By Andre Boreas, Vice President-Head of Marketing, DiligenceVault.

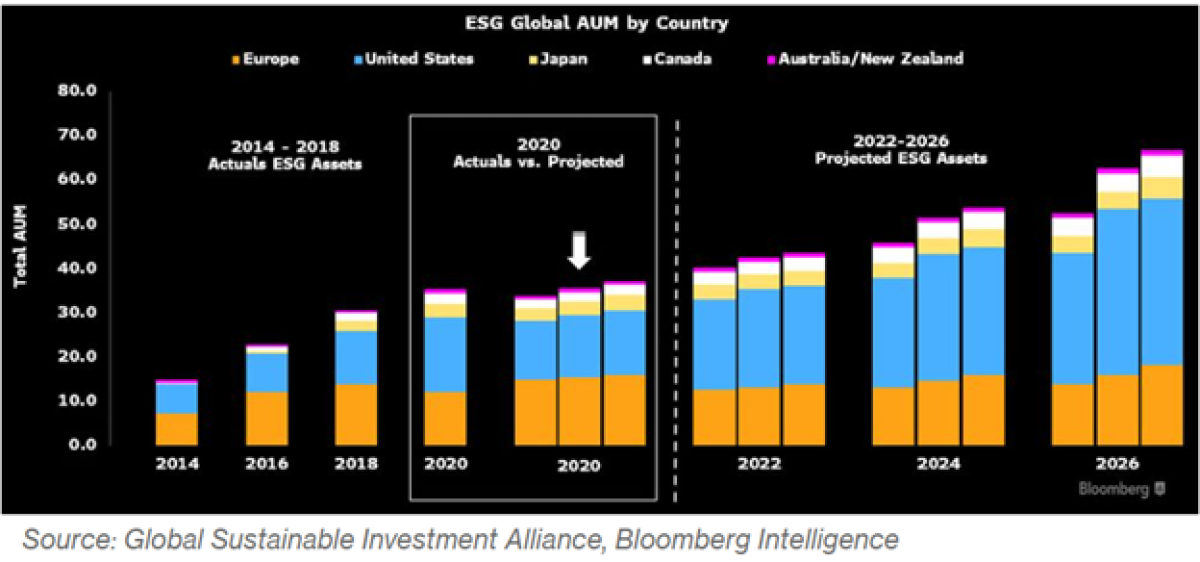

One of the most profound changes the capital markets has seen in some time is the rise of investors’ interest in all things ESG – both institutional and retail. According to Bloomberg Intelligence, ESG-related assets are set to balloon from approximately $35tn at the end of 2021, to $41tn at the end of this year and to $50tn by 2025. ESG considerations by investors when making an investment decision is quickly becoming the norm rather than the exception.

From asset owners to fund managers to the companies themselves, market participants across the investment spectrum all have a vested interest in addressing to the changing socio-economic conditions that the world finds itself in. Greenhouse gas emissions, gender and ethnic diversity across the workforce and in the boardrooms, improved governance practices – as Bob Dylan notes, “The Times They are A -Changin.” These changes, though, are fraught with complexity. Education, politics, regulation, standardization – all play a role in how the industry moves on from the why to the how.

What Does ESG Reporting Constitute?

ESG reporting is the disclosure of data that explains the impact of a company across three areas: environmental, social and governance performance. While ESG reporting is not new, its purpose has grown in importance in recent years as the trend for socially-conscious investments grows. Here again, the rising need for ESG data and reporting adds yet another layer of complexity for investors as they seek to make informed decisions about which companies to invest in.

A Round-Up of ESG-Focused Sustainability Working Groups

There are a number of industry groups that have been formed in order to address the aforementioned how. While many of these are fairly new, some are extensions of existing organizations such as CAIA, ILPA or the CFA Institute that have seen a need for better investor education on ESG investing with some proposing new standards in guidelines to address some of the challenges being faced with data, standardization and reporting efforts.

CAIA – ESG resources for alternative investment allocators. CAIA has also formed the Independent DEI Advisory Council, comprised of CAIA Members and industry allocators to help guide the organization in understanding where it can make the greatest impact and leverage its unique strengths to create meaningful change.

Carbon Disclosure Project (CDP) – CDP is a not-for-profit charity that runs the global disclosure system for investors, companies, cities, states and regions to manage their environmental impacts.

CFA Institute – The CFA institute has recently introduced its global ESG disclosure standards for ESG products

Climate Action 100+ – formed in the wake of the 2015 Paris Agreement and formally launched in December 2017, the group aims to work with the companies in which they invest, to secure greater disclosure of climate change risks and robust company emissions reduction strategies. The group has over 615 members with $65tn in AUM represented.

The Diversity Project – The purpose of the Diversity Project is to accelerate progress towards an inclusive culture in the investment and savings profession with a number of global pension, consultants and managers as part of its membership. The Asset Owner Diversity Charter is an initiative created by the Asset Owner Diversity Working Group in conjunction with The Diversity Project.

Global Impact Investing Network (GIIN) – The GIIN Initiative for Institutional Impact Investment supports institutional asset owners seeking to enter, or deepen their engagement with, the impact investing market, by providing educational resources, performance research, and a vibrant community of practice.

Global Reporting Initiative (GRI) – GRI helps businesses and other organizations take responsibility for their impacts, by providing them with the global common language to communicate those impacts. The organization provides the world’s most widely used standards for sustainability reporting – the GRI Standards. It allows any organization to understand and report on their impacts on the economy, environment and people in a comparable and credible way, thereby increasing transparency on their contribution to sustainable development.

ILPA – The organization’s due diligence questionnaire incorporates an ESG section aligned with the Principles for Responsible Investment’s LP Responsible Investment DDQ, as well as an enhanced Diversity, Equity and Inclusion questionnaire.

Impact Investing Institute – UK based and launched in 2019, the Impact Investing Institute provides research, education and advocacy programs to accelerate the growth and improve the effectiveness of the impact investing market in the UK and internationally.

Institutional Allocators for Diversity Equity & Inclusion (IADEI) – IADEI is a consortium of asset owners, primarily endowments and foundations, that seeks to drive diversity, equity, and inclusion within institutional investment teams and portfolios and across the investment management industry, including directing capital toward diverse fund managers.

Institutional Investors Group on Climate Change (IIGCC) – The IIGCC is the European membership body for investor collaboration on climate change and the voice of investors taking action for a prosperous, low carbon future. IIGCC has more than 375 members, mainly pension funds and asset managers, across 23 countries, with over €51 trillion in assets under management.

International Sustainability Standards Board (ISSB) -The ISSB is part of the IFRS Foundation, a not-for-profit, public interest organization established to develop a single set of high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards. The goal ISSB to deliver a comprehensive global baseline of sustainability-related disclosure standards that provide investors and other capital market participants with information about companies’ sustainability-related risks and opportunities to help them make informed decisions.

Intentional Endowments Network – A consortium of leading endowments that seek to enhance financial performance by making investments that advance an equitable, low carbon, and regenerative economy. It offers a guide for plan sponsors evaluating the addition of ESG funds to retirement plans, and steps outlining how to advocate for ESG integration in retirement plans.

InvestEurope – in March, InvestEurope issued their Guide to ESG Due Diligence for Private Equity GPs and their Portfolio Companies.

Level 20 – is an organization dedicated to improving gender diversity in the European private equity, with the goal for women to hold 20% of senior positions in the industry.

The Net Zero Asset Managers Initiative – Launched in December 2020, The Net Zero Asset Managers initiative is an international group of asset managers committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner. The initiative has over 236 signatories with $57.5tn in AUM represented

PensionsForPurpose – exists as a bridge between asset managers, pension funds and their advisors to encourage the flow of capital towards impact investment. The consortium consists of: 130+ Affiliates (asset owners, trustees, independent advisers, researchers, journalists and government bodies,) 100+ Influencers (asset managers, investment consultants and legal firms) and 20+ Network Supporters (peer organizations who have a similar commitment to raising the profile of impact investment)

Principals for Responsible Investment (PRI) – The Limited Partners’ (LP) Private Equity Responsible Investment Due Diligence Questionnaire (DDQ) has been developed to help investors understand and evaluate a general partner’s (GP) processes for incorporating material environmental, social and governance (ESG) risks and opportunities into their investment practices. This effort is part of a broader United Nations commitment rooted in the 17 Sustainable Development Goals (SDGs) initiative developed in 2015.

Task Force on Climate-related Financial Disclosures (TCFD) – The Financial Stability Board established the TCFD to develop recommendations for more effective climate-related disclosures that could promote more informed investment, credit, and insurance underwriting decisions and, in turn, enable stakeholders to understand better the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to climate-related risks. The Task Force consists of 32 members from across the G20, representing both preparers and users of financial disclosures.

The original article can be found here.

About the Author:

Andre Boreas is charged with overseeing all communication and marketing initiatives at DiligenceVault. He previously worked for Allvue Systems and before that, Intralinks, where held senior product management and strategy positions at both firms.

Before entering the investment technology space, Andre was the Chief Investment Officer at a NYC-based family office and before that led manager research initiatives at an institutional investment consulting firm. Andre was also a portfolio manager at an institutionally-focused fund-of-hedge funds.

Andre has a BS in Business Administration with a concentration in Finance from Villanova University and an MS from Drexel University.