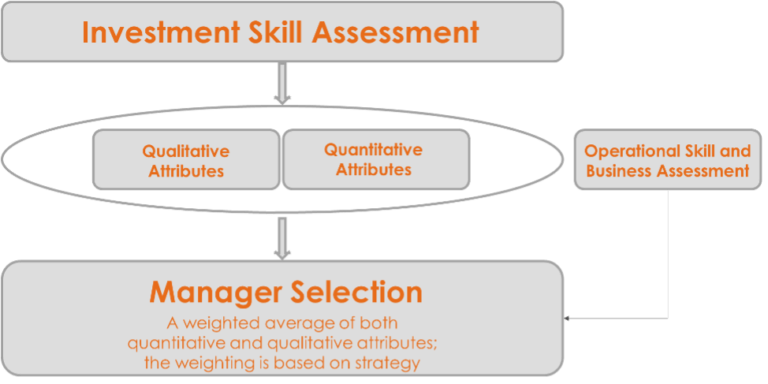

By Keith Black, PhD, CFA, CAIA, FDP, Managing Director, Content Strategy, CAIA Association and Mark S. Rzepczynski, PhD, Founding Partner and CEO, AMPHI Research and Trading Given the reliance on quantitative analysis in asset allocation, some investors may be tempted to continue with a numerical approach when filling their asset allocation buckets with managers. That is, if capital markets assumptions and quantitative risk and return analyses helped you to decide how to allocate 8% to hedge funds in the first place, why not just use historical returns to find which six hedge fund managers will comprise that 8% of your portfolio? To understand the current practice of due diligence, and more specifically, to test the relative importance of quantitative, qualitative, or operational factors within manager selection processes, CAIA Association recently surveyed its global membership base, receiving responses from 111 asset managers and 233 institutional investors. CAIA Members were instructed to only complete the survey if they were regularly involved in the manager research process, either as an investor searching to place new allocations, an asset manager searching for new investors, or a consultant interviewing asset managers on behalf of investors. In this post, we highlight some key results from our survey, along with some other insights from our own experience as practitioners. The Manager Research Process Manager research is a relatively complex and lengthy process, with most investments made after a three to nine-month process. Some investors start the process with a quantitative screen, seeking to narrow down the universe of managers for potential investment by setting minimum return, maximum risk, and/or minimum track record requirements. Other investors will start their search in a qualitative way, contacting asset managers they have met at conferences or through referrals from other investors.  Figure 1: Simplified Version of the Manager Research Process Source: CAIA Association Once an asset manager appears on a due diligence list, the investor initiates contact either through a request for a short meeting or a more formal request for proposal (RFP) or due diligence questionnaire (DDQ) process. Completing the due diligence questionnaire can be time-consuming for an asset manager, as less than 14% of investors say they use an industry-standard DDQ form. This means that asset managers will be spending time answering questions that are at least partially customized for each investor. This effort is not in vain, though, as over 70% of the investors we surveyed view DDQ responses as very important or extremely important to the due diligence process. Qualitative vs. Quantitative Analysis: Which Is More Important? The majority of CAIA Members who responded to the survey say that they place equal weight on the qualitative and quantitative due diligence processes. After the Madoff scandal of 2008, increasing numbers of investors moved away from a purely quantitative process, as no matter how strong the reported returns may appear to be, investors now know that qualitative and operational due diligence are vital to confirm those returns. Not only do investors want to know if the track record truly reports historical risk and return, they also want to understand the asset manager and their strategy to determine the sustainability of those returns and the market environments when the strategy may earn favorable returns.

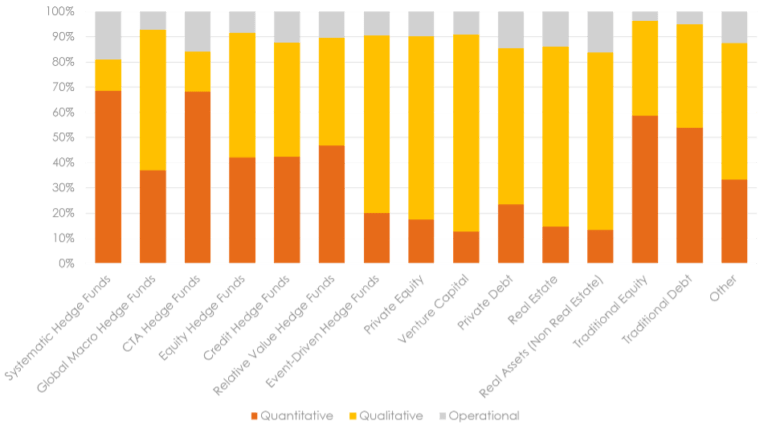

Figure 1: Simplified Version of the Manager Research Process Source: CAIA Association Once an asset manager appears on a due diligence list, the investor initiates contact either through a request for a short meeting or a more formal request for proposal (RFP) or due diligence questionnaire (DDQ) process. Completing the due diligence questionnaire can be time-consuming for an asset manager, as less than 14% of investors say they use an industry-standard DDQ form. This means that asset managers will be spending time answering questions that are at least partially customized for each investor. This effort is not in vain, though, as over 70% of the investors we surveyed view DDQ responses as very important or extremely important to the due diligence process. Qualitative vs. Quantitative Analysis: Which Is More Important? The majority of CAIA Members who responded to the survey say that they place equal weight on the qualitative and quantitative due diligence processes. After the Madoff scandal of 2008, increasing numbers of investors moved away from a purely quantitative process, as no matter how strong the reported returns may appear to be, investors now know that qualitative and operational due diligence are vital to confirm those returns. Not only do investors want to know if the track record truly reports historical risk and return, they also want to understand the asset manager and their strategy to determine the sustainability of those returns and the market environments when the strategy may earn favorable returns.  Figure 2: Relative Importance of Quantitative, Qualitative, and Operational Due Diligence by Strategy Source: CAIA Association The perceived difficulty of due diligence, as well as the importance of qualitative versus quantitative analysis, varies by the asset class or strategy being considered. Traditional equity and debt strategies require a relatively straightforward and quantitative due diligence process, perhaps because many of those strategies are managed under the oversight of a national securities regulator that requires regular transparency of returns and holdings, specific governance structures, as well as limits on concentration, leverage, and derivatives. At the opposite end of the spectrum, the evaluation of private equity and venture capital managers is the most qualitative and the most complex. Because these are private structures, the general partners of these funds don’t have the same required transparency and liquidity requirements of funds available in the traditional markets. In addition, quantitative data may be less available in private equity, as many GPs may launch only a few funds in their career and only report quarterly returns based more on appraisals and valuations of recent funding rounds rather than marking the positions to publicly-traded valuations. When investors do rely on quantitative measures, they might not be focusing on the same measures that asset managers believe are most important. While many managers are focused on risk-adjusted returns, such as the Sharpe ratio, investors consider returns and correlations to be more important than volatility. One of the most important factors to investors is to be able to understand the returns and determine the attribution of those returns to skill or market factors. Investors say they also value the ability to compare the returns to other managers offering similar investment strategies. When considering qualitative factors, the most important is to build trust between the manager and the investor. After verifying the risk and returns to be true, the investor needs to be convinced that the manager’s firm is managed with integrity and transparency and that investor interests are aligned with the interests of the manager. Indeed, according to our investor survey, integrity, alignment of interests, and transparent communications were rated as the three most important cultural factors, outweighing factors such as office layouts, team size, ownership, or client service. Investors also care deeply about the personnel and the team employed by the asset manager. They focus on employee retention, the experience of the team in managing assets, and consider investment credentials, such as CAIA, FRM, or CFA, to be more influential in the manager evaluation process than the specific universities attended by the team or the number of investment professionals holding MBA or PhD degrees. When considering the investment process, allocators want to understand the source of the manager’s returns, unique insights, and the risk management process. Managers with strong returns may find it difficult to be approved for investment when their risk management process is not well implemented or well explained. Over the three-to-nine-month process, investors will have a large number of both quantitative and qualitative queries before hiring an asset manager. The process may start with an in-person (or now Zoom) meeting and progress to an on-site meeting, where the investor visits the office of the asset manager to have access to a wider portion of the asset management team. While more managers believe that the lead analyst on the due diligence team makes the final decision, that is only partly true. While the lead analyst typically has the ability to conclude a due diligence process without an investment, investors say that most often it is an investment committee that makes the final decision as to which managers are ultimately added to the allocator’s portfolio. Stay tuned for more posts in this series. You also are invited to watch a replay of “The Art of Due Diligence” webinar to see conclusions from the survey data as well as extra analysis from the authors of the survey and the study.

Figure 2: Relative Importance of Quantitative, Qualitative, and Operational Due Diligence by Strategy Source: CAIA Association The perceived difficulty of due diligence, as well as the importance of qualitative versus quantitative analysis, varies by the asset class or strategy being considered. Traditional equity and debt strategies require a relatively straightforward and quantitative due diligence process, perhaps because many of those strategies are managed under the oversight of a national securities regulator that requires regular transparency of returns and holdings, specific governance structures, as well as limits on concentration, leverage, and derivatives. At the opposite end of the spectrum, the evaluation of private equity and venture capital managers is the most qualitative and the most complex. Because these are private structures, the general partners of these funds don’t have the same required transparency and liquidity requirements of funds available in the traditional markets. In addition, quantitative data may be less available in private equity, as many GPs may launch only a few funds in their career and only report quarterly returns based more on appraisals and valuations of recent funding rounds rather than marking the positions to publicly-traded valuations. When investors do rely on quantitative measures, they might not be focusing on the same measures that asset managers believe are most important. While many managers are focused on risk-adjusted returns, such as the Sharpe ratio, investors consider returns and correlations to be more important than volatility. One of the most important factors to investors is to be able to understand the returns and determine the attribution of those returns to skill or market factors. Investors say they also value the ability to compare the returns to other managers offering similar investment strategies. When considering qualitative factors, the most important is to build trust between the manager and the investor. After verifying the risk and returns to be true, the investor needs to be convinced that the manager’s firm is managed with integrity and transparency and that investor interests are aligned with the interests of the manager. Indeed, according to our investor survey, integrity, alignment of interests, and transparent communications were rated as the three most important cultural factors, outweighing factors such as office layouts, team size, ownership, or client service. Investors also care deeply about the personnel and the team employed by the asset manager. They focus on employee retention, the experience of the team in managing assets, and consider investment credentials, such as CAIA, FRM, or CFA, to be more influential in the manager evaluation process than the specific universities attended by the team or the number of investment professionals holding MBA or PhD degrees. When considering the investment process, allocators want to understand the source of the manager’s returns, unique insights, and the risk management process. Managers with strong returns may find it difficult to be approved for investment when their risk management process is not well implemented or well explained. Over the three-to-nine-month process, investors will have a large number of both quantitative and qualitative queries before hiring an asset manager. The process may start with an in-person (or now Zoom) meeting and progress to an on-site meeting, where the investor visits the office of the asset manager to have access to a wider portion of the asset management team. While more managers believe that the lead analyst on the due diligence team makes the final decision, that is only partly true. While the lead analyst typically has the ability to conclude a due diligence process without an investment, investors say that most often it is an investment committee that makes the final decision as to which managers are ultimately added to the allocator’s portfolio. Stay tuned for more posts in this series. You also are invited to watch a replay of “The Art of Due Diligence” webinar to see conclusions from the survey data as well as extra analysis from the authors of the survey and the study.

←

Back to Portfolio for the Future™

The Art of Due Diligence, Part I: The Story Beyond the Numbers

February 25, 2021