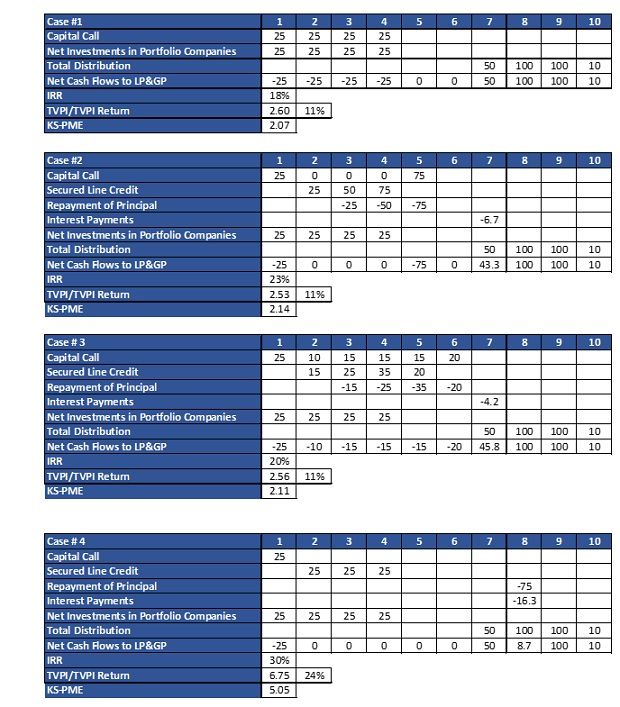

By Hossein Kazemi, PhD, CFA, CAIA Association, FDP Institute, and Isenberg School of Management A subscription line of credit (SLC) is one of many sources of funding that general partners (GPs) can use to invest, manage, size, and time a private equity fund’s cash flow. By far, the largest source of capital is contributed by investors. Other sources of funds come in the form of debt backed by (a) uncalled capital commitment of investors, (b) proceeds available to the fund due to exits, and (c) the net asset value of the fund. While private equity funds and their GPs have used SLCs since the 1980s, they have become increasingly popular in recent years. Flood (2017) reports the size of this source of funding to be $400 billion. In this short note, I discuss some of the benefits, risks, and distortions that arise through the use of SLCs. Recent surveys of private equity funds indicate that over 90% of funds have used SLCs in the past. SLCs are a senior secured revolving credit facility secured by the investors’ uncalled capital commitments. This debt is different from the leverage available at the portfolio company level, and the creditor typically does not have recourse to the portfolio companies' assets. Since the unfunded commitments secure the credit line, the credit characteristics of the fund’s investors are critical. They determine the credit quality of the asset base and the loan to value that the creditor would be willing to accept. The available evidence indicates that the LTV could range between 20%-60%. GPs could seek to secure committed or uncommitted lines of credit, with some opting for an uncommitted line of credit in order to avoid the commitment fees. Because the unfunded capital commitments are used as collateral, lenders acquire certain rights regarding them. In particular, GPs grant the lender the right to make capital calls and to enforce the obligations of the investors to contribute capital. For this reason, LPs are generally aware that the GP has secured such lines of credit. However, GPs are generally under no obligation to inform LPs that SLCs are being utilized and to what degree. The stated purpose of SLCs is to provide liquidity for the fund. While capital calls take at least 10 days to be honored by the LPs, the liquidity provided by SLCs is available within 1-2 days. For this reason, SLCs started as short-term credit facilities for bridging of capital calls. However, they can be rolled over and, therefore, used for longer-term purposes. Available evidence indicates that the latter form of uses has increased in recent years. A typical line of credit contains several protections for the lenders. These safeguards include a set of ratios covering the borrowing base and other financial aspects of the fund, covenants on the investors' credit quality, restrictions on rights transfers, and many others. If a fund violates the terms of the SLC's agreement, the lender could declare a default. In such a case, the GP may have no other option than to trigger a capital call. While the COVID-19 crisis has not thus far led to the illiquidity issues that we saw during the GFC, it is sure to lead some LPs to question the hidden risks associated with the use of SLCs. Benefits and Risks to GPs Since GPs control the use of SLCs, one might safetly assume that SLCs provide all benefits and no costs or risks to GPs. This is mostly true, but there are risks. First, we consider the benefits: Flexibility: SLCs provide liquidity and short-term capital. Therefore, GPs can reduce the frequency of capital calls. GPs might be able to delay capital calls if some LPs are facing liquidity problems. Opportunity: SLCs allow GPs to take advantage of opportunities that require quick actions. This could be particularly important in the leveraged buyout space where investment opportunities could arise unexpectedly. Hurdle Rate: The flexibility discussed above allows GPs to manage the cash flows such that the hurdle rate is reached earlier, which allows the GPs to collect performance fees sooner than otherwise. Performance: We will discuss this issue in more detail later in this note. At this point, it suffices to state that the use of SLCs invariably improves the IRR, Modified IRR, and often the public market equivalent measures of performance. GPs benefit from inflated performance measures when raising funds. Other stakeholders who occupy various levels of the food chain benefit as well. For example, consultants and investment officers whose compensations may be linked to the reported IRRs or other performance measures will benefit. It is important to note that some measures of performance, such as TVPI, decline when SLCs are used. Secondly, while it may appear that SLCs pose all benefits and no risks to GPs, under some (perhaps unlikely) circumstances, the GPs are in fact exposed to certain risks: Loss of Flexibility: While the availability of SLCs provides flexibility, they could reduce the ability of the GPs to give LPs some leeway when they are facing liquidity constraints. As mentioned above, the lenders acquire the right to call for capital contributions by LPs. This could arise because of a deterioration in the credit quality of the collateral during extreme market crisis periods (e.g., GFC and COVID-19). Increased Scrutiny: Capital calls arising to meet lenders' demands may give rise to increased scrutiny by LPs and could even leading to legal challenges by the LPs. Default by LPs: LPs defaults are highly unusual, but should they happen, implications will be more severe for funds that have used their SLCs. Because SLCs could be used instead of capital calls, it is conceivable that an LP may decide to walk away from a fund that has already made poor investments. Again, this is a highly unlikely event but cannot be entirely ignored. Benefits and Risks to LPs A fund's LPs will benefit when SLCs are appropriately used on a relatively small scale. As we will see, risks appear to be on the rise, especially when there are inadequate disclosures by the GPs. First, we discuss the potential benefits: Infrequent & Predictable Capital Calls: By using SLCs, GPs can reduce the frequency of capital calls, which reduces the administrative costs associated with honoring frequent capital calls. Also, GPs should be able to create more predictable capital calls if there are no unexpected capital calls initiated by the lenders. It is essential to point out that the available empirical evidence does not support the claim that the increased use of SLCs reduces the frequency of capital calls (see Albertusy and Denesz (2020)). Higher Return through Leverage: It is often argued that SLCs do not create leverage because the unfunded committed capital backs SLCs. This would be correct if the presence of SLCs does not lead GPs to reduce the total amount of capital that is called. Available evidence appears to contradict this argument. It is shown that funds that use SLCs tend to call a smaller amount of capital. As we will see, this introduces leverage, leading to higher IRRs when the underlying assets are performing well. We have already highlighted some of the risks that the GPs and, by extension, the LPs could face when SLCs are used. In the next section, we will discuss the distortions that are created when SLCs are employed. Here, we briefly identify a few risks not discussed above or directly related to the distortions discussed later: Secondary Transactions: Since unfunded capital commitments serve as collaterals, LPs may face additional obstacles from both the GPs and the lenders, should they decide to exit through a secondary transaction. These obstacles could impact the prices at which the secondary transactions take place. Management of Overcommitment: GPs are under no obligation to report the use of SLCs to LPs. As a result, the LPs will not know the amount of capital that has been allocated on their behalf. In other words, LPs may not be aware of the total amount of capital that has been invested by GPs on their behalf. Of course, this risk can be mitigated if there is transparency and sufficient communication from GPs. Interest Expenses: SLCs create a direct partnership expense to the fund, including an upfront fee, commitment fee, and interest expense. These will cause a decline in the TVPI and distributions received by LPs. Correlated Capital Calls: For large institutional investors managing the liquidity aspects of capital calls are critical considerations in managing a portfolio of private equity funds. In periods of financial distress, some of these funds may have to satisfy lenders' requests to reduce their loan balances. This could lead to simultaneous capital calls by several private equity funds, creating increased liquidity risks for LPs. Also, there may be liabilities for LPs should there be an outstanding balance at the end of the fund's life, obligating LPs for more than their pro-rata share of the balance should another LP default on subsequent capital calls. Distortions and Available Empirical Evidence Even when SLCs are used to manage liquidity, to reduce the frequency of capital calls, and to take advantage of unexpected market opportunities, a byproduct is the distortion of some of performance measures. The critical questions are whether there is a systematic bias in these distortions and whether there is empirical evidence that GPs use SLCs to impact performance measures. To see the impact of SLCs, I have provided four examples in the Appendix. These examples share similar characteristics. The committed capital, the total investments in portfolio companies, exit proceeds, and the rate of interest are the same in all cases. To keep the examples simple, I am ignoring management and performance fees. The summary of performance figures appears in the following table.  The first example is the base case, where no SLCs are employed. The fund lives for ten years, and capital calls are spread evenly over the first four years. In the second case, the GP uses SLCs to delay the capital calls for four years, leading to a large capital call in year five. In the third case, the GP uses SLCs to spread the capital calls over six years. In the last case, the GP uses SLCs as a substitute for LPs' capital, calling only 25% of the committed capital. We can see that in all three cases where SLCs are employed, the reported IRRs and PMEs increase. The primary reason for this is that by reducing the length of time that the LPs’ capital is deployed, one can increase the IRR and PME. Further, the TVPI decreases in cases 2 and 3 due to interest costs. Case 4 is different from the others because the use of SLCs has created leverage, and therefore all performance figures have increased. Of course, for a poor performing fund, the losses would have been magnified. Recent studies (e.g, Albertusy and Denesz (2020) and Jäckel (2019)), show that the impact of SLCs on IRRs could be significant (around a 6% increase). However, the impact will depend on the size the credit line and underlying performance of the fund’s assets. The impact is much smaller for median funds and in some cases the impact could be negative. It is often argued that SLCs do not create a source of leverage because they are backed by unfunded committed capital. This would be true if the GP calls the entire committed capital eventually. Empirical evidence does not support this. As reported by Albertusy and Denesz (2020), funds that employ relatively large amounts of SLCs reduce their capital calls. On the other hand, these funds do not appear to reduce the frequency of their capital calls, which is the primary stated reason for using SLCs. Also, the study reports that poor-performing funds are more likely to use SLCs. The examples above highlight the sensitivity of the reported IRRs to the timing of cash flows. Since GPs have substantial freedom in managing this timing, the question arises whether GPs use this freedom to manipulate the IRR. While TVPI is not an ideal measure of performance, it does have the advantage of being manipulation-free. One can, therefore, use TVPI to calculate the annualized rate of return on the fund if the net cash flows were spread evenly through a fund's life. The difference between the IRR and the TVPI return is referred to as the IRR gap. It measures the extent that the timings of cash flows have inflated the reported IRRs. In a recent study, Larocque et al. (2020) show that funds with the largest IRR gap tend to have lower subsequent performance. This provides additional indirect evidence that GPs could be using the SLCs to manipulate returns. Concluding Comments SLCs represent one of several funding tools available to GPs. The flexibility offered through SLCs can be used to the benefit of both LPs and GPs. SLCs can reduce the frequency of capital calls and help GPs avoid surprise capital calls. Also, SLCs may help GPs avoid capital calls if some of the investors are facing liquidity issues. As we discussed, the side effects of these benefits are distorted performance measures. The flexibility offered by SLCs and the associated performance distortions may hurt the alignment of interest between LPs and GPs. To reduce the potential moral hazards associated with SLCs, GPs must agree to provide full transparency and disclosure regarding the use of SLCs. In its most recent announcement on SLCs, Institutional Limited Partners Association (ILPA) provides a set of guidelines to address the concerns of LPs while recognizing the benefits that SLCs could offer to all stakeholders. In particular, ILPA calls GPs to disclose the following information regularly (a) the total size and balance of subscription facility, (b) how much of the LPs' and GP's unfunded commitment is financed through the facility, (c) the average number of days each drawdown is outstanding, and (d) the net IRR, with and without the use of the subscription facility. The guidelines provided by ILPA are reasonable and do not appear to limit GPs use SLCs or to put an undue burden on GPs. References Albertus, James F. and Denes, Matthew, Private Equity Fund Debt: Capital Flows, Performance, and Agency Costs (May 26, 2020). Flood, Chris, 2017, Private Equity's Dirty Finance Secret, Financial Times. ILPA, Enhancing Transparency Around Subscription Lines of Credit: Recommended Disclosures Regarding Exposure, Capital Calls and Performance Impacts, June 2020. Jäckel, Christoph, How Big is the Impact of Credit Lines on Fund Performance Really?, 2019, Larocque, Stephannie A. and Shive, Sophie and Sustersic Stevens, Jennifer, Are private equity investors fooled by IRR? (May 28, 2020). Appendix

The first example is the base case, where no SLCs are employed. The fund lives for ten years, and capital calls are spread evenly over the first four years. In the second case, the GP uses SLCs to delay the capital calls for four years, leading to a large capital call in year five. In the third case, the GP uses SLCs to spread the capital calls over six years. In the last case, the GP uses SLCs as a substitute for LPs' capital, calling only 25% of the committed capital. We can see that in all three cases where SLCs are employed, the reported IRRs and PMEs increase. The primary reason for this is that by reducing the length of time that the LPs’ capital is deployed, one can increase the IRR and PME. Further, the TVPI decreases in cases 2 and 3 due to interest costs. Case 4 is different from the others because the use of SLCs has created leverage, and therefore all performance figures have increased. Of course, for a poor performing fund, the losses would have been magnified. Recent studies (e.g, Albertusy and Denesz (2020) and Jäckel (2019)), show that the impact of SLCs on IRRs could be significant (around a 6% increase). However, the impact will depend on the size the credit line and underlying performance of the fund’s assets. The impact is much smaller for median funds and in some cases the impact could be negative. It is often argued that SLCs do not create a source of leverage because they are backed by unfunded committed capital. This would be true if the GP calls the entire committed capital eventually. Empirical evidence does not support this. As reported by Albertusy and Denesz (2020), funds that employ relatively large amounts of SLCs reduce their capital calls. On the other hand, these funds do not appear to reduce the frequency of their capital calls, which is the primary stated reason for using SLCs. Also, the study reports that poor-performing funds are more likely to use SLCs. The examples above highlight the sensitivity of the reported IRRs to the timing of cash flows. Since GPs have substantial freedom in managing this timing, the question arises whether GPs use this freedom to manipulate the IRR. While TVPI is not an ideal measure of performance, it does have the advantage of being manipulation-free. One can, therefore, use TVPI to calculate the annualized rate of return on the fund if the net cash flows were spread evenly through a fund's life. The difference between the IRR and the TVPI return is referred to as the IRR gap. It measures the extent that the timings of cash flows have inflated the reported IRRs. In a recent study, Larocque et al. (2020) show that funds with the largest IRR gap tend to have lower subsequent performance. This provides additional indirect evidence that GPs could be using the SLCs to manipulate returns. Concluding Comments SLCs represent one of several funding tools available to GPs. The flexibility offered through SLCs can be used to the benefit of both LPs and GPs. SLCs can reduce the frequency of capital calls and help GPs avoid surprise capital calls. Also, SLCs may help GPs avoid capital calls if some of the investors are facing liquidity issues. As we discussed, the side effects of these benefits are distorted performance measures. The flexibility offered by SLCs and the associated performance distortions may hurt the alignment of interest between LPs and GPs. To reduce the potential moral hazards associated with SLCs, GPs must agree to provide full transparency and disclosure regarding the use of SLCs. In its most recent announcement on SLCs, Institutional Limited Partners Association (ILPA) provides a set of guidelines to address the concerns of LPs while recognizing the benefits that SLCs could offer to all stakeholders. In particular, ILPA calls GPs to disclose the following information regularly (a) the total size and balance of subscription facility, (b) how much of the LPs' and GP's unfunded commitment is financed through the facility, (c) the average number of days each drawdown is outstanding, and (d) the net IRR, with and without the use of the subscription facility. The guidelines provided by ILPA are reasonable and do not appear to limit GPs use SLCs or to put an undue burden on GPs. References Albertus, James F. and Denes, Matthew, Private Equity Fund Debt: Capital Flows, Performance, and Agency Costs (May 26, 2020). Flood, Chris, 2017, Private Equity's Dirty Finance Secret, Financial Times. ILPA, Enhancing Transparency Around Subscription Lines of Credit: Recommended Disclosures Regarding Exposure, Capital Calls and Performance Impacts, June 2020. Jäckel, Christoph, How Big is the Impact of Credit Lines on Fund Performance Really?, 2019, Larocque, Stephannie A. and Shive, Sophie and Sustersic Stevens, Jennifer, Are private equity investors fooled by IRR? (May 28, 2020). Appendix

Interested in contributing to Portfolio for the Future? Drop us a line at content@caia.org