By Nicolas Rabener, CAIA, of FactorResearch (@FactorResearch)

INTRODUCTION

Investing in hedge funds is challenging as both strategies and fund structures are complex. Almost all strategies are cyclical, although not all are on the same cycle. For example, statistical arbitrage tends to perform best when volatility is high, however, that represents a poor environment for long-short equity strategies with a value bias. The performance drivers are relatively clear for some strategies, but far less obvious for others like CTAs.

Creating and managing a dedicated team of hedge fund analysts is expensive and time-consuming, which makes it viable for only the largest asset managers. An alternative option is hiring investment consultants, however, there is plenty of evidence that these do not add much value to the strategy selection process. The key issue seems to be that these primarily recommend the largest and most successful funds in order to minimize their own career risk, which essentially represents performance chasing (Jenkinson et al). Given a lack of performance consistency, this approach tends to result in poor returns.

Asset allocators can also outsource the strategy selection process to hedge fund managers by investing in multi-strategy hedge funds. Theoretically, these should have fewer conflicts of interest and superior knowledge of the different hedge fund strategies as well as their performance drivers.

In this short research note, we will explore the performance and characteristics of multi-strategy hedge funds.

COMMERCIAL SUCCESS OF MULTI-STRATEGY HEDGE FUNDS

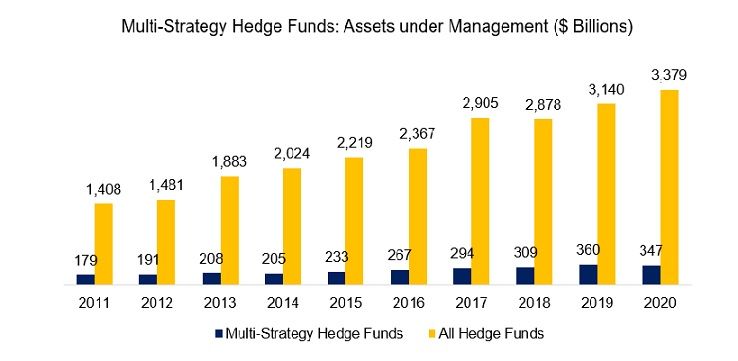

The assets under management in the hedge fund industry have increased by approximately 10% per annum from $1.4 to $3.4 trillion in the period between 2011 and 2020. Multi-strategy hedge funds also gained assets over that period, but their market share decreased from 13% to 10%.

Given that the number of hedge fund strategies continues to increase, e.g. the fairly new cryptocurrency funds, the complexity of hedge fund investing has not reduced. From this perspective, it is somewhat unusual that multi-strategy funds have not managed to exploit their expertise and gained market share.

Source: BarclayHedge, FactorResearch

PERFORMANCE OF MULTI-STRATEGY HEDGE FUNDS

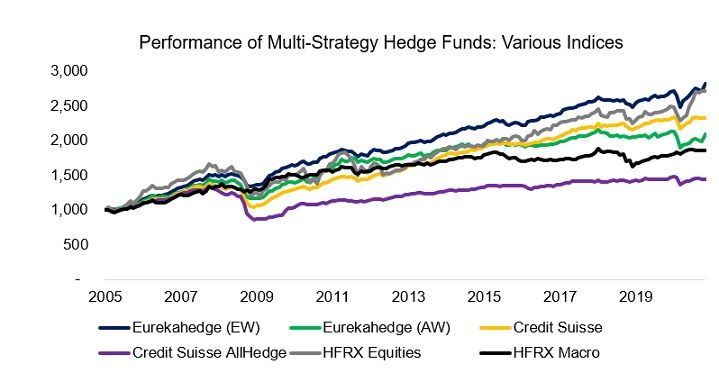

First, we investigate the performance of multi-strategy hedge funds by using indices from three different data providers. Eurekahedge offers equal (EW) and asset-weighted (AW) indices, Credit Suisse two indices with different universes, and HFRX only multi-strategy indices for equities and global macro, but not ones that invest across all asset classes.

We observe divergent returns across the indices in the period from 2005 to 2020 that range from 2.3% to 6.8% per annum. However, although the returns were heterogenous, the trends were identical.

The difference in returns can be explained by higher survivorship bias, which is more extreme in some indices than others. Hedge fund managers tend to report returns to data providers only when performance has been great, which introduces a backfill bias as some providers allow the inclusion of past realized returns. Furthermore, fund managers tend to stop reporting when returns become too negative and a fund liquidation is foreseeable. In essence, this means that realized investors’ returns are far lower than some of these indices indicate.

Source: Eurekahedge, Credit Suisse, HFRX, FactorResearch

THE ALLOCATION SKILLS OF MULTI-STRATEGY HEDGE FUND MANAGERS

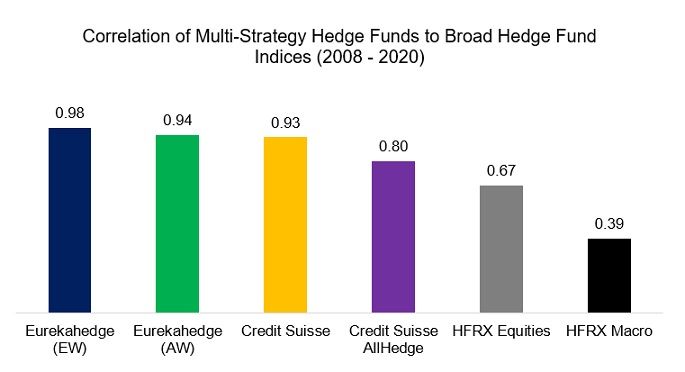

Next, we evaluate if multi-strategy funds offer the same exposure as broad hedge fund indices. Some of these indices are available as ETFs and structured notes sold by investment banks, which are significantly cheaper than the fees charged by multi-strategy hedge funds. The fees charged are quite diverse and in the worst-case, there is a double-layer of fees, i.e. a fee for the multi-strategy fund manager as well as fees for the underlying fund managers.

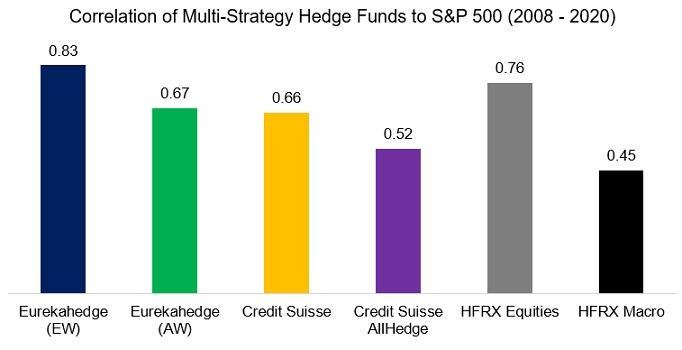

We calculate the correlation of the multi-strategy hedge funds to the broad hedge fund indices and observe high correlations for the indices from Eurekahedge and Credit Suisse. In the case of HFRX, the correlations are lower, but that is due to comparing single-asset class to cross-asset class indices.

These results indicate that investors get almost the same exposure from multi-strategy funds as when investing in broad hedge fund indices directly, which is not unexpected.

Source: Eurekahedge, Credit Suisse, HFRX, FactorResearch

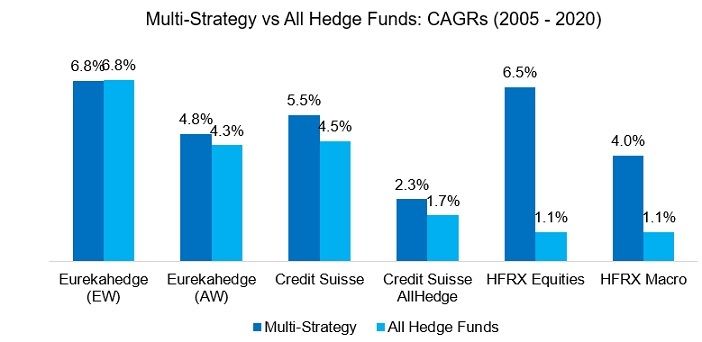

Given the high correlations, an investor might argue that it is better to invest in the broad hedge fund indices rather than allocating capital to expensive multi-strategy hedge funds. However, when comparing the returns per annum between 2005 and 2020, multi-strategy seems slightly advantageous, which would indicate superior strategy selection skills.

The equity and global macro multi-strategy hedge funds from HFRX seem especially attractive, but in this case, the comparison is not quite accurate given that these represent single asset classes versus the broad hedge fund indices that also include asset classes like fixed income and commodities.

Source: Eurekahedge, Credit Suisse, HFRX, FactorResearch

One of the frequent criticisms of hedge funds is that they represent expensive beta plays. In order to evaluate this claim, we measure the correlation of multi-strategy hedge funds to the S&P 500 in the period from 2008 to 2020, which supports the argument. Unfortunately, this implies that investors should expect marginal diversification benefits from investing in multi-strategy hedge funds.

Source: Eurekahedge, Credit Suisse, HFRX, FactorResearch

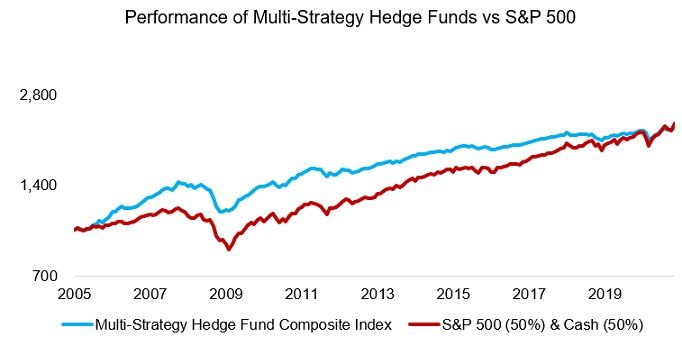

We can visualize the equity beta of multi-strategy hedge funds by creating a simple proxy comprised of the S&P 500 (50%) and cash (50%). Comparing this proxy to an equal-weighted composite of the six multi-strategy hedge fund indices highlights identical trends in performance over the last 15 years, which is also reflected in a high correlation of 0.77 to the stock market.

A hedge fund aficionado might argue that multi-strategy hedge funds have outperformed the proxy throughout most of that period and perhaps offered high risk-adjusted returns. However, it is worth recalling that hedge fund indices suffer from survivorship bias, which means we need to discount the returns as realized investors’ returns will be lower.

Source: Eurekahedge, Credit Suisse, HFRX, FactorResearch

FURTHER THOUGHTS

Why do multi-strategy hedge funds not offer more compelling investment characteristics?

There are multiple reasons why that is challenging to achieve.

In principle, a hedge fund should offer a portfolio that is partially or fully hedged, which typically means having a low beta or correlation to equity markets, as that offers the highest diversification benefits for a capital allocator. However, many strategies like CTAs are not designed to be constantly equity market neutral.

Even focusing purely on equity market neutral strategies does also not seem viable as the alpha has become less than the fees being charged on average given the highly competitive capital markets. Multi-strategy hedge fund managers need equity beta for generating positive performance.

Although that defeats the purpose of investing in a hedge fund in the first place, capital allocators bizarrely want equity beta. In theory, everyone seeks uncorrelated strategies, but in reality, even the most sophisticated investors struggle with strategies that behave totally differently from equity markets, e.g. long volatility strategies. Given this, multi-strategy funds are somewhat doomed to provide nothing more than equity in a different shade.

RELATED RESEARCH

Hedge Fund Battle: Systematic vs Discretionary Investing

Equity Market Neutral Hedge Funds: Powered by Beta?

Global Macro: Masters of the Universe?

Merger Arbitrage: Arbitraged Away?

Replicating Famous Hedge Funds

REFERENCED RESEARCH

Picking Winners? Investment Consultants’ Recommendations of Fund Managers