By William J. Kelly, CAIA, Founder & Managing Member, Educational Alpha LLC

Marcello Malpighi did not invent the microscope, but he is believed to be the first biologist to use it for scientific research. It was he who first contemplated and explored the plumbing inside of woody plants and how water was transported from roots in the ground to their loftiest limbs. It is the xylem that acts as the water (think liquidity!) transport system. When the woody plant is just a single-stem sapling, it is the primary xylem that navigates this short root-to-shoot lane. However, woody plants, not unlike our capital markets, tend to grow just like the giant sequoia, and closer to home for our readers, the private markets. How, then, are we able to sustainably and efficiently bring liquidity to the furthest ends of these respective systems?

The woody plants have figured this out in the most natural of ways, as a secondary xylem system takes over when the expected girth and expanse evolve, solving for a wider and more complex set of liquidity challenges to the maturing plant. Have we, in turn, put our private markets under the same rigor as Malpighi’s microscope to understand the complexities of how secondary liquidity moves within a much more expanded private market, now measured in the trillions of dollars?

It might be instructive to begin pondering this question by first going back in time again, to the Buttonwood Agreement, signed 233 years ago (ironically, under the canopy of a woody plant in lower Manhattan). Prior to that agreement, there was no organized mechanism to buy and sell equity holdings: no market makers, no formal settlement processes (T+ Whenever), no recordkeeping, nor well-established custodial services. This formative pact created the NYSE, where access to equity risk premia moved from the exclusive club of a small number of private investors to all shareholders, and the public equity markets were born. In essence, this was the beginning of a secondary market for listed companies who (mostly) maintained the right to determine how much of their equity ownership they chose to float.

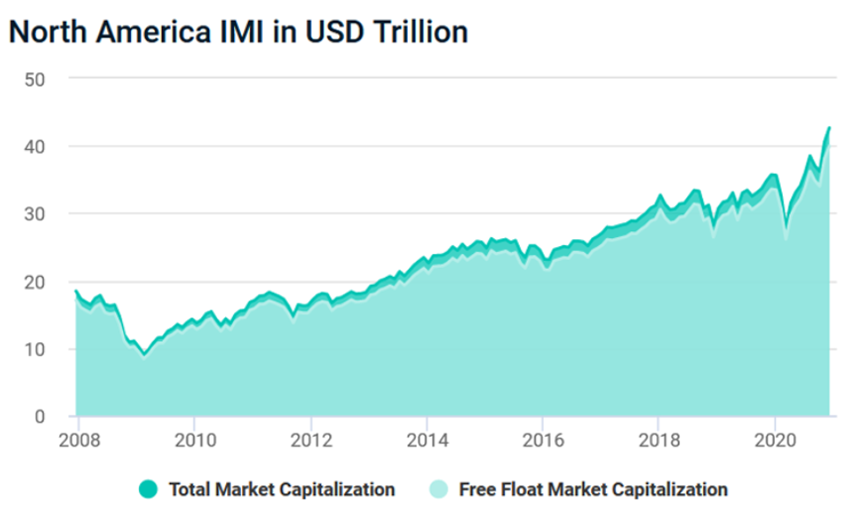

We can think of the IPO as the equity market’s version of primary xylem (liquidity) and the post-IPO trading sessions as the secondary xylem, where next-day liquidity can be brought to any investor, anywhere in the world. Absent this aforementioned apparatus, supported by deep pools of (secondary) market liquidity, this construct would simply not work. Interestingly, this chart courtesy of MSCI shows that the vast majority of the public equity market capitalization in North America is floated, providing for an abundance of liquidity for all market participants.

Armed with this knowledge, let us take a closer look at the private markets and the xylem on that side of the equity rubric. According to CAIA Association, the current size of the private equity markets weighs in at $11.3T. Historically, the PE market was the exclusive domain of the institutional investor, and the wrapper of choice was the drawdown fund. Price discovery was less meaningful, as investors rarely traded on any interim NAV, and the ultimate price was discovered upon liquidation of the underlying portfolio company.

Fast forward to the liquidity winter of 2022 and we are reminded that primary, let alone secondary liquidity, is still mostly a mirage in the private markets. Interestingly, this very subject was covered in a recent article in the Financial Times, where we learned that “investors offloaded a record volume of private equity stakes in 2024,” which in fact showed a demonstrative increase of 45% compared to the same volume in 2023. While mathematically correct, we have also been reminded about the importance of the denominator effect, which can matter a lot on a relative basis. As this same article highlights, the total secondary volume for the full year was $162B, of which $87B was LP-led. The balance of the 2024 activity was instigated by the GPs, and most of that volume was just a roll-over of the same portfolio holdings into a new continuation vehicle. Even using the more generous total secondary volume, that indicates that the secondary liquidity for all of 2024 only represents about 1% of the total capitalization of the PE market.

If the story ended there, it would not be crazy to assume that the institutional forces would once again find the right liquidity balance, along with solid rather than (over) engineered financial returns, and all would be right in the rarified world of private equity. However, there is a new chapter emerging as the wealth client is being invited into these hallowed halls with a siren song of higher returns and better diversification, accompanied by lower volatility and drawdown risk… and (more) liquidity, if that is what they want!

It does appear that the interval fund is the wrapper of choice in this democratization phase, where 20% annual liquidity is the typical offer to investors (subject to a tender process), and unlike its institutional cousin (the drawdown fund), there will be quarterly secondary trades done at these interim NAVs.How will this work as the volume of interval funds grow? If the underlying asset is illiquid (and it is!), how can the system be targeting 20% liquidity in a market that is only showing a secondary float of 1%? Despite the more liquid sleeve in these offerings, which would be more akin to a public market proxy, it would seem that the maturity phase of the PE market will require a much greater component of secondary liquidity. On point, this was an early call by Yann Robard on the Educational Alpha Podcast, and it might now seem that his prediction for a $1T secondary market by 2032 was a bit conservative!

Trees and capital markets may not grow to the skies, but nature and nurture will always have an influential effect on their development. Liquidity, like xylem, cannot be manufactured at will, and we must remain mindful of that fact as the private equity markets continue to expand. If liquidity is being promised at these volumes, those outer extremities need to be organically sated, or they might just wither and die.

Seek education, diversity of both your portfolio and people, and know your risk tolerance. Investing is for the long term.

About the Contributor

William (Bill) J. Kelly, CAIA is the Founder and Managing Member of Educational Alpha, LLC where he writes, podcasts, and speaks on a variety of investment related topics, focused on investor education, transparency, and democratized access to differentiated risk premia. Previously he was CEO of CAIA Association since taking this leadership role in 2014 until his retirement in 2024. Prior to that, Bill was the CEO of Boston Partners, and CFO and COO of The Boston Company Asset Management, a predecessor institutional asset manager. In addition to his current role, Bill is also the Chairman and lead independent director for the Boston Partners Trust Company and serves as an independent director for the Artisan Partners Funds, where he is also Chair of Audit Committee and a designated Audit Committee Financial Expert. He is also currently an Advisory Board Member of the Certified Investment Fund Director Institute within the IOB (Dublin) which strives to bring the highest levels of professionalism and governance to independent fund directors around the world. Bill began his career as an accountant with PwC where he earned his CPA (inactive).

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/