By Aaron Rowlands, Research Editor, and Stanislava Zvolinskaya, Research Analyst, at Cult Wines, a global fine wine collection and investment management company.

Q4 2021 Performance Highlights

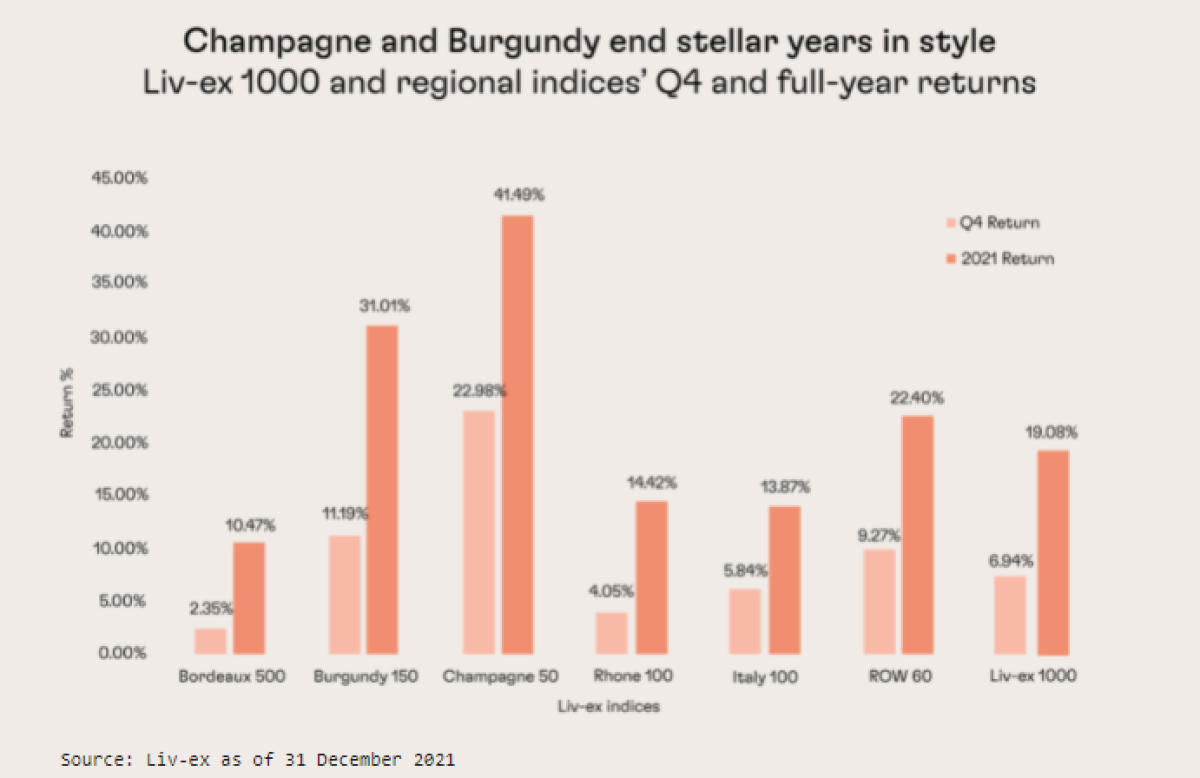

Fine wine markets had an excellent final quarter of the year. Top name producers led the rally as supply-demand imbalances continue to fuel soaring price rises for some of the world’s most iconic wines.

Champagne continued to astound with another towering gain of 22.98%, according to the Liv-ex Champagne 50 index. Low availability of vintage Champagnes alongside growing demand from an investment-minded audience has led to ongoing price rises. Several back vintages of Salon, Le Mesnil-sur-Oger Grand Cru, and Dom Perignon Vintage and Vintage Rose appreciated the most.

Supply shortages contributed to the ongoing rally in the Burgundy 150, which posted an 11.19% quarterly gain in advance of the upcoming 2020 vintage en primeur (EP) releases. Top tier producers posted the biggest gains, with prices of several Domaine Leroy wines continuing to shoot higher. Burgundy also posted its highest ever annual trade share (21.4%) in 2021, according to Liv-ex.

Some top US wines, such as Screaming Eagle and Opus One, propped up the Rest of World 60 index’s very strong final quarter, pushing its annual mark to 22.40%. The US made up 7.6% of Liv-ex’s trade by value, its highest ever share.

Conditions Support Onward Growth After Sizzing 2021

- Fine wine can continue to post healthy performance and carry over a fantastic 2021 campaign into 2022.

- Economic growth and a deepening supply-demand imbalance point to ongoing price appreciation. The pace of the fine wine rally could moderate, but it should still offer an attractive source of stability and healthy real returns amid a shifting inflation and macro policy backdrop.

- Selectivity is key, especially in Champagne and Burgundy where top names posted sky-high returns in 2021. These wines still form strong long-term investment options but select wines from Bordeaux and Italy and some up-and-coming regions and producers now offer attractive relative value.

Our outlook from a year ago noted fine wine’s greater growth potential in 2021, and the market did not disappoint. The Liv-ex 1000 index, the widest measure of the market, gained 19.08% in 2021. Fine wine posted positive returns in each month, displaying more stability than equity and government bond markets which wobbled at times amid inflation, monetary policy uncertainty, and the ongoing pandemic. We think fine wine holds plenty more performance potential as we head into 2022. Historically, fine wine’s growth periods have lasted much longer than the current rally (see Figure 1). Top name Burgundy and Champagne wines posted massive gains in 2021, but the market also diversified, opening the door for other regions and up-and-coming producers to carry the baton in the year ahead.

Source: Pricing data from Liv-ex as of December 31, 2021

Market Conditions Favour Higher Prices

The economy is in much better shape than a year ago. Although the new omicron variant provides a reminder that the pandemic is far from over, most economies can hopefully avoid extended shutdowns as vaccine rollouts continue, keeping the recovery in place. Within the fine wine market, a supply/demand imbalance should drive price appreciation into 2022. On the demand side, reopening hospitality sectors and high savings rates have sought spending outlets in recent months. Although this pent-up demand will gradually moderate, we don’t except a sharp drop as economic growth remains healthy. On the supply side, expectations of lower volumes hitting the market in upcoming vintages is fueling the imbalance. Here, we address these points in more details as part of three core themes that will drive the fine wine market in the year ahead: a) the shifting financial market backdrop; b) expectations of lower wine supply; c) market expansion to new producers and regions.

Theme 1 - Financial Market Uncertainty

Fine wine forms important diversifier: Despite the economic recovery, financial markets are entering a new period of uncertainty, and we expect to see more variable returns across asset classes and sectors in the year ahead. However, this could boost the appeal for investors to diversify into alternative assets such as fine wine. Even if fine wine’s absolute rate of return moderates, its relative performance to other assets could improve. Fine wine’s track record of performing in different macro backdrops is why we think its appeal as a safe place to park cash will remain strong during the current uncertainty. Inflation in most major economies is higher than at any point since the global financial crisis over a decade ago and recently hit a 31-year high in the US. Fine wine can provide an excellent inflation hedge because, as a collectible and physical asset, its prices have historically been driven by internal market factors. Fine wine’s intrinsic supply and demand imbalance have enabled it to outperform long term inflation rates significantly.

Fine wine also reduces the need to guess the direction of central bank policy, which is important as the US Federal Reserve and other central banks are planning to rein in the massive stimulus measures in place since early in the pandemic. This should send bond yields higher (yields move in opposite direction as prices) and could destabilise some sectors of the stock market as valuations are sky-high in many places. Fine wine has also benefitted from the global stimulus, and demand will likely normalise over the long term as the stimulus is withdrawn. However, demand should remain strong amid the improved economy. As a real asset, fine wine has proven relatively immune to swings in macro policy.

Theme 2 - Impacts from Climate Change

Lower production levels add to market imbalance: Climate change and extreme weather is deepening the supply-demand imbalance. While warmer average temperatures can benefit some cooler climate regions by helping grapes ripen consistently, unusual weather is also disrupting production and threatening quality in some places. Investors and wine collectors will need to increasingly consider the market impacts of weather disruption. A dramatic example of this came in spring 2021 when frosts across France and elsewhere in Europe came after budburst on the vines. Damp, humid weather and other irregularities have also contributed to the forecasts for lower supply for the 2020 and 2021 vintages. France, by far the largest source of investment-grade fine wine, could see its 2021 output drop by 22%-27% versus the average over the previous five years (1). Burgundy levels could fall by 50% compared to five-year averages. Italy, too, expects a lower output. Elsewhere, wildfires in California could cause many leading estates to not release a 2021 vintage due to smoke damage.

Anticipation of lower volumes during next year’s 2020 Burgundy and 2021 Bordeaux en primeur campaigns is already creating a more competitive landscape for both new releases and physical back vintages. If the cooler 2021 growing season also hurts quality in some places, expect the price pressure among select back vintages to increase.

Theme 3 - The Importance of Being Selective

Maturing market strengthens fine wine’s foundations: Selectivity within the fine wine market will take on greater importance. Many wines posted towering growth rates in 2021 that cannot sustain for the long term. This does not mean we expect prices to decline but just that certain producers and wines will now offer better relative value than others. Although selectivity can be difficult amid the fierce competition, especially in red-hot Burgundy, we are confident looking at the whole market can reveal many growth opportunities. For example, finding undervalued physical back vintages will likely be central to generating alpha for investors.

Cult Wine Investment has long stressed the potential of up-and-coming producers and wine regions. Although big returns in 2021 came from top Burgundy and Champagne producers, we also saw increased diversification with Liv-ex reporting a record number of individual wines (11,452) traded on its platform in 2021.

Italy and the US saw their trade shares rise in 2021 (Figure 4). We also expect more top wines from emerging regions such as Spain, South America, Germany and even English sparkling wine to gain traction with global fine wine collectors in the years ahead. With more choice comes more opportunity, but these less established regions and wines can be more volatile. Therefore, we approach these areas of the market with a research-based approach taking into account wine quality, relative value, demand trends and other factors on a wine-by-wine basis.

Regional Outlooks

- Bordeaux remains a cornerstone of fine wine investing.

- The upcoming 2021 EP will again form a key focal point. Difficult 2021 growing season could hurt volumes, meaning EP prices again could come higher than buyers would like.

- Select back vintages and producers in Cult Wine Investment’s Quality-Price-Ratio category offer some of the most exciting growth opportunities.

- Bordeaux’s trade share dropped below 50% for the first time in 2020 and averaged 39.0% through November 2021. This decline stems from the rise of other regions and producers rather than any material decline in Bordeaux’s appeal.

- Competition is looking fierce for 2020 vintage EP in early 2022. Getting in early while also looking at physical back vintages is essential.

- Supply-demand imbalance stems from global buyers looking to get in on red-hot market alongside expectations of lower supply of future vintages.

- Iconic and Tier 1 Burgundy wines posted some of the highest returns in all fine wine in 2021. While names like Leroy and Domaine de la Romanée Conti remain some of the safest long-term investments, their short-term performance could ease.

- The spread between these top-echelon producers and Tier 2/Up-and-coming wines widened in 2021. We think some Tier 2/Up-and-coming Burgundy wines could catch up in 2022.

- Champagne’s status as a core investment region has arrived, meaning its long-term outlook remains bright following a stellar run.

- Recent vintage releases have come in lower volumes, increasing the demand and scarcity of back vintages.

- However, the pace of the rally should moderate. Very strong post-pandemic demand and availability will likely normalize over the course of 2022.

- Rhone remains a consistent source of healthy gains even if it has been overshadowed by the sky-high pace of price appreciation in other French regions.

- Rhone’s relative value vs top-level Burgundy producers has improved. Many of the region’s wines could form a prominent source of alpha in 2022.

- Italy has established itself as a core fine wine investment region, led by Tuscany and Piedmont wines. Increasing interest from Asia has helped firm Italy’s status as a key global region.

- Italy saw a 15.3% average monthly trade share in 2021, according to Liv-ex data. After a jump in 2020, Italy maintained itshigher trade share even after the repeal of US tariffs in March, from which Italy enjoyed an exemption.

- Liv-ex reported a higher number of individual Italian wines traded so far in 2021, which is a good sign for onward growth potential.

- California and other Rest of World wines hold many long-term growth opportunities, although will likely see more volatility of returns than more established regions as liquidity is typically lower.

- California boasted more perfect 100-point critic scores in 2021 than other regions. This, alongside ‘cult’ status and low production volumes of top producers will keep prices elevated.

- Damage from wildfires and smoke in recent years is further hurting volumes, adding price pressure on physical back vintages.

- Chile continues to offer higher quality wines and represents an exciting region for the long-term. Up-and-coming producers in Spain, such as Remirez de Ganuza and Telmo Rodriguez, are boosting the growth potential of the regional market.

- Australia’s trade share has declined under the burden of Chinese import tariffs. While tariffs remain an obstacle heading into 2022, the situation could create relative value opportunities over the long term in certain Australian wines.

Original Article: Cult Wines Performance | Fine Wine Market Data | Wine Investment

About the Author:

Aaron Rowlands is the Research Editor at Cult Wines, a global fine wine collection and investment management company.

Drawing on Cult Wines’ fine wine expertise and quantitative market research, Aaron creates content discussing fine wine’s performance track record and investment credentials in order to broaden the awareness of this growing asset class.

Stanislava Zvolinskaya is the Research Analyst at Cult Wines, a global fine wine collection and investment management company.

She develops comprehensive research on the fine wine market, integrating quantitative and qualitative data and building upon Cult Wines’ existing insights.