By Frank Dornseifer, Managing Director, Philipp Bunnenberg, PhD Candidate and Level II Candidate in the CAIA program, Consultant Alternative Markets and Sven Gralla, Research Associate Alternative Markets at Bundesverband Alternative Investments e.V. at (BAI).

Methodology, Cross-section of Investors & Assets under Management:

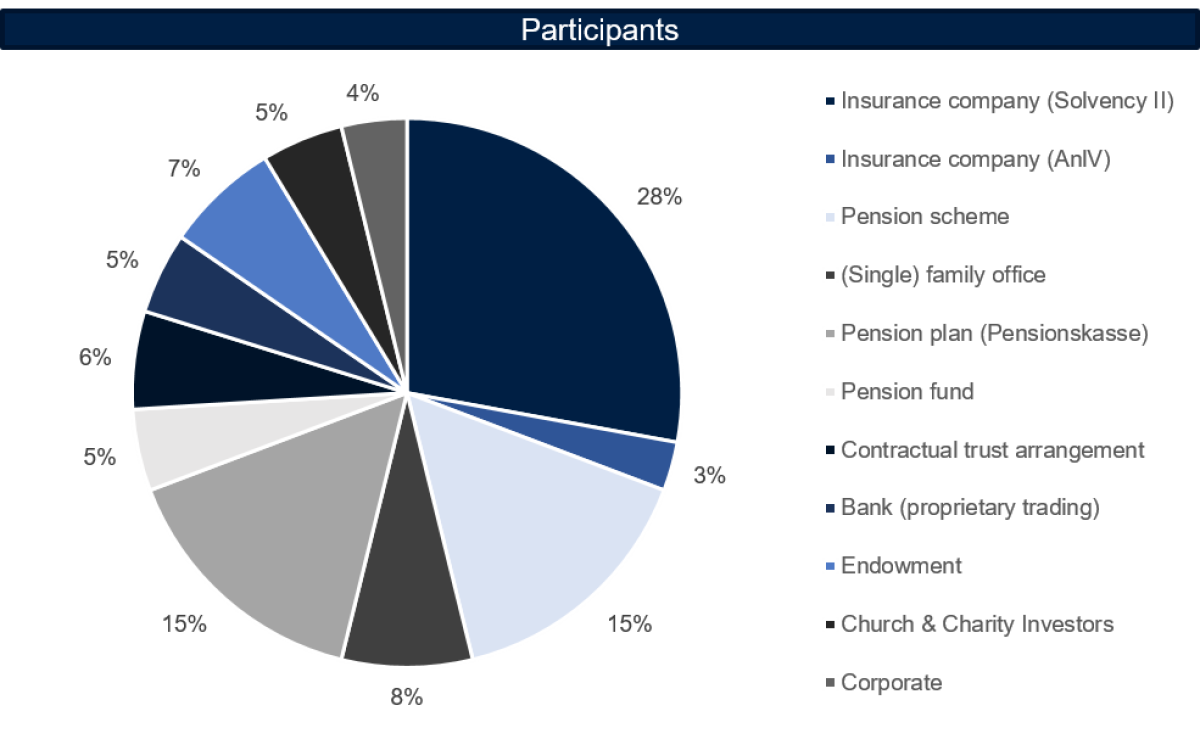

The Bundesverband Alternative Investments (BAI) recently published their BAI Investor Survey, the 8th and with 104 participating German institutional investors, including insurance companies, pension funds, pension plans & CTAs, pension schemes, corporates, traditional banks (proprietary trading), family offices, church & charity investors and foundations, combined with more than € 1,700 billion AuM the most comprehensive BAI survey to date. The BAI investor survey traditionally focuses on the buy-side, not the sell-side, of asset owners, which is why asset manager did not participate. This CAIA Blog post highlights our annual survey results with a hope of providing you with a deeper understanding of how institutional investors in Germany invest in alternative assets – not just today, but also in the future.

By its very nature, the structure of the participating investors could be a limitation of the study. The results of the BAI investor survey might be positively influenced by a self-selection bias, as investors from the BAI network are naturally more committed to alternative investments than the overall population of investors. However, with 104 institutions and more than €1,700 billion AuM, we cover a substantial and highly representative part of the investor landscape in Germany. As a consequence, we are convinced that the results of the participating investors are robust and that they very accurately reflect the population and the investment behavior of the German institutional investor landscape.

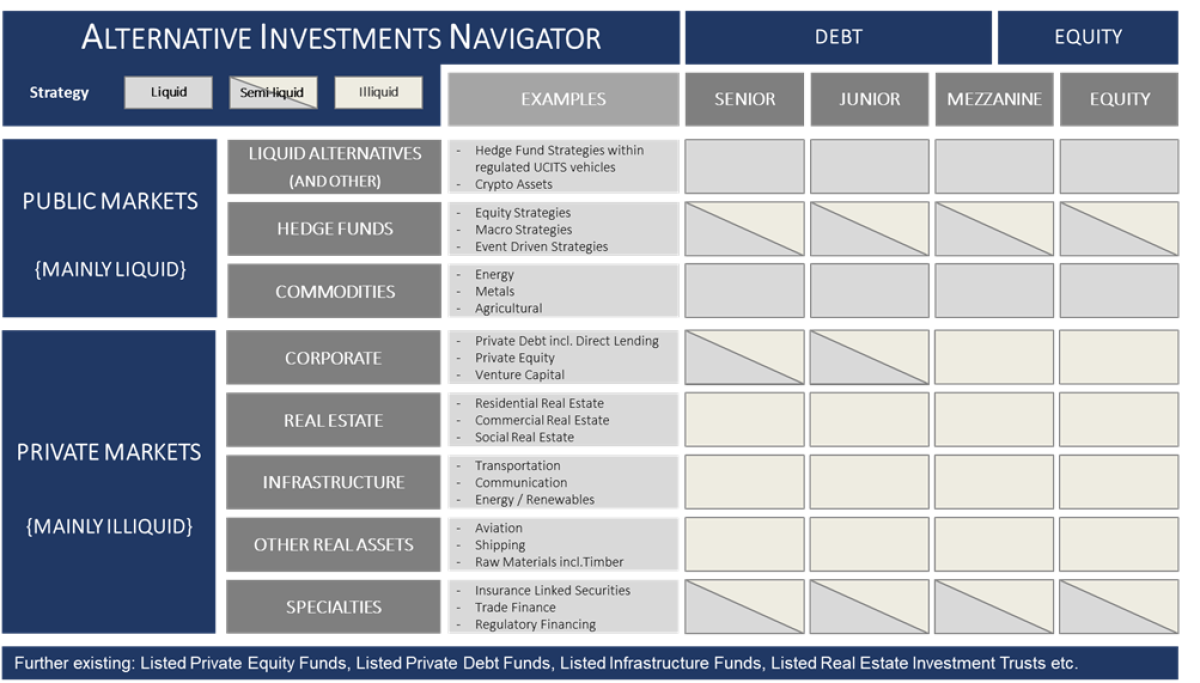

Based on the BAI definition of alternative investments, as shown in the BAI “Alternative Investments Navigator” below, we cluster alternative asset classes into hedge funds, liquid alternatives (mainly UCITS), private equity (in detail: corporate private equity, infrastructure equity, and real estate equity), private debt (in detail: corporate private debt, infrastructure debt, and real estate debt), credit specialties (such as ILS and trade finance), other real assets (such as farmland, timberland, aviation, shipping etc.), commodities, and crypto assets. We consider non-alternative investments as traditional investments, such as listed equities, corporate and sovereign bonds, and cash, but do not further discuss or quantify them.

Alternative Investments Portfolio Allocation

Despite the ongoing Covid-19-pandemic in 2021, the portfolio allocation shift towards alternative assets has not left its impressive growth path. It is the undoubtedly positive experience of investors in terms of risk-return ratio that explains the significant increase in the allocation to private market investments in recent years. The diversification potential of alternative asset classes, with which LPs unlock illiquidity and complexity premiums, is and remains the main reason for investments in alternatives.

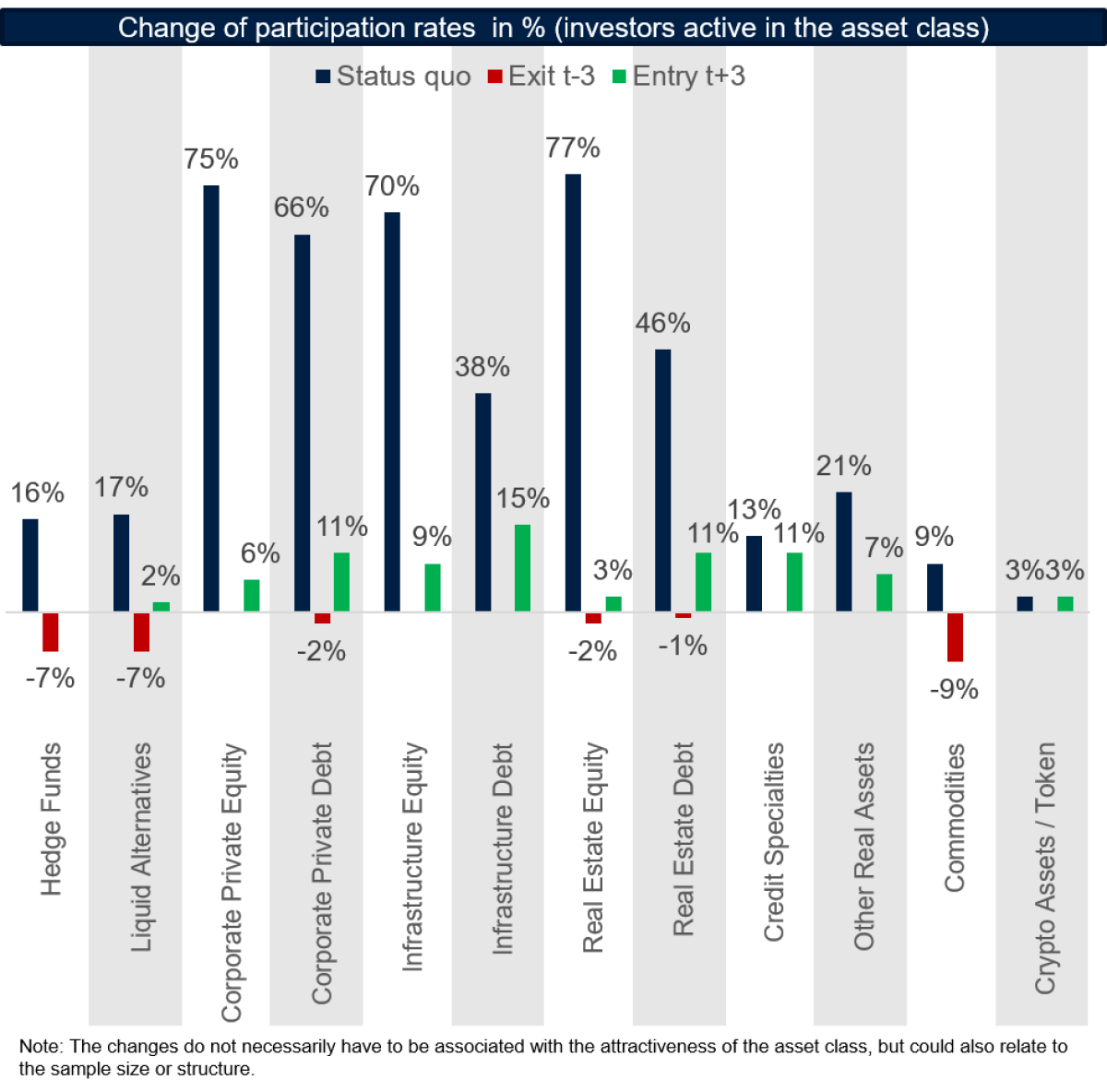

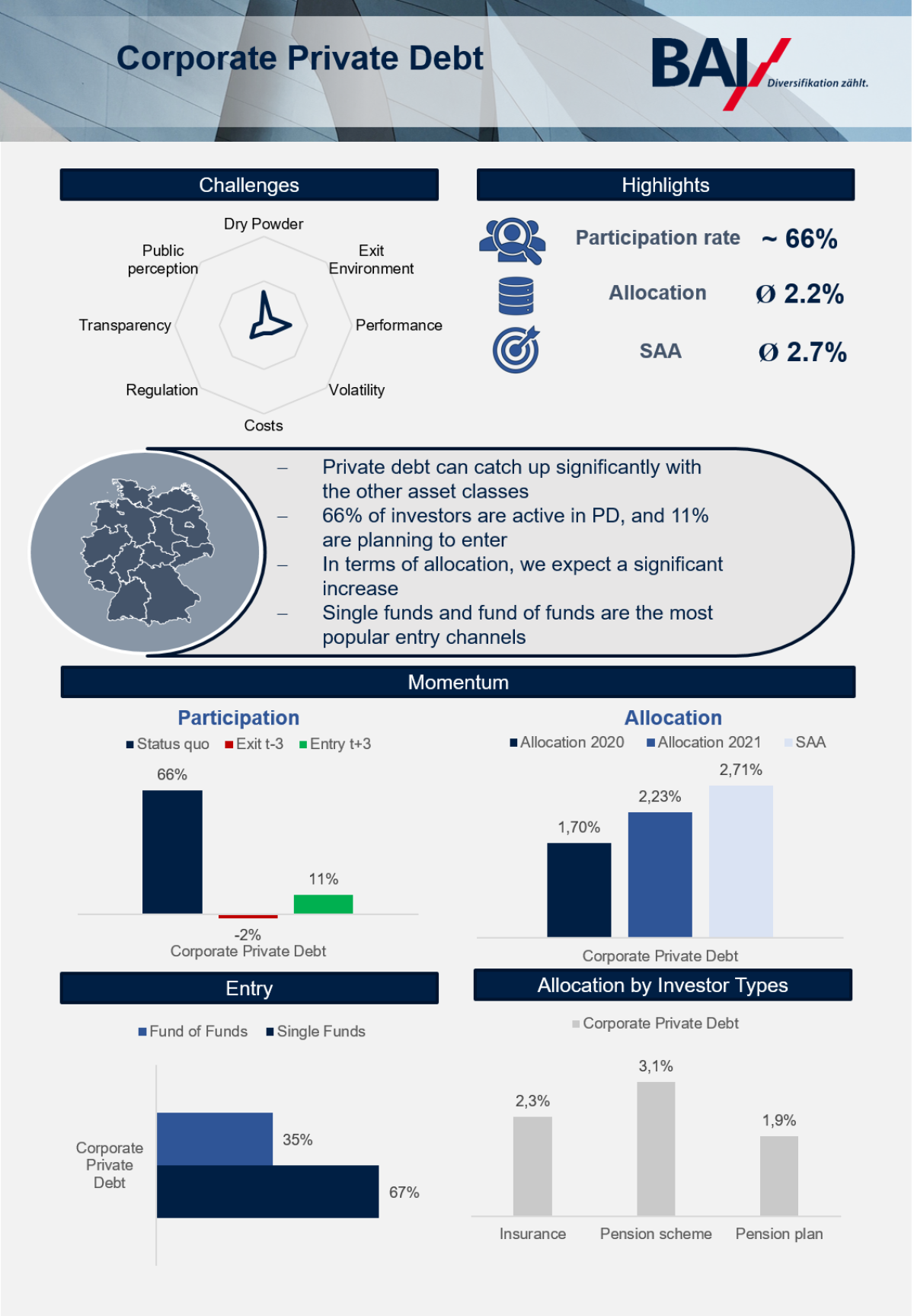

Alternative investments are no longer a niche but an established part of the portfolio for the majority of participants. Private equity investments in corporates (75 %), infrastructure (70%), and real estate (77%) are an integral part of their portfolios. Already 66 % of the investors diversify their portfolios with corporate private debt. This represents a significant increase in investments of new investors in this asset class compared to previous years. What’s more real estate debt (46%) and infrastructure debt (38%) investments continue to grow significantly as well as the demand for real assets such as timber and farmland.

On the other hand, hedge funds and liquid alternatives continue to have a difficult time in Germany. Many of the investors surveyed completely forgo additional portfolio diversification through alternative strategies. But the rather negative overall picture on the investor side did not appear in a significant exposure withdrawal from hedge fund investments. Nevertheless, only few investors are willing to enter the universe of alternative strategies. Product performance remains the biggest challenge, especially for alternative strategies in UCITS vehicles. From the perspective of German investors, management and performance fees are set too high by many hedge fund managers. However, one in six investors is still allocated and many of these plan to strategically increase their allocation in the upcoming years.

At first glance, one can see that real estate equity and corporate private equity can be found in almost all investors’ portfolios nowadays, which is why future first-time investments are limited in size. During the Covid-19-pandemic, private equity once again proved its worth as a performance and stability anchor in the institutional portfolio. The high level of dry powder certainly remains a challenge. The fact that not one of the investors surveyed wants to exit the asset class speaks for itself. In the coming years, the allocation is to be steadily expanded so that German institutional investors will soon have on average 5% of private equity exposure in their portfolios. Pension schemes are pioneers in this regard and are already moving towards an average of 7% SAA.

For infrastructure equity (9%) and in particular debt (15%) a significant increase in participation is to be expected. Moreover, it is striking that, across all asset classes, private market debt investments will continue to catch up to their equity counterparts over the upcoming years. Comparable to last year’s survey it becomes apparent that investors are still willing to increase their investments in private debt vehicles. The entire range of debt asset classes, corporate private debt, infrastructure debt, real estate debt, but also credit specialities such as ILS, will grow further in the upcoming years.

What is more, it should not be ignored that, for the first time ever, participants in the BAI investor survey stated that they currently invest in crypto assets such as crypto currencies and crypto token. The number of crypto investors will double in the next few years as another three percent plan to invest. In Germany, these are primarily HNWIs (not represented by this survey), family offices and foundations. However, the results of the survey clearly show that while interest in digital assets among institutional investors is high, allocation is still low currently. This should not come as a surprise in view of the regulatory framework that is only just developing. The low correlation to traditional investments and guard rails for the market in the form of increasing legal certainty could also make crypto assets an attractive diversifier in institutional portfolios in the future.

The growth of the alternative investments market is reflected by our estimated alternative investments portfolio allocation, based on the information provided by the respondents. On average, about 22.70 % of the portfolio is invested in alternatives. Looking at the distribution of the allocation of those investors who invest in the asset class, it is once again striking, but also not surprising for German institutional investors, that real estate equity has a significantly higher portfolio weight compared to other asset classes. Real estate is followed by corporate private equity and infrastructure equity, two asset classes in which investors have also committed a lot of capital.

Based on the investors’ sentiment, as already stated in last year’s survey, the expansion of the alternative investments’ portfolio shares will continue next year, as the growth momentum of equity as well as debt investments in corporates, infrastructure, real estate and other real assets will most likely carry on. Our survey results show that the split between traditional and alternative investments continues to become more and more aligned. We expect that the average institutional investor in Germany will expand the alternative investments exposure from 22.70% to over 25% in the next few years.

By comparing the estimated current and estimated future target allocation, it can be concluded that investors have not yet reached their target allocation in almost all alternative asset classes. One exception to this is real estate equity, which is traditionally very strong in Germany. In this field most investors are already close to their strategic target allocation. Private debt and infrastructure exposure will be increased significantly. On the other hand, some real assets are currently in a more difficult position, e. g. aircraft and ship financing. This could be related to a realignment of the portfolios from an ESG perspective, but also to the after-effects of the pandemic on travel and interrupted supply chains.

Focus on (Corporate) Private Debt

As mentioned before, debt products in particular will continue to catch up. On the one hand, the demand among investors for corporate private debt, in particular direct loans, as the most common type of private debt strategies, has been exceptionally high in recent years. Private debt’s high cash yields are especially attractive to investors in the persistent low-rate environment. On the other hand, the financing needs of SMEs are increasing. Recent regulatory proposals presented by the EU Commission could therefore provide important impetus, but it will be important that the actual design and implementation is not thwarted in the end, as e. g. in Germany, where a largely unrelated alignment with banking supervision law once again nipped the topic of loan funds in the bud. Consequently, it is not surprising that almost all German investors invest through Luxembourg vehicles. In comparison, German AIFs are only minor components in the portfolios.

All in all, for private debt funds, the Covid-19-pandemic has been a successful test for the integration into the institutional portfolio. An all-encompassing assessment of the private debt market is difficult to rate due to the heterogeneous investment universe. Return patterns diverge (in times of crisis), sometimes strongly, depending on the sub-segment of the asset class under consideration. Nevertheless, in a recent BAI paper we did illustrate that private debt, and corporate direct lending in particular, is an established and systemically important asset class that has been able to generate consistent excess returns at moderate drawdowns even in crisis periods compared to liquid debt instruments. However, the pandemic and thus a re-emerging crisis scenario is far from over. In the future, the changing interest rate environment and rising inflation rates will also have to be observed, which may also influence the environment for private debt investments.

ESG – an Alternative Investments Perspective

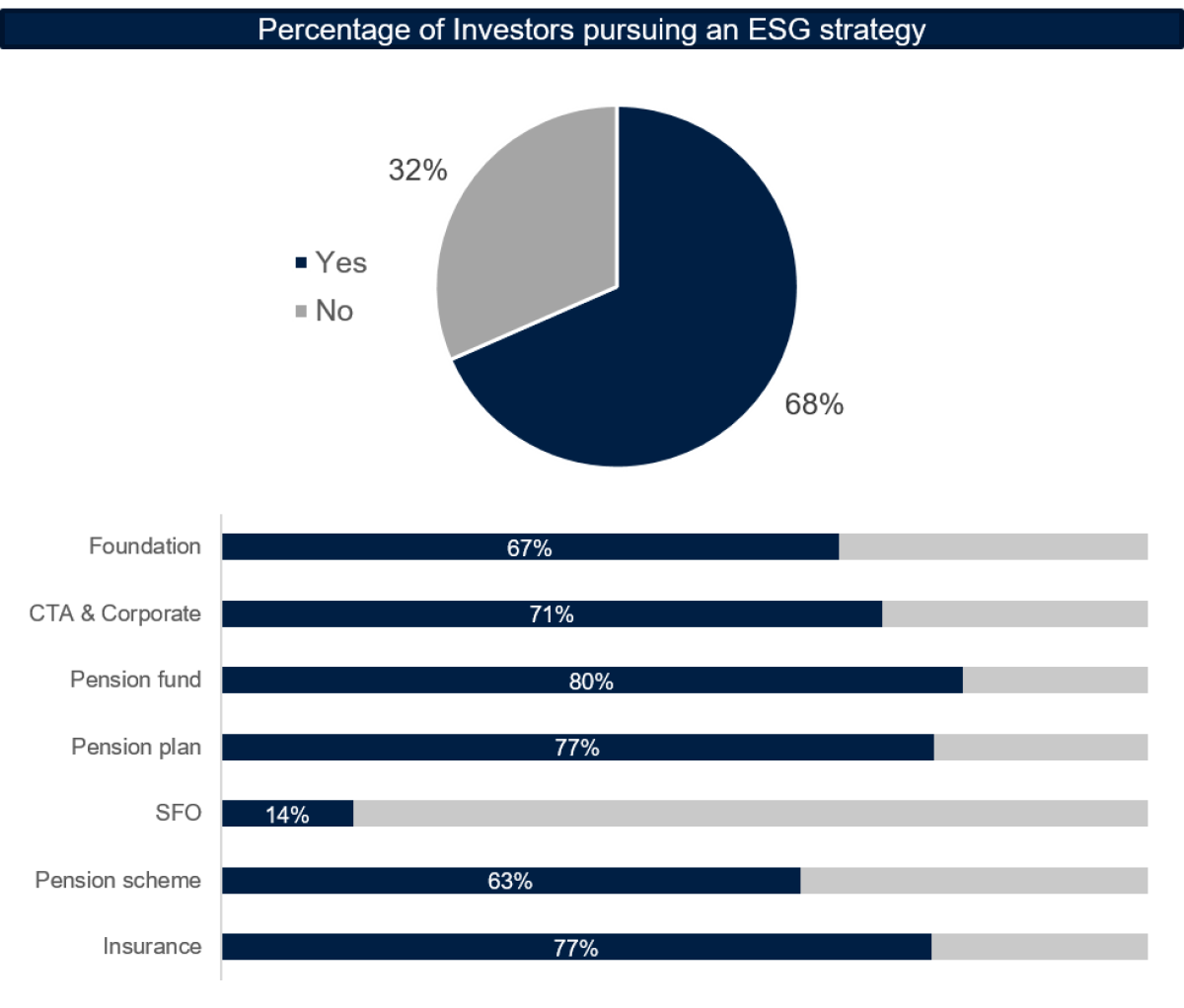

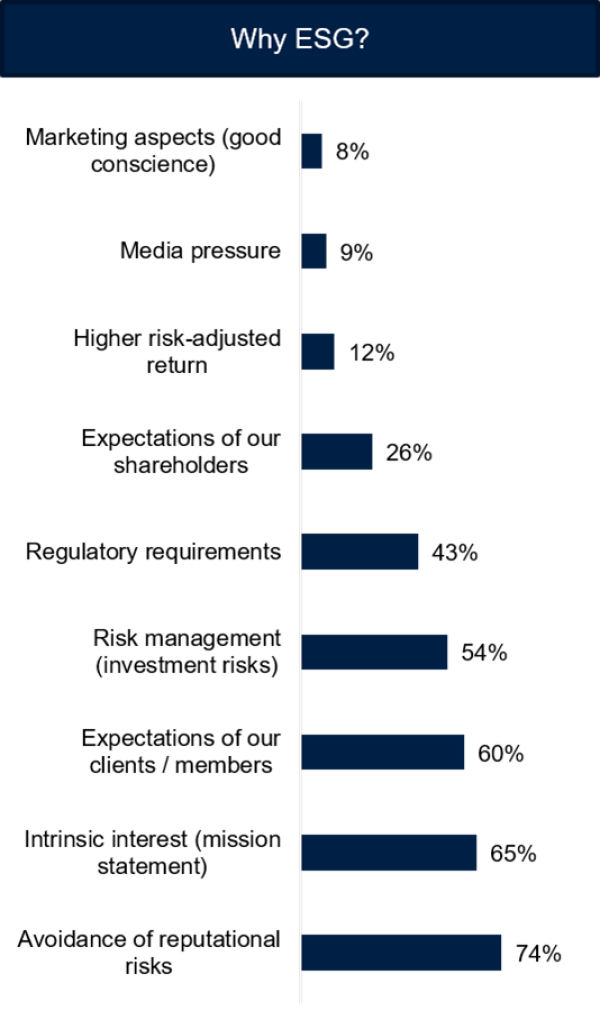

Integrating environmental, social, and governance (ESG) principles in the investment process is increasingly vital for the alternative investments industry. Asset managers are responding to growing demand from institutional investors pursuing to allocate to ESG-committed funds. The need for transparency across the industry is vibrant. Recently almost no other topic is of greater importance to the entire industry and there is no doubt that ESG will become an even bigger part of the industry in the future in the progress of the EU Sustainable Finance Initiative. Concerns about greenwashing are common and the need to draw lines are pursued by regulators in various manners in the context of the EU sustainable finance initiative. But one legitimate question is driving investors and other market participants: Is greenwashing adequately captured by regulation? There are still many question marks behind this topic. For German institutional investors greenwashing is definitely a concern, but it is not yet adequately covered by regulation. The statements made by the investors in the survey provide a clear message. They rely on their own expertise, which they are constantly building up. The investors ESG integration takes into account all three ESG aspects (environmental, social, and governance) almost equally, with environmental aspects coming first, as expected.

The return on investment is not one of the main reasons for ESG portfolio integration. Instead, primary drivers are the avoidance of reputational risk, which is an intrinsic interest, the expectation of the clients and the ESG implementation into the risk management. The four reasons mentioned have once again significantly increased in importance compared to the previous year's survey. The survey results prove that the reasons for ESG integration into the investment process are still extremely heterogeneous. This shows us, as an industry association, how difficult it is to reconcile these sometimes strongly divergent levels of interests of investors as well as of our members and other market participants.

Access to Alternative Investments

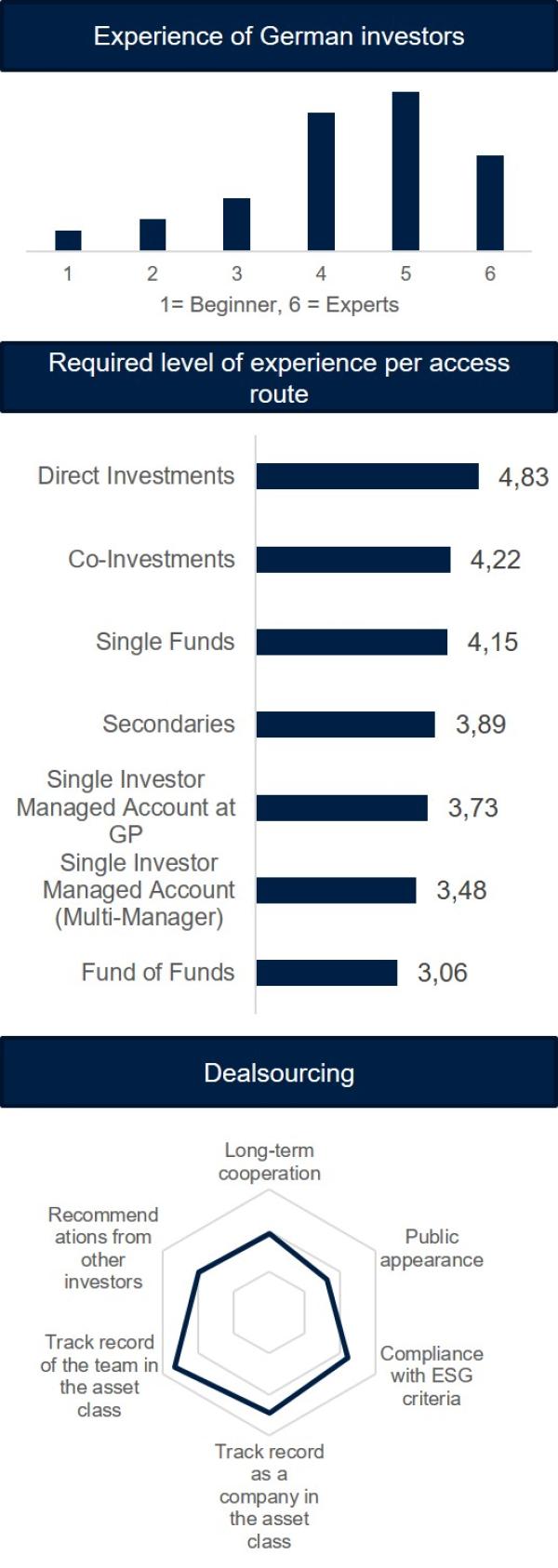

This year, we also wanted to gather information from investors on how they assess their own experience in the field of alternative investments. The results show that the experience of the individual investor is extremely heterogeneous with a wide range from rather inexperienced beginners to experts in the field of alternative assets.

Experience plays a crucial role in access routes into private markets. By their very nature, experienced investors with large in-house investment teams have a more diverse range of access to alternative investments such as direct or co-investments.

In general, we recommend that especially rather inexperienced investors seek external expertise and advice. Our survey among investors shows that experience is necessary even for entry-friendly products such as fund of funds. Managed accounts, which are becoming increasingly important offer an additional, suitable access route.

The most popular path among the participants is the acquisition of single funds. This applies to all asset classes. In addition, one can invest via fund of funds, managed accounts, and co-investments.[i] Co-investments are more time-consuming in comparison to single fund investments. The associated personnel requirements and the knowledge of what needs to be built up internally seems to be a central obstacle for some investors. The interviewed investors emphasized that the path to co-investment is a product of many years of experience in the asset class and necessary long-time exposure. Constant growth is also given for managed accounts and platform solutions. They are becoming increasingly important and are particularly widespread in the established asset classes in the private markets sector such as corporate private equity. This also applies to secondaries, which have recently experienced a genuine boost, especially in private equity.

In short summary, it can be said: Even if the omnipresent pandemic has led to performance losses in some industries, the tenor of German investors is more than clear: The allocation to alternative investments has increased and will be further expanded in the coming years. In the search for uncorrelated returns to the liquid capital markets, there is no way around alternative investments.

Footnotes:

[i] The term co-investments can be subdivided into co-investment funds (funds that invest exclusively in co-investments), direct co-investments (LPs do not invest in the flagship fund at the same time), and sidecars (usually particularly large LPs of the fund are offered the opportunity to invest additionally in single transactions).

About the Author:

Philipp Bunnenberg, PhD Candidate and Level II Candidate in the CAIA program, is working at BAI as a consultant and market analyst and is responsible for the Alternative Markets report.

The Bundesverband Alternative Investments e.V. (BAI) is the asset class- and product-spanning representation of interest for Alternative Investments in Germany. The objective of our association’s work is to improve the level of public awareness, create internationally competitive and attractive conditions for alternative investments, and represent the interests of the industry to politics and regulators. The BAI’s annual investor survey helps to in-crease transparency in the alternative investments market. Founded 1997 in Bonn, the more than 250 BAI association's members are based in any field of the professional alternative investments business. The members’ directory can be found here.