By Frank A. Burke, CFA, CAIA, Chief Investment Officer, PPB Capital Partners.

After inflation in the month of May came in at nearly 9%,1 the markets have been skittish in June. Attempting to bring inflation under control, the Federal Reserve responded with an aggressive increase of 75 basis points.1 While many believe that much of the immediate pricing pressures are likely to be more transitory, and with supply-chain related shocks from the pandemic lockdowns continuing to mitigate, the ongoing conflict in the Ukraine has had immediate effects on energy prices around the globe.

As expected, the immediate impact on the 10-year treasury has been dramatic, as it’s now sitting well over 3% after touching just below 3.5% at mid-month. It is now up almost 200 basis points from the beginning of the year. In addition, the equity markets have been under heavy pressure, with the S&P now dropping more than 20% YTD, and the tech heavy NASDAQ down more than 30% as investors weigh the Fed’s heavy actions with the potential for a recession.2

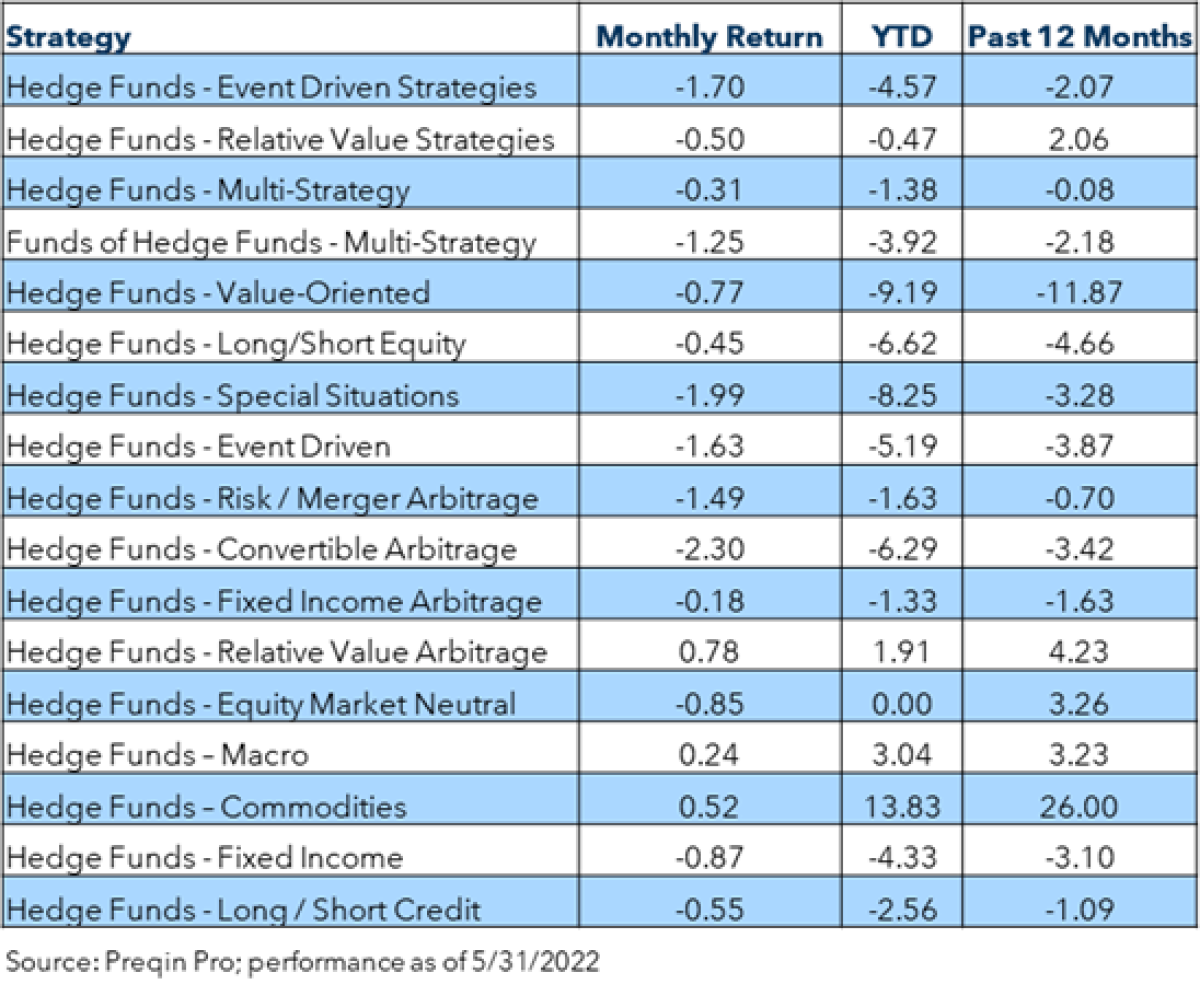

Accordingly, the appetite for alternative strategies has never been stronger. Private markets can provide volatility preservation and stability in times of immediate market stress. Investors who are looking at shorter time horizons, however, can also account for stability with hedge funds. Look no farther than the returns of hedge funds as of May 31 (chart 1) to support—and prove—this downside mitigation strategy.

Chart 1

With inflation spiking, commodities are the clear standout strategy for both 2022 and the past twelve months. Ancillary commodity positions in areas such as global macro have also pushed that strategy to positive performance. In addition, long/short equity, which has delivered annualized double digit returns over the past three years, has seen a renewed interest on PPB’s platform. While it has been down in 2022, it has functioned exactly as intended to help mitigate broader equity losses and volatility.

We have seen a resurgence of interest in other hedge fund strategies as well: relative value, multi-strategy and equity market neutral. Generally speaking, these were strategies that struggled in the low interest rate environment and the stimulus-fueled bull market run that evolved from the Great Financial Crisis. These performance issues were exacerbated by a higher fee strategy compared to basic indexing and with little net market exposure.

Obviously, the environment is vastly different now. Additional stimulus measures are off the table as the Fed’s No. 1 priority is to fight inflation aggressively. Unfortunately, in a situation like this, a market selloff is considered collateral damage. When this happens, picking stocks based on fundamentals matters again. And, since many of these funds were forced to adapt, investor terms have become more favorable.

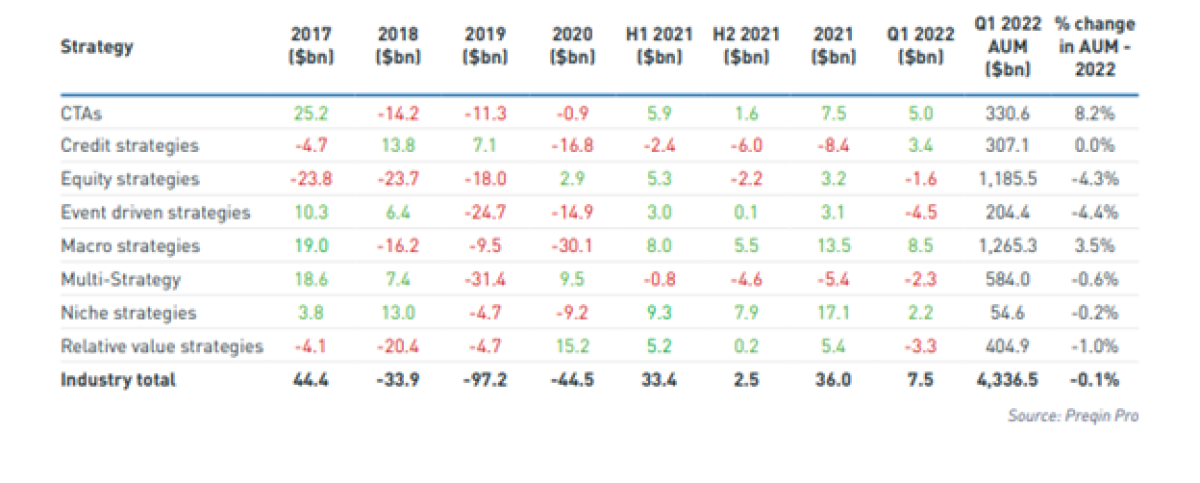

Relative to fund flows (chart 2), data from Preqin illustrates that hedge funds saw a net inflow of $7.5B during the first quarter, offsetting the $5B of outflows from the Q4 2021 market selloff. It’s no surprise that the strategies with exposure to energy—macro and CTA—saw the greatest inflows ($13.5B combined). Conversely, equity-based strategies saw a net decline of $1.6B. Given the broader market selloff, that is also not surprising.

Chart 2

Simply putting your money in an index was a way to generate returns over the last decade but that approach may not be enough now. The market is under pressure. Fears of a recession in the near term are being fueled every day and allocating to more hedged strategies is the prudent play.

All the noise around short-term volatility in the public markets has caused many sleepless nights for investors. Fundamentals matter again. As the push to generate alpha gains traction, the top stock-picking talent may once again have its moment in the spotlight. Implementing strategies that are less tied to the broader markets can alleviate investors’ concerns. Ideally, combining more hedged public positions with a dedicated private allocation can further mitigate some of the market noise that is dominating the news. A positive byproduct of this strategy may be investors profiting from the illiquidity premium.

It's no secret that inflation pressures may make the next year or two challenging. More headline-generating market noise during that time may only cause added anxiety for investors. In these moments, advisors can look to alternative investments as stabilizers for their clients’ portfolios.

About the Author:

As Chief Investment Officer at PPB Capital Partners, Frank Burke is a valuable resource for wealth advisors looking for guidance in sourcing or allocating to new private investment strategies or hedge funds. Frank is a thought leader in strategy implementation and has extensive experience in the portfolio construction process for both individual clients and custom fund-of-funds.

During a career spanning more than 20 years of asset management, portfolio construction and financial advisory experience, Frank has held numerous investment positions at some of the industry’s most well-known firms.

Prior to joining PPB in 2017, he was a senior member of the portfolio management team at Hatteras Funds, managing several of the firm’s alternative investment fund-of-funds and co-investment strategies. Earlier in his career, Frank helped source managers and built alternative investment portfolios at various multi-family offices including Abbot Downing (formerly Calibre Investment Consulting) and GenSpring family offices.

Frank resides in Exton, Pa., with his wife and daughter. He is an avid college basketball fan, frequently attending regular and postseason games with his family—including the Final Four in 2016 and 2018 to witness his Villanova Wildcats be crowned champions. He earned an MBA at the Fuqua School at Duke University, a Bachelor of Science degree from Villanova University and holds CFA and CAIA charters.

Important Disclosures

1 https://www.wsj.com/articles/us-inflation-consumer-price-index-may-2022…

2 Market and index data from the Wall Street Journal (wsj.com)

This document or any part thereof may not be reproduced, distributed or in any way represented without the express written consent of PPB Capital Partners, LLC. A copy of PPB Capital Partners, LLC’s written disclosure statement as set forth on Form ADV is available upon request. Although the information provided has been obtained from sources which PPB Capital Partners, LLC believes to be reliable, it does not guarantee the accuracy of such information and such information may be incomplete or condensed. PPB Advisors, LLC is an affiliate of PPB Capital Partners, LLC by virtue of common control or ownership.

The statements included in this material may constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Some of these forward-looking statements can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “will”, “should”, “seeks”, “approximately”, “intends”, “plans”, “estimates”, or “anticipates”, or the negative thereof or other variations thereof or other variations thereon or comparable terminology. Due to these various risks and uncertainties, actual events or results of the actual performance of an investment may differ materially from those reflected or contemplated in such forward-looking statements and no assurances can be given with respect thereto. Hedge Funds are Private entities and are not required to file with Preqin. The data given in this document is composed of all data that has been filed with Preqin but is not composed of every Hedge Fund.

Certain securities offered through Registered Representative with Vigilant Distributors LLC (Member FINRA/SIPC), which is not affiliated with PPB Capital Partners or its affiliates.