By Rick Roche, CAIA, Little Harbor Advisors, LLC

Part 2 of a two-part series on The Alternative Imperative in the COVID Era. In Part 2, the author tackles notorious technology laggards. This piece transitions to alternative data pioneers (Alt-Venturers) and the 4-1-1 on Alt-Data: Hype or Hope? The author dispels the false dichotomy of the “Unattainable Triangle” for human vs. machine intelligence. The author addresses the “vacuum” concept and varied approaches to explore, extend or expand the use of Alt-Data in “legacy” quantitative models and those powered by machine learning algorithms.

Let’s cut to the chase. FinServ firms in general, and asset managers in particular, are laggards. Laggards when it comes to technology adoption and diffusion. No two ways about it – asset managers are near isolates when embracing technological advances. While “laggard” seems like a pejorative term, it is a kinder, gentler descriptor than dinosaur, pre-meteor strike causing Chicxulub crater on the Yucatan Peninsula. The data does not lie. As Chuck Todd of NBC News said “…alternative facts are not facts. They’re falsehoods.”[1]

In a November-2018 worldwide survey of global money managers, a McKinsey & Company report trumpets, “…asset managers generally have remained digital laggards”. In this sobering survey of 300 asset managers, McKinsey & Company found “…roughly 20 firms belong to this select group of asset managers creating digital alpha”.[2] McKinsey is not alone in unveiling certain hard truths about financial firms wed to legacy computing, held back by staid culture and entrenched biases.

Survey after survey sings the same old tune. PricewaterhouseCoopers’ (PwC’s) “Global Data and Analytics Survey” ranked the Asset & Wealth Management industry dead last in using machine learning algorithms for decision-making.[3] There was a 2017 Survey of Financial Services’ CEOs on firms’ openness to embrace a digital finance future. The consulting firm, Gartner Research, found a majority were “…restricted by mental maps that cause executives and strategies to remain within 20th century cultural, business and legal boundaries.[4]

Another Gartner Research note blares, “Digital Disruption Will Force CIOs in Financial Services to Accelerate Digital Transformation”. Gartner predicts that by 2030, “… only 20% of ‘heritage financial firms will flourish and win. Eighty percent will cease to exist, become commoditized or achieve zombie status.”[5] Watch out for that asteroid overhead!

A more recent and (damming) indictment was just released in 4Q 2020 by the ESL ThoughtLab and DataRobot. “Driving ROI Through AI” surveyed 1,200 companies, across 12 industries, 15 countries with combined revenues of $15.5 trillion. Of the twelve industries, “Investment” ranked #11 – barely ahead of “Media” at 12. Their findings state, “The investment sector, which includes private wealth officers, hedge funds, brokers, and other small business, has the fewest (AI) leaders”. [6] These AI investigators claim that most industries are gearing up for the Age of Algorithms” …except for investment and media (industries) – which will stay considerably behind”. [7]

Alt-Venturers

There are thousands of purported actionable alternative datasets, hundreds of thousands of Alt-Data trial users and buyers and hundreds of millions in annual spend by asset managers on non-traditional data. Given these alternative facts, one might surmise that the “Age of Alt-Data Aquarius” has arrived? But one would be wrong!

Despite alternative data’s impressive growth rate, it remains a sliver of the overall data spend by asset managers. In 2019, data detective, Burton-Taylor International Consulting estimated there was USD $31.9 billion spent on financial market data by investment firms worldwide.[8] The highest amount this writer has seen for 2019 estimated alternative investment data spend was $1.08 billion or 1/32nd total spent on financial market data.[9]

Everyone loves an interesting origin story. Who were among the first to venture into the world of alternative data? A venturer is an individual who undertakes or shares in a trading venture. One of the first to venture using alternative data sources was Mr. Sam. Mr. Sam Walton. In a 1981 Walmart World letter, Sam the Man confessed that he had “smashed into the rear of one of our Walmart trucks…My only excuse is that, following my custom for many years, I was counting cars in a competitor’s parking lot and not looking…”.

Sam Walton, a licensed pilot, loved to fly and was known for inspecting the number of cars in the Wal-Mart parking lots as he buzzed overhead.[10] Taking a page out of Mr. Sam’s book, in 2010, a UBS analyst used satellite images to count cars in parking lots and accurately predict future sales at Wal-Mart.[11] It’s an everyday practice to use satellite imagery to count cars, to track rail, truck and barge shipments and oil tanker movements through the Persian Gulf or South China Sea.

Another Alt-Venturer is Mr. Tony Berkman. In 2002, Tony Berkman was a Co-Founder and CEO at Majestic Research. Majestic Research was one of the first sellers of non-traditional data. Tony Berkman has a BS in Computer Science & Math and an MS in Computational Finance from Carnegie Mellon University. Tony has been called by some, “The Godfather of Alternative Data”.[12] Tony Berkman is currently a Managing Director at Two Sigma, a leading practitioner of machine learning in investment management.

Majestic Research, now known as “M Science” and a part of Jeffries Financial Group Inc, was a pioneer in curating anonymized credit and debit card transactions a decade ago.[13] M Science is a data-driven research and analytics firm, dedicated to revolutionizing investment management research, discovering new datasets and pioneering methodologies to provide actionable intelligence.[14]

The 4- 1- 1 on Alternative Data: Hype or Hope?

“…let me make a general observation– the test of a first-rate intelligence is the ability to hold two opposed ideas in the mind at the same time, and still retain the ability to function.”

– F. Scott Fitzgerald, The Crack-Up, Esquire, Feb 1936

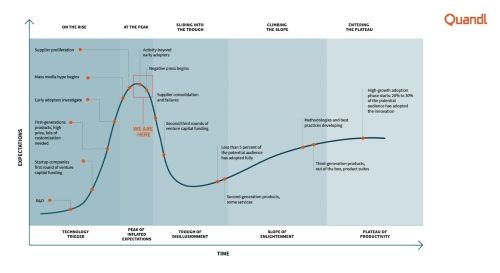

Every major technology breakthrough or innovation experiences a Hype Cycle of some sort. Initial expectations for revolutionary changes are sky high, tempered over time, fall into despair and ultimately are borne or flame out. The hype cycle proports to describe and display the maturity, adoption and social adaptations that accompany new and improved technologies or methods.

This author frequently turns to Gartner’s Hype Cycle for insight and a healthy dose of tech-reality. Gartner first introduced its “Hype Cycle” in 1995.[15] The term “Big Data” made its first appearance on the Gartner Hype Cycle in 2012.[16] In 2020, “small data” made its first appearance as an emerging technology on the Hype Cycle. For the record, in checking with Gartner staff, the term “alternative investment data” has yet to appear on Gartner’s Hype radar.

However, the former Chief Marketing Officer at Quandl, Carrie Shaw made a clever adaptation to Gartner’s Hype Cycle. Quandl is a leading platform for financial and alternative investment data with 400,000 users on its platform (Quantl was acquired by Nasdaq in 2018).

In her 2019 depiction, Alternative Data was on the downlow, heading into the “Trough of Disillusionment.” Why? Ms. Shaw cited headlines like “there’s no gold to be found in alt data” and “we looked at 700 datasets and didn’t find anything”.[17] In fact, Quandl (itself a leading provider of alt and traditional investment data, states, “90% of all alternative data is noise’”.[18] And Quandl boasts that “Only one in a hundred data sets survive our tests… because 90 to 95% of what we see is totally useless”.[19]

In COVID Crisis, No Alternative to Alt-Data Guidance

“I never guess. It is a capital mistake to theorize before one has data.”

– Sir Arthur Conan Doyle, author, Sherlock Holmes. A Scandal in Bohemia (1891)

There is an alternative chorus of opposing voices who believe the Alternative Imperative has arrived. The SARS-CoV-2 virus is unlike anything prior living generations of Americans have experienced. {The U.S. population was roughly 103 million at the time of the Spanish Flu of 1918; it’s over 330 million today} In addition to a population three times as large, we’re living in a globally connected world. With the benefit of 20-20 hindsight in the first half of 2020, the global financial markets were far too complacent about the threat posed by COVID-19 on the health and wealth of nations.

For experts in data science, the COVID-19 pandemic has been a humbling experience. For years, data scientists and quants alike were encouraged to use rich historical or comparable data in their models to identify repeated (and repeatable) patterns to make data-driven decisions. As the pandemic hit, structural shifts in demand wreaked havoc on prediction models slow to adapt to unusual data patterns. One manager quipped, “…our automated machine learning models didn’t handle eight weeks of zeros very well.”[20]

Ever since stay-at-home mandates in the Spring of 2020, most publicly traded firms have ceased giving guidance on quarterly earnings estimates. As of mid-June 2020, no fewer than 840 firms had stopped providing annual guidance because of supply chain disruptions and disrupted mobility among fearful consumers.[21] With CEOs and CFOs reluctant to forecast even their own firms’ key performance indicators (KPIs), investors are left in the dark with little to no guidance from corporate titans.

In such situations, there is very limited historical or benchmark data to base decisions on. Many predictive models using historical financial data and relationships have been shattered. This has forced asset managers to combine the limited data observed with “quantitative intuition”—a combination of data science, human intuition, and investment domain expertise.[22]

A Forrester Research Principal Analyst states, “Why Wait? The Future of Data is Now”.[23] Michele Goetz, a Forrester Principal Analyst, declares, “The future of data isn’t three years, five years or 10 years out… You must transition or be left behind. This isn’t hyperbole”. Because of the COVID-19 Crisis, the Boston Consulting Group (BCG) believes that, “…leaders and teams (must) act quickly on data-driven analytical insights rather than relying on gut-based decisions”.

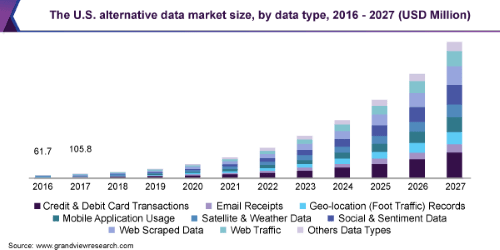

Grand View Research, Inc. (whose Alternative Data Market Size illustration is above), projects that the Alt-Data Market will grow at a compounded annual growth rate (CAGR) of 40.1% per year through 2027.[24] If the 40% growth rate were to materialize, the Alternative Data Market Size would balloon from ~$1.1 billion to $17.3 billion.

What’s in these alternative digital datasets? Electricity demand, weekly jobless claims, public transit and foot traffic, air quality readings, active oil rigs, restaurant and airline bookings, and the list goes on. Skilled investment managers are using real-time data to gain an edge in the COVID Era. Higher frequency, short-term data can track nearly everything from consumption to population mobility to disruptions in global trade and supply chains.

It’s important to note that the Alt-Data vendor marketplace is highly fragmented with dozens of “established” vendors and scores of “wanna-be” data merchants. Much of the growth in the alternative data ecosystem was born out of the exhaust from business processes, generated as a side effect of operations and transactions. Corporate data can be a byproduct or ‘exhaust’ of corporate record-keeping such as credit card receipts, supermarket scanner data, supply chain data, mobile apps, etc. Companies involved in payment systems, such as credit card networks or point-of-sale terminals often sell this data to investment firms. Consumer transaction can be reliable predictors of company performance.

Vendors began selling analytics directly to businesses as ways to enhance organizational return (e.g. hotel statistics to lodging and leisure companies). As vendors eventually realized that this data might offer commercial insights for investing, they began offering datasets to buy-side firms. Dataset aggregators like Quantl, Eagle Alpha and Neudata actively solicit sellers of “exhaust data” believing there’s fuel for elusive alpha generation in company exhaust.

Alternative Data: Agile, Mobile, But Not Hostile

“Most problems don’t require more data. They require more insight, more innovation and better eyes. Information is what we call it when a human being takes data and turns it into a useful truth.”--Seth Godin, Seth’s Blog[25]

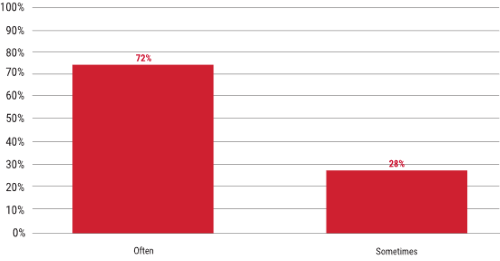

Several years ago, numerous stories appeared suggesting that alternative investment data would make traditional data obsolete. That’s not what happened. In 2019, Lowenstein Sandler, a national law firm with a practice specializing in investment funds, surveyed hedge funds on their use and concerns surrounding alternative data.[26] With only 76 respondents, survey sample size was small (the firm, Hedge Fund Research, estimates that worldwide there were roughly 9,000 hedge funds at year-end 2019.)[27] But their survey revealed several universal truths. Ninety-eight percent (98%) of hedge funds surveyed said they use alternative data in combination with fundamental analysis to make investment decisions.

Two additional queries unearthed timely insight. In the chart above, nearly three-quarters of hedgies surveyed stated they most often used both traditional market data and Alt-Data together.[28] When asked why they use alternative data, 68% said, “To provide additional support for findings or assumptions in fundamental research”. Alternative data is not an existential threat to traditional financial market data. However, in the midst of a pandemic, it’s essential to use high-frequency data and exhaust in quant or quantamental models to make more robust predictions and generate trading signals.

Data insights are perishable, can spoil or be arbitraged away. Forward-thinking asset managers are evaluating an array of ultra-high frequency indicators that, taken together and integrated with their internal data, provide a more accurate and granular view of markets and macroeconomics. Like machine learning itself, the onset of alternative investment data use is an evolutionary step forward rather than a revolutionary shift.

Asset managers who’ve made a pivot to high-frequency data have shifted away from more advanced analytics to fast-cycle “descriptive” analytics and data visualization. A transition to real-time dashboards has placed an emphasis on the speed of incorporating alternative data insights to train machine learning algorithms.

These new forms of alternative data are less digestible in traditional quant models trained on tick data, risk premia, and factor analysis. Because Alt-Data comes from unconventional sources, mostly in an unstructured form, it isn’t as searchable or organized in a pre-defined way. Unstructured data may include images, video, audio, social media posts, and unlabeled text. As a result, in order to turn unstructured data into actionable insights, advanced algorithms, substantial computational power, adequate cloud storage as well as a “different mindset” are required.[29]

Extracting actionable information from ubiquitous and unfamiliar data sources is hard work and may lead into blind alleys. Because structured and unstructured datasets take different forms, asset managers with specialist capabilities in data analysis and processing are better positioned to capitalize on Alt-Data. Which leads to the conclusion below that, “We Hold These Truths to be Self-Evident.”

Either Machine or Human Intelligence? A False Dichotomy

“Listening to the data is important … but so is experience and intuition. After all, what is intuition at its best but large amounts of data of all kinds filtered through a human brain rather than a math model?” – Steve Lohr, Technology & Business Writer, New York Times[30]

You’re familiar with the “Unattainable Triangle,” right? The Unattainable Triangle is that you can either have it fast, cheap, or good, but you can’t have it all! The triangle is a maxim that high-quality goods delivered quickly and efficiently to customers will always come at a higher price and vice versa. That’s the cold, hard truth of the unattainable triangle.[31]

There’s a comparable dilemma that says that investment managers should rely exclusively on machine intelligence or human intellect. That’s a false choice. Alternative data and machine learning algorithms can co-exist with asset allocation and portfolio construction processes engineered and overseen by flesh and bone financial professionals.

Investment professionals, we’re here to tell you that "Yes, Virginia, there is a Santa Claus," and Yes, Investment Domain Expertise is Still Required.[32] Machine learning algos and alternative data may yearn to run free, unobstructed by human oversight and input, but machine learning algos fueled with Alt-Data may generate spurious correlations and lead into blind alleys. {Warning: A machine learning algorithm will always find a pattern, even if there is none.[33] }

Collaboration between investment professionals, data science specialists, and programmers can complement investment decision-making. Domain expertise is essential by formulating investment hypotheses that can be tested and instill confidence in model outputs. This ensures conviction in the investment thesis and that any conclusions drawn from data inputs and model outputs are based on statistical rigor and rooted in sound investment rationales.[34]

Judgment and expertise may be used to adapt models and data from other domains to the current situation. Machine learning, statistics, and econometrics are useful to derive information from existing data and predict the future as long as the environment is similar to the environment used in the data analysis.

Human judgment and theory can guide us in deciding which factors are similar or different across datasets or situations, and how one can adapt or combine different sources of data to the current situation. Humans are good at pattern recognition and computers are good at data processing. At times like these when data is limited, we need to combine both.[35]

In the COVID era, homo sapiens will need to audit data input, model assumptions, and model output more frequently than prior to the novel Coronavirus. How will models respond to zero inputs, tenfold demand increases, “annualized” GDP figures, or the negative price of oil?[36]

The task of synthesizing novel information is best done by humans rather than machines and summons the call for quantitative intuition. This writer has faith in the indomitable spirit of chartered and credential financial professionals and fiduciaries to answer the call.

Rick Roche is a Managing Director at Little Harbor Advisors, LLC. Little Harbor Advisors (LHA) is a sponsor of alternative investment strategies. Rick is also the Founder of Roche Invest AI, LLC, a consultancy that promotes the use of machine learning and alternative investment data in quantitative models. He holds Series 3 (Commodities), 7, 63 and 65 licenses. He earned his Chartered Alternative Investment Analyst (CAIA) charter designation in 2014.

[1] “Alternative Facts,” Wikipedia, Chuck Todd of NBC News response to Kellyanne Conway on Meet The Press, interview, Jan 22, 2017.

[2] Baghai, P., et al., McKinsey, “Achieving Digital Alpha in Asset Management,” Nov-2018, page 11.

[3] “Global Data and Analytics Survey,” PwC, July-2016.

[4] Furlonger, D., Gartner Research, “2017 CEO Survey: A Financial Services Perspective,” published Apr 11, 2107 (subscription required).

[5] Furlonger, D., & Newton, A., Gartner Research, “Digitalization Will Make Most Heritage Financial Firms Irrelevant,” Jan 29, 2018.

[6] “Driving ROI Through AI: AI Best Practices, Investment Plans and Performance Metrics of 1,200 Firms” e-book, by ESI ThoughtLab and DataRobot, 4Q 2020, pages 12, 14, 16.

[7] Ibid, “Driving ROI Through AI,” page 16.

[8] Burton-Taylor Intl. Consulting, “Global Spend on Financial Market Data Totals A Record $32. Billion in 2019, Rising 5.6% on Demand For Pricing, Reference and Portfolio Management Data,” April 15, 2020.

[9] “Total Buy-side Spend on Alternative Data,” accessed at Alternativedata.org, Industry Stats, and “Alternative Data Market Analysis and Forecasts from 2016 to 2027," Grand View Research, Inc., Sept., 2020.

[10] Kennedy, M., “Sam Walton: A Legacy of Customer Obsession,” May 7, 2016.

[11] Hope, B., “Counting Cars to Predict Earnings,” Wall Street Journal, MoneyBeat Blog, Nov. 20, 2014.

[12] Neudata “The Future of Alternative Data Conference Agenda, Oct 29-30, 2019; and “Jeffries’ M Science has shaken up among data science, sales execs,” Business Insider, Dec. 18, 2019. https://www.neudata.co/events/london-conference-2019

[13] “M Science” profile on Alternativedata.org

[15] Fenn, J., Blosch, M., Gartner, “Understanding Gartner’s Hype Cycle,” Aug 20, 2018.

[16] Khan, I., “Gartner dead wrong about big data hype cycle,” Computer World, Sept. 6, 2012.

[17] Shaw, C., CMO-Quantl, “Top 5 Trends in Alternative Data,” Quandl Blog, June 4, 2019.

[18] Quantl, “Sell Your Data to Wall Street” Guide, page 2.

[19] Taylor, P. “The extraordinary rise of alternative data, investors’ secret weapon,” Pivot Magazine, CPA Canada, Dec. 19, 2019.

[20] Camm, J., & Davenport, T., “Data Science, Quarantined,” MIT Sloan Management Review, July 15, 2020.

[21] Marrale, M., CEO of M Science, “Alternative Data Is The New Guidance,” Forbes, June 16, 2020.

[22] Netzer, Ph.D., O., “How to Make Sound Decisions With Limited Data During the Coronavirus Pandemic,” Columbia Business School/Data Science Institute, April 2, 2020.

[23] Goetz, M., Forrester Research “Why Wait? The Future of Data is Now,” Sept. 28, 2020.

[24] Ibid, “Alternative Data Market Analysis & Forecasts from 2016-2027," Grand View Research, Sept., 2020.

[25] Seth’s Blog: Data into information.

[26] Greene, P., Atty, Lowenstein Sandler, “Alternative Data = Better Investment Strategies, But Not Without Concerns,” Sept., 2019.

[27] “More Hedge Funds Close in 2019 than Opened,” Chief Investment Officer magazine Jan. 6, 2020.

[28] Ibid, Lowenstein Sandler survey, page 13.

[29] Noble, L., & Balint, A., “Casting The Net: How Hedge Funds are Using Alternative Data,” page 16.

[30] Lohr, S., “Sure, Big Data Is Great. But So Is Intuition,” New York Times, Dec. 29, 2012.

[31] Digital Brew, “Quality, Speed or Price: The Unattainable Triangle,” accessed on 08-12-20.

[32] Editorial called, "Is There a Santa Claus?" appeared in Sept. 21, 1897, edition of The (New York) Sun.

[33] Lopez de Prado, Ph.D., M., “The 7 Reasons Most Machine Learning Funds Fail,” Advances in Financial Machine Learning, John Wiley & Sons, 2018.

[34] Cook, M., Sanchez, J., Schechter, A., & Bernadiner, M., “The Ubiquity of Data: Challenges and Opportunities for Asset Managers,” Lazard Asset Management, May 2019.big d

[35] Ibid, Netzer, Ph.D., O., “How to Make Sound Decisions With Limited Data During the Coronavirus Pandemic,” April 2, 2020.

[36] Ibid, Camm, J., & Davenport, T., “Data Science, Quarantined”