By Aaron Filbeck, CAIA, CFA, CIPM, FDP, Managing Director and Head of UniFi by CAIA™ at CAIA Association.

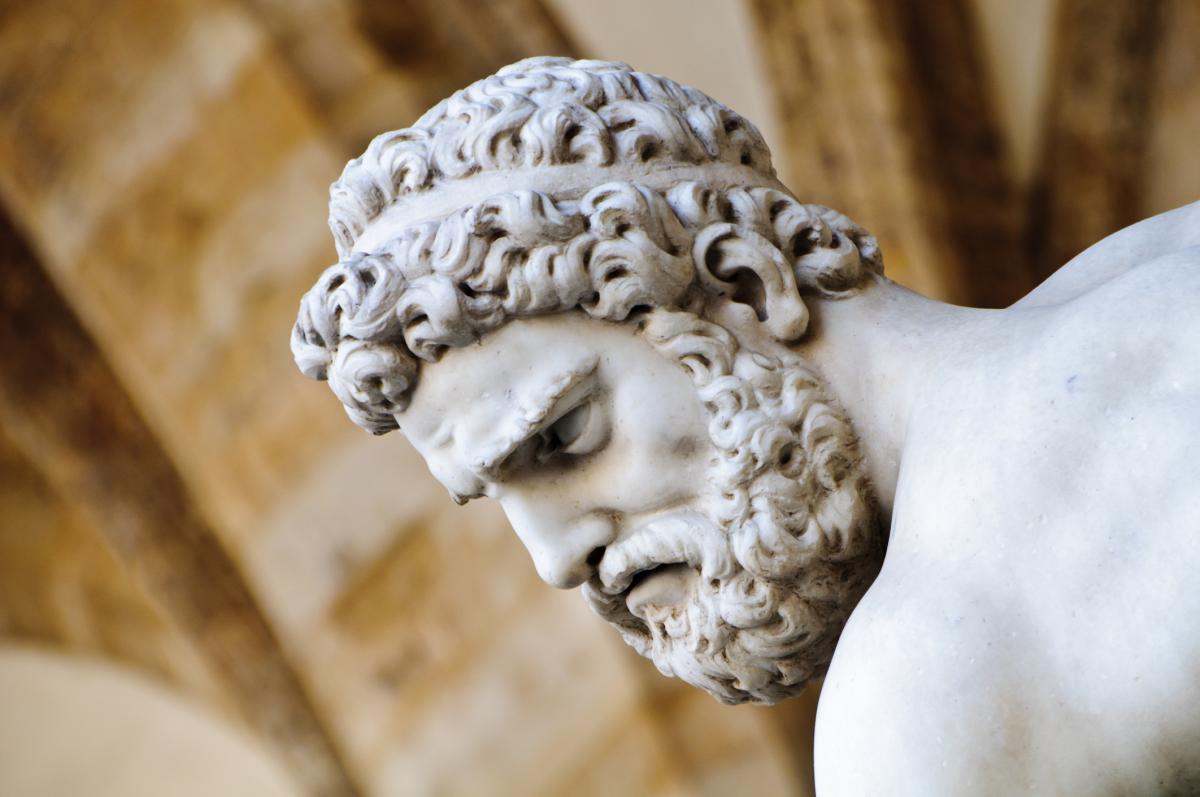

“I trained all those would-be heroes. Odysseus, Perseus, Theseus. Alotayusses! And every one of those bums let me down flatter than a discus. None of them could go the distance. And then, there was Achilles. Now there was a guy who had it all: the build, the foot-speed. He could jab! He could take a hit! He could keep on comin’! But that furshlugginer heel of his! He barely gets nicked there once, and kaboom! He’s history.”

- Philocetetes in Hercules (1997)

It seems like we’ve tried a few times to go the distance with providing access to private markets and hedge funds. As I’ve written before, the Achilles heel of the liquid alternatives movement in the 2010s was seemingly a combination of mismatched structure (jamming complex strategies with shorting and leverage into a regulated wrapper wasn’t the best idea) and misaligned expectations (equity like returns with bond like risk? Get out of here). Bring us to the 2020s, where it seems like every week we find another attempt to democratize non-traditional strategies into traditional long-term savings vehicles. If you cut one head off, three really do take its place!

Like Phil, trainer of Olympic gods (not to be confused with the Chief Investment Officer of Savant Wealth Management and advisory council member to UniFi by CAIA™), the industry keeps trying but the big moment hasn’t quite come yet. While frustrating, it provides opportunity for additional training. The wealth management industry is still in a place where we can do things in the right order: educate, then allocate…or don’t!

Access to alternative investments is coming at the individual investor from both sides now. While industry titans are predicting private capital products will soon be available for retirees, cryptocurrencies, which is almost entirely retail-driven (and owned), are now in the running for your retirement plan! The lines of democratization have blurred considerably since the DOL first entertained placing private equity in target date funds and the SEC first revisited the accredited investor rule. While the former example is less concerning to me (and worth noting that plan sponsors are fiduciaries and are not likely to jump into Bitcoin without rigorous due diligence), the product machine is well-oiled and ready.

At CAIA, we’re a broken record on the need for better education around these products and strategies but, more importantly, we must place the client’s interests at the center of them.

Ultimately, access and choice are a good thing for the end investor, but only if they know what they’re buying. As I wrote in a recent op-ed for WealthManagement.com, products cannot drive portfolio decisions and informed consent should be a pre-requisite before the advisor, or the end client, hits the buy button – otherwise we’re in for a world of pain…and panic.

Panic: [Hades] is gonna kill us when he finds out what happened

Pain: You mean if he finds out

Panic: If? “If” is good.

The entire wealth management industry, from the asset owner to the intermediary to the advisor, need to make sure we strike an important balance of adaptability and responsibility. To be truly educated is to know when to walk away, not bury our heads in the sand and hope for the best. The reality is that if the entire industry doesn’t do both, the end investor will do it themselves.

Our announcement of UniFi by CAIA™ last week was more than the announcement of a cool platform and some future microcredentials. Instead, it was a clear signal to the wealth management industry that our mission is just as relevant to them as it is to any institutional investor. After all, it’s a small underworld – let’s keep it that way.

Seek education, diversification of both your portfolio and people, and know your risk tolerance. Investing is for the long term.

Aaron Filbeck, CAIA, CFA, CIPM, FDP is Managing Director and Head of UniFi by CAIA™ at CAIA Association. You can follow him on LinkedIn and Twitter.