As noted in Part I, SEI has offered a report about the ways in which hedge funds, if they know what’s good for them, will adjust to the tough climate of the present and the foreseeable future.

As noted in Part I, SEI has offered a report about the ways in which hedge funds, if they know what’s good for them, will adjust to the tough climate of the present and the foreseeable future.

The report listed six imperatives: a sustainable edge; adaptability; clear value added; the right fit; scale or sizzle; business and marketing acumen. We discussed the first three of those in Part I, and so resume here with the question of …

The Right Fit

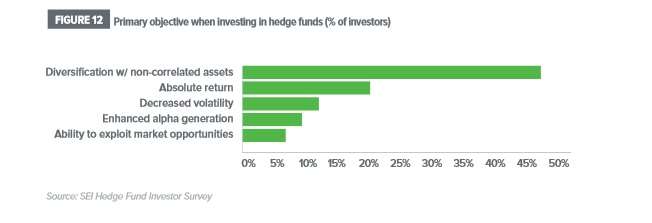

Investors use hedge funds for a range of purposes: for absolute return; for non-correlated assets; for the mitigation of risk elsewhere in their portfolio, and so forth. Managers have to focus their own efforts, figure out what their investors want, and be prepared to sell precisely that, not something else.

In the two roundtables that SEI hosted last year, they noticed “resistance to the notion that having wide latitude helps fund managers respond to rapidly shifting markets.” That is the usual argument of managers who don’t want to be focused, because focusing implies limits.

And yes, it does imply limits. Deal with that. Rick Nelson, the CIO of Commonfund, said at one of the roundtables, “This idea that a talented manager can easily and rapidly shift between risk-on and risk-off situations – it’s heightened expectations too much.”

As the above figure indicates, diversification through non-correlated assets is the most common primary objective of investors in hedge funds. Nearly half of those asked give that answer. The more flattering, give-them-wide-latitude, answer, “ability to exploit market opportunities,” is the least common response.

On a related point, transparency remains a hot-button issue. As SEI puts the point, transparency “is essential to continually prove and reinforce a hedge fund’s fit with institutional needs.”

Scale or Sizzle

Size can be both a blessing and a curse. Size squelches the sizzle of a nimble start-up. Indeed, on the one hand institutional investors may want precisely “the kind of original thinking and audacious risk-taking that made legends of George Soros, Julian Robertson and their ilk.”

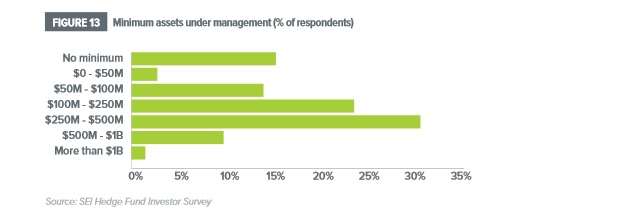

Yet on the second hand the same institutional investors have cautious people among their own gatekeepers and decision-makers. The cautious want to invest in a hedge fund that can check the boxes on the Request for Proposals and Due Diligence Questionnaires.

And on the third hand there are subjective not-so-cautious reasons for favoring the larger funds and their managers. Scale implies that the best technology systems are cost-effective, the best people can be hired for the range of tasks that a large management firm needs done, and the management/fund/family has the market power to execute effectively on a strategy, perhaps even to wait out adverse developments while holding a dodgy position.

Eighty four percent of the respondents to SEI’s survey indicated they had minimum asset thresholds that could screen out too-small managers. The specific minimum varies widely from one institution to the next.

The bottom line is that small funds have to compensate for their smallness by excelling at the first point we listed in Part I: a sustainable edge. They have to be able to make the case that their smallness is itself integral to that edge. If so, they may “survive and even thrive” in the present environment despite the power of scale.

Marketing Acumen

As we have had reason to mention already in both parts of this summary of the report: hedge fund managers have to sell their own skills, their team, their products, through effective communication with actual and potential investors. This is at least as important as is an impressive Sharpe or Sortino ratio or success by other investment-performance metrics. Many hedge fund entrepreneurs go into their market with the sense that they can just produce trading results and let the other aspects of the business take care of themselves.

If they’re lucky, they learn better quickly and survive the lesson.

Here is an adaptive thought that will fittingly serve as a conclusion. Andrea Malagoli, a consultant, says that she has seen too many presentations “that follow the same old pattern: pedigree of the managers, number of years’ experience, and so on. What you really need to do is tell a compelling story that captures attention upfront.”