By Hitesh Patel, CFA, FRM, vice president and co-portfolio manager, and Rene Casis, vice president and head of ETF portfolio management for American Century Investments®.

Convertible bonds provide an alternative for investors worried about short-term stock market volatility but with a goal of preserving the long-term prospects of growth investing. These hybrid securities offer a way to gain exposure to the growth-equity style while potentially minimizing the effects of market volatility. Convertible bonds contain an income feature for those concerned about volatility and low rates.

Portfolio Managers Hitesh Patel and Rene Casis explain how convertible bonds work and why investors should consider investing in these securities via actively managed ETFs.

What Are Convertible Bonds?

A convertible bond (convertible) is a fixed-income security with an embedded option to convert the bond into an equity security. Because it’s part bond and part stock, a convertible offers an income stream and growth potential.

At their basic level, convertibles are corporate bonds. Similar to their conventional bond cousins, convertibles pay a coupon stream, and at maturity, the issuer returns the principal to the investor. These bond-like features highlight convertibles’ defensive attributes, including potentially reducing volatility and downside risk during turbulent markets.

Although convertible yields are typically lower than corporate bond yields, they are generally comparable to or higher than the dividend payments of their underlying equity securities. Therefore, convertibles may provide an alternative source of yield versus riskier high-dividend-paying stocks. They also offer an alternative to traditional bonds, which may deliver slightly higher yields but no participation in equity appreciation.

Why Should Investors Consider These Securities?

Since the market sell-off in early 2020, equities have experienced a strong rebound. Growth-oriented stocks—particularly technology stocks—were the main drivers of the rally.

In the wake of this performance, we believe equity valuations are generally stretched by historical standards. And because of this, there’s growing concern that the market may rotate away from growth-equity stocks, at least temporarily.

Convertible bonds offer an alternative for those who want to remain invested in the longer-term secular growth equity trend but are wary of a pullback. Convertibles can provide equity participation while delivering diversification and may offer some downside protection, should equity market volatility rise. Also, convertibles typically have lower duration (price sensitivity to interest rate changes) than most traditional bonds, allowing them to provide a level of income with less exposure to interest rate volatility.

Given the current market backdrop, we’ve noticed a renewed interest in this often-overlooked asset class. Convertibles have posted attractive performance recently, and we’ve seen a surge in issuers coming to the market.

How Does a Bond Offer Exposure to Growth?

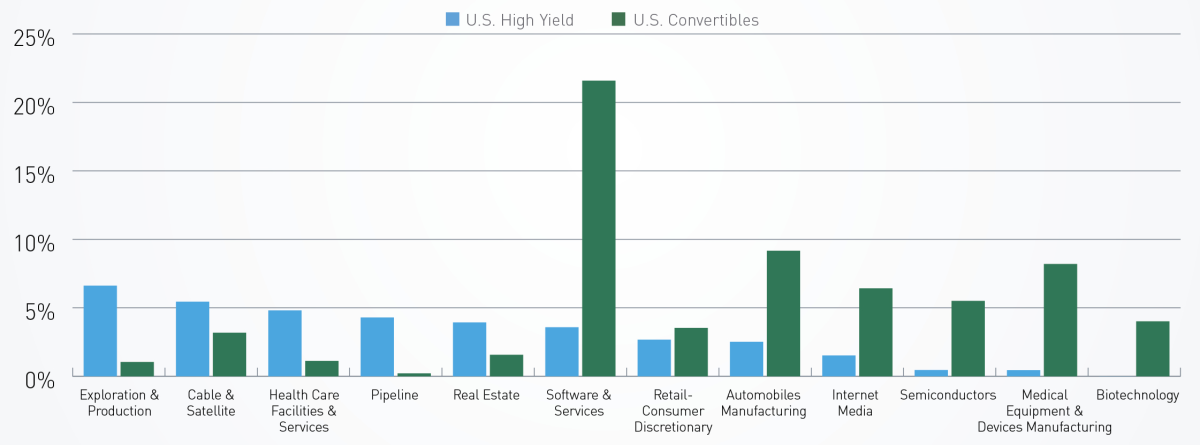

Most convertibles are issued by growth-oriented companies, particularly firms in the information technology sector. See Figure 4. And even though they’re technically bonds, convertibles tend to perform more like stocks over time. Unlike traditional bonds, convertibles can participate in stock market rallies. This comes from the equity conversion option, a predefined ratio indicating the number of common stock shares an investor receives when converting a convertible bond. If a convertible’s underlying equity appreciates in price, the convertible’s value also increases, and the security behaves similar to the equity due to the conversion feature.

Convertibles’ unusual structure provides benefits to the issuer and the investor. In exchange for offering the equity conversion option, the issuer enjoys lower coupon payments. And if the investor converts the bond to stock, the issuer’s debt disappears (albeit at the expense of diluting equity value). For the investor, the benefit is twofold—upside potential from the equity feature and downside protection from the regular coupon payments and return of principal upon maturity.

What Are the Longer-Term Performance Trends and Potential Benefits?

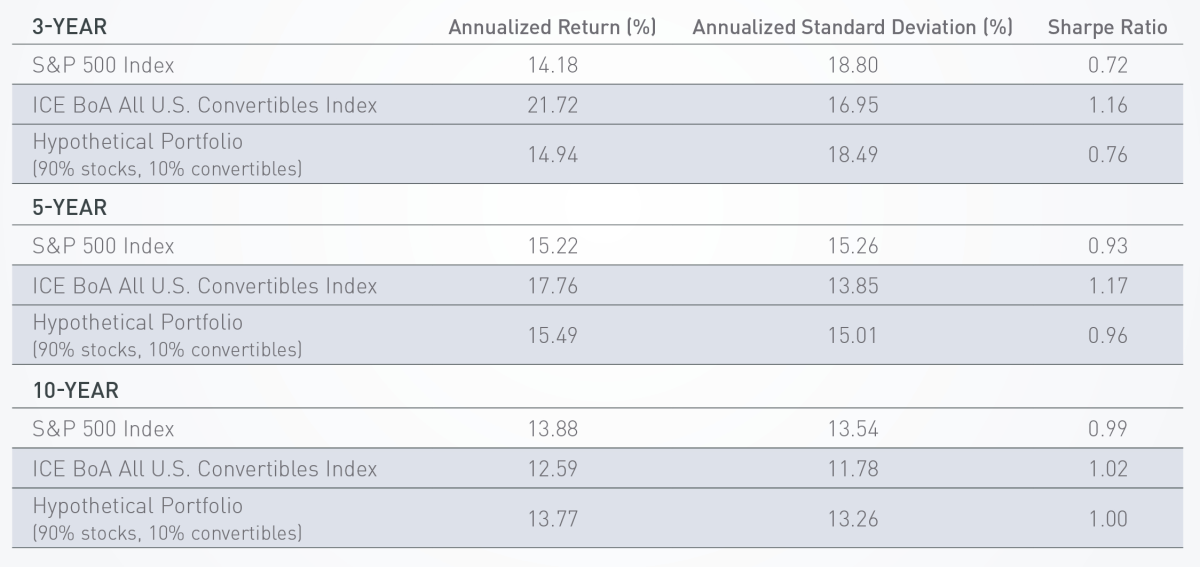

We believe convertible bonds can complement an equity portfolio by enhancing risk-adjusted performance potential over time. Convertibles have proven to be fairly correlated to equities and historically have generated comparable returns. However, they also have delivered lower volatility than equities (as measured by standard deviation) over the multiple market cycles highlighted in Figure 1. Throughout a full market cycle, convertibles posted risk-adjusted performance that was comparable to or better than stocks, as illustrated by the Sharpe ratios in Figure 1.

The hypothetical portfolios in Figure 1 show the historical performance results of combining convertibles and stocks.

From a historical perspective, convertibles have offered attractive returns in different market environments. They generally have participated in rallying stock markets and offered more stability when stocks turn volatile. Furthermore, convertibles have only slightly underperformed the equity market during strong rallies, but they have demonstrated an ability to outperform during equity drawdowns.

In these volatile periods, convertibles were typically less exposed to stock market declines. This is due to the securities’ defensive bond characteristics, which led to less volatility than equities. For example, over the past three years, convertibles captured more than 93% of the S&P 500® Index’s upside but only 58% of the downside, as illustrated in Figure 2. Because of their hybrid structure, convertibles have historically tended to be more resilient through a full stock market cycle.

Where Do Convertible Bonds Fit in a Portfolio?

We believe substituting a portion of a portfolio’s equity exposure with convertibles may improve risk-adjusted performance, as illustrated in Figure 1. In this hypothetical example, we replaced 10% of an all-stock portfolio with convertibles. For the three-, five- and 10-year periods, convertibles delivered similar total returns as stocks (S&P 500 Index) with lower volatility (standard deviation). As a result, convertibles enhanced risk-adjusted returns (Sharpe ratio) and reduced volatility compared with the S&P 500 Index in all three time periods. This trend was particularly evident over the three-year period when volatility notably increased.

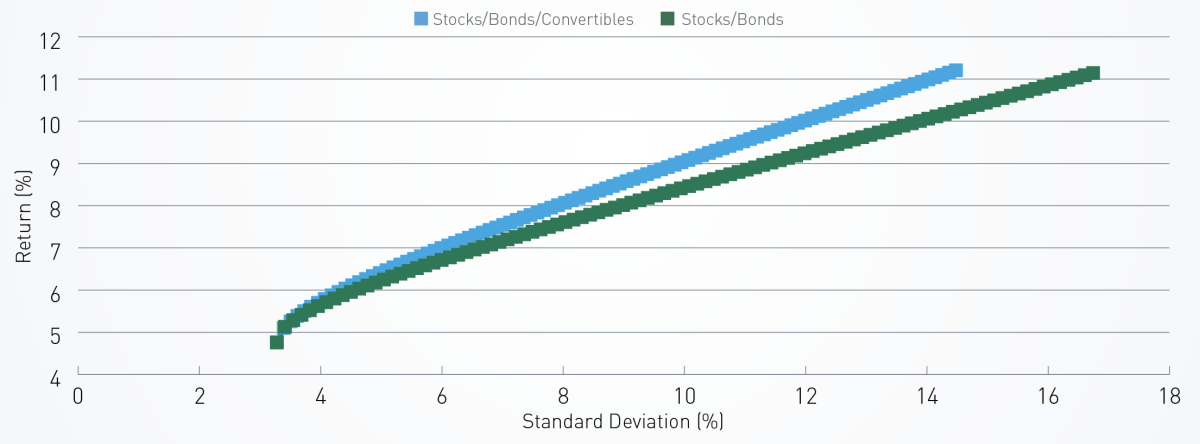

Of course, the exact weighting to convertibles depends on the investor’s objectives and overall portfolio composition. Figure 3 shows that adding convertibles to a stock and bond portfolio historically has increased returns without increasing risk, thus improving the efficient frontier.

As we mentioned earlier, most issuers of convertible bonds are growth-oriented companies. Figure 4 illustrates the industry breakdown of the asset class. Firms in the information technology and health care sectors account for much of the convertibles universe. Therefore, we believe it might make sense to substitute a portion of a portfolio’s equity exposure with convertibles. We believe this strategy captures the longer-term capital appreciation prospects while providing some protection from the higher volatility of growth-oriented equities.

How Can Investors Invest in Convertibles?

Investors have traditionally owned convertibles via low-cost passive portfolios (designed to mimic a broad benchmark index) or expensive actively managed mutual funds. We believe the passive structure contains inherent flaws— particularly the inability to shift the mix of securities and risk exposure according to market conditions. Given this key factor, we prefer active management. But we favor an active approach within an ETF framework, offering all the potential benefits of these sophisticated securities within a cost- and tax-efficient portfolio.

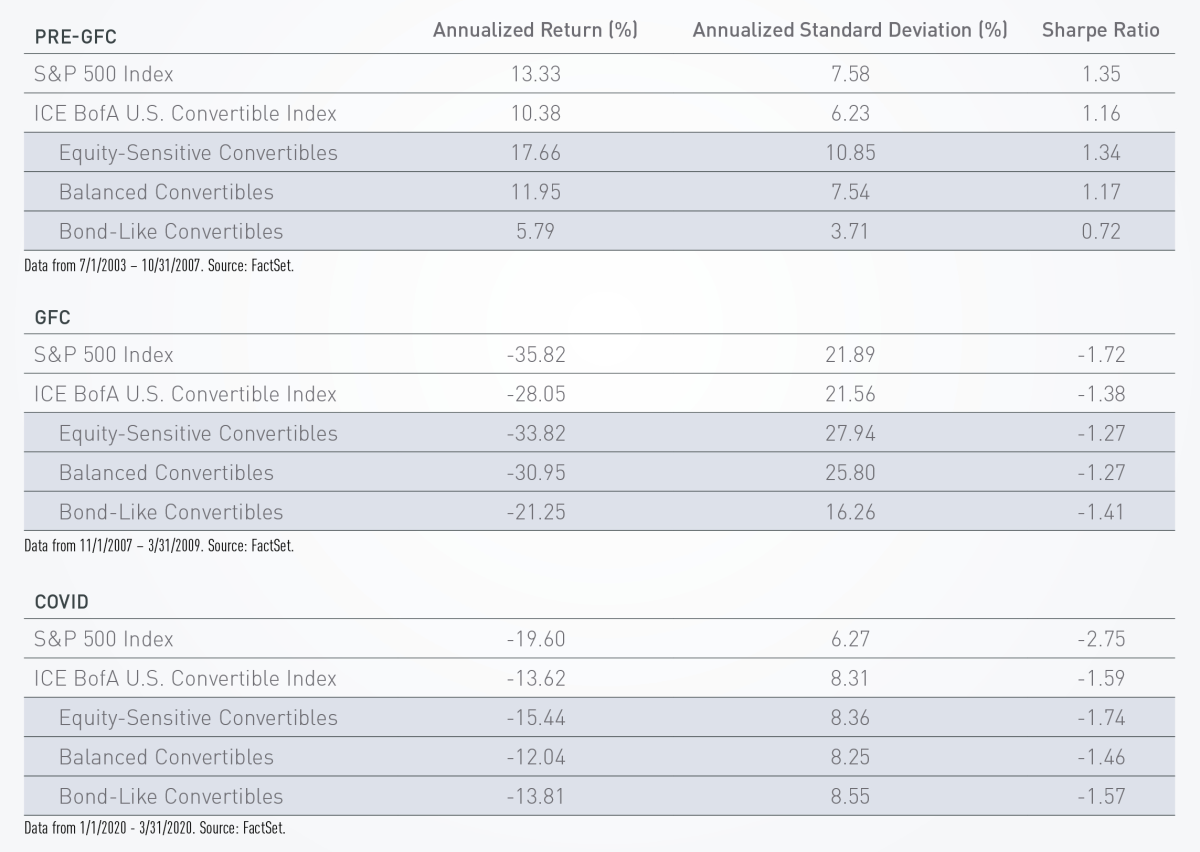

Convertible securities have varying degrees of equity sensitivity, which we believe underscores the importance of active management. For example, in bull markets, convertibles with greater sensitivity to equities have historically tended to post stronger returns than the broad convertibles index. But these same securities have experienced sharp losses in down markets. Meanwhile, bond-like or yield-alternative convertibles have generally performed better in periods of market stress but have lagged in strong, upward-trending markets.

Figure 5 outlines the historical performance of different assets in bull and bear markets. As the chart demonstrates, the broad convertibles index lagged equity-sensitive convertibles in the pre-global financial crisis (GFC) period (market rally). However, during the global financial crisis period (market sell-off), equity-sensitive convertibles underperformed the broad index, while bond-like convertibles held up better. The COVID-19 sell-off period demonstrated similar patterns.

Unlike passive portfolios, actively managed portfolios can adjust their security mix according to prevailing market and issuer-specific conditions, potentially providing participation in rallies and manage risk in downturns.

Are There Potential Tax Advantages to Owning Convertibles?

Convertibles may offer benefits to tax-conscious investors, particularly versus high-yield bonds. Looking back to Figure 1, the total return of convertibles historically has been higher than the total return of high-yield corporate bonds. That’s because price appreciation (or depreciation) typically comprises a greater portion of convertibles’ total return than income payments. This is partly due to the lower coupon yield of convertibles versus high-yield debt.

Investment income is typically taxed at ordinary income tax rates, which for many investors are higher than the long-term capital gains tax rate. Accordingly, lower-coupon convertibles may provide a tax advantage compared with higher-coupon high-yield bonds. The lower income contribution of a convertible bond’s total return may translate into a lower tax obligation and better after-tax performance versus higher-yielding bonds.

Accessing convertibles via an ETF structure also may provide potential tax advantages. An ETF may be more tax efficient than a traditional mutual fund for several reasons. Most notably, the mechanism that underlies the creation and redemption of ETF shares focuses on in-kind delivery of securities. This enhances the tax efficiency relative to mutual funds, where cash-based transactions require activity that may trigger taxable events.

What Should Investors Look for in a Convertibles ETF?

We believe investors considering this asset class should seek an actively managed ETF that emphasizes quality. In our view, focusing on quality securities helps investors capture the diversification benefits of the asset class. It may also provide more defense against equity market volatility.

We believe the process to uncover these securities should consider such factors as:

- Earnings Quality. Key indicators of quality include stability and growth of a company’s earnings. Additionally, profitability, leverage and strength of the balance sheet are important factors in the security selection process.

- Credit risk. Many issuers of convertibles are newly established or growth-oriented companies that previously have issued little to no debt, preferring to use their cash flow to fund the firm’s growth. As a result, these issuers have limited credit-rating histories, which is why much of the convertibles universe is unrated.

- Equity sensitivity. While convertibles are inherently sensitive to their underlying equities, the level of sensitivity can change over time. A convertible’s call feature and other elements of its structure can influence its equity sensitivity and valuation over time. Passive portfolios do not consider these influences.

- Small-cap issuers. Most issuers in the convertibles universe are small-cap companies. Such companies typically offer attractive long-term growth potential, but they also contain higher degrees of risk than larger, more- established companies. This increased risk requires active analysis and review.

We believe examining these factors and others may help create quality portfolios offering participation in rallying stock markets and risk mitigation in volatile markets. Furthermore, active management allows portfolio managers to adjust exposure to equity- and bond-sensitive convertibles as market conditions and issuer dynamics dictate.

Rene Casis' interview at ETF Exchange Conference

About the Authors:

Hitesh Patel, CFA, FRM is vice president and co-portfolio manager for American Century Investments®. He joined American Century Investments in February 2018 from UBS Securities, where he was a senior member of the Alternative Investment Specialist team within the Equity Derivatives group. Before that, Hitesh was director and head of Americas Origination and Content, responsible for manager selection and due diligence of all North America-based alternative investment managers for the UBS Liquid Alpha Managed Account and UCITS Platform. He has also served in roles at Merrill Lynch, Citigroup and the Federal Reserve Bank of New York. He has worked in the industry since 1996.

Hitesh earned a bachelor's degree in economics from Yale University. He holds the Chartered Financial Analyst (CFA®) and Financial Risk Manager (FRM) designations.

Rene Casis is vice president and head of ETF portfolio management for American Century Investments®.

He joined American Century Investments in 2018, from 55 Institutional Partners where he was a member of the senior management team responsible for oversight of portfolio management and trading. Before that, he served as a director at BlackRock and a senior portfolio manager at Barclays Global Investors. Rene earned a bachelor's degree in economics from the University of California, Santa Barbara.