By Harsh Singhal, Managing Director, CDPQ.

Despite the news headlines about raging floods and uncontrolled forest fires across the globe, action to limit the effects of climate change is far short of what is needed to get the world back to net-zero. In recent years, though, the investment community has focused its attention on sustainability.

There is little surprise that sustainability is taking the centre stage in the world of finance and economics. Investors are looking to invest in environment-friendly companies, protecting their returns over the long term. At the same time, the definition of sustainability expands to encompass wider economic activities and create new opportunities for investors to contribute to change.

An increasing number of global investors are making sustainability the core of their investment strategy. Global investors with assets of $43 trillion (around half of global institutional capital) have pledged to reduce the carbon footprint of their portfolios in line with global pacts and benchmarks.

At CDPQ, we set a target in 2017 to reduce the carbon intensity of our portfolio by 25% by 2025. It is encouraging to report that by the end of 2020, the carbon intensity of our portfolio had fallen by 38%.

On the demand side as well, many recent surveys show that Gen Z prefers sustainable products more than other categories. In India, there has been 190% growth in online engagement on environmental issues, with about 70% of customers saying they are willing to shift to more sustainable brands.

EUA, which is the European mechanism for buying carbon offsets, is up 6.5x in the past 3.5 years – much ahead of the NASDAQ and Indian markets (BSE 100 and even the BSE ESG index). This reflects substantial demand for sustainability-linked solutions and outcomes.

India has a huge opportunity ahead

India is already seeing some of the adverse effects of climate change. It has many of the world’s most polluted cities and has seen a doubling of the number of cyclones in the Bay of Bengal. Large swatches of the population reside along the coastline and the erratic monsoon rains create serious risks for millions of Indian farmers who rely on rainfall for irrigation.

Rapid action on climate change is essential. It has been estimated that if India can reach net-zero status by 2050 instead of by 2090, it would lead to savings of 41% of the global climate budget. We reach net zero when the amount of greenhouse gas we produce is no more than the amount taken away. So, India has a big role to play in the global campaign for reducing carbon emissions. Yet, sustainable investing is yet to pick up the pace in India.

On the brighter side, large scale renewable energy has attracted about $8 billion of capital over the past few years. In 2021, installed capacity of solar energy had gone up to 40 GW in India, much ahead of its initial target set in 2015. According to Venture Intelligence, $6 billion of capital has been invested in Series B (or prior stages) in companies in cleantech or socially sustainable business, in the past 5 years.

However, this is woefully short of what is needed. For example - India’s target of achieving installed solar power capacity at 280 GW by 2030 will require more than $250 billion of capital. A similar magnitude of investment is required in other areas like electric vehicles, where India has barely scratched the surface.

Investor experience has been encouraging

One argument made against sustainable investing is that imposing investment restrictions or forcing divestments means the sector will struggle to generate returns; therefore capital available will always remain short.

But sustainable investing is no different from traditional investing, wherein carefully selected and well-built organizations will produce outsized returns for their investors. Given that the sector is still relatively recent, some companies may take time to become bigger and hence the sector will need patient capital.

Recent research indicates that global cleantech investments have grown 37x in the past 6 years and these companies are already giving substantial returns. Among the latest crop of Indian Unicorns are four companies focused on renewable energy – a sector that looked like a small experiment just a decade ago.

The introduction of 1.75 million electric rickshaws in the past 6 years is another good example of scaled-up demand for useful sustainable products in India.

Considering that governments across two-thirds of the global economy have committed to carbon reduction targets, with more research and scale, the cost of sustainable technologies is set for a dramatic fall. This, combined with increased demand, will ultimately produce greater returns.

India’s per capita emissions are currently lower than most equivalent nations, but as the country industrialises, this is projected to grow. For India, this is an opportunity to capture economic growth with more advanced sustainable technology instead of adopting conventional ones; the classic technology leap, such as leapfrogging into digital payments without adopting physical credit cards.

Sustainable Investing is about transforming economies and not just energy

It is important to remember that sustainability needs to be embedded in every sphere of the economy. For example, the current chip shortage in the world is linked to fresh-water availability in Taiwan. Increasing awareness of ocean plastics and the damage to marine life is making sustainable packaging important for customers. Sustainability has to take account of biodiversity as well as climate and environmental concerns. Therefore, even in conventional investing, there is huge scope to add sustainability elements.

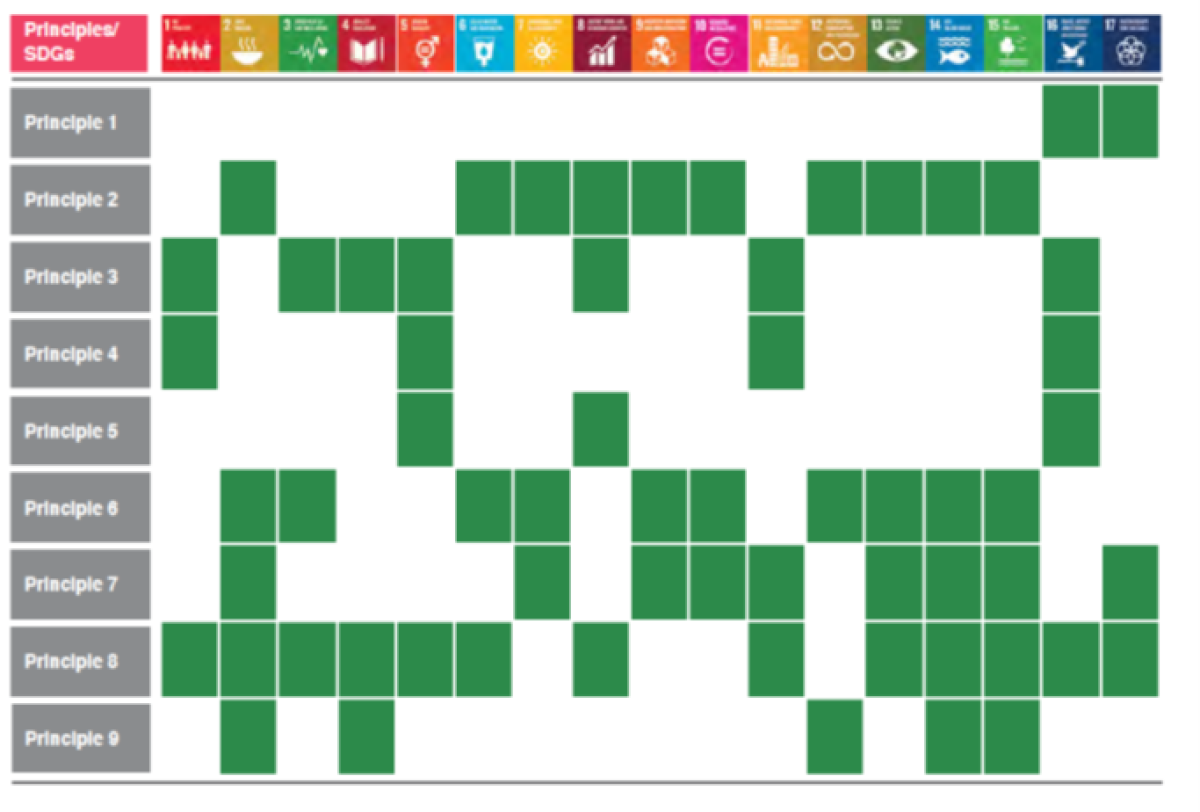

Recently introduced ‘Business Responsibility and Sustainability Reporting’ (BRSR) will maintain the pressure on the 1000 largest listed companies in India. The nine principles in the BRSR report rightly cover all the UN Sustainable Developments Goals and will force large Indian companies to take a holistic view of sustainability.

For investors, this has wide implications because a business that is not prepared for a thorough scrutiny via the BRSR framework may not attract quality investors, thus it may have limited multiple expansion. Moreover, existing companies will also need to adapt their business models to a sustainable basis to continue attracting quality investors.

There are other practical challenges in that India does not yet have a taxonomy of what qualifies as ‘sustainable’. There is a push to harmonize ESG standards across the world, with IFRS launching the Sustainability Standards Board (SSB) at COP 26 last year. This and other global and regional pacts on climate and sustainability will eventually coalesce into a recognised best practice on ESG.

A well-articulated standard for sustainability will help both businesses as well as customers. For example, star rating of electrical goods helped the customers to buy more energy-efficient products, as a result this scheme along with other energy efficiency schemes helped India save 10% of electricity consumption in 2020.

Opportunity for better business fundamentals

Ultimately, sustainability must be looked at as an opportunity for businesses to reduce risk and save costs over the longer term. There are many examples of Indian companies taking the lead in water conservation, responsible use of resources and the circular economy. They are benefitting immensely in terms of lower costs and a lower environmental footprint. We all need to do a better job of articulating and replicating such successes.

India can convert many of the challenges it currently faces into sustainable investment opportunities. For example, about 40% of Indians will still not have access to fresh water by 2030; this is a challenge but also represents a huge opportunity.

The use of technology will help India achieve more with less and faster. With tools like artificial intelligence, machine learning, 3D printing, and the Internet of Things (IoT), there are further efficiencies that may be unlocked for businesses that relentlessly focus on making their processes sustainable. India’s software capabilities present a comparative advantage for it to leapfrog into sustainable, state-of-the-art manufacturing.

It is important that investors address climate change and India’s development as an economic powerhouse presents an opportunity to build organizations of the future in areas critical to human survival.

If you enjoyed this article, be sure to read CAIA Association’s new report, The Rise of India’s Private Equity Market.

About the Author:

Harsh Singhal is a senior investment professional with experience across emerging markets. He is currently Managing Director with CDPQ India. Previously Harsh has worked with International Finance Corporation. He is passionate about spotting trends early and succeeding through investments and activities which lead to sector transformation and build organizations of the future. Harsh has experience across asset classes i.e. Private Equity, Public Equity, Infrastructure and Fixed Income. Harsh is a fellow member of Institute of Chartered Accountants of India and holds a management degree from Indian School of Business, Hyderabad.