By ESG Playbook.

Supply chain shortages were the focal point of 2021, 2022, and continue into 2023 advancing the era of environmental, social and governance on a global stage. The supply chain squeeze has spanned across multiple industries, pushing the inflation rate in the U.S. to the highest level since 1982. There is uncertainty concerning when the supply chain bottleneck will ease. However, one thing that we ascertain is that ESG will be here to stay and reshape the supply chain landscape over the long run. As ESG goes mainstream, a few breakthrough developments are underway.

The Market calls for a global mandatory sustainability standard

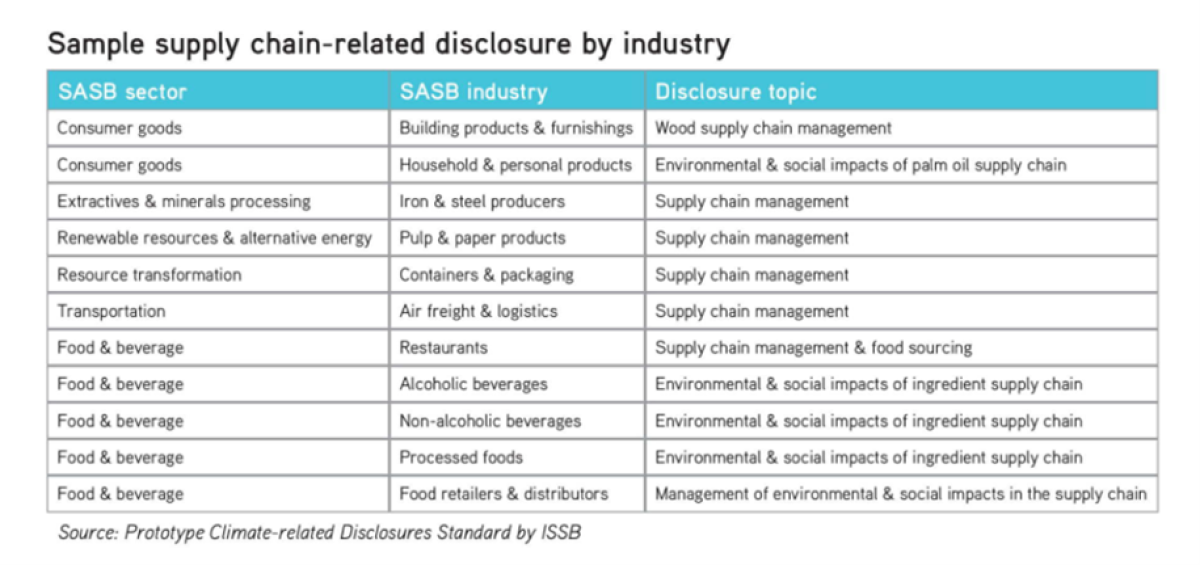

With successful experience in developing a global accounting standard, and implementing it in more than 140 jurisdictions, IFRS joined the force of promoting sustainability by launching the International Sustainability Standard Board ("ISSB") at the COP26. A global baseline sustainability disclosure standard spearheaded by ISSB in collaboration with multiple market-led standard-setters will redefine enterprise value. Notably, the proposed Climate-related disclosure prototype identified 11 industries to disclose supply chain management practices.1 When passed the due process, supply chain management will be deemed as material information on sustainability risks and opportunities. We expect companies will report ESG in the same rigorous manner as financial reporting in the coming years. In short, ESG reporting will be a new norm.

Ballooning ESG funds fuel shareholder activism to take actions on supply chain

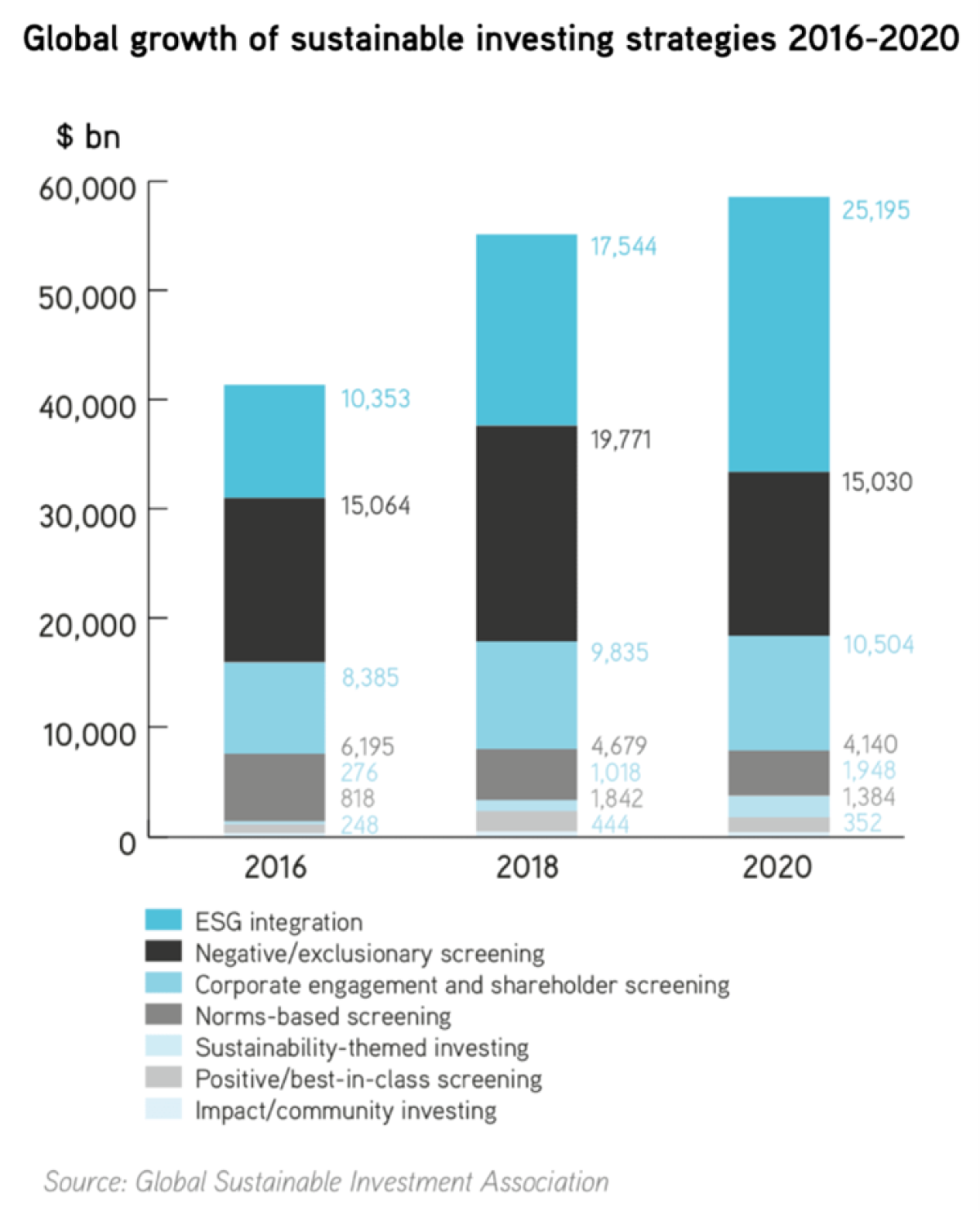

Investors are the driving force behind the ESG revolution, calling out corporations to tackle supply chain issues using growing stewardship power. With the AUM of ESG funds surpassing $35 trillion according to the GSIA,2 we see a record high support rate (34%) for shareholder resolutions during proxy season in the U.S. According to Morningstar, this is largely attributed to the substantial support from large asset managers, such as BlackRock, and State Street, to name a few. In particular, concerns arising from the supply chain led to mounting shareholder proposals and supply chain human rights shareholder resolutions gained 52% support.3 We anticipate the supply chain issues will continue to be a major focus for investors’ stewardship efforts in the coming years.

Mandatory regulations accelerate the sustainable supply chain management

Governments are stepping up to regulate supply chain issues spurring more attention to sustainability. In 2021, the EU passed the proposal for the EU Directive on Mandatory Human Rights, Environmental and Good Governance Due Diligence.4 Following the EU's legislation, Germany adopted the "Act on Corporate Due Diligence in Supply Chains." Large companies that meet certain thresholds must identify human rights violations and environmental degradation risks at both direct suppliers and indirect suppliers. Compliance failures will lead to fines up to 2% of the average annual revenue for large companies.5 The EU and German due diligence laws will significantly impact the suppliers due to the highly intertwined global economy. To prevent companies from seeking regulatory arbitrage, other countries will ramp up regulations and increase global collaboration.

Barriers stand in the way of supply chain progress

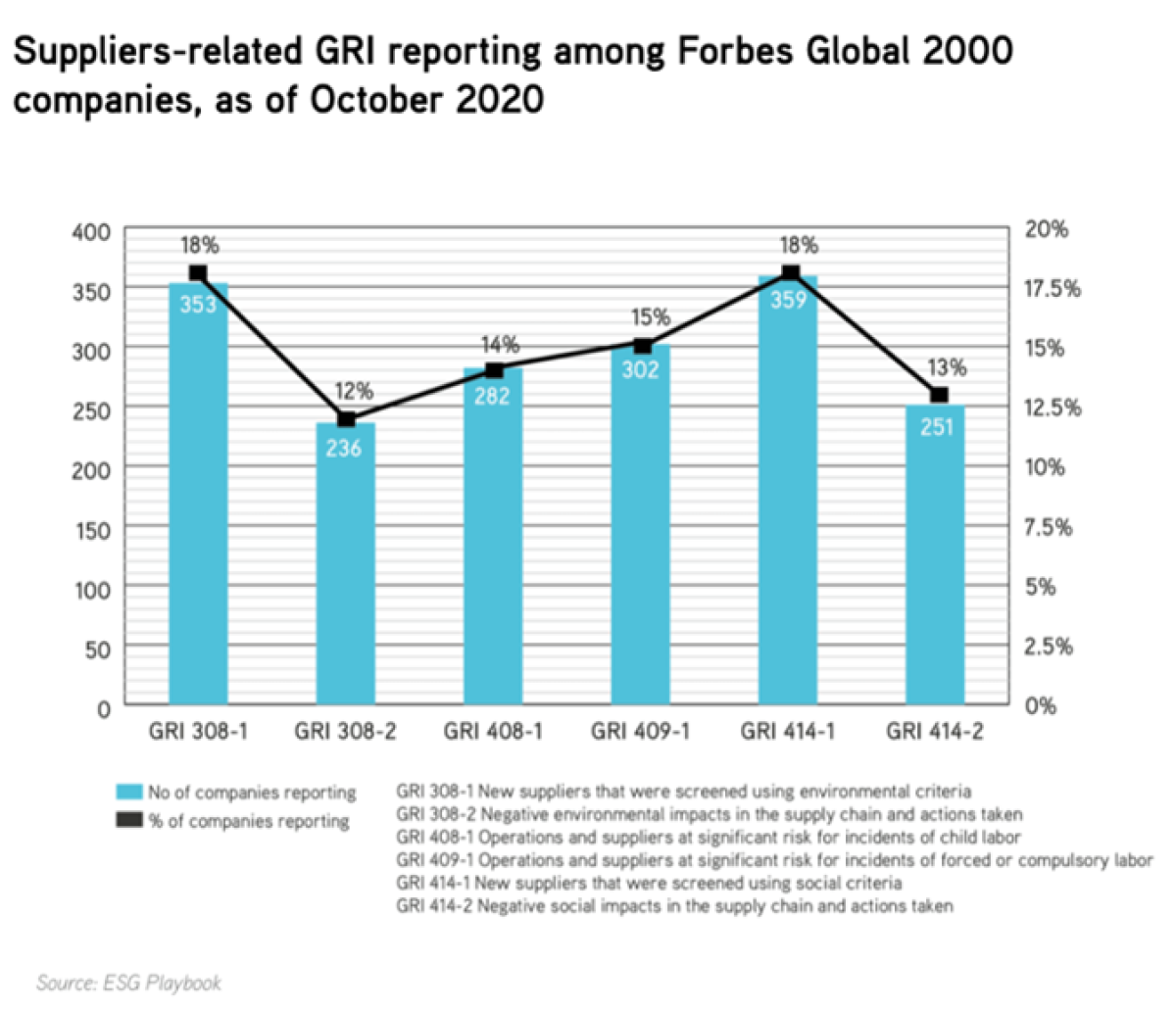

Despite the heightened regulation and growing attention, addressing ESG issues along the value chain is challenging. The first obstacle is the lack of visibility due to the sheer number of direct suppliers, not to mention indirect suppliers. The second roadblock is the limited data availability impedes assessing suppliers' ESG performance. ESG Playbook has found, less than 18% of the 2020 Forbes Global 2000 companies screened suppliers using environmental and social criteria. Last but not least, the complexity of quantifying suppliers’ carbon footprint hinders supply chain decarbonization. McKinsey estimates, for many companies, Scope 3 emission accounts for 80% of their carbon footprint. 6 However, among the 2062 companies who have set SBTi goals in line with 1.5 °C or well below 2 °C pathway, less than half include Scope 3 emissions reduction goals. 7 There is a lot of work to be done to improve these numbers.

Plans to understand the opportunities and control risks

There is no perfect solution. To comply with the supply chain regulations and meet stakeholders' expectations, corporations should start the ESG reporting promptly. Introducing an affordable and scalable digital platform to monitor the suppliers is a good starting point. Sending industry-standardized questionnaires to suppliers to streamline ESG data is another step in the right direction. Furthermore, empowering and incentivizing suppliers facilitate changes in behaviors, such as setting goals and recommending easy-to-use carbon calculators. Lastly, identifying hot spots and allocating the resource to the highest impact area can enhance the return on investment and secure buy-in internally.

To summarize, the leaders who demonstrate leadership in sustainability and in particular in their supply chain will be rewarded with a lower cost of capital, attract top talent, and enhance their brand image. ESG Playbook offers a one-stop solution to help companies streamline the ESG data collection and comply with regulations with prebuilt worksheets, supplier dashboards and carbon calculators, etc. For more information, visit ESG Playbook website.

Source:

1.IFRS https://www.ifrs.org/groups/technical-readiness-working-group/#resources;

2.The Global Sustainable Investment Review 2020 http://www.gsi-alliance.org/wp-content/uploads/2021/08/GSIR-20201.pdf;

3. The 2021 Proxy Voting Season in 7 Charts https://www.morningstar.com/articles/1052234/the-2021-proxy-voting-season-in-7-charts;

4. European Parliament corporate due diligence and corporate accountability https://www.europarl.europa.eu/doceo/document/TA-9-2021-0073_EN.html;

5.German parliament passes mandatory human rights due diligence law https://www.business-humanrights.org/en/latest-news/german-due-diligence-law/;

6. Making supply-chain decarbonization happen https://www.mckinsey.com/business-functions/operations/our-insights/making-supply-chain-decarbonization-happen;

7. Science based targets https://sciencebasedtargets.org/companies-taking-action;

Sponsor Statement

ESG Playbook is a leader in sustainability and carbon reporting. ESG Playbook offers the most reporting tools and frameworks in the industry on a single integrated platform with streamlined data collection and analysis. Contextual guidance, prebuilt templates and the ability to mix and match reporting standards to create customized reports and dashboards further set ESG Playbook apart from the competition and provide its clients across industries the flexibility they need in this evolving market. Visit us at www.esgplaybook.com.