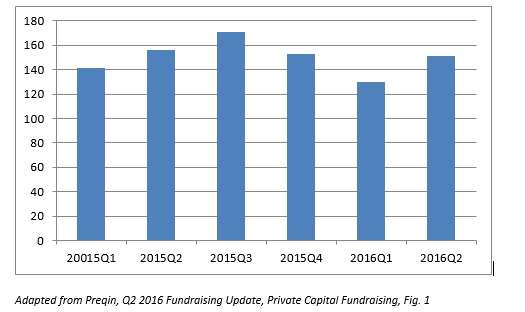

Preqin, the multinational data and consulting firm, has looked at the second quarter and found it was, for private capital fundraising … slow. So was the quarter before it. Together they made up the first half of 2016, in which the funds closed in the world of private capital globally raised only a combined $281 billion, down $19 billion from a year before.

Preqin attributes the slow start of the latest year to “macro factors in emerging regions and commodity markets” as well as the stultifying consequences of political uncertainty in both the U.S. and Europe.

Expectations are Dropping

The report quotes Christopher Elvin, Preqin’s head of private equity products, saying that volatility will persist “in the wake of Britain’s EU referendum result [thus] we can expect further uncertainty to affect the European fundraising market.”

The number of funds is growing, while expectations/targets are headed down. As the second half of the year begins, there are 1,720 PE funds in the global market, an increase of 90 since the start of the year. They are now targeting an aggregate $447 billion, a decrease of $41 billion since the start of the year. This, Preqin observes, the “the first reduction in aggregate target capital since the start of 2014.”

Getting more granular, Preqin observes that unlisted infrastructure fundraising fell in the second quarter. Eight funds in this space closed in the quarter, securing $4.2 billion of investor capital. This is less than a third of the same figure for the first quarter, $15.9 billion.

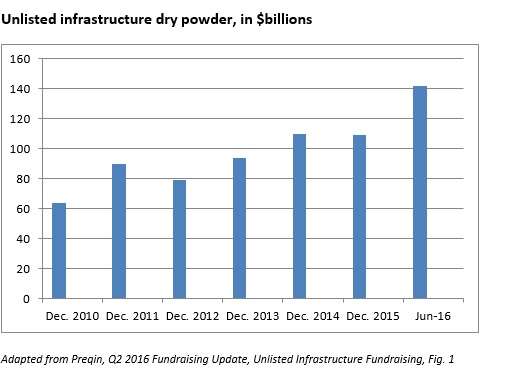

Meanwhile, “unlisted infrastructure dry powder has increased by 30% over H1 2016 to reach a record” of $142 billion. As the graph below indicates, as recently as December 2012, that figure was only $79 billion.

Despite rising valuations and intense competition for assets, Preqin expects that fund managers will be under pressure in the coming months to put this powder to work.

Preqin has issued a separate release that goes somewhat further into global infrastructure, emphasizing the fact that Asia is leading the world there.

The second quarter saw a surge in interest in Asian infrastructure projects. Asian financings constituted 51% of total deal value worldwide, despite representing only 27% of all transactions.

Refineries for Indonesia

Asia saw 57 deals in this quarter completed, worth a cumulative $36 billion, more than doubling the previous quarter’s $18 billion. By way of contrast, Europe saw $17 billion in infrastructure financings over the quarter and North America $14 billion. The rest of the world, outside of those three regions, saw just $3.6 billion.

The single largest infrastructure deal announced thus far this year was the Tuban Refinery Plant in East Java, Indonesia. In April, Indonesia’s oil and gas giant PT Pertamina announced a $13.8 billion transaction with the Rosneft Oil Company to create what will be Pertamina’s first new oil refinery in 22 years.

In the following month, May, Pertamina was involved in another mega-deal, joining with Saudi Aramco to finance the Cilicap Refinery, Central Java. Amec Foster Wheeler PLC will provide engineering and project management services there. That’s a $5 billion transaction.

Another of the major Asia-based infrastructure deals this quarter is the Kunming Rail Transit in China, financed by the China Railway Construction Company.

How Green Is Your Valley?

Infrastructural projects are conventionally classified into three stages: greenfield; brownfield; secondary. A greenfield project is one that does not at present exist – it is (at least metaphorically) expected to rise up from the grasslands. Thus, everything has yet to be funded, beginning from design to ground-breaking, etc.

A brownfield project is one designed to improve or update one that already exists, where that already existing property may be generating some income, which can be joined to the new investment money for the work that needs to be done.

A “secondary stage project” requires neither ground breaking nor structural improvements on an existing plant. It is essentially the sale of a fully operational asset.

In the first quarter of this year, 70% of all deals were for secondary stage projects. That number declined to just 41% for the second quarter. Financings for brownfield sites rose from 5% of the whole to 20%; for greenfield projects, from 25% to 39%.