By Victoria Dobrynskaya, PhD, associate professor of Finance at National Research University Higher School of Economics

Looking at the whole cryptocurrency market through the prism of standard multi-factor asset-pricing models reveals that there is a significant heterogeneity in the exposure to the downside market risk across coins, and that a higher downside risk exposure is associated with higher average returns. The extra downside risk is priced with a statistically significant premium in the cryptocurrency market. The downside risk is orthogonal to the size and momentum risks and constitutes an important component in the multifactor cryptocurrency pricing model.

Cryptocurrencies have burst into our lives as alien alternative investment assets with outrageous potential returns and severe crashes. In the seven years from 2013-2019, the total capitalization of the crypto market increased from 1$ to $250 billion with more than 5,000 cryptocurrencies traded. Individual coin returns have been as high as 20,000% and as low as -99% in one week.

Of course, such weird return dynamics have received a lot of attention from academia and media. Jamie Dimon, CEO of JP Morgan, famously said cryptocurrency is “a fraud, worse than tulip bulbs” and Warren Buffet claimed cryptocurrency was analogous to “rat poison squared.”: “If I could buy a five-year put on every one of the cryptocurrencies, I’d be glad to do it but I would never short a dime’s worth.” What’s more, Nouriel Roubini’s congressional testimony in October 2018 was titled “Crypto is the mother of all scams and (now busted) bubbles…”[1] Finally, numerous academic papers have proclaimed fraud and bubbles in the cryptocurrency market.

Other followers of the cryptocurrency market are more optimistic about the future of blockchain technology and have begun to provide fundamental theories regarding cryptocurrency pricing. In general, authors agree that cryptocurrency returns are generally unrelated to equity, currency, and commodity returns, as well as macroeconomic factors, supporting the argument that major cryptocurrencies provide diversification, hedging, or even "safe haven" properties.

On the other hand, the financial and academic press is flooded with articles about the crash risk of cryptocurrencies. This is not surprising given that the entire cryptocurrency market experienced a series of significant crashes in 2018, when the overall market capitalization plunged about 90% from 800 billion to 100 billion during the year.

These articles tend to focus on the idiosyncratic crash risk of cryptocurrencies. However, an investor who invests in a diversified portfolio of cryptocurrencies, the downside market risk[2] plays a key role. Consider a recent episode of Black Thursday – March 12, 2020 – the global stock market crash, when we observed a 10% drop in CRSP Index, the largest single-day drop since Black Monday of 1987. Bitcoin crashed by 40% on this single day, and other cryptocurrencies followed suit. It is important to understand how various cryptocurrencies are exposed to the overall crypto-market losses, and whether higher exposure is compensated by higher average returns. In other words, we seek to discover how (and whether) the downside market risk is priced in the cryptocurrency market.

This study sheds light on this issue. It documents a significant heterogeneity in the exposure to downside market risk across various coins, where a higher downside risk exposure is associated with higher subsequent returns, indeed. This conclusion is drawn from a thorough cross-sectional analysis of all major cryptocurrencies with the market capitalization above $1 million traded in 2014-2018 (about 1,700 coins). Apparently, the cryptocurrency market is not so different from traditional asset markets in terms of downside risk pricing, despite a prevailing view that cryptocurrency market is characterized by weird return dynamics, bubbles and idiosyncratic risks.

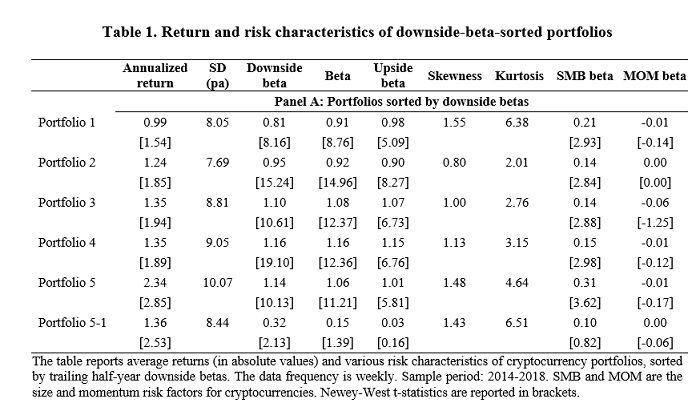

First, I adopt a portfolio approach. I sort cryptocurrencies into quintile portfolios by their trailing market betas, downside market betas or upside market betas and analyze the portfolios’ subsequent returns. The portfolio analysis reveals that only the downside-beta sort produces a monotonically increasing pattern in the portfolio returns. Portfolios with coins with higher downside betas yield higher average returns, and the return on the zero-cost portfolio, which has a long position in the high-downside-beta coins and a short position in the low-downside-beta coins (the portfolio which loads only on the downside risk), yields a statistically significant premium of 2.6% per week or 136% per annum (table 1). A portfolio with a long position in the high-downside-beta coins and a short position in Bitcoin yields an even higher premium of 3% per week or 160% per annum.

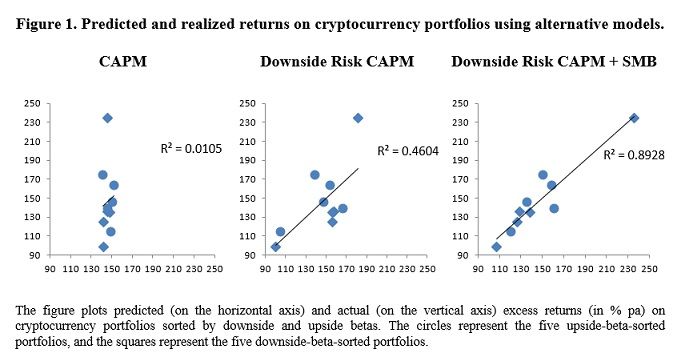

Secondly, I perform a cross-sectional regression analysis for the sorted portfolios, as well as for the individual cryptocurrencies, and show that the extra downside risk (on top of the overall market risk) is priced with a statistically significant premium, whereas the regular market risk premium is insignificant. Adding the downside risk component to the CAPM improves the explanatory power of the model significantly. These results are illustrated on Figure 1. These findings are similar to the ones obtained for equities, currencies and several other asset classes.

The idea that downside and upside risks are priced differently in financial markets goes back to early 50s, and was formalized and confirmed empirically by Ang, Chen and Xing (2006). The intuition is that investors care more about losses than they care about gains, referred to as loss aversion. Moreover, even under the standard utility assumptions, downside market risk is of greater importance to the investor because the marginal utility of wealth is higher in times of adverse market conditions and low overall wealth. Therefore, assets which perform poorly in times of market losses are particularly unattractive and should carry a premium. The upside market risk, however, is of much lower importance due to the overall favorable market conditions, and hence it is not priced.

Indeed, we observe in the cryptocurrency market that whereas the downside beta premium is positive, high and statistically significant, the upside beta premium is insignificant and even negative, in line with the original prediction of the model of Ang, Chen and Xing (2006). Because the regular market beta is the weighted average of the downside beta and the upside beta, it has less explanatory power for cryptocurrency (and other assets) returns than the downside beta alone.

As the cryptocurrency market grows and develops, and as more cryptocurrencies are issued and become liquid, a thorough analysis of the whole market uncovers surprising similarities to conventional asset markets. I look at the cryptocurrency market through the prism of standard asset-pricing models, which have been successful in explaining returns in other financial markets, and similar risk and return relationships are observed. Coupled with findings of Liu, Tsyvinski and Wu (2019) on the size and momentum risk factors for cryptocurrencies, we can conclude that cryptocurrencies are not wild animals, in general, and they are priced rather similarly as traditional assets, although the magnitudes of the risk premiums are significantly higher.

References:

- Ang, A., J. Chen and Y. Xing, 2006. Downside risk. Review of Financial Studies 19(4), 1191-1239.

- Liu, Y., Tsyvinski, A., and Wu, X., 2019. Common risk factors in cryptocurrency. NBER Working Paper #25882.

Read the full paper.

[1] The citations are borrowed from Coursera course “Cryptocurrency and Blockchain: An Introduction to Digital Currencies” by Jessica Wachter.

[2] The downside market risk is measured by the downside market beta, i.e. the scaled covariance between the returns on an individual cryptocurrency and the returns on the cryptocurrency market conditional on the negative market performance.

Victoria Dobrynskaya, PhD, associate professor of Finance at National Research University Higher School of Economics, e-mail: vdobrynskaya@hse.ru