By Fiona Boal, Head of Commodities & Real Assets and Jim Wiederhold, Associate Director, Commodities & Real Assets at S&P Dow Jones Indices.

Even though the diversification and inflation protection arguments touted by long-only commodity advocates have been somewhat diminished over the past decade, we find that there are additional investment opportunities presented by broad commodity indices, single commodities, and absolute return commodity strategies.

Alternative Approaches to Broad Commodity Beta

The S&P GSCI has paved the way for three decades of index innovation in the commodities market and remains the most widely recognized commodities index benchmark, just as when it launched in April 1991.

Critiques of first-generation broad commodity beta indices, such as the S&P GSCI, have largely centered on the choice of weighting scheme. A more diversified approach to portfolio construction may better capture the inherently low intra-commodity correlation and offer potential enhanced diversification benefits—for example, by aiming to achieve equal risk contribution from each of the underlying components.

Other ways to improve risk-adjusted returns may be by applying a level of risk management to an underlying commodity beta exposure such as targeting a specific annualized volatility level or systematically adjusting notional exposure based on a drawdown control mechanism.

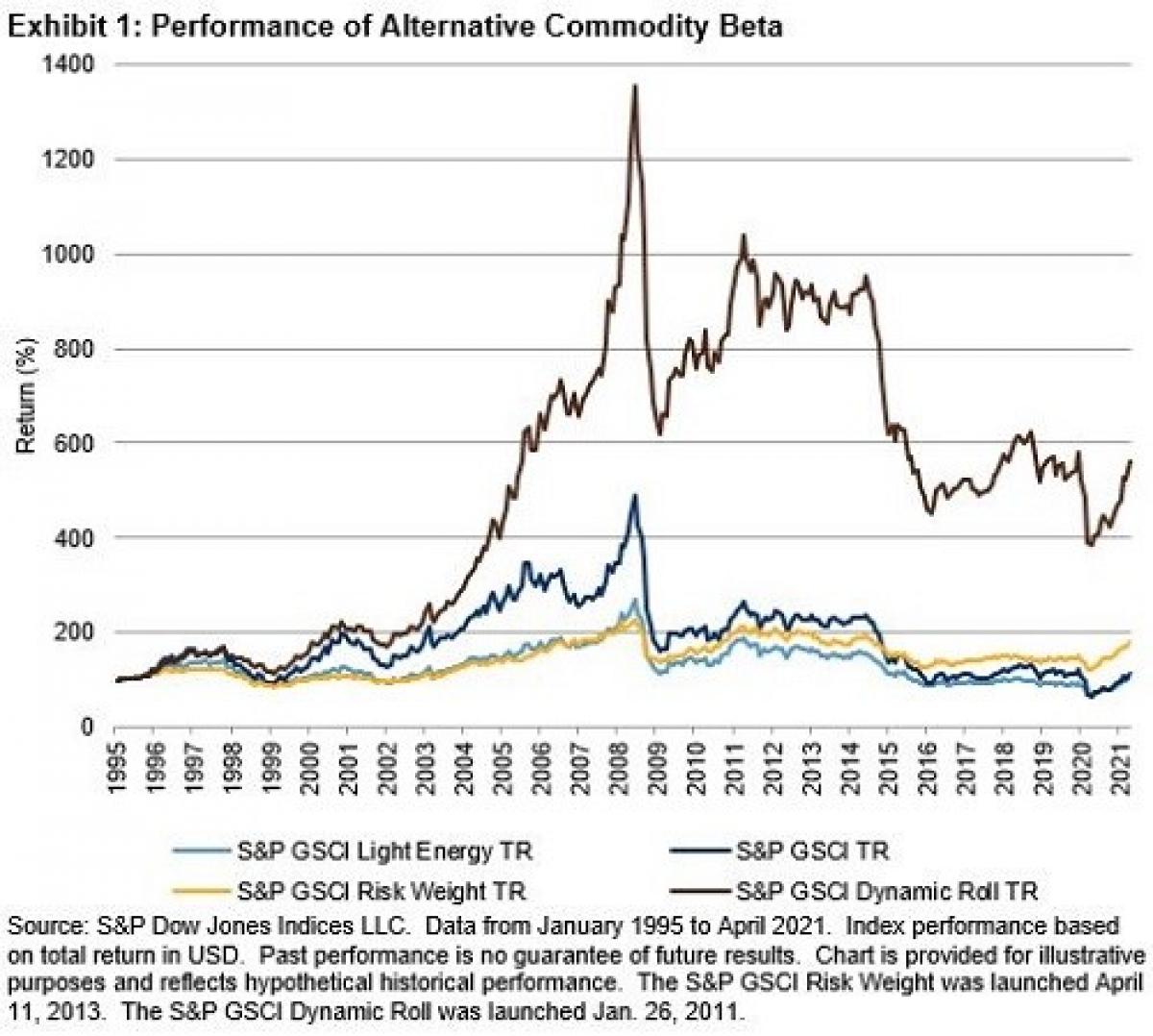

In Exhibit 1, we show the performance of a first-generation commodity index, the S&P GSCI, against some of its second-generation counterparts that aim to provide alternative commodity beta.

Commodities as Building Blocks to Express Specific Investment Themes

Increasingly, there are opportunities for investors to use commodities in their portfolios as building blocks to express specific views of a particular market, event, or risk factor. Single commodities, whether crude oil, gold, or soybeans, can be useful to investors looking to express investment themes that are dependent on unique geopolitical, demographic, structural, climate, and even health and disease factors. Commodities also benefit from being equally tradeable both long and short.

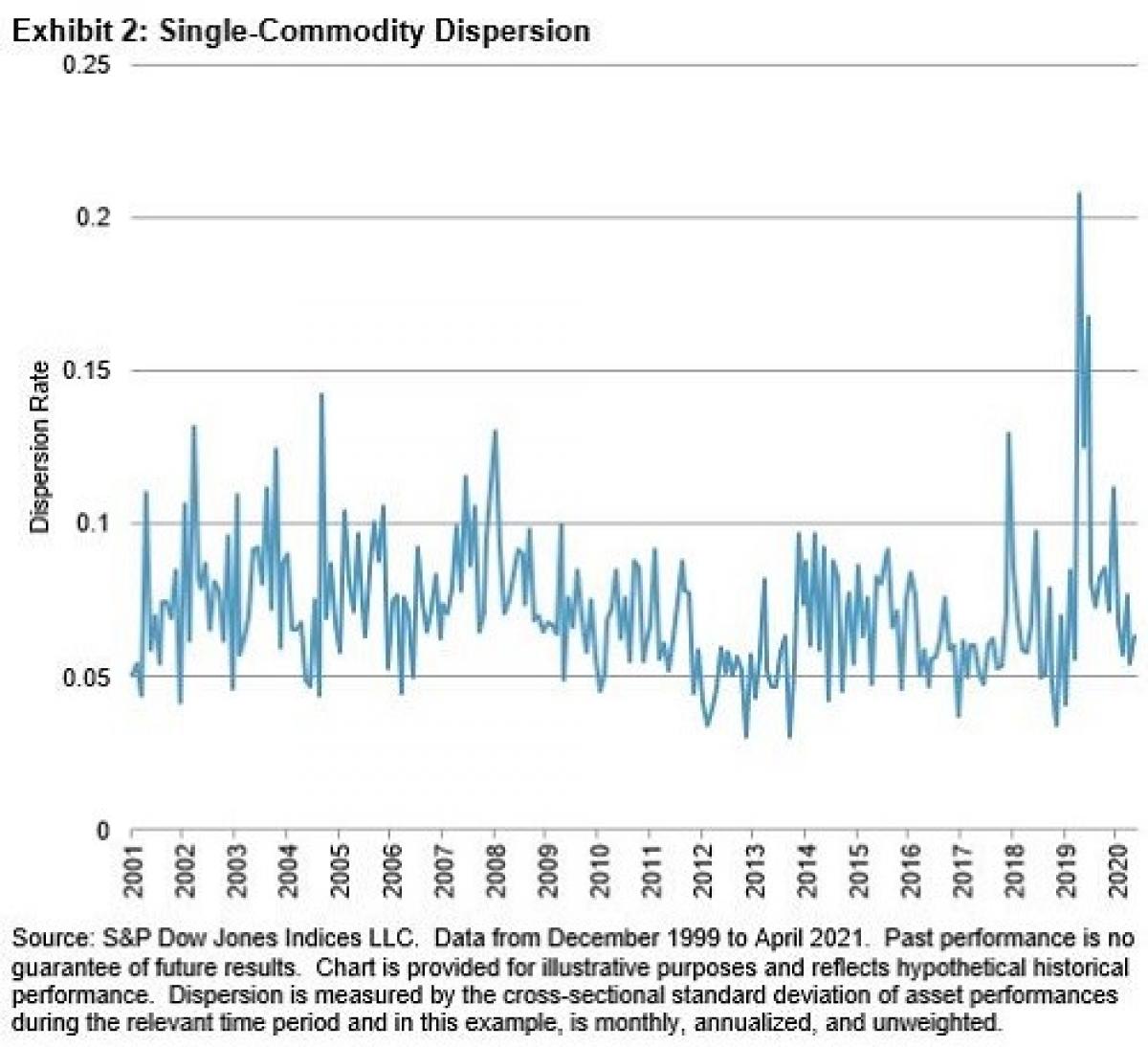

A simple look at the dispersion in the commodity market illustrates the opportunities for single-commodity investments based on a specific investment theme, or more broadly based on the idea of active management (see Exhibit 2). Dispersion provides a direct measure of diversity by measuring how differently individual assets perform compared with the average, and it is regularly considered to be a measure of market opportunity. A high level of dispersion suggests that there is alpha to be captured by investors who have the knowledge and skill to identify single-asset investment opportunities.

A number of current market trends may be interesting to see through a commodities lens—the post-COVID-19-pandemic recovery and associated inflationary pressures or the growth in green technology, for example. Historically, technology has worked against commodities, either by encouraging substitution or improving productivity and thereby requiring less of a certain raw material to meet demand. But in the case of decarbonization, the opposite is true; the adoption of green technologies signals strong demand for many commodities.

Commodities as a Tactical Trading Tool

Market participants may also use commodities for shorter-term, tactical purposes. A tactical asset allocation could be based on commodity fundamentals, macroeconomic data, and price trends, and executed in a fundamental or systematic manner. The concept of tactical tilts is well utilized by many multi-asset investors when it comes to making temporary adjustments to a long-term equity/bond mix in response to broad macroeconomic conditions or sector tilts within an equity allocation based on valuation metrics. Investors are often more cautious when it comes to adjusting what has traditionally been a smaller alternative asset allocation such as commodities. Some of this hesitation is justified on the basis of expertise, cost, and logistical trading constraints.

There may be environmental, social, and governance (ESG) lenses through which individual commodity allocations can be tilted. Creating an ESG-screened broad commodity index is possible, but for some investors, tactically tilting their commodities exposure on a more granular levels may allow them to directly advocate for more efficient and sustainable commodities production and usage.

Harnessing Commodity Risk Premia

Investors are becoming well versed in using alternative risk premia to efficiently measure, isolate, and gain access to alternative sources of return through rigorous, liquid, and transparent rules-based indices across asset classes. Risk premia that are economically intuitive, persistent over time, and executed in highly liquid markets are likely to offer the most benefit to market participants. In the commodities market, concepts such as carry have a strong economic rationale, while the underlying commodities themselves exhibit low correlation to traditional asset classes and are traded in liquid derivatives markets. The prevalence of non-profit-seeking participants in the commodities market adds to their attractiveness.

Finding ways to use the large amount of non-financial data available in commodities markets in rules-based, investable strategies is seen as a natural extension of commodity-specific risk factors. A new generation of commodities indices utilizing supervised machine learning to compute large, non-linear datasets to generate investable signals may be on the horizon.

The broad role of commodities in asset allocation may also be advanced by alternative risk premia. For some market participants, the use of a passive multi-strategy risk premia commodities allocation may be an attractive alternative to passive long-only commodities exposure. Long-only commodities exposure that is tilted to reflect risk premia such as carry, curve, or momentum may also be an alternative.

Conclusion

Commodities is a unique asset class, and there is room to consider new strategies to benefit more from the unique characteristics of commodities. Notwithstanding, market participants should be encouraged to re-examine their commodity allocations.

Looking ahead, we expect commodities investing to merge with a number of powerful trends such as incorporating ESG metrics, greater adoption of commodities risk premia, the tactical use of commodities, and the incorporation of non-traditional data.

This blog is based on the paper, Rethinking Commodities (https://www.spglobal.com/spdji/en/research/article/rethinking-commodities/) , published January 2020. The posts on this blog are opinions, not advice. Please read our Disclaimers.

For additional SPDJI commodities research & insights visit https://www.spglobal.com/spdji/en/landing/investment-themes/commodities/