By Andrew Beer

By Andrew Beer

As of mid-month October, the S&P 500 was down over 5% and the MSCI World was down 6%. In this context, drawdowns among hedge funds have been unexpectedly large. Before fees, the HFRX Global Investable index was down over 4%, while the Equity Long/Short and Event-Driven sectors were down 5% and over 7%, respectively (note that the reported losses are lessened by the reversal of accrued performance fees). The average alternative multi-manager mutual fund (generally with 0.2 to 0.3 equity beta targets) was down 3% net of fees.

What explains the underperformance? A significant portion likely is due to position crowding, which occurs when many hedge funds hold similar positions. In good times, additional buying can support stock prices and contribute to excess returns. For instance, the GS VIP index, which tracks positions in which hedge fund managers have a significant stake, outperformed the S&P 500 index by around 400 bps (per annum) from 2009 to September 2014. Performance like this is used to support the thesis that hedge fund managers add value over time through stock selection.

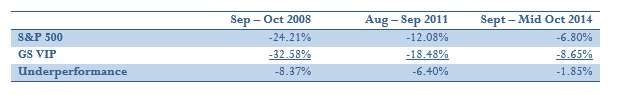

In periods of market stress, however, those same positions can underperform significantly as hedge funds cut positions simultaneously. The table below shows the GS VIP performance during the market drawdowns of 2008, 2011 and the current year:

In each of these drawdowns, widely held positions declined by 30-50% more than the market as a whole. While gross underperformance in September through mid-October has not been nearly as pronounced as earlier periods, the data suggests that these positions will further underperform.

Another form of position crowding occurs when hedge funds invest in a common theme. This year, many event-driven managers have owned stocks that are takeover candidates due to tax inversion arbitrage; a recent shift in the regulatory environment led to price declines in numerous such positions (most recently Shire, which purportedly caused over $1 billion in losses for hedge funds last week alone). Anecdotally, many hedge funds also have outsized exposure to oil and gas producers, an implicit bet on high oil prices; it remains to be seen if the recent decline in oil prices has caused outsized losses here as well. Likewise, the sudden drop in 10 year Treasury yields last week has also been blamed on hedge funds scrambling to cover short positions.

It is quite possible that the concentration of capital among the largest hedge funds will exacerbate this going forward. Further, numerous investment products now clone long positions of prominent hedge funds (from recent 13F filings) and investors regularly piggyback on positions held by their hedge funds. This additional capital may amplify both upside and downside performance in the quarters and years ahead.

Position crowding is analogous to (or maybe a form of) illiquidity risk. Alpha can quickly turn negative in periods of market stress, as we saw with illiquid hedge funds during 2008. Looked at another way, low beta funds became high beta when markets declined. The same is true for position crowding. Hedge fund investors who are seeking to protect against downside moves may need to factor this into overall portfolio construction.

Andrew Beer, CEO: At Beachhead, Mr. Beer oversees all marketing and research efforts and is influential in portfolio construction. Mr. Beer began his career in mergers & acquisitions at the James D. Wolfensohn Company, a boutique firm founded by the forthcoming President of the World Bank. Mr. Beer worked in leveraged buyouts at the Thomas H. Lee Company in Boston during his tenure at Harvard Business School. Upon graduating, he joined the Baupost Group, a leading hedge fund firm, as one of six investment professionals. Additionally, Mr. Beer co-founded Pinnacle Asset Management (leading commodity fund) and Apex Capital Management (Greater China hedge fund). Mr. Beer is an active member of the Board of Directors of the US Fund for UNICEF, where he serves as Chairman of the Bridge Fund, an innovative financing vehicle designed to accelerate the worldwide delivery of life-saving goods to children in need. With his wife, Mr. Beer is a co-founder of the Pierrepont School, a co-educational K-12 independent school located in Westport, CT. Mr. Beer received his Master in Business Administration degree as a Baker Scholar from Harvard Business School, and his Bachelor of Arts degree, magna cum laude, from Harvard College.