By Rafał Chudy, Chief Forestry Officer at FOROS, and Fred Cubbage, Professor, Department of Forestry and Environmental Resources, North Carolina State University.

Introduction

Global institutional investments in forestry have materially increased from virtually zero in the early 1980s to more than 100 billion U.S. dollars ($) today[i]. The asset class is still considered small compared with, for instance, the $4 trillion invested in private equity[ii]. However, it grows rapidly (tenfold since the early 2000s[iii]) due to key forest investments attributes, such as high risk-adjusted returns, risk diversification potential, and inflation hedging ability1. Traditional forestry investment potential is estimated to be between $100 billion to $300 billion; however, if forest grown for carbon is included then the investable universe in forestry can even exceed $1.0-1.5 trillion[iv].

Historically institutional forest investments started with pension plans in the U.S. due to changes in regulations of private pension plans in the U.S. (The Employee Retirement Income Security Act, 1974) requiring them to diversify beyond stocks and bonds[v], and then were followed by different kinds of investors around the globe.

Investors quickly learned that forestry offers the growth in value of trees as they mature, long-term appreciation of the underlying land, and the potential for multiple income streams from different uses of the assets, such as timber production and recreational activities (e.g., hunting). These features were particularly attractive for investors with long-dated liabilities looking for assets with long-dated revenue streams, which could immunize their plans against changes in interest rates (see e.g., Macaulay duration).

Currently, interest in forest assets is growing even stronger due to forests’ ability to sequester (i.e., capture) and store carbon, which gives institutional and corporate investors of all types opportunities to commit and achieve net-zero emissions through voluntary or compliance markets.

In this post, we discuss why pension plans and other net-zero investors should consider or continue adding forest investments to their portfolios. We focus on the state of art on forest investments, key impediments that stop investors from entering this asset class, and potential solutions which overcome some of these challenges.

Forestry – A Natural Climate Solution with Favorable Long-Term Market Fundamentals

Forest investments are underpinned by favorable long-term market fundamentals such as economic growth, population growth, and increasing urbanization, which drive demand growth for wood products (e.g., cross-laminated timber used for taller commercial buildings).

Worldwide leaders have long stated their commitment to international efforts, such as the Paris Agreement, to tackle climate change and to transform their countries into highly energy-efficient, low-carbon economies. Forests are a natural climate solution to reduce greenhouse gas emissions and have a very significant role to play in climate mitigation[vi]. The net carbon sequestration in the forest sector of Europe depends on the sequestration in forests (caused by harvest and silviculture decisions) and what happens in forest products markets regarding for example the length of time that carbon remains sequestered in the various forest products and the degree to which their consumption substitutes for a more carbon emission intensive product such as steel or concrete. Therefore, the contribution of forestry and wood industry sectors should further focus on stimulating additional forest carbon sequestration and reduced emissions through changes in forest management, product substitution and storage in long-lived forest products, or renewable energy (e.g., pellets, biofuels).

Investing in forests offers an opportunity for businesses to stay ahead of new policies to address nature loss and climate change, generate environmental and commercial returns, e.g., through the sale and use of sustainable forest products, and help businesses to become leaders in sustainability, strengthening their business reputation among employees, customers, and ecosystem partners, including the communities they operate in.

Forestry Investments - Key Features

Over the last three decades, private equity (PE) timberland funds returned around 4-6% per annum (net, pre-tax), while separate accounts outperformed the commingled funds in the U.S. by around 3%[vii]. Such historical returns in forest investments have been placed between the returns of the bond (3-8%) and stock markets (10-13%). However, what differs forest assets the most is that cash flows and especially returns are predominantly driven by wood prices and biological growth. Wood prices, like other commodity prices, are a result of wood supply and demand interaction. Biological growth that affects yield is essentially independent of financial markets. Thus, given that returns in forestry are driven by different economic fundamentals than are stocks and bonds, forest assets have little correlation, or even negative correlation, with the prices of financial assets, providing a diversification potential in the mixed portfolio and superior performance (on a risk-adjusted basis) than stocks and most other alternative assets. Since forest assets are often described as relatively illiquid investments, this even further protects them from financial crises and inflation. Recent research suggests that forest returns are found to be countercyclical, positively correlated with innovations in default spread, personal consumption expenditures and inflation, and negatively correlated with innovations in term spread. [viii]

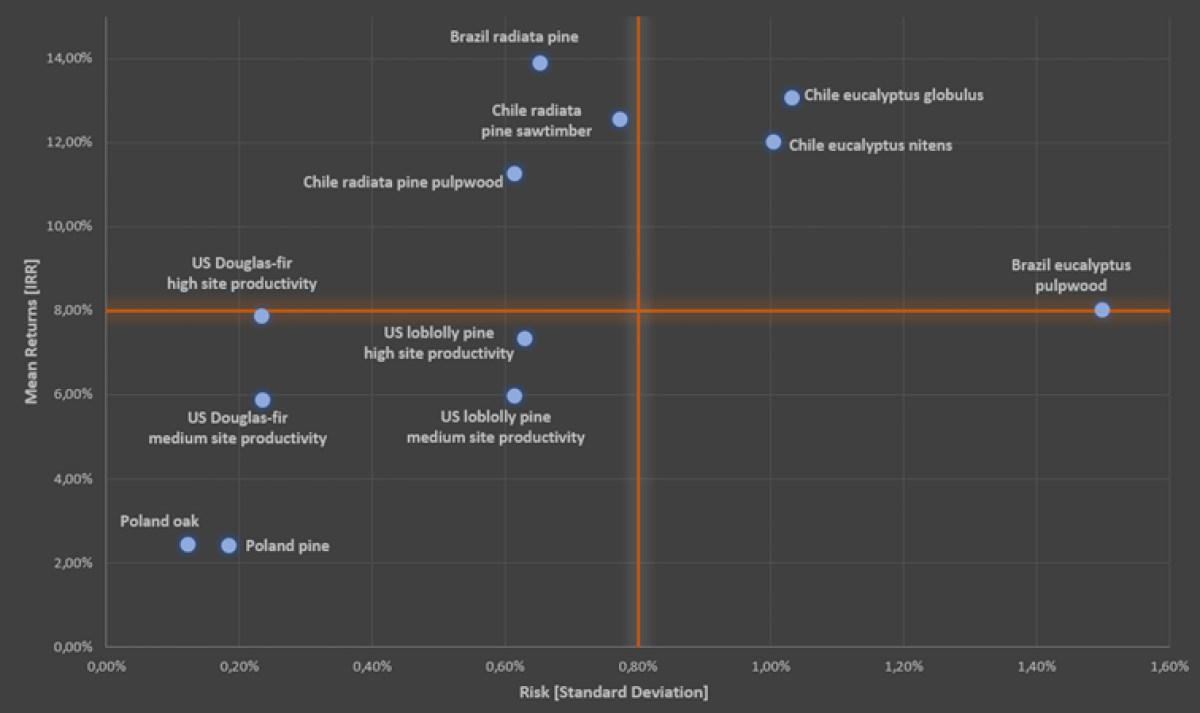

Initially, over 90% of the forest investments by institutions were in the U.S; however, as this market has matured, increased competition for assets and a decline in returns have occurred. In consequence, investors have increasingly sought new investment opportunities in non-U.S. markets, especially Latin America, Australia, and New Zealand, as well as modest interest in Asia, Africa, and Europe. The returns in other geographies can reach higher levels than in the U.S., but opportunities in developing countries and markets carry greater political and investment risks, and forest land purchase by foreigners may be substantially constrained by countries’ laws and policies. Investors should carefully consider their preferred risk exposure. Figure 1 shows risk and return profiles for selected global forest investment opportunities for countries with good forests, although some have either legal constraints on purchase, or limited available private land for sale.

Source: Chudy, R.P., Chudy, K.A., Kanieski da Silva, B., Cubbage, F.W., Rubilar, R., Lord, R., 2020. Profitability and risk sources in global timberland investments. For. Policy Econ. 111. https://doi.org/10.1016/j.forpol.2019.102037

Key impediments in forest investments and how to mitigate them

Despite unique features of forest investments, this asset class still suffers from some impediments or misconceptions, such as natural disasters, political and reputational risks, high transactional, management costs and uncertain valuations, or not fully transparent market of forest properties, products, or carbon credits. We address these issues next.

Natural disasters, political, and reputational risks

Natural disasters, such as biotic (insect, disease) and abiotic (fire, storms, floods) threats, to forest investments are perceived as issues. Nevertheless, recent studies suggest that natural disasters are (a) less likely to attack managed forest stands compared to not managed ones, (b) such risks are much less than presumed and if happen—the likelihood of tree mortality is less than 1% per year, and (c) some of the damaged stands could be still salvaged and sold at any reasonable timber prices. Although in some countries, forest owners and managers are hedging the risk of natural disasters by insuring their forest assets, that is quite expensive.

Practical experience suggests that active forest management is the best insurance. The recent record fires in the 2020s do appear to be increasing fire risks, but well managed and protected planted forests remain quite safe, especially in emerging wetter regions, and stand to benefit from reduced supply from lost natural stands. Damage from storms and hurricanes still remains quite limited but spreading coastal land purchases over several regions is prudent.

Forest investments in developing or frontier regions may also suffer from political and reputational risks. Regarding the political risk it can usually take the form of expropriation, war and civil disturbances, contract breaches or changes in the business environment (e.g., subsidies). The latter one concerns complex social and environmental conflicts, such as land tenure, the impact of forests on other land uses and natural resources (e.g., water scarcity, conflict with agriland) or illegal activities (bribery, illegal logging, child labor or poaching). Such risks can be mitigated as well either by using political risk insurance (e.g., MIGA[i]) and well-recognized third-party forest certification schemes (e.g., FSC or PEFC).

Transactional and management costs, and uncertain valuations

A good understanding of forest due diligence and transaction costs is important for investors as those significantly may impact the ultimate price paid for the investment. Those transaction costs can include broker commissions, verification costs related to forest area, yield and growth, silvicultural management, overall business, legal costs or sometimes consultancy fees for finding investment opportunities, preparing harvest scheduling and financial models.

The largest forest transaction components are usually related to the verification of wood inventory, productive forest area and land records, legal costs, but also harvest schedule development, financial models or timber product market analysis and vetting costs.

After the successful forest acquisition, investors must face other costs related to forest management (e.g., silvicultural expenses, inventory expenses, administrative and overhead expenses, road building and maintenance, as well as costs of controlling fire, insects and diseases) and depending on selected investment vehicle also capital costs (management and incentive fees for the services of asset managers) or expenses related to independent valuations of forest assets.

When stacked together, all the above costs may significantly impact the return metrics for forest investments. Furthermore, the problem with private equity forest investments is that usually, their performances rely on the valuations of underlying forest assets, which tend to respond slowly to market information and could be artificially smoothed (stale pricing issue).

How can investors mitigate those costs and improve their returns? Forest investments are somewhat unique in that good forest management practices—such as superior tree genetics selection, improved planting and silvicultural management, careful matching of capital costs and site productivity to maximize returns, good market timing of wood sales, and reduced costs for inventory and planning—are quite possible to achieve and can help many investors consistently beat the sector average returns. They also can be sagacious in buying land and making investments in safer regions and in planted stands, and by selecting genetic material that can withstand storms and winds.

Advances in new technologies such as augmented reality, the internet of things, artificial intelligence or remote sensing (drones, satellites) may significantly reduce the costs and improve the accuracy of forest inventory. There are currently new solutions on the market where investors can manage their forests remotely online and pay only for the activities being done, without paying any fixed charges for forestland administration and management or net timber sales commissions. Such solutions (based on the Uber approach) give the owner more flexibility and control over their assets and moreover provide built-in forest valuations based on changing market conditions, growth & yield functions or performed operations. Often, they may also track forest carbon sequestration and storage parameters, or what can be expected in the future, they have a possibility to connect directly to carbon emission trading platforms.

Such technological solutions also create a marketplace for buying and selling forest properties, wood or carbon credits, significantly reducing the costs related to brokerage fees, legal work, consulting or investment banking services. These solutions concurrently improve forest investments transparency and significantly reduce if not completely eliminate various conflicts of interest, such as advisors simultaneously working for investors and vertically integrated forest products firms.

Conclusions

Over the last four decades, we have witnessed the rise of forest asset class, spreading quickly from the United States to other continents. Forest assets provide reasonable rates of return, albeit usually less than equities, and less market risk. They also provide exceptional and practical markets to achieve environmental, social, and governance (ESG) benefits, including both commodity returns in land and timber and some nontimber products, and ecosystem service potential in carbon offsets, water quality and quantity, and biodiversity. Commodity returns for timber have decreased since the recession of 2007, coupled with large, planted forest productivity increases and higher land costs, which have compressed discount rates some. But forests seldom create significant losses if purchased at a reasonable price, and almost always can generate considerable flexible cash flows in good timber markets.

Nevertheless, it seems that the future for forest investments is quite promising as (1) the economic fundamentals are supportive for wood due to demographic growth and rising income levels, (2) pervasive recognition of forests and wood products in the climate mitigation policies (e.g., bioenergy, the substitution of coal, wood construction supplanting steel and concrete), and (3) advancement in new technologies creating more transparent and low-cost forest and wood marketplaces, and active management platforms.

We anticipate that in the future more forest investments will be managed on dedicated platforms, where individual or institutional investors, such as pension plans, will be able to track their investments like stock markets, having full control over the assets and their investment returns. Better forest investment vehicles, liquidity, and subdivision are being developed, such as in the carbon markets, and could extend further throughout the entire value chain.

There is a trend of more investors that are willing to invest in forest assets directly, saving on capital management fees. This trend will be strengthened in the future especially from companies and long-term investors who need to decarbonize their portfolios by committing to net-zero emission programs, are willing to prove strong ESG metrics to their stakeholders, and are concerned with climate mitigation efforts, without having to give up returns.

[i] Chudy, R.P., Cubbage, F.W., 2020. Research trends: forest investments as a financial asset class. For. Policy Econ. 119. https://doi.org/10.1016/j.forpol.2020.102273

[ii] McKinsey. 2020. A new decade for private markets. Accessed at https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/mckinseys-privatemarkets-annual-review

[iii] https://www.unpri.org/investment-tools/private-markets/infrastructure-and-other-realassets/

forestry, retrieved on 22 June 2021.

[iv] According to BCG, the estimated total value of the world’s forests is as much as $150 trillion—nearly double the value of global stock markets. The largest component of that total value is within the ability of forests to regulate the climate through carbon storage, accounting for as much as 90%. Source: https://www.bcg.com/en-ch/publications/2020/the-staggering-value-of-forests-and-how-to-save-them

[v] Mei, B., 2019. Timberland investments in the United States: A review and prospects. For. Policy Econ. 109, 101998. https://doi.org/10.1016/j.forpol.2019.101998

[vi] Griscom, B.W., Adams, J., Ellis, P.W., Houghton, R.A., Lomax, G., Miteva, D.A., Schlesinger, W.H., Shoch, D., Siikamäki, J. V., Smith, P., Woodbury, P., Zganjar, C., Blackman, A., Campari, J., Conant, R.T., Delgado, C., Elias, P., Gopalakrishna, T., Hamsik, M.R., Herrero, M., Kiesecker, J., Landis, E., Laestadius, L., Leavitt, S.M., Minnemeyer, S., Polasky, S., Potapov, P., Putz, F.E., Sanderman, J., Silvius, M., Wollenberg, E., Fargione, J., 2017. Natural climate solutions. Proc. Natl. Acad. Sci. U. S. A. 114, 11645–11650. https://doi.org/10.1073/pnas.1710465114

[vii] Chudy, R.P., Mei, B., Skjerstad, S., 2021. The Performance of Private Equity Timberland Funds in the United States between 1985 and 2018. J. For. Econ. In Review.

[viii] MIGA is a member of the World Bank Group that provides political risk insurance and credit enhancement solutions, refer to https://www.miga.org/

About the Authors:

Rafał Chudy has over 11 years of experience in forestry and forest industry businesses worldwide. He works as a Chief Forestry Officer at FOROS, a digital forest investment and management platform. Co-organizer of the International Forest Business Conference.

Fred Cubbage is Professor, Department of Forestry and Environmental Resources, North Carolina State University. He has co-authored more than 500 research papers on analysis of global timber investments, natural resource policy, market-based conservation programs, sustainability certification, and agroforestry; and teaches natural resource policy and forest economics.