By Roxanna Islam, CFA, Associate Director of Research at VettaFi.

While correlations are just one factor to consider when investing in Bitcoin and Bitcoin-related equities, it remains a widely discussed topic especially given the state of the current market. There are two separate debates we often see regarding Bitcoin correlations: 1) how much is Bitcoin correlated to equities and what does that mean? and 2) how well do different indirect crypto investments correlate with Bitcoin?

Question 1: How much is Bitcoin correlated to equities and what does that mean?

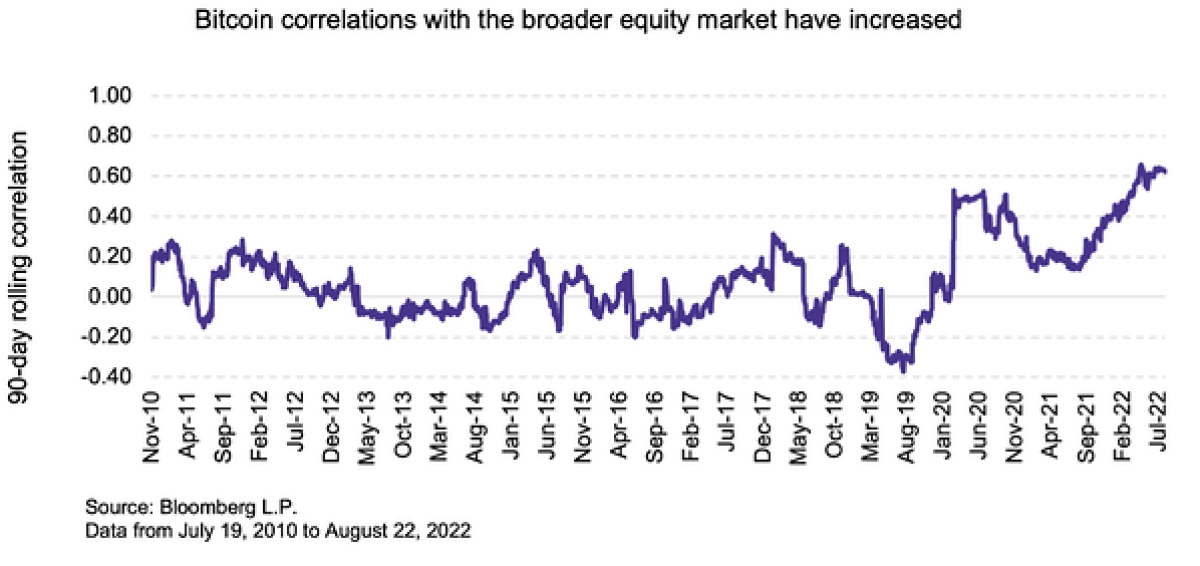

During most of Bitcoin’s lifespan, it exhibited low or even negative correlation to broader equities. Because of Bitcoin’s negative correlation, it was often viewed as a portfolio diversifier/inflation hedge. Over the years, correlations with equities have climbed, causing investors to wonder whether coupling of Bitcoin and equities is a long-term trend or a short-term occurrence. Two main explanations exist. First and most obvious, asset classes show increased correlation during times of market volatility and uncertainty. Even the bond market, which usually exhibits a negative correlation with equities, has been showing an increasing positive correlation throughout 2022. On the other hand, some of the correlation could be attributed to cryptocurrency market maturity. Since its inception less than 15 years ago, cryptocurrency’s penetration of mainstream investing has accelerated over the past few years. The most high-profile IPO—Coinbase (COIN)—occurred only recently in April 2021, with the first U.S. futures-based Bitcoin ETF—the ProShares Bitcoin Strategy ETF (BITO)—launching six months later in October 2021. Additionally, the SEC, the Fed, and other financial bodies are starting to treat crypto like any other exchange traded security, and institutional adoption continues to grow. With limited data and no set precedent, it is difficult to tell how Bitcoin correlations will look like in the future. It is likely that correlations could decouple slightly as markets normalize, but correlations may still remain high given market maturity. But higher correlation with equities isn’t necessarily bad, especially since many investors have started to use Bitcoin and Bitcoin-related equities as a return enhancer or as a portion of a larger tech allocation at levels around 1-5% of their total portfolio. With Bitcoin prices hovering above the $20,000 level, investors may see this is a good entry point to establish or add to their allocations.

Question 2: How well do indirect crypto investments correlate with Bitcoin?

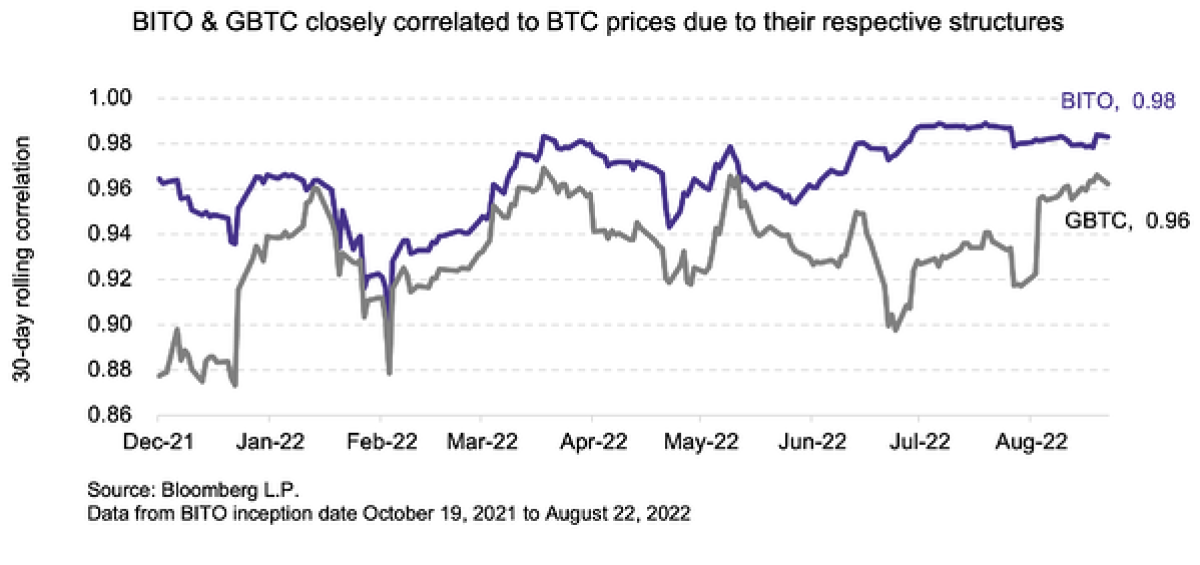

In an earlier note, we discussed different ways to invest in Bitcoin including index-based ETFs which are used to provide thematic or sector-specific exposure to crypto/blockchain companies and Bitcoin futures ETFs which track the price of Bitcoin. The ProShares Bitcoin Strategy ETF (BITO) is the first and largest U.S. futures-based ETF with $706.3 million AUM. It shares an almost perfect correlation with BTC (currently 0.98). The difference results from the roll costs from future contracts, which create a small drag over time. YTD, the ETF has fallen over 55.3%, compared to BTC which fell 54.4% during the same time period. The Grayscale Bitcoin Trust (GBTC) also shares a high correlation with Bitcoin prices; however, the trust price varies from Bitcoin prices because of its premium/discount mechanism. Right now, GBTC is currently trading at a 32.5% discount to its underlying assets and its price has fallen 62.2% YTD.

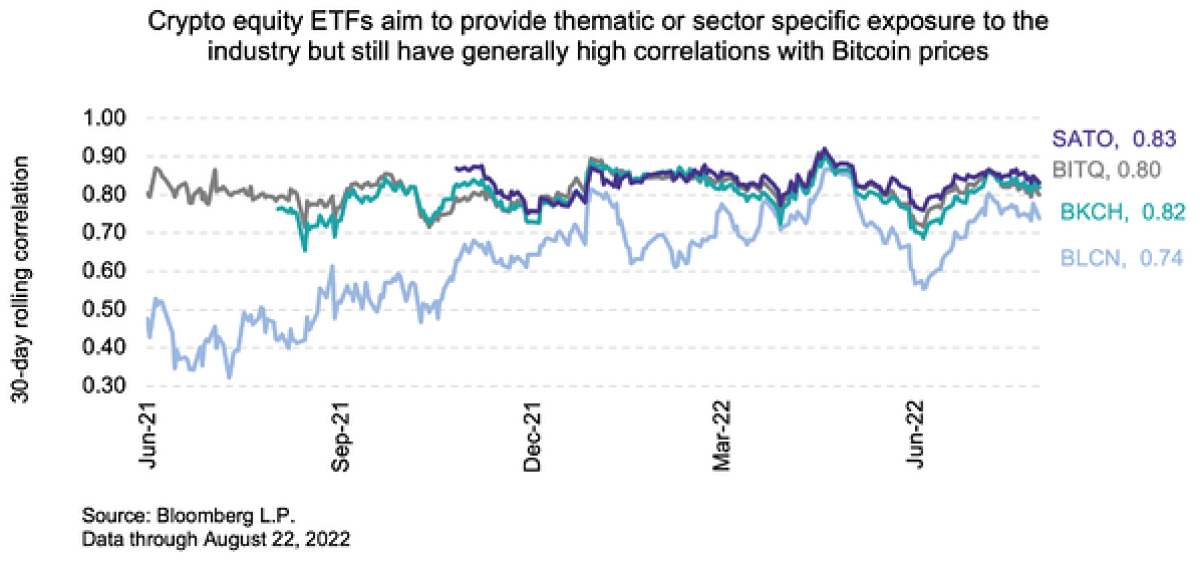

Although index-based crypto ETFs do not aim to directly track the price of crypto, most of these ETFs share relatively high correlations with the price of Bitcoin depending on their holdings (discussed in more detail in the table below). Those that hold mostly pure-play crypto equities like the Bitwise Crypto Industry Innovators ETF (BITQ) and Global X Blockchain ETF (BKCH) have correlations closer to 0.80. Thematic ETFs that hold more diversified holdings like the Siren Nasdaq NexGen Economy ETF (BLCN) may have slightly lower correlations. Although the Invesco Alerian Galaxy Crypto Economy ETF (SATO) also holds some diversified holdings, it has around a 0.83 correlation with BTC because it has an approximate 15% allocation to GBTC.

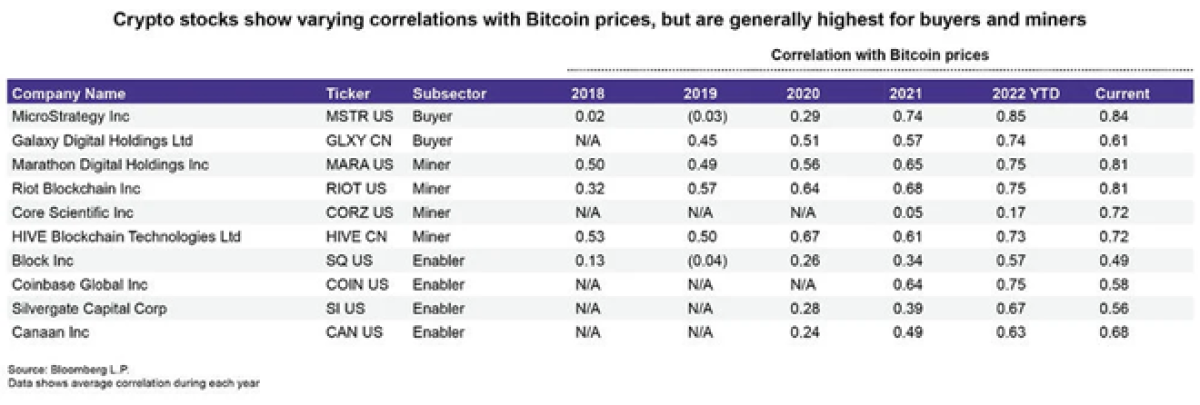

The table below shows a further look into crypto ETFs and indexes by examining correlations of individual crypto stocks with Bitcoin prices. These currently range from about 0.60 to 0.85. Correlations are highest for companies like Microstrategy (MSTR) which hold a large amount of Bitcoin on its balance sheet as an “acquire and hold” strategy (as of June 30, 2022, the company had 129,699 bitcoins on its balance sheet). Crypto miners also share high correlations with Bitcoin as they derive most of their profits based on the price of Bitcoin mined but can vary based on how well they manage electricity costs and overhead expenses. Correlations for exchanges and banks are still relatively high but lower than other parts of the crypto ecosystem as their profits are also derived from volumes, fees, and commissions.

Bottom Line:

While Bitcoin’s correlation with broader equities still remains high, it’s hard to distinguish short-term from long-term trends given continued market uncertainty and a relatively short historic dataset. Higher correlations with equities are not necessarily bad, especially for investors that are using Bitcoin and Bitcoin-related equities as a portion of a larger allocation to the technology sector or as a return enhancer.

The Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts and ETPs Index (CRYPTO) is the underlying index for the Invesco Alerian Galaxy Crypto Economy ETF (SATO).

About the Author:

Roxanna Islam is the Associate Director of Research at VettaFi. In this role, Roxanna is responsible for research on thematic and non-energy indexes. Prior to joining VettaFi, she spent several years in sell-side equity research at Stifel where she covered freight transportation, logistics, and electric vehicle stocks. She also spent the beginning of her career at Wells Fargo in closed-end fund and ETF research. Roxanna is a CFA Charterholder and has earned the CFA Institute Certificate in ESG Investing. Outside of the office, Roxanna is actively involved with several nonprofit organizations. She serves on the Board of Directors of the Dallas Cotillion Club, belongs to the Leadership Arts Institute for the Business Council for the Arts, and volunteers with the Junior League of Dallas.