By Hitesh Patel, vice president and co-portfolio manager, and Sean Walker, vice president and ETF regional consultant for American Century Investments.

In periods of interest rate uncertainty and stock market volatility, the hybrid features of convertible and preferred securities ETFs may enrich your investment mix.

Key Takeaways

- As a substitute for or a complement to traditional securities, hybrids may help you boost overall portfolio diversification and risk-adjusted performance.

- Convertible bonds tend to offer lower volatility than stocks and less interest-rate sensitivity than conventional bonds.

- Preferred securities typically provide yield and credit-quality advantages compared with high-yield corporate bonds.

- When you purchase hybrids via ETFs, you gain access to a dynamic asset class along with low-cost active management and tax efficiency.

Hybrid securities may help your portfolio weather periods of heightened stock market and interest rate volatility. Whether you use them in place of or along with traditional stocks and bonds, they offer features designed to improve overall diversification.

Furthermore, historical performance patterns suggest convertible and preferred securities may enhance risk-adjusted performance over time.

What Are Hybrid Securities?

Hybrid securities incorporate features of two different security types. Convertible bonds and preferred securities are classified as hybrids because they include characteristics of stocks and bonds:

- Typically issued by growth companies, convertibles are fixed-income securities with an embedded option to convert to an equity. They’re generally less volatile than stocks and less sensitive to interest rate swings than traditional bonds.

- Preferreds typically offer higher yields than dividend-paying stocks and investment-grade corporate bonds and higher credit ratings than high-yield bonds. Large, highly regulated companies, such as banks, utilities and insurance companies, typically issue preferreds.

Because they reside lower in the issuing company’s capital structure, preferreds generally offer higher yields than corporate bonds.

Hybrid securities can contribute important features to your well-rounded portfolio. And, when you invest in them via actively managed ETFs, you may gain additional benefits of professional insight and tax efficiency.

Upside Potential, Downside Protection

Hybrid securities can help stock and bond investors pursue the universal investment goal of boosting performance potential while mitigating risk. Here’s how:

Diversification Benefits

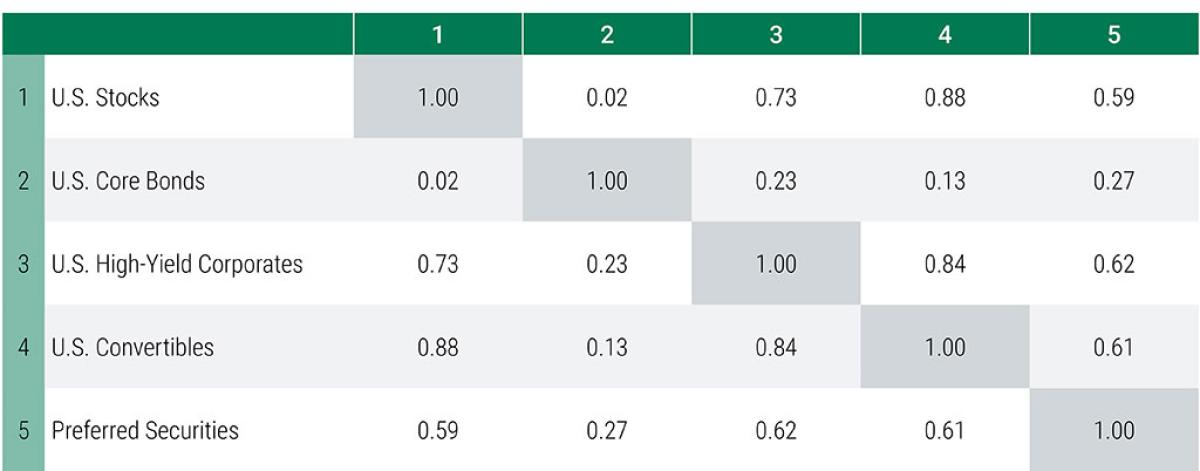

Their hybrid qualities may make convertibles and preferreds ideal diversifiers. As Figure 1 illustrates, each has little in common with common stocks, core bonds, and high-yield bonds. Because of these differences, hybrids can aid performance potential and help limit the effects of volatility.

Income Advantages

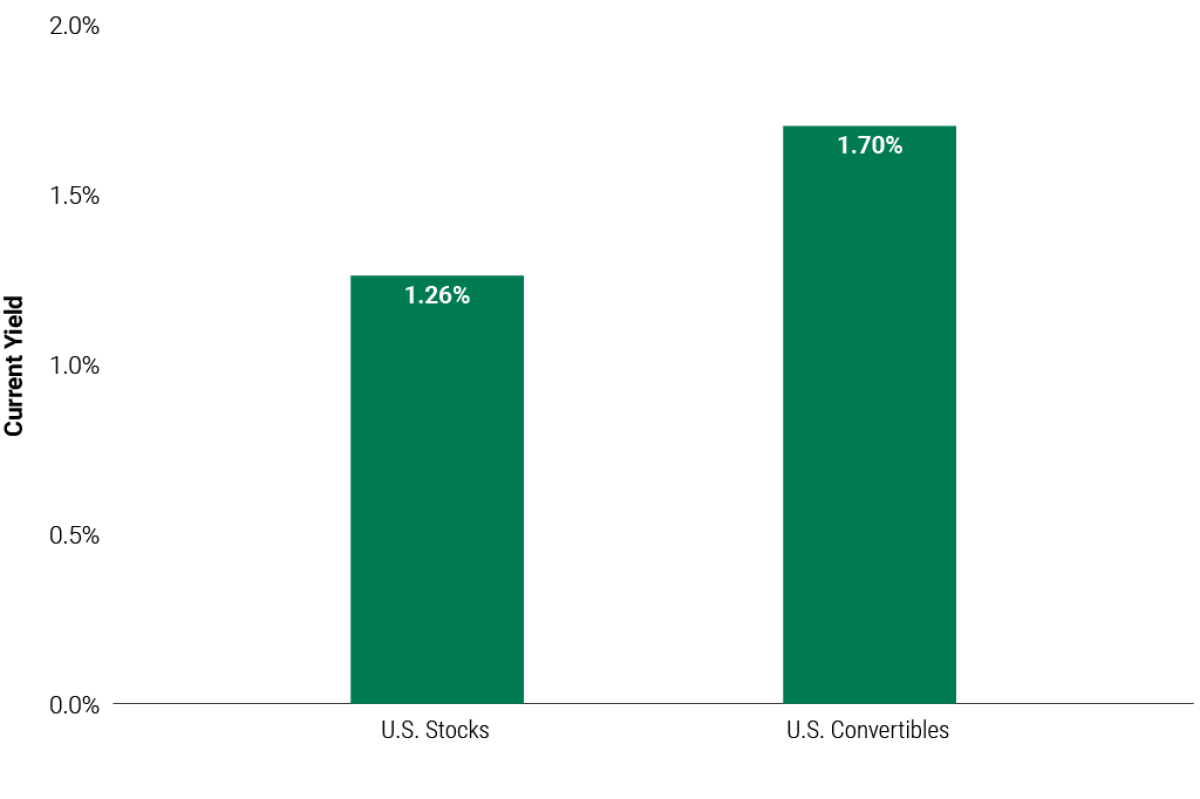

Growth-oriented companies typically issue convertibles. This characteristic means you may use convertibles as a substitute for some equity exposure in a diversified portfolio. In addition to their growth potential, convertibles have historically delivered higher yields than their growth-stock cousins, as Figure 2 illustrates.

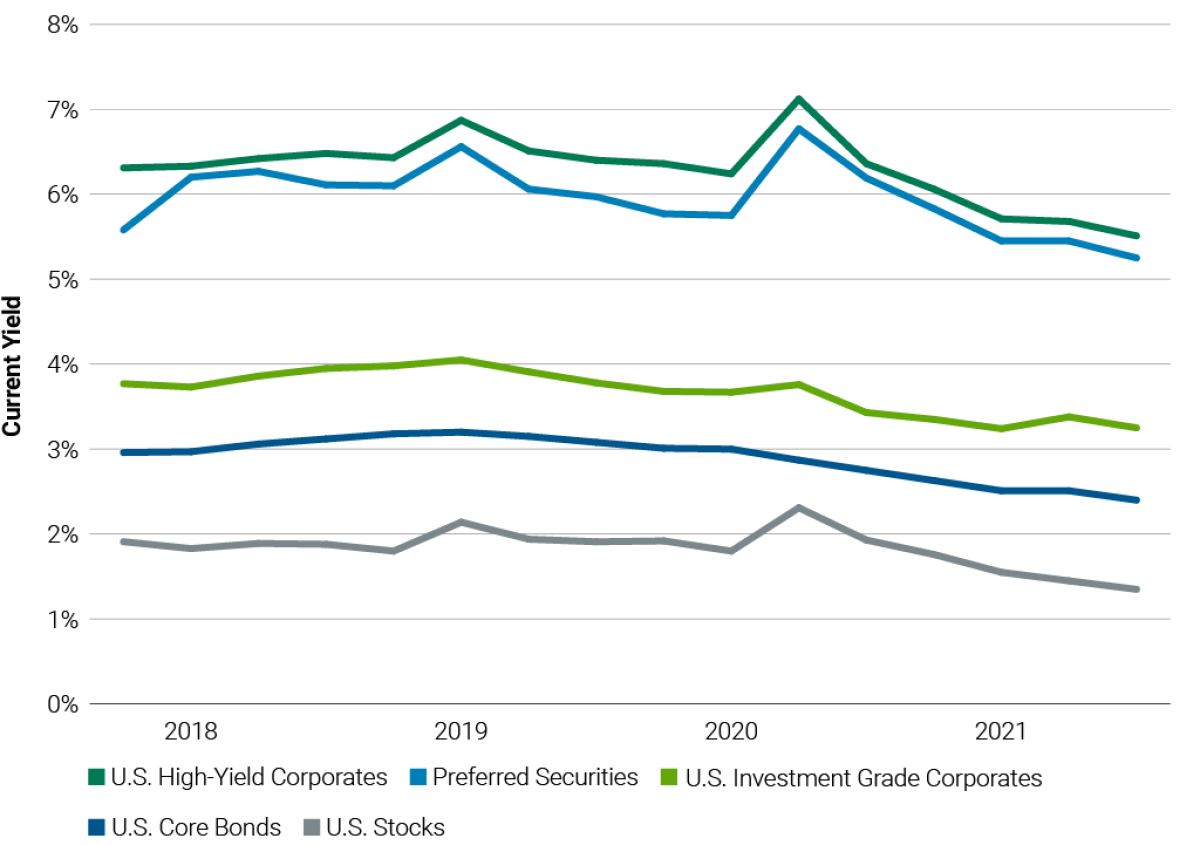

Meanwhile, preferred securities offer yields that historically have outpaced other assets. See Figure 3.

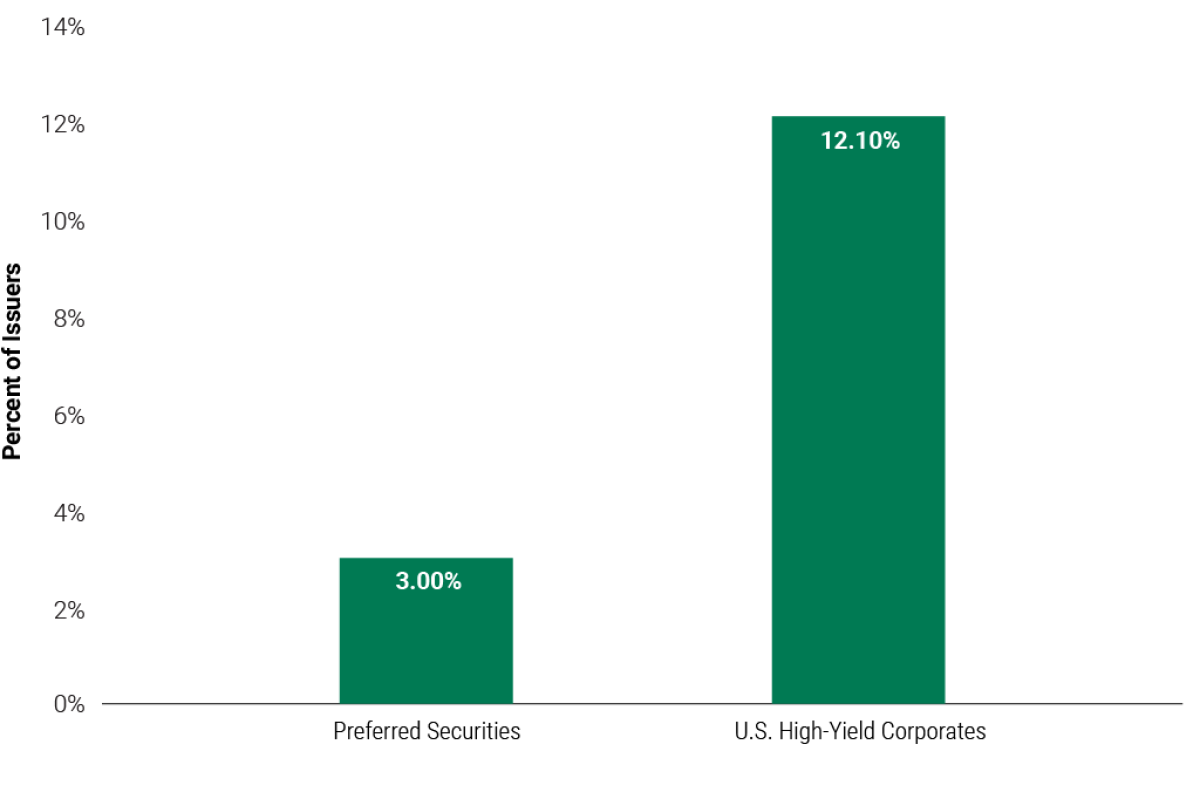

In addition to delivering yields that rival those of high-yield bonds, preferreds generally offer higher credit quality. Figure 4 illustrates this feature by showing the percentage of dividend impairments during the global financial crisis. High-yield bonds experienced dividend impairments at four times the rate of preferred securities.

Less Rate Sensitivity

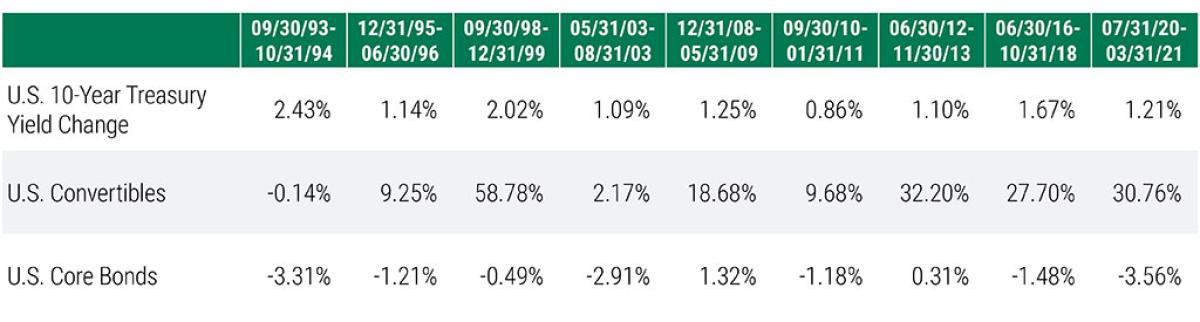

While interest rates have been unusually low, history suggests the next big move in rates likely will be upward. Convertibles generally contain less sensitivity to interest-rate changes than traditional fixed-income securities.

For example, in rising-rate periods since 1993, convertible securities outperformed core bonds, as illustrated in Figure 5.

Although preferred securities are subject to interest rate risk, their higher yields may cushion the negative effects rising rates have on prices. Furthermore, some preferred securities feature floating rates that reset along with prevailing interest rates. So, as interest rates rise, these preferreds pay higher yields.

How May Hybrid Securities Help Investor Portfolios?

Investors often use hybrid securities as substitutes for traditional stocks and bonds, with the goal of enhancing overall portfolio diversification.

Convertible Bonds

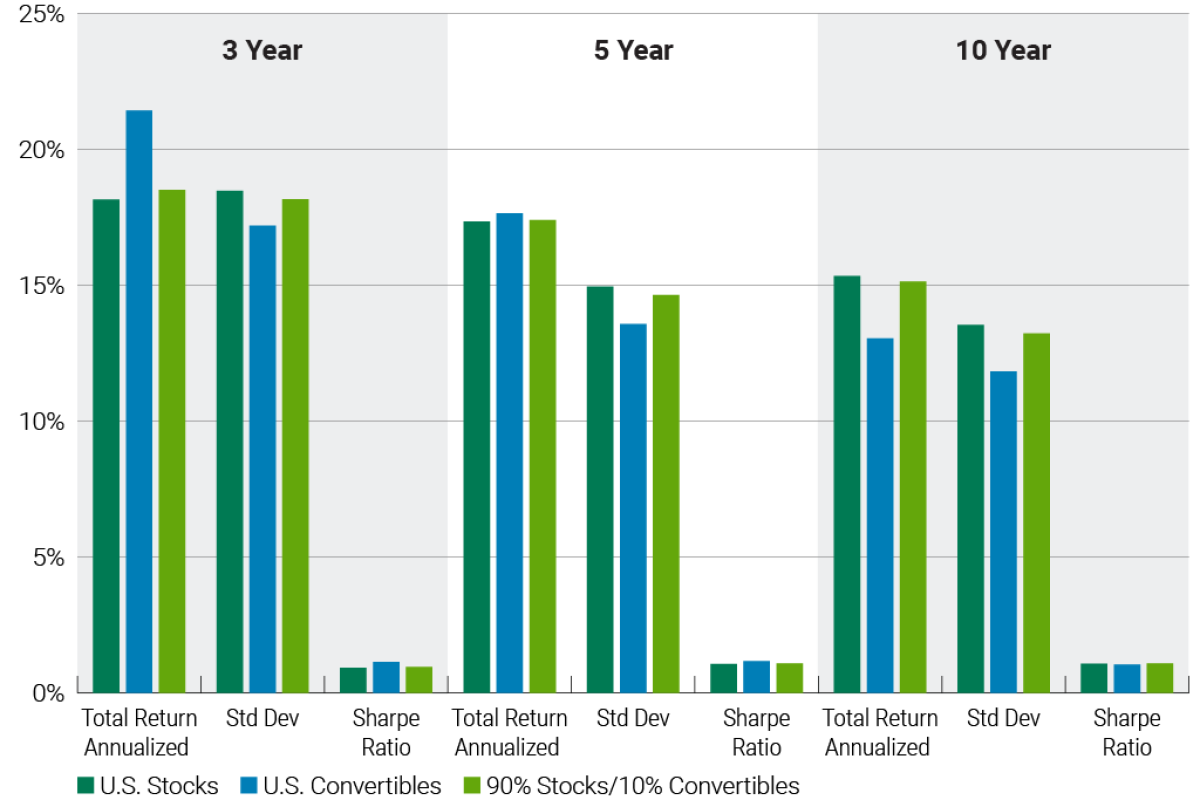

Given their conversion option and association with growth companies, convertibles may be effective equity substitutes. Historical performance trends suggest convertibles offered comparable returns and lower volatility than stocks, as Figure 6 demonstrates.

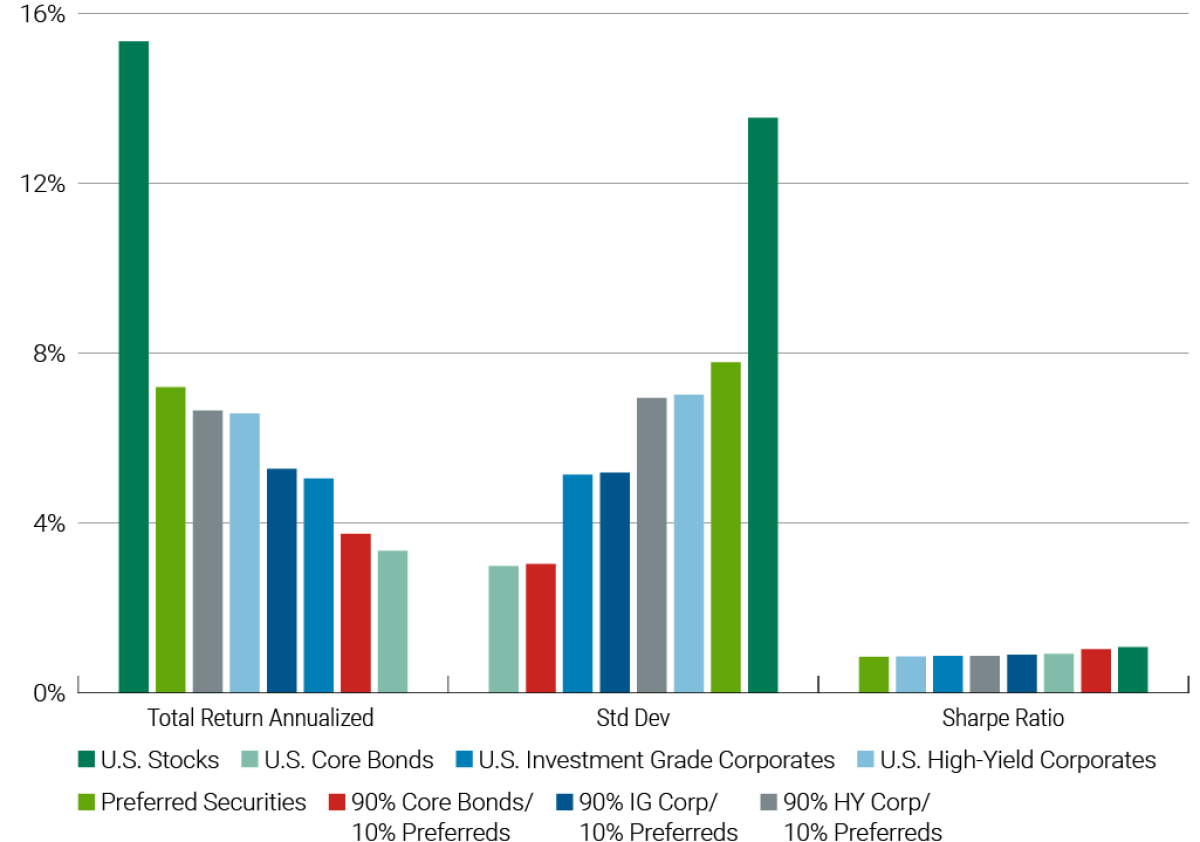

Preferred Securities

With their attractive yields and investment-grade credit ratings, preferred securities may be appropriate substitutes for high-yield bonds or valuable partners to core fixed-income securities. Based on historical performance, preferreds have boosted risk-adjusted returns (as defined by the Sharpe ratio) in hypothetical combinations with other bonds. See Figure 7.

ETFs Offer Easy, Efficient Access

In the past, investors had only two options for investing in hybrids: passive portfolios that track a benchmark index or expensive actively managed mutual funds. However, thanks to the explosive growth in actively managed ETFs, investors may now own these securities via the low-cost, tax-efficient ETF structure.

Unlike passive portfolios, actively managed ETFs provide greater flexibility. Investment managers can shift the mix of hybrid securities and risk exposure according to market conditions and their research insights. Furthermore, the ETF framework is inherently lower cost and provides greater tax efficiency than other alternatives.

About the Authors:

Hitesh Patel, CFA, FRM is vice president and co-portfolio manager for American Century Investments®.

He joined American Century Investments in February 2018 from UBS Securities, where he was a senior member of the Alternative Investment Specialist team within the Equity Derivatives group. Before that, Hitesh was director and head of Americas Origination and Content, responsible for manager selection and due diligence of all North America-based alternative investment managers for the UBS Liquid Alpha Managed Account and UCITS Platform. He has also served in roles at Merrill Lynch, Citigroup and the Federal Reserve Bank of New York. He has worked in the industry since 1996.

Hitesh earned a bachelor's degree in economics from Yale University. He holds the Chartered Financial Analyst (CFA®) and Financial Risk Manager (FRM) designations.

Sean Walker, CIMA®, MBA is vice president and ETF regional consultant for American Century Investments®.

He joined American Century Investments in 2017. Sean previously served as an investment management consultant at BlackRock where he covered South Florida for iShares. Before that, he served in various roles at Northern Trust/FlexShares, Managers Investment Group, Russell Investment Group, JPMorgan Chase, Franklin Templeton Investments, VALIC and Morgan Stanley.

Sean earned a bachelor's degree in international business from Florida State University and a master’s degree from the University of Miami Herbert Business School.