioned to benefit from greater access, lower trading costs, and further potential expansion of the permissible instruments. Whether it is equities, bonds, or commodities, China is already one of the largest markets in the world. Furthermore, traditional assets such as equities and bonds have so far exhibited a low correlation to global benchmarks while commodity markets tend to be unique to China. An alternative investment strategy such as momentum on commodities appears to be diversifying and exhibits high alpha potential while a well-managed, long-only China equity/bond portfolio is both a great diversifier and potential return enhancer in global equity/bond portfolios. This research was originally published by Man AHL in April 2021. Read the original post here. Endnotes 1. QFII is a certification programme launched in 2002 by the Chinese government, allowing foreign or offshore institutional investors to invest in exchange-traded China A-shares, bonds and fixed income products traded in the China inter-bank bond market, among other instruments as permitted under QFII rules, directly within China’s domestic markets. 2. GDP quoted at current prices in US dollars. Source: IMF. 3. Source: HKEX Investor Presentation, November 2020.

4. Source: International Monetary Fund.

About the Authors Giuliana Bordigoni is Director of Specialist Strategies and a member of Man AHL’s management and investment committees. She has held several positions since joining Man AHL in 2007, including Head of Alternative Markets and Director of Fixed Income, where she has made significant contributions to Man AHL’s managed futures and Evolution portfolios. Giuliana holds a PhD in Mathematics and Applications from Politecnico of Milan and a Master of Advanced studies in Finance from ETH and University of Zurich. Adrian Chang is Principal Quant of Man AHL based in Hong Kong. He first joined Man AHL in London in 2002 and re-joined Man AHL in 2009 when Man AHL established an office in Hong Kong. Adrian is part of the Alternative Markets team responsible for investment management of non-traditional markets. In additional, he is also responsible for the investment management of the Hong Liang strategies, Man AHL’s onshore trend-following strategies in China. Before re-joining Man AHL, Adrian was a fund derivative structurer at BNP Paribas HK. Adrian graduated from the University of Hong Kong with a BSc in Actuarial Science (First Class). He also holds a MSc in Mathematics and Finance (Distinction) from Imperial College London. Adi Mackic is a Senior Client Portfolio Manager at Man AHL with principal responsibility for communication of Man AHL’s strategies to clients. Prior to joining Man AHL in 2015, he worked at IMC Asset Management where he was responsible for sales and marketing of systematic macro and credit hedge funds. Adi holds an MSc in Finance and Investments and a BSc in International Business Administration from the Rotterdam School of Management, Erasmus University. Sophie Rossini is a Senior Business Manager at Man AHL. She is responsible for supporting the senior management team in the operational and strategic management of Man AHL. Sophie has been in this role since July 2018. She was previously with Man FRM, where she was the Sector Head of Relative Value strategies. Prior to joining Man Group in August 2008, she was at Atlas Capital. Sophie holds an MA in Banking and Financial Techniques from the Paris Assas University. Kate Straker is Chief Operating Officer of Man AHL. She is responsible for Man AHL’s non-investment functions, including product strategy, project management, trade monitoring and the implementation of changes to the trading system. Kate joined Man Group in 2006 and has worked in a number of different roles, including product development and operations. Kate qualified as an ACA with PKF (UK) LLP, which is now part of BDO LLP, and holds a BSc (First Class) in Pathology and Microbiology from the University of Bristol. Hypothetical Results Hypothetical Results are calculated in hindsight, invariably show positive rates of return, and are subject to various modeling assumptions, statistical variances and interpretational differences. No representation is made as to the reasonableness or accuracy of the calculations or assumptions made or that all assumptions used in achieving the results have been utilized equally or appropriately, or that other assumptions should not have been used or would have been more accurate or representative. Changes in the assumptions would have a material impact on the Hypothetical Results and other statistical information based on the Hypothetical Results. The Hypothetical Results have other inherent limitations, some of which are described below. They do not involve financial risk or reflect actual trading by an Investment Product, and therefore do not reflect the impact that economic and market factors, including concentration, lack of liquidity or market disruptions, regulatory (including tax) and other conditions then in existence may have on investment decisions for an Investment Product. In addition, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. Since trades have not actually been executed, Hypothetical Results may have under or over compensated for the impact, if any, of certain market factors. There are frequently sharp differences between the Hypothetical Results and the actual results of an Investment Product. No assurance can be given that market, economic or other factors may not cause the Investment Manager to make modifications to the strategies over time. There also may be a material difference between the amount of an Investment Product’s assets at any time and the amount of the assets assumed in the Hypothetical Results, which difference may have an impact on the management of an Investment Product. Hypothetical Results should not be relied on, and the results presented in no way reflect skill of the investment manager. A decision to invest in an Investment Product should not be based on the Hypothetical Results. No representation is made that an Investment Product’s performance would have been the same as the Hypothetical Results had an Investment Product been in existence during such time or that such investment strategy will be maintained substantially the same in the future; the Investment Manager may choose to implement changes to the strategies, make different investments or have an Investment Product invest in other investments not reflected in the Hypothetical Results or vice versa. To the extent there are any material differences between the Investment Manager’s management of an Investment Product and the investment strategy as reflected in the Hypothetical Results, the Hypothetical Results will no longer be as representative and their illustration value will decrease substantially. No representation is made that an Investment Product will or is likely to achieve its objectives or results comparable to those shown, including the Hypothetical Results, or will make any profit or will be able to avoid incurring substantial losses. Past performance is not indicative of future results and simulated results in no way reflect upon the manager’s skill or ability. Important Information This information is communicated and/or distributed by the relevant Man entity identified below (collectively the ‘Company’) subject to the following conditions and restriction in their respective jurisdictions. Opinions expressed are those of the author and may not be shared by all personnel of Man Group plc (‘Man’). These opinions are subject to change without notice, are for information purposes only and do not constitute an offer or invitation to make an investment in any financial instrument or in any product to which the Company and/or its affiliates provides investment advisory or any other financial services. Any organisations, financial instrument or products described in this material are mentioned for reference purposes only which should not be considered a recommendation for their purchase or sale. Neither the Company nor the authors shall be liable to any person for any action taken on the basis of the information provided. Some statements contained in this material concerning goals, strategies, outlook or other non-historical matters may be forward-looking statements and are based on current indicators and expectations. These forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update or revise any forward-looking statements. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those contained in the statements. The Company and/or its affiliates may or may not have a position in any financial instrument mentioned and may or may not be actively trading in any such securities. This material is proprietary information of the Company and its affiliates and may not be reproduced or otherwise disseminated in whole or in part without prior written consent from the Company. The Company believes the content to be accurate. However accuracy is not warranted or guaranteed. The Company does not assume any liability in the case of incorrectly reported or incomplete information. Unless stated otherwise all information is provided by the Company. Past performance is not indicative of future results.