By Paul Anthony Thomas

By Paul Anthony Thomas

My father was an investor, investment adviser and publisher who purchased his first public stock in 1926. Thereafter he was hooked on investing as a profession. He studied the markets, read every book, the Wall Street Journal, went to school to study investing, and continued to invest his own money throughout the Depression and the 55 years thereafter. He bought and sold raw land, coins, precious metals, currencies, art, real estate, commodities, cars; any form of investing, he would study the markets and trade. He went on to study engineering and geology, graduating from Oklahoma State with a master’s degree in civil engineering, and then from LSU in 1940 with a Ph.D in geology.

He was a master investor: studious, intelligent, knowledgeable, and experienced with a vast amount of knowledge gained from first-hand investing activities over a 60-year career. From all his investing experience, his life motto became "There are no greater assets to own, in certain or uncertain economic times, than producing energy in the ground.”

During World War II, my father’s contribution to the war effort was in finding oil along the Gulf Coast of Texas, Louisiana, and Mississippi. He was good at it, identifying prospects that routinely found new fields and astounding discoveries in some of the most treacherous geologic settings in the world, the highly-faulted Gulf Coast. He was a staff geologist working for a major oil company when the company was finding, on average, a salt dome oil field a week.

Unbeknownst to me, he started my investing career when I was about 13, by showing me how to contour geologic maps. Imagine a young person wanting to draw lines and pictures on a big piece of paper. Between geologic learning sessions, we read the Wall Street Journal together and discussed common stocks, bonds, commodities, and currencies, their merits and pitfalls. Together we read books and edited his publications. We purchased all forms of public instruments and private assets, traded, made money, and lost money. Throughout these decades of my financial education, we would research and invest. We would write about our experiences with these investments in my fathers’ newsletter “New Horizons for Investors.” He would write and I would read and ask him questions.

This publication was a monthly newsletter sent to 10,000 paid subscribers throughout the world. There was a section dedicated to “Hot Stocks,” including fundamental analysis and the “new fad” of technical analysis, one section dedicated to our past recommendations and our current portfolio performance, one area about commodities, one section about upcoming currency trends, and another page about private programs on which we were working. These private programs included: prospecting for oil, investing in oil and gas leases, residential and commercial real estate, mining for coal, copper, gold and silver, pipelines, natural gas/oil arbitrage, art, coins, precious metals and currencies, among others.

Today, our company motto remains “There are no greater assets to own, in certain or uncertain economic times, than producing energy in the ground.” After six decades of seeking the greatest risk-adjusted investment returns on the planet, my father continually made the above statement to me throughout our 20 years in business together.

The reasons my family has participated in the energy business since the 1930’s and that we specialize in the energy business today are numerous, but several key reasons are:

WHAT FAMILIES WANT FROM THEIR INVESTMENTS:

- Core investments with social importance

- Protection of wealth

- Predictable cash flow

- A hedge against inflation

- Potential for growth

- Tax-advantaged income

UNIVERSAL

Unlike precious metals, energy is universally required by the masses. Energy is a “core” asset required for human survival. This single fact gives producing energy true intrinsic value. This is in contrast to the value of gold, which is arbitrarily assigned by human psychology and desire;

PREDICTABLE

Distinct from the value of a common or preferred stock, which is based not insignificantly on consumer confidence, once established, the value of energy is foreseeable. Therefore the profits from energy production are predictable for a short time into the future (in this context, a short time is 2 to 5 years);

HEDGEABLE

Unlike real estate, energy products have the ability to be hedged (the price and thus the value of the asset can be protected from decline for a predictable time into the future);

INFLATION RESISTANT

Unlike luxury items, demand for energy is not materially affected by inflation and due to its “core” commodity status, energy carries a natural hedge against inflation, (e.g., when inflation causes prices to rise, energy prices rise with the tide);

DEMAND SENSITIVE

The supply of oil and gas is limited and uncertain while the demand for energy continually grows as global consumption expands. This fact alone supports the long term value of oil and natural gas into the future; and

TAX-ADVANTAGED

No other industry enjoys the current tax advantages that are carried by producing oil and natural gas. Fifteen percent (15%) of gross income derived from oil and gas production (producing wells) is not taxed by the federal government. This “no tax” allowance is provided by the tax rules because the asset is considered a “wasting” asset, not renewable, by producing its income until there are no remaining resources to produce. To my knowledge, there are no other industries that carry such favorable tax treatment from the U.S. Internal Revenue Service.

All of these factors and many more make the energy production business a rewarding, exciting and required component of a global and local economy and a required component to human survival. Energy is required, not just desired. What follows is a more in-depth examination of the key reasons to consider energy investing.

CORE ASSET

Producing energy is a core asset. What defines a core asset? From cellular division which is fueled by nourishment, to the growing of food, the cleaning of water, the building of shelter; energy (in the form of oil, gas, coal, wood, fire, sunlight, waves, or wind) is required for every living thing on earth to survive and prosper. If the economy fails, humans will need four things: shelter, food, water, and energy. If the economy prospers, energy is the core requirement and the driving factor in every process known to man. In my discussions with audiences about energy, I challenge every participant to think of a single item on the planet that does not require some form of energy to be produced, grow, and survive.

PREDICTABLE INCOME

Predictable income is a common characteristic of the producing energy business. Once an oil and gas field has been established and defined, the future income of the property can be estimated using analysis of the production decline curve. The production decline curve shows the amount of oil and gas produced per unit of time for several consecutive periods and, if projected, will furnish useful knowledge as to the future production of the well. This analysis helps in valuing a property. In special situations, volumetric calculations (total storage capacity of the reservoir times the recovery factor per acre) is also used to estimate energy reserves. In the wind and solar energy business, future production of energy can be modeled using historical studies conducted for decades prior to installation of the generating facilities.

HEDGEABLE

One of the drawbacks of investing in any type of real estate is the ability to hedge price fluctuation, which can greatly impact the value of real estate, as seen during the market crash of 2008. The price of producing energy has the ability to be hedged against loss of value and thus, loss of capital. By protecting the future price received for the produced commodity, be it oil, natural gas, or electricity, the investor may protect future profits by hedging his production price. For oil and gas, over-the-counter oil and natural gas commodity contracts and/or options (PUTS or FLOORS) are used, where the counterparty is the market. For electricity generated from solar or wind power, this hedging is accomplished using futures contracts on electricity with the counterparty being the actual distributor of the electricity, such as an electric utility company or, in the case of large commercial users of electricity, a manufacturing plant or mining operation.

NATURAL HEDGE AGAINST INFLATION

Unlike luxury items, demand for energy is not materially affected by inflation. If inflation becomes an issue in the economy, luxury items suffer greatly and demand for these items declines. However, because of its core status, producing energy reserves contain a natural hedge against inflation. When money loses value, as has occurred with the US dollar over the past many years, the price of energy automatically adjusts to compensate. When the buying power of the dollar drops 10%, the price of energy rises 10%, in keeping with the laws of supply and demand. In the oil and gas business, there is a theoretical break point where energy can become too expensive to purchase, but as inflation occurs and the value of the currency fluctuates, the value of energy compensates and this theoretical break point has remained undiscovered and unproven.

POTENTIAL FOR GROWTH

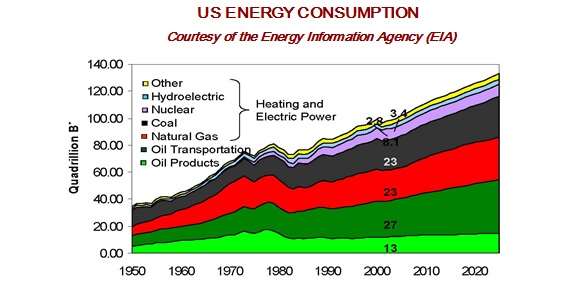

As the above chart shows, demand for energy is endless. Due to constant growth in global demand and dwindling supply of oil and gas, which is limited and uncertain, the demand for energy continually rises. Because of its “core” commodity status the demand for energy is omnipresent, regardless of the economy or the psychology of the marketplace, without concern to interest rates or government spending, irrespective of what happens to the value of the dollar. We always have a demand market for oil and gas. If it can get to the marketing point, the commodity will sell.

With regard to supply, finding sufficient oil and gas (exploration and drilling) is the risky portion of the energy business. As a result of his 60-year global investing career, my father placed extreme value on a world-class oil and gas prospect, a prospective lease where chances favored the production of hydrocarbons in commercial quantities. He knew that the key to finding profitable oil and gas production was the quality of the prospect. Given the discovery of commercial hydrocarbons, the production process becomes a predictable and required activity.

FAVORABLE TAX TREATMENT

Due to its core commodity status and the risk required to find, exploit, and produce oil and natural gas, today the oil and natural gas production business is blessed with some of the most favorable tax treatment from the Internal Revenue Code available to any global investor. Some of the ways in which this favorable treatment can be realized include:

- INTANGIBLE DRILLING/WORKOVER COSTS: The expense of drilling and completing (installing the well) or working over (repairing) a well may be expensed by the owner as “Intangible Drilling Costs” in the year that they occur. If you are a working interest owner (a partner that pays the bills), these expenses may be taken against the ordinary active income of the tax payer.

- DRY HOLE COSTS: All exploration expenses, including leasehold costs, may be expensed in the year spent if a dry hole is drilled.

- CAPITAL DEPRECIATION: On producing leases, leasehold costs are generally capitalized along with the “tangible” portion of the installation or workover process such as recoverable pipe, pumps, surface equipment and other equipment that may be salvaged when the well is plugged. These items are depreciated using short term (5 or 7 year) depreciation rates, depending on the class of asset.

- 15% OF GROSS INCOME IS EXCLUDED FROM INCOME TAX: Once a well is put into production, only 85% of the gross income from oil and gas production is taxable as income. 15% is not subject to any form of income tax because it is considered depletion of the producing asset (known as the ‘depletion allowance’). For working interest (bill-paying) owners, this income is offset by any expenses of producing the oil, liquids, and natural gas (known as operating expenses), severance or property taxes, and required maintenance/workover costs. Intangible expenses (non-salvageable portion) are written off in the year spent while the tangible costs are depreciated.

- PERCENTAGE DEPLETION ALLOWANCE ALLOWED EVERY YEAR: Another benefit not found in any other asset class is that the depletion allowance (15% of gross income) is available every year of production. Regardless of the owner’s basis in the property, the owner may take 15% depletion allowance off the top of the gross income for 100 years if the property produces in paying quantities for 100 years.

The era of cheap oil is behind us. It is common knowledge that, over the next 100 years, oil and natural gas will give way to other energy sources such as solar, wind, waves, and nuclear as they become affordable and manageable. The media would have one believe that the new horizontal shale production made possible by the use of hydraulic fracturing (“fracing”) will sustain the supply for oil and gas for the foreseeable future. In fact, horizontal drilling has been an industry standard since the 1970’s and the first reported fracing was conducted in 1865 with the Roberts Torpedo.

It is true that shale production has unlocked many new producing hydrocarbon zones, but the truth is that the storage capacity of those reservoirs is extremely limited when compared to historical oil and gas production. The simple fact remains that a large percentage of the “easy” and cheap oil has already been discovered, with future production being more expensive to the extreme.

An example of this fact is the East Texas Field which produced 5.2 billion barrels of oil from 1930 through 2000 and continues to produce today. This field was the largest oil deposit discovered in the world until the giant fields of Saudi Arabia (estimated 77 billion barrels) and the Prudhoe Bay field in Alaska (estimated 25 billion barrels) joined the discovered sites. The East Texas field produced 5.2 billion barrels from 148,000 acres (an estimated 37,000 barrels per acre). In contrast, the newly developing Bakken Shale/Dolomite (including the Three Forks formation) of North Dakota and Montana covers 128,000,000 acres and has estimated recoverable reserves of about 7 billion barrels.

Although the extent of the recovery from the Bakken/Three Forks will not be known for a few more decades, it is currently estimated that the recovery will be about 50 barrels per acre. The difference between these two fields illustrates definitively that oil and gas will be harder and more expensive to produce in the future than they were in the past by several orders of magnitude.

SUPPLY AND DEMAND IS THE ULTIMATE REGULATOR

With regards to natural gas, one historical fact that seems clear is that “cheap energy prices are the cure for cheap energy prices.” As natural gas prices remain low, oil producers move to the higher priced liquid and oil products. As operators move away from natural gas, the supply diminishes and prices rise. Another factor affecting this scenario is commercial demand. As the price of natural gas lowers, electric utilities and commercial users move to natural gas as a cheap fuel causing increased demand. More natural gas vehicles are built. As demand grows and supply lessens due to lower production due to less drilling caused by the sustained low price, the price rises, causing oil and gas operators once again to explore and drill for natural gas, increasing the supply and, hopefully, stabilizing the price.

In conclusion, the factors that drew our family to invest in producing energy are compelling. Energy is a required core asset with a predictable, hedgeable, and protectable value; little reliance on the “psychology” of the global or local marketplace; an inherent indifference to interest rates or public market sentiment; possessing a natural hedge against inflation; providing favorable tax treatment; and with an uncertain supply and a continually increasing demand. These factors support our family mantra, “There are no greater assets to own, in certain or uncertain economic times, than producing energy in the ground.”

Paul Thomas is a Certified Professional Geologist with over 30 years’ experience as a well-site superintendent and exploration professional including 15 years in upper management of petroleum exploration, production and transportation operations. He has a proven history of evaluating and implementing successful private equity investments throughout North America and abroad. Mr. Thomas has personally drilled or supervised the drilling of over 200 oil and gas wells and currently owns an interest in over 225 producing oil and gas wells throughout the US. He is also a principal at Ledger Petroleum, LLC, based in Abilene, Texas.

In the 1990’s, he served for 5 years as the US EPA Region 6 alternative energy/recycling coordinator, working with the Department of Energy on alternative energy generation profitability and technology transfer. He was editor of “Human Psychology in the Stock Market,” 1969 © EP Thomas Ph.D., Bruno’s Press, and most recently “Winning With Private Equity,” 2010 © Paul Anthony Thomas. He is currently working on the publication of “Twenty Five Ways to Make Money In the Oil and Gas Business” due out in 2013. Contact him in Abilene, Texas at 325-695-1329 or at paul.a.thomas1110@gmail.com.