By David Donahue, Partner at Mbuyu Capital Limited, Nina Tannenbaum, Head of Business Operations at Algorand, and Elsie Russell Brown, VP, Technology Product Management at Grayscale.

EXECUTIVE SUMMARY

- Smaller investors have demonstrated growing interest in accessing quality alternative investments including private equity, private credit and venture capital, across a range of methods including listed private investment vehicles, special purpose acquisition companies (SPACs), crowdfunding, programs established by private fund managers and investment managers, web-based private fund access platforms, and others, with activity levels increasing rapidly from a low base relative to the potential scale.

- Investor interest is driven partly by the decline in the number of listed equity investments available and as more recently formed and growing companies are remaining private for longer time periods.

- Allowing smaller investors greater access to investing in illiquid alternatives brings a number of common concerns including risks introduced, required education, potential liquidity limitations, the quality and entry valuations of available investments, transparency, and others, which must be addressed, partly through regulation evolving across various jurisdictions.

- A number of new, technology-based, platforms are being developed and deployed to allow individuals access to alternative investments intermediated by asset management firms and/or advisors as well as direct access to investment opportunities in a curated or self-directed manner.

- Providing more self-directed or guided investment may allow for greater diversification and for investors to express preferred strategies including regional, sector, stage and ESG/Impact goals.

- As investment managers look to increase assets under management (AUM) they need to expand their investor base, beyond traditional pools of capital, including defined benefit pension funds. Globally, the individual investor asset pool is very large, with estimates well over $100 trillion, and many new efforts and plans to serve smaller investors are underway.

- This article provides a brief description of the primary channels currently available, along with the key benefits, possible drawbacks, and activity levels of each, and discusses the potential to allow even greater access through innovation.

Investment in illiquid alternative assets, including private equity, private credit and venture capital, has historically been conducted by larger, institutional investors. Recently however, evidence indicates that many individual investors are keen to invest in illiquid alternatives, with access being provided through new investment products and technology-based innovation.

Approaches to allow smaller investor access to illiquid alternatives cover a wide range including:

- Listed Private Investment Vehicles

- Special Purpose Acquisition Companies (SPACs)

- Crowdfunding

- Private Fund/Co-Investment/Pre-IPO Shareholding Platforms

- Asset Manager or Consultant Sponsored Pooled Private Investment Funds & Network Arranged Access

- Efforts & Adaptation of Private Fund Managers Underway

- The Potential Role of Blockchain-Based Solutions

This article provides a brief description of each approach, key benefits, possible drawbacks, activity levels, and discusses the potential to allow even greater access through innovation. This innovation can make high-quality, private alternatives even more accessible to smaller investors including qualified purchasers, accredited investors, and retail investors.

The capacity for the growth of individual investors' assets is large, with indications including:

- Hamilton Lane’s 2022 Market Overview comments; “Access to the asset class continues to expand; report finds that a 1% increase in the capital high-net-worth individuals invest would lead to a 10% increase in the size of the private markets”.

- Private fund manager Blackstone sees individual investors as at least a $80 trillion addressable market (page 8).

- According to a recent survey by consultancy Oliver Wyman, individuals are expected to allocate an additional USD 1.5 trillion to private markets by 2025.

- Generally, expanding offerings to individual investors’ underserved pool of capital should become an important AUM growth hedge for managers, given the decline in traditional sources of capital including defined benefit pension plans AUM.

The on-going evolution introduces new investment opportunities, including for individual retirement planning. Growth of this activity is expected, especially for more scalable, technology-enabled approaches, with an associated increased regulatory oversight intended to protect investors across jurisdictions globally.

There are many reasons for allowing smaller investors access to illiquid alternative investments, including:

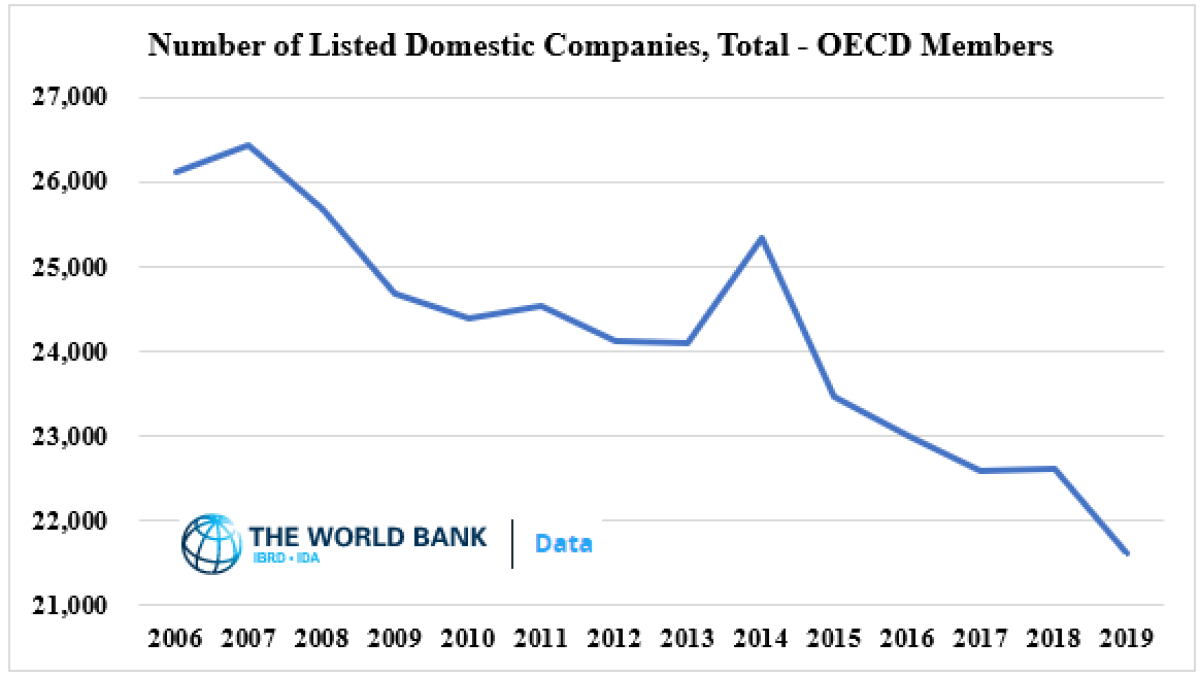

- The increase in the number of publicly traded firms globally has stalled and been declining in more recent history.

Source: World Bank

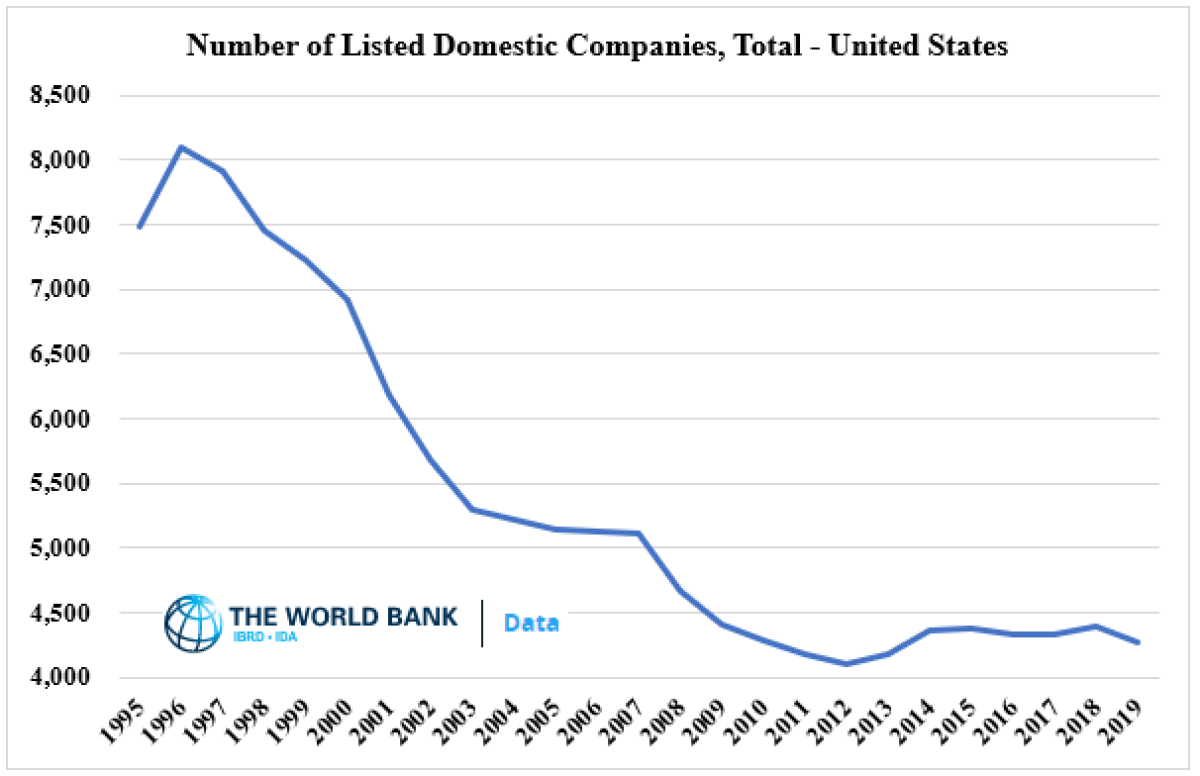

- In the United States, for example, there are now fewer than 4,000 public companies, down from more than 8,000 in the late 1990s, and now has more firms owned by private equity investors than listed on all United States exchanges. IPOs account for a diminishing share of capital raised and invested while more recently formed, growing, companies remain private for longer (page 37).

Source: World Bank

- A result of the shrinking universe of listed equities, a portfolio of privately held companies may generate higher revenue and earnings growth than listed equity market averages as private equity and venture capital investors have an ability to invest in newer and faster growth (page 12), technology-enabled sectors, and advantaged business models.

- Providing more self-directed or guided investment may allow for greater diversification and for investors to express preferred strategies including regional, sector, stage and ESG/Impact goals.

- Historically, private equity and venture capital investment have delivered investment returns and provided investors with diversification beyond listed markets, particularly in some countries where listed equity markets are limited in their coverage and sector diversification.

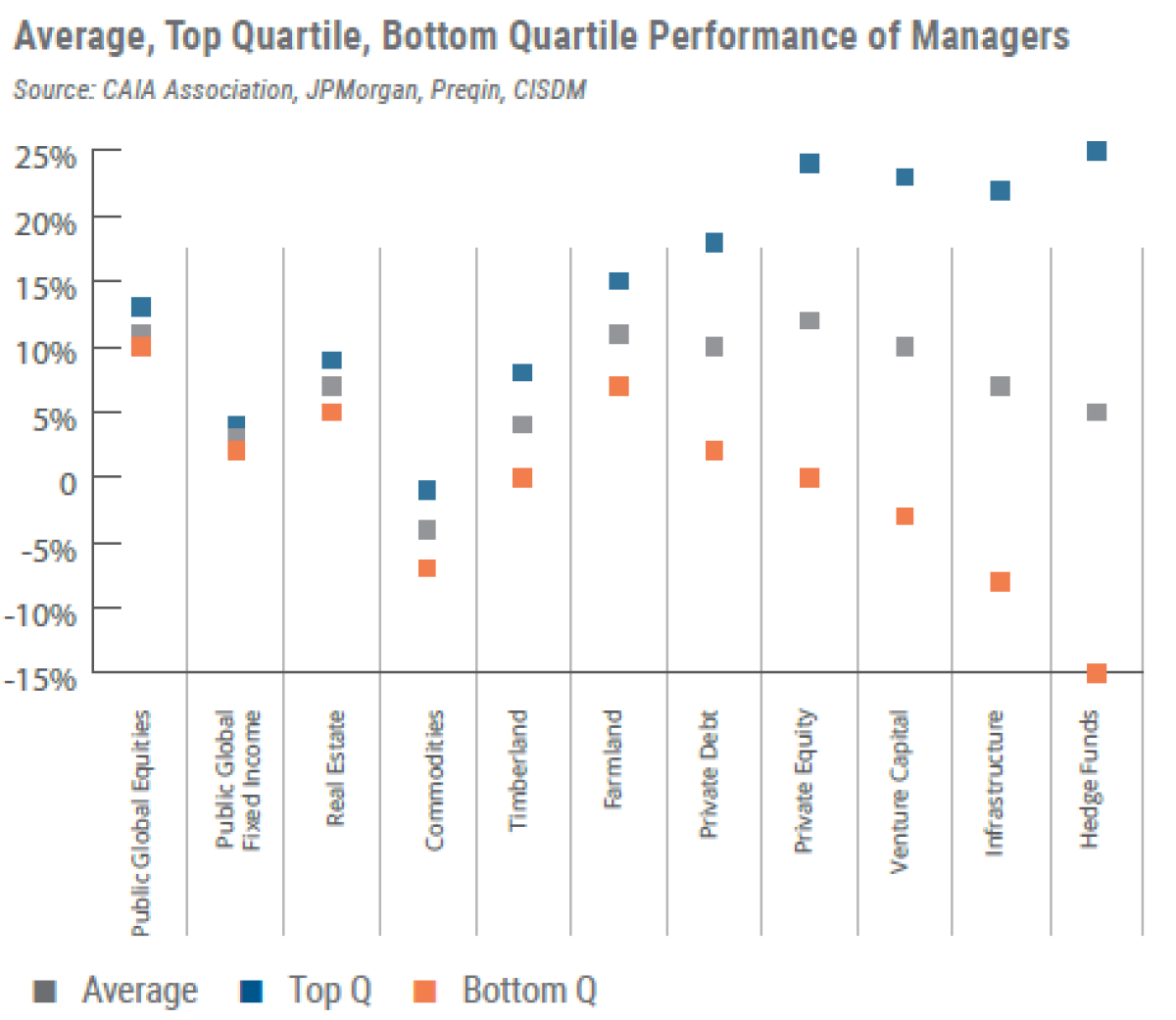

Allowing smaller investors access to self-directed investments in illiquid alternatives brings a number of risks including the need for increased education, reduced negotiating power compared to high-commitment-amount investors, lock-up periods, and higher potential for fraud due to limited regulatory oversight. Obtaining median performance in private equity and venture capital is more difficult than with listed equities as it requires access to better performing fund managers, direct investment opportunities, and research to understand the different, unstandardized performance metrics used by fund managers. For example, there is a wide dispersion in the performance of managers in private equity and venture capital in comparison with public equities:

Source: CAIA

It is essential that with expanded access, investors understand that past performance is not indicative of future performance. To broaden education on private funds, managers can leverage educational, self-service technology that allows a new pool of investors to demonstrate an understanding of private fund risks while documenting sophistication for fund managers. Smaller investors may not be represented comparably to larger, institutional investors in the negotiation of investment agreements including fees, governance, reporting, and exercising contractual rights; however, there is US regulatory attention underway to increase investor protections. To mitigate the risk of lock-up periods, this new class of direct investors should start with investing with a long-term approach to listed equities demonstrating sophistication before diversifying into a private equity fund investment with a 10-year fund term, generally deployed over a 5-year investment period. Market participants and governments are aware of the benefits of allowing additional access to alternatives balanced with the potential drawbacks. Regulation is evolving fueled by technology advances. Access to these better opportunities will be essential for successful, diversified investment performance.

It is important to really highlight the role played by technology to expand access to alternative investments. There is a gap between private markets and the wealth management industry and without digitalization it would be very difficult and operationally inefficient to focus on the retail channel. With technology and structuring solutions, however, including feeder funds and aggregation vehicles, this is starting to change. But to tap into the vast opportunities that these new pools of capital represent, alternative asset managers need to provide a fully digital and seamless experience including digital onboarding and subscription processes. End-to-end digitization for General Partners (GPs) reduces administrative costs, streamlines investor processes, and provides them with the tools to access an ever-expanding wealth management market. According to a white paper from Bite Investments and Mergermarket, enhanced data access and operational efficiencies are the main drivers for digitalization among investment firms to grow and stay competitive. The pandemic encouraged large firms to enhance their technological capacity and smaller firms to capitalize on a first-mover advantage. 90% of firms with AUM of more than $1 billion agree that keeping ahead of the game in regard to technological capabilities at their organization is a top priority. Investors are arguably the most important part of the private capital ecosystem. Therefore, catering to their desires and demands is an absolute priority for alternative asset managers. Digital adoption is needed to help enhance this client onboarding.

Historically, for Limited Partners (LPs) investing in a private equity or venture capital fund, a $10 million minimum LP commitment is fairly standard (page 3) with a quarter of managers requiring a higher amount to constrain the number of investors in any fund. Each investor introduces maintenance costs to service the LP for the life of a fund, initiating at investor onboarding with lawyers reviewing redlined subscription agreements and continuing over the life of the fund with facilitating capital calls, redemptions, dispositions, custom LP financial reporting, etc. When expanding funds to lower commitment investors ranging from $50,000 to $25 million, the net earned management fees are reduced due to increased investor maintenance operational costs. To alleviate this, managers can provide individual investors with access through traditional 401(k)s with appropriate regulatory support, feeder funds, or other types of pooled capital which the managers service as a single investor. As a result, many asset managers and fund administrators are investing heavily in new technology which automates investors onboarding and fund lifecycle operations reducing the cost to maintain investors. These technical upgrades can be slow as firms pivot from legacy technology stacks and need to overcome “technical debt” before launch. Alternatively, outsourced solutions are increasingly available from service providers supporting client onboarding, e.g. Unqork, Anduin, fundformer, and Nova as well as AML/KYC automation, e.g. Plaid, Middesk, Alloy, Socure, and Cearview AI (biometrics).

The following sections cover approaches to allowing smaller investor access. A brief description is provided along with key benefits and potential drawbacks specific to each approach. Additionally, where possible, an indication of past performance, activity and growth potential is provided. As part of this review, the role of technology and digitalization in allowing increased access will be considered specifically as relevant to the approaches.

1) Listed Private Equity Investment Vehicles

Listed private equity allows stock market investors to invest in a diversified portfolio of unlisted companies, otherwise available only to large institutions. There are three main types of listed private equity vehicles: 1) direct investment companies which normally provide exposure to a single private equity manager who invests funds in individual companies that together comprise portfolios of directly-held private equity investments, 2) funds-of-funds which invest in the funds managed by a number of direct investment companies that themselves invest in individual companies, and 3) private equity fund managers that generate management fees from managing private equity funds.

There are about 300 tradable, closed-end PE funds listed globally. These investments are tracked by index providers including: 1) the Morningstar PitchBook Listed Private Equity Indexes, 2) Redrocks Listed Private Equity Series, S&P Listed Private Equity Index, and 3) the LPX Index Series. Listed Private Capital’s (LPeC’s) analysis of LPX data shows that the size of the listed private equity market around the world has more than tripled over the last decade, from a combined market value of £41.5 billion in 2010 to £125.8 billion by the end of 2019 (ca. $166 billion). LPeC’s analysis (page 10) indicates that an investment in a broader listed private equity index has outperformed the Morgan Stanley Global Equity Index over the past ten years. While any potential drawbacks are made clear, overall this approach offers a straightforward, easily accessed route to obtaining the benefits of exposure to private market access and the newer companies represented, in addition to asset class-specific listed real estate, newer US business development corporations, and infrastructure funds.

Technology is allowing increased transparency and access to information on underlying funds. For example, investors can monitor NAV discounts on a portfolio and index level with regular frequency and can be provided with aggregated information on investment fundamental characteristics including EBITDA growth and valuation.

A proxy for activity is the market capitalization of the LPX Composite Index.

Source: LPX, updated to April 2022

Though still relatively small by comparison to the wider investment trust market, the sector is now large enough to be a serious contender and is attracting greater attention from a new range of investors. As listed investments, this approach allows a simple manner for individual retirement accounts to invest in private assets and may see further growth if new vehicles are created to expand the investable universe.

2) Special Purpose Acquisition Companies (SPACS)

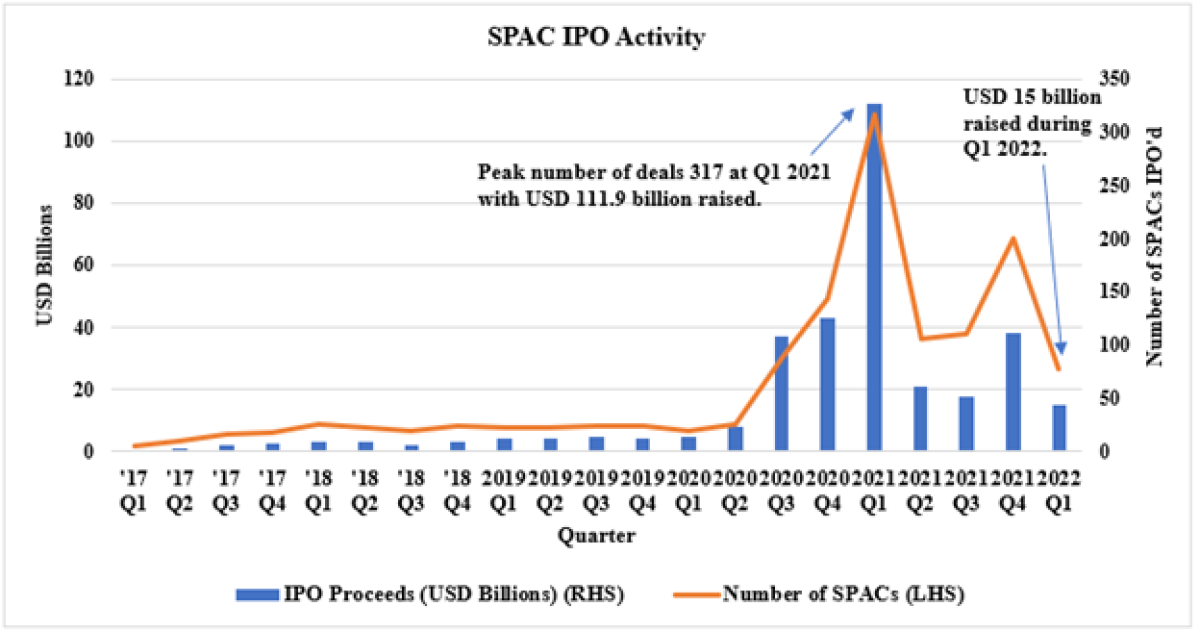

“SPAC” means special purpose acquisition company (also known as “blank-check company”), and describes a shell entity with no operations, created by a financial sponsor for the sole purpose of raising capital on a stock exchange via IPO. SPAC formation in the United States reached a record level during March of 2021 and has since continued albeit at lower levels.

Source: Pitchbook

Given recent increases in the issuance of new SPACs and related acquisition activity there has been wide coverage of this topic with the benefits and potential drawbacks, particularly for smaller investors, gaining attention. Changes to the regulatory oversight of SPACs is expected in the United States with SPACs also allowed in Europe, the UK, the Middle East and potentially Asia.

While it may be early to assess the weaker indicated performance for retail investors in SPACs over the recent period, the growth in activity certainly demonstrates investor interest in accessing private companies despite issues, now being addressed by increasing regulation, in an environment that has seen fewer IPOs until very recently.

3) Crowdfunding

Crowdfunding, as defined by the European Commission, is a way of raising money to fund projects or businesses from individuals or corporations. The fundamental idea of crowdfunding revolves around increasing the access to and for investors. Crowdfunding activity crosses four main channels:

- Crowd-lending, specifically peer-to-peer lending: the crowd lends money to a company with the understanding that the money will be repaid with interest. It is very similar to traditional borrowing from a bank, except that you borrow from lots of investors.

- Equity crowdfunding involves the sale of a stake in a business to a number of investors in return for investment. The idea is similar to how common stock is bought or sold on a stock exchange, or to venture capital.

- Reward-based crowdfunding lets individuals donate to a project or business with expectations of receiving in return a non-financial reward, such as goods or services, at a later stage in exchange for their contribution.

- Donation-based crowdfunding lets individuals donate small amounts to meet the larger funding aim of a specific charitable project while receiving no financial or material return.

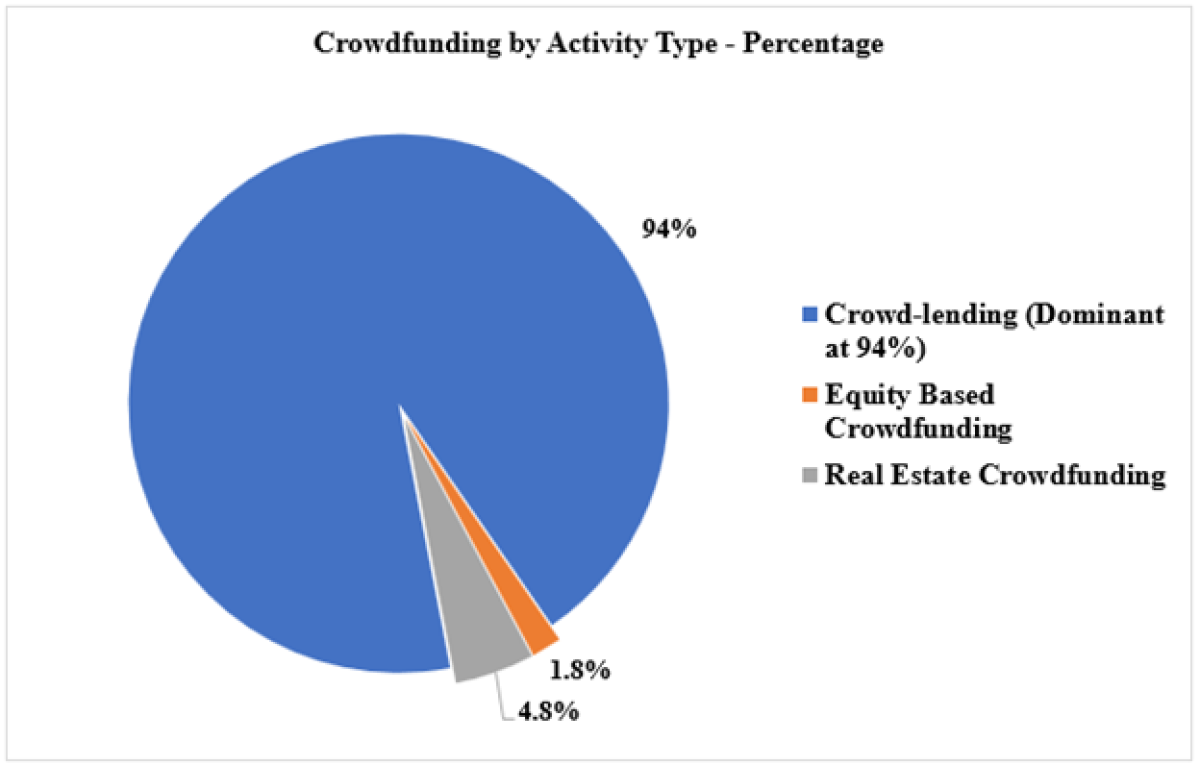

Because of the overwhelming size and interest of the first two channels, the following section will focus on the investment applications, drawbacks, and the future of crowd-lending and equity crowdfunding.

Source: Cambridge, UK: Cambridge Centre for Alternative Finance

Crowd-lending

Crowd-lending is the largest, and arguably most diverse, channel of crowdfunding. Crowd-lending comprises over 80% of crowdfunding’s volume, totaling just about $100 billion in transactions in 2020 alone. Platforms offering crowd-lending include Yieldstreet, offering a range of alternatives, and Mintos, reporting over €8 billion peer-to-peer loans arranged since 2015. Although the way in which these loans are administered varies widely, the advantages for both lender and borrower remain constant. Lenders observe good returns and diversification, and borrowers often receive lower rates by avoiding financial intermediaries, as well as increased access to borrowing.

A study of over 3,000 European loans between 2012 and 2017 resulted in an IRR of over 7.7% in using crowdfunding as an investment vehicle. The borrowing in this study was only commercial; loans to individuals were excluded. More recently, a survey of nearly 50 crowd-lending platforms produced an expected return of about 9.5%. Naturally, returns vary on sector and risk profile.

For most types of crowd-lending in 2020, more than 25% of users were either underbanked or unbanked (page 55). The access provided by crowd-lending holds tremendous potential. Globally, over 2 billion individuals and 200 million small businesses are unable to participate in debt transactions.

Increased access also produces diversification for investors. Platforms have realized the attraction of diversification and use technology to emphasize its potential. Machine learning programs known as “automated lender diversification” match lenders with loans that meet their preferences. These algorithms do much of the investor’s leg work with efficiency.

Equity Crowdfunding

Equity crowdfunding gives smaller investors access to private equity, and it gives entrepreneurs access to funding necessary for scaling their projects. Although the success of equity crowdfunding is generally lower and less mutable than traditional private equity, the underlying power of private markets remains. Examples of equity crowdfunding platforms include WeFunder and GoFundMe.

Worldwide, equity models alone generated over $4 billion in 2020, and have shown trends of consistent growth. Most of these funds come from non-institutional but fully banked investors.

The performance of equity models is important for the integrity of these investments. Over its decade-and-a-half lifespan, such measures are mostly well recorded, both by platforms and academics. Although biases exist, the platforms often boast top quartile returns. WeFunder, for example, reports a 23% IRR between 2013 and 2019.

Equity models have produced a number of well-known unicorns over the past few years. In the UK, BrewDog and Revolut both achieved unicorn status in 2018 via Crowdcube. In that same year, the US saw crowdfunded companies Checkr, Zenefits, and Patch of Land all cross the billion-dollar threshold. For consumer-facing companies like BrewDog, crowdfunding leverages investors’ personal stake in the company, creating a loyal customer base.

Common Concerns of the Crowdfunding Industry

Each sector of crowdfunding raises its own unique concerns, but three broad concerns span the industry as a whole: cybersecurity, fraud, and changes in regulation. These threats concern players in the industry for good reason; each has uncovered extreme vulnerabilities in the market already. Disruptions caused by any of the three can change the playing field quickly and dramatically.

Crowd-lending and equity crowdfunding offer a new and exciting investment opportunity, but risks exist. Crowd-lending is still adolescent, and lenders, borrowers, and platforms are learning how to operate most efficiently. The biggest concerns are the complexity of trading crowdfunded debt, and flaws in credit rating systems. Specific to equity models, these risks include illiquidity and high failure rates. In addition to the crowdfunding platforms themselves new entrants are providing support to crowdfunding. For example, KingsCrowd is aggregating information that can be used by individuals to better assess investment opportunities. Improvements are being made to reduce these risks, but the nature of the investment inhibits their elimination completely.

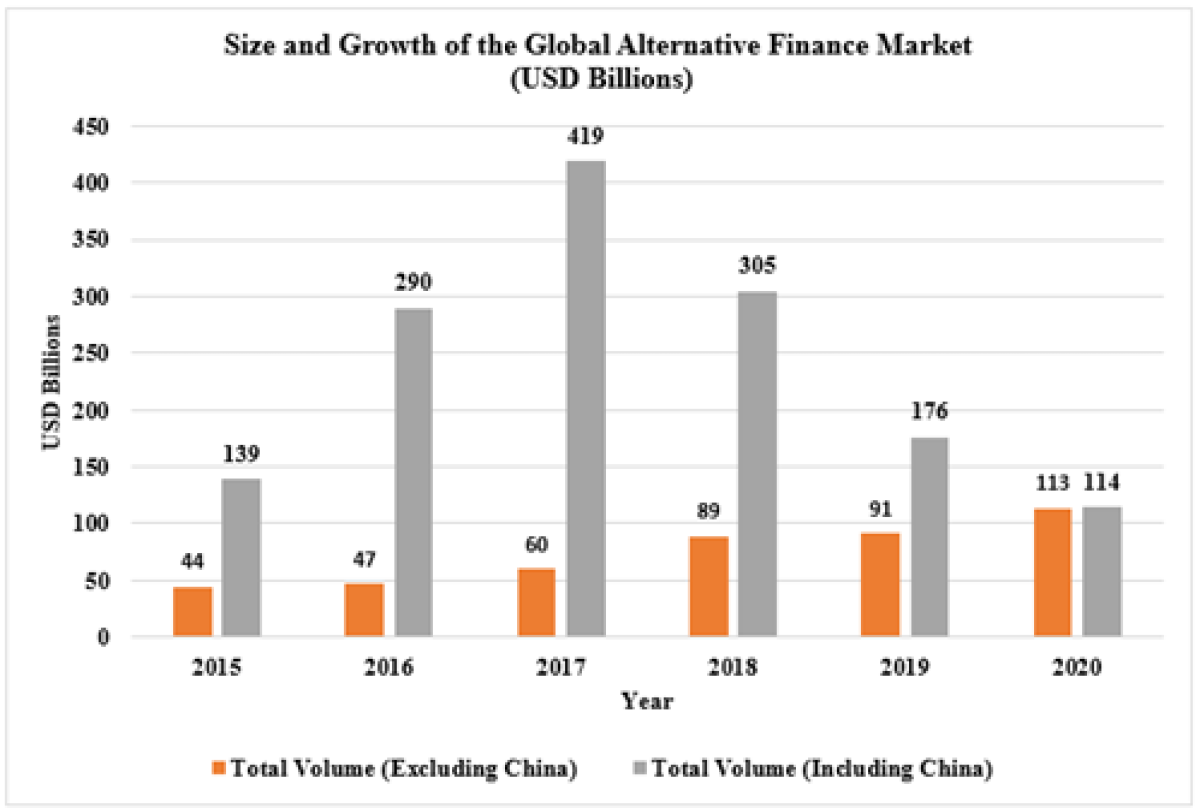

China based Ezubao planted the thought of fraud in the minds of most people and firms in the industry globally, but the response by regulators raised an equally concerning factor: changes in regulation. After the incident, crowdfunding was made almost entirely illegal in China. In just over two years, the Chinese crowdfunding industry fell from over $350 billion to less than $2 billion.

Despite the retrenchment of crowdfunding activity in China...

Source: Cambridge, UK: Cambridge Centre for Alternative Finance

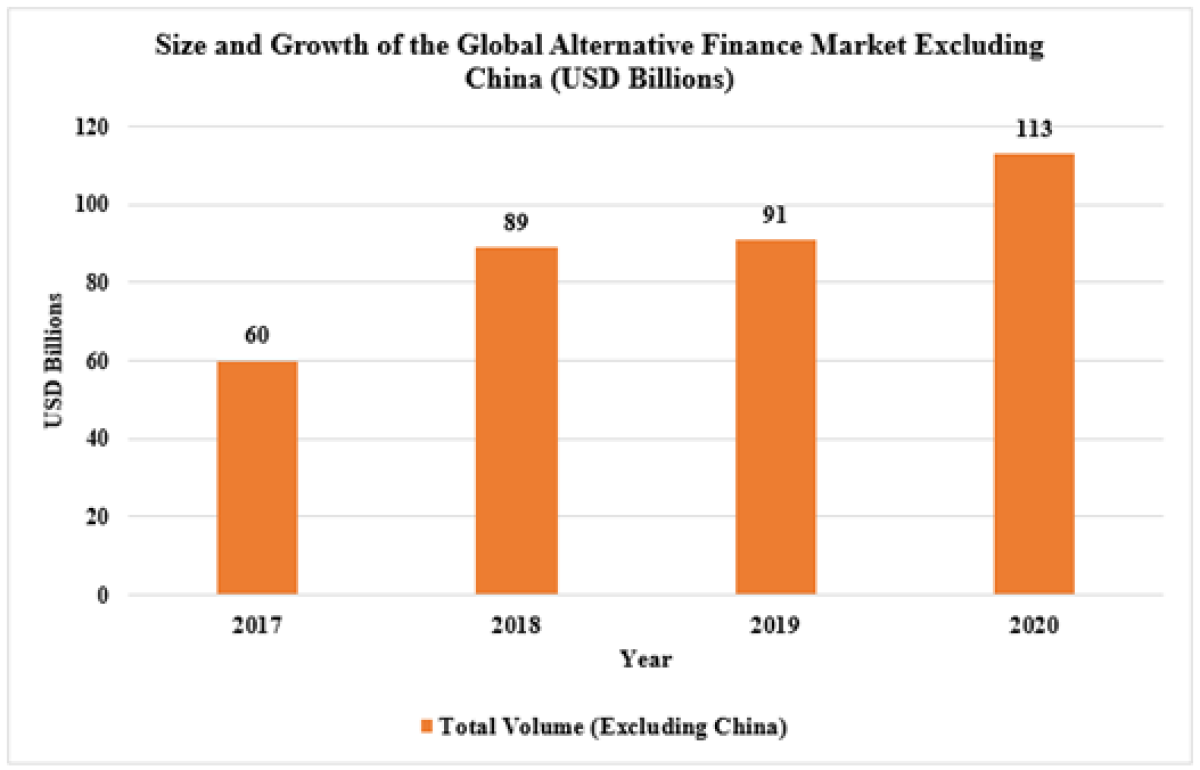

…crowdfunding volumes continue to grow across other markets demonstrating smaller investors' interest in the new opportunities provided.

Source: Cambridge, UK: Cambridge Centre for Alternative Finance

Crowdfunding is a viable option of increasing access to alternatives both as a substitute and as a complement. On a broad scale, the idea is not to replace existing financial institutions, but to democratize channels of investment that have previously been reserved for institutional or high-net-worth investors.

4) Private Fund/Co-Investment/Pre-IPO Shareholding Platforms

A growing number of relatively new platforms provide access to private equity and venture capital funds as well as directly into private companies with lower minimum investment amounts than normally available. Potential investors log-on to the platform websites, complete an identification and KYC process, and are then shown investment opportunities to which they can subscribe. The platforms include Moonfare, Titanbay, ALTO, Bite Investments, Forge Global, Sweater Ventures, AngelList, FlowStone Partners and Xen Capital with investment from strategic industry players and venture capital firms. The focus of each platform differs, for example:

- Moonfare provides access to private investment funds from managers including Silver Lake Partners, KKR, The Carlyle Group, Cinven, Warburg Pincus, EQT, Permira, CD&R, AlpInvest, Ares, H.I.G. Europe, CVC and a diversified feeder vehicle with a minimum investment as low as €50,000. Moonfare has demonstrated an ability to onboard leading fund managers that have historically delivered investment returns with an annual 0.5% fee on commitments. The direct access can allow end investors to avoid other fees normally charged by asset managers including investment advisors. In 2021 Moonfare established a secondary market along with Lexington Partners in order to allow investor liquidity.

- Bite Investments is built to expand access to private markets in a seamless end-to-end process. It is a technology-enabled, award-winning alternative investment platform catering to all private market investors. Through the digital wealth platform, investors and LPs get access to leading alternative investment opportunities, with lower fees and low minimum investment amounts. The fundraising management software provides General Partners (GPs) with everything they need to compliantly streamline and scale the distribution of private markets investment products to the wealth management market. The global SaaS platform enables managers to offer a fully digital end-to-end user service for product launch, investor subscription, onboarding, and post investment events to their investor base.

- Recently listed, Forge Global is actively providing investor access to private companies including Toast, Square, WHOOP, and Discord. Other “pre-ipo” platforms include OurCrowd, AngelList, Republic and Webull with PrimaryMarkets introducing a fund fundraising and liquidity solution.

- Canadian FinTech company Wealthsimple is aiming to bring venture capital and growth equity investments to retail investors.

- Titanbay is expanding a platform for sophisticated investors and wealth managers.

- Alto IRA has launched an alternative IRA account for individuals who want access and diversification in some alternative asset managers such as AcreTrader, ATX Venture Partners, Capital Engine, Equity Multiple and Percent. Alto IRA offers traditional, Roth or SEP IRA options, and provides access to a wide range of alternative investment products such as the ones listed above, and many more including cryptocurrencies and private startups. The investment minimums for Alto IRA’s onboarded offerings range from as little as $100 to $5 million.

Awareness of the platforms is expanding which helps to reduce the investor acquisition costs being absorbed at this stage of market evolution. Indications of asset growth on these platforms include Moonfare’s reporting of over €1.6 billion of AUM arranged, Xen Capital over $200 million arranged, PrimaryMarkets over $250 million securities traded and Titanbay indicating progress towards growth targets. Forge Global reports over $3 billion of transactions completed in 2021 alone. Recent partnerships with some of the platforms and the asset managers and private fund managers described below are expected to greatly increase the level of utilization and activity.

Platforms can provide simple, direct access to individual investors capable of making their own fund or fund-of-funds selections, or relying on the vetting offered by the platforms if provided, and managing their own liquidity requirements. As with the listed private investment funds, smaller investors may face limited transparency which could be an issue in the secondary market but overall the platforms can provide access to better performing investments, especially in the case where the offerings are curated, that would otherwise be unavailable to smaller investors. This direct access can provide end investors with the flexibility to customize their portfolio toward individual goals and preferences including impact.

5) Asset Manager or Consultant Sponsored Pooled Private Investment Funds & Network Arranged Access

An increasing number of large asset managers serving smaller investors as part of their client base are making efforts to increase access to illiquid alternative investments. Traditional asset managers have made strides towards democratizing private equity including Fidelity International, Vanguard, Mercer, and Schwab. As a result, new partnerships are being formed between both the private fund managers and the larger asset managers. For example:

- Fidelity International has recently taken a minority stake in Moonfare as part of a broader partnership.

- Vanguard is offering private equity to qualified investors through a partnership with Harbourvest

- Blackrock recently launched The BlackRock Private Investments Fund which ‘democratizes access to private investments through a continuously offered, closed-end fund’ accessible to smaller investors.

- From a UK base, Schroders is anticipating democratization of private asset investment. with the FCA regulator changing rules to allow investors to reduce constraints and help meet goals.

- Mercer has expanded its client base’s access to private equity by partnering with platform Titanbay.

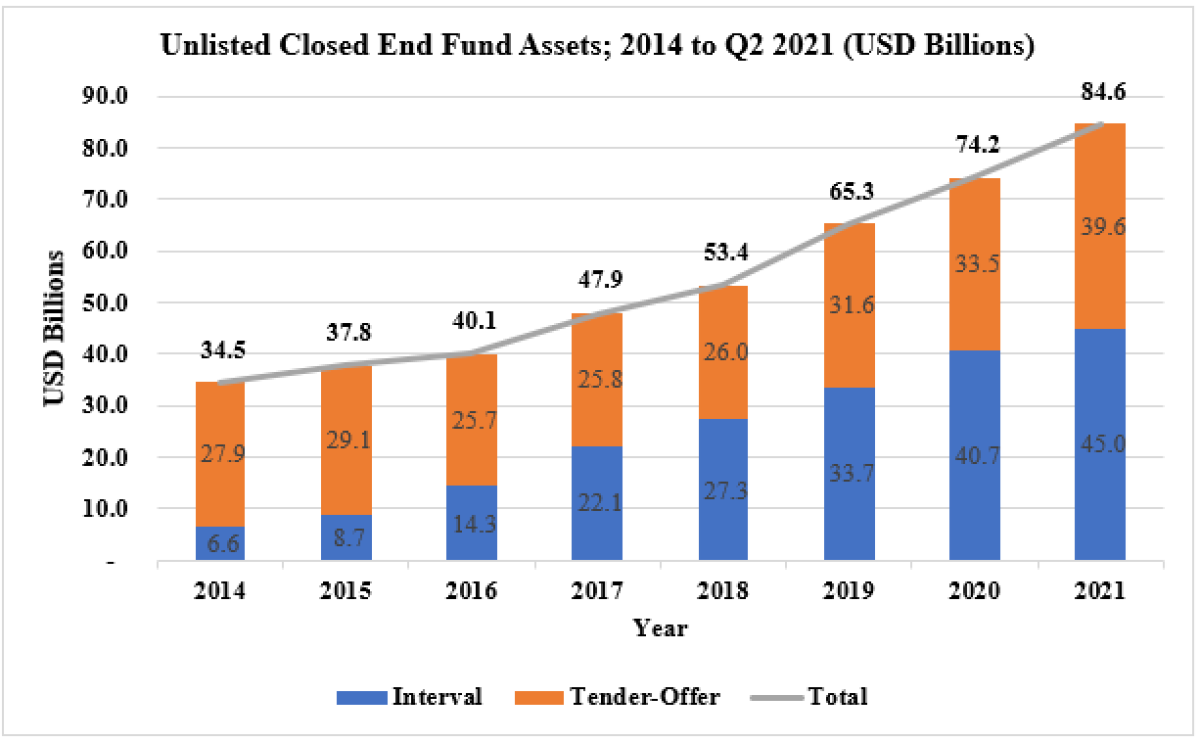

- Institutional private market managers including Carlyle Group and KKR have launched traditional, evergreen, ‘40 Act mutual fund structures to make private markets more accessible to smaller investors, with Pantheon and others having passed the $1 billion fund size. A large number of these funds are targeting real estate and credit investments, in addition to equity holdings. The number and AUM of closed-end funds has recently increased substantially to over 130 funds and asset levels reportedly have grown to $85 billion (page 3 & 6):

Source: UMB Fund Services - Fuse Research Network, October 2021.

iCapital has emerged as an important solutions provider making high-quality private investments more widely accessible to advisors and their high-net-worth clients while enabling fund managers to reach new sources of capital. iCapital was founded in 2013 and is headquartered in New York City, with offices in Zurich, London, Lisbon, Hong Kong, Singapore and Toronto.

- The company’s technology facilitates digitalized access to alternative investments such as private equity and hedge funds, and provides investor relations, administrative, and reporting support for the life of the investments.

- Wealth managers and their high-net-worth clients use iCapital’s platform to access, diligence, and invest in a curated menu of alternative investments. Asset managers use the platform to raise capital and automate the complex operational and back-office support services associated with alternative investments such as AML review and subscription agreement processing.

- In an effort to connect all players in the alternative investments ecosystem, the company offers single-point integration to custodians, third-party fund administrators, and reporting platforms. On iCapital’s flagship platform, which serves the independent advisor channel, iCapital typically provides access to strategies such as middle market buyout, growth equity, secondaries, private credit, private real estate, as well as a broad range of hedge funds and structured notes.

- Private market and hedge fund strategies are available to investors through feeder funds as well as ’40 Act registered funds such as interval and tender offer funds. As of April 30, 2022, the company serviced more than $125 billion in global client assets across more than 1,000 funds.

- According to CEO Lawrence Calcano, iCapital is committed to educating advisors about the responsible use of alternatives in client portfolios, and offers educational programs, including AltsEdge, which focuses on foundational coursework in private markets, and AI Insight, which provides fund-specific education and accreditation. iCapital also offers a portfolio risk modeling tool that can assist clients with stress testing private market allocations to help understand performance. iCapital’s success has fueled significant interest from investors; to date, the company has formed key strategic partnerships with Apollo, Bank of New York, Bank of Singapore, BlackRock, Carlyle, Credit Suisse, Fidelity, Goldman Sachs, Morgan Stanley, UBS, WestCap, and Wells Fargo.

Peer platform Cais Group provides similar access and has recently raised $100 million for further expansion.

In terms of growth, this approach benefits from the access that the fund managers already have to existing clients which helps reduce acquisition and administration costs and speeds the ability to scale assets under management. While end investors will typically face higher fees than is currently allowed for retirement accounts in many regulatory jurisdictions it is expected that there will be growth as investors and their advisors remain interested in accessing new and diversified investment opportunities.

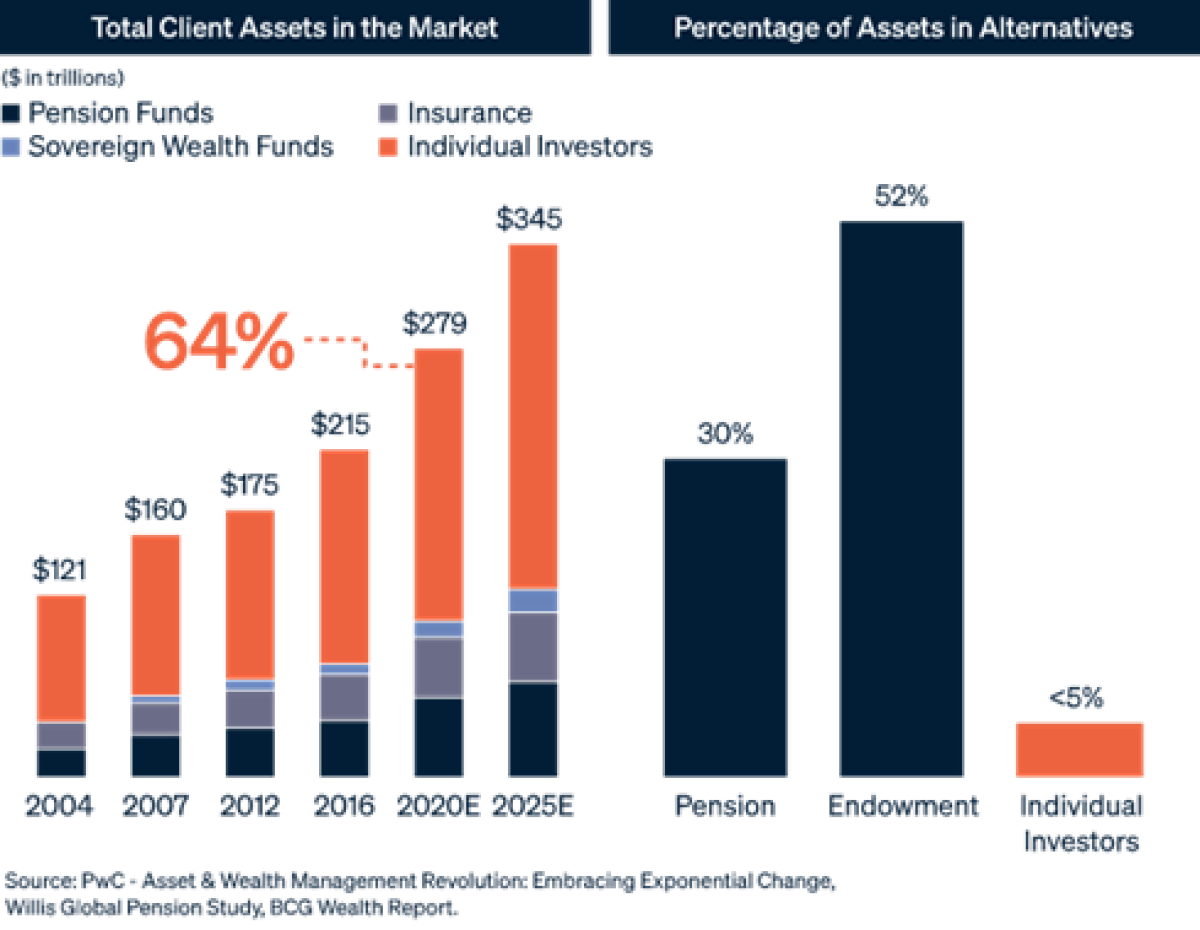

6) Efforts & Adaptation of Private Fund Managers Underway

Many private fund managers have announced plans to increase the portion of their investor base that is composed of smaller investors, including KKR & Co. Inc., Apollo Global Management, Blackstone, BlackRock, Carlyle Group, Ares Capital Corporation, Carlyle, Pantheon, and Partners Group. All of these institutions have announced interest in the smaller investment market in one way or another. KKR’s 2021 Investor Day presentation provides estimates that individual investors account for 64% of total client assets in the market. Per the analysis, individual investors account for over $179 trillion in assets but individuals make up less than 5% of assets invested in alternatives. KKR further estimates that the actual figure is closer to just 2% and 3%.

Source: KKR (page 151)

Examples of adaptation undertaken by private fund managers include:

- EY’s 2022 Private Equity Survey reports approximately half of respondents are “seeking to increase the amount of capital from wealth and retail channels” (page 19).

- As noted above, KKR is onboarded with Moonfare and has recently invested in iCapital through a key partnership.

- A number of managers are offering structures designed to allow smaller investor access including Partners Group establishing programs to allow smaller, defined benefit pension plan participants to access private investments; Pantheon growing evergreen private investment vehicles; and Bite Investments allowing access to a portfolio of private fund investments.

- Ares Management growth initiatives include Ares Insurance Solutions providing offerings to serve individuals as well as a SPAC; Ares Acquisition Corp, private funds including secondary funds, and the addition of Black Creek’s non-traded retail REIT capabilities.

- Similarly Apollo Global has been active in the insurance and annuity space and the firm expects individual investor assets under management to increase from less than 5% to over 30% of the investor base in the future. Stephanie Drescher, Senior Partner and Chief Client & Product Development Officer commented, during the most recent annual investor meeting; “And finally, I do believe in the democratization of finance (page 45) and the ability over time for high-net-worth and mass affluent investors to continue to gain greater and more efficient access to a number of high-quality alternatives as we move forward”. Apollo Global is also expected to grow asset management for individual clients partly through its annuities activities.

- Carlyle is the first private capital investment firm to make certain funds available through Allfunds’ alternatives service offering. iCapital and Allfunds announced a strategic partnership in June 2021 leveraging iCapital’s technology and fund solutions to make private market investment opportunities available for Allfunds’ clients. Carlyle has also invested in iCapital with plans to further increase the assets managed for individual investors.

- Blackstone expects individual investors to grow to represent half of managed assets in the future.

As mentioned above, technology is a factor in the ability of the larger private fund managers to adapt, as with an increased, more efficient ability to complete compliance checks including KYC and AML reviews it is now possible to include a broader set of LPs.

With a greater representation of smaller investors included in private fund investments, there could be a shift in the LP base for the larger fund managers, changing the influence of some of the established, larger institutions. As private equity and venture capital become more accessible there could be greater calls for regulation, moving these private investments in the direction of the public markets in terms of transparency and investor protections.

While at an early stage, with many very recent announcements, further activity can be expected given the need for the larger fund managers to source new pools of capital and the potential size of the individual investor capital base. The direct access will also allow smaller investors to target their investments towards preferred regions, sectors, asset types, ESG requirements and impact goals.

7) The Potential Role of Blockchain-Based Solutions

Blockchain tokenization is the process of digitally representing a real-world asset on a distributed ledger. Asset tokenization involves the representation of pre-existing real assets on the ledger by linking or embedding by convention the economic value and rights derived from these assets into digital tokens created on the blockchain. Dematerialization is the process for taking the tokenization process to its logical conclusion and imbuing the digital representation with full legal rights and retiring the physical representation.

What is Tokenization?

Tokenization is the issuance of a blockchain entity, called a token, that represents a tradable good. Advanced blockchains, such as Algorand and Polkadot, support sophisticated features that allow these tokens to be imbued with not just data representing the tradable good but also its rules and restrictions. Real-world assets such as company shares, commodities, art, real estate, and money, are all examples of items that have been successfully tokenized on the blockchain. Some of these assets exist in identical multitudes such as company shares and money. These can be represented with fungible tokens on the blockchain. Others, such as individual pieces of art, are unique and can be represented with non-fungible tokens which enforces that uniqueness.

Tokenization, especially in its ultimate fully dematerialized form, has the potential to revolutionize the way we invest and trade assets. Blockchains, because of their decentralized property, enable a borderless network where participants, such as investors, businesses, and communities can interact with each other without deferring to a central authority. When combined with tokenization, rich complex assets representing real-world objects and securities, can be traded safely and quickly while abiding by all necessary standards and regulations.

These tokens are “smart objects” and can be traded safely at world-scale while conforming to all necessary requirements such as abiding by relevant regulations and ensuring that the supply cannot be altered accidently or maliciously. Their behavior is enforced by the sophisticated consensus algorithm at the heart of the blockchain and mathematical proofs of their correct behavior are computed by the numerous Validators of the blockchain that sign all transactions once they have been tested and have passed all applicable rules.

Blockchain can transform many industries and the way investors interact with businesses and brokerage firms. Thanks to its decentralized nature, blockchain can enable investors, businesses and communities, anywhere in the world to interact with one another without relying on a central authority to connect them together and to act as a neutral arbiter in their deal. In this borderless network chaos is held at bay because the very assets can be defined with logic and behavior to prevent their misuse or misappropriation.

Though the technology and practice of tokenization are nascent, the potential benefits are large and include efficiency gains driven by automation and disintermediation, transparency, and improved liquidity potential. Tokenization is poised to become the next big thing in the financial markets because it provides the following benefits:

- Fractional ownership - One of the most important features of tokenization is the ability to own fractions of an asset. For example, as an investor, you might be interested in getting exposure to the real estate market by owning property in the best region. However, you might not hold enough funds to buy a single property, let alone create a real estate portfolio. If every property would be converted into multiple tokens, you could own a portion of it or shares of multiple properties and thus benefit from their potential price gains. By holding a token or several of them, you hold the definitive proof that you are the owner of a share of that property.

- Faster and cheaper transactions - Modern blockchains enable fast and low-cost transactions, and this relates to the tokenized assets as well. For example, the latest generation of blockchains, such as Algorand, Cosmos, and Polkadot, rely on a consensus mechanism Proof of Stake. These algorithms ensure that the network has high throughput and low fees while still ensuring instant finality of settlement. This could speed up the adoption of tokenization as the main approach to deal with real-world assets without exposing investors to new risks of unsettled funds that may be reverted, as is the case in legacy blockchain systems.

- Transparency - Blockchain has become one of the most important technologies thanks to its unique attributes, including immutability and transparency. Once a blockchain transaction has achieved finality, thanks to the irreversibility of cryptographic hashing, it cannot be undone, reversed, canceled, or tampered with in any way. Additionally, all transactions must be digitally signed by authorized parties in order to be considered valid and only valid transactions are included in a block. On Algorand, for example, these new blocks containing valid signed transactions are created in less than five seconds and are instantly final the moment they appear in a block. This allows all network participants to monitor data almost in real time and be sure about the authenticity of transactions.

- Potential Liquidity - By converting real-world assets to blockchain tokens, issuers can secure greater liquidity. For example, private securities are typically illiquid, which affects the trading process on secondary markets. Thanks to tokenization, this limitation can be addressed to give investors more freedom to implement various strategies on scarcer assets.

- Convenience - Several decades ago, the main form of communication between investors, brokers, and market makers was done by phone. There were no online accounts and no advanced charting options right in your pocket. Today, everyone can get exposure to stocks by buying shares or speculate on their price via derivatives through online platforms. The internet has transformed the way we invest, but blockchain can do even more by making the investment process more convenient and accessible while decreasing the possibility of fraudulent activity because of their ubiquitous use of digital signatures.

The benefits, by asset class, are further described in CAIA’s inaugural coverage on the topic. Again, the important benefit of fractional ownership may allow for more inclusive access of small and retail investors to now restricted asset classes, while enabling global pools of capital to reach parts of the financial markets previously reserved to large investors. As tokenization of assets expands, issues including security, scalability, data protection, and regulatory oversight are being actively addressed (page 19).

In terms of activity, launched in 2008, Bitcoin was the first public use case of blockchain combining a secure chain of blocks and a distributed ledger into the decentralized mechanism. This innovative technology, however, has immense reach beyond a payment or store of value system. Blockchain enables safe interactions between parties without requiring a trusted intermediary. This simple but powerful feature enables many use cases. Perhaps chief among these is the ability to tokenize both digital-native and traditional (real-world) assets.

Over the last five years, a new generation of blockchain technologies, such as Algorand, developed initially at MIT by Turing-award-winning computer scientist, Silvio Micali, have emerged to possess the unique combination of scalability, decentralization, security, and sustainability (ie carbon neutrality), which - although in early phases of adoption - are providing the critical backbone infrastructure for fully operational, transparent, liquid, and efficient marketplaces for tokenized real-world assets and funds.

Tokenization activity to date for private equity, credit and other alternative assets, appears to be limited, but is increasing with platforms supporting the blockchain-enabled distribution of funds and investments, and potential secondary trading, including, for example:

- Republic, an Algorand based private investing platform and technology services provider made up of numerous operating entities, that lets anyone invest in early-stage companies. Spun out of AngelList, Republic's private investing platform features more than 500,000 users investing as little as $10 in over 170 vetted companies.

- ADDX intends to provide digital token access to assets including funds.

- Valk Tech is a Corda blockchain-based DeFi service provider, building decentralized infrastructure for capital markets.

- ARCHAX, building on Algorand, is the first digital securities exchange to receive FCA authorization as a digital securities exchange, virtual asset service provider (VASP), brokerage and custodian. Founded by experts from the regulated financial markets world, Archax offers a credible bridge between the new blockchain-centric community and the traditional investment space.

- TOKO is a digital asset creation engine created by DLA Piper, one of the world’s largest law firms, using Hedera Token Service.

- QuantmRE and Vesta Equity are platforms making home equity accessible, investable and tradable.

- Y Combinator announcing plans to increase investor access via blockchain.

- AllFunds platform which is automating the entire fund distribution value chain and investment cycle, including blockchain capabilities.

- FundsDLT efforts connecting investors and asset managers by helping intermediaries to digitize fund distribution operations through a market infrastructure based on distributed technologies.

- Neufund is a blockchain-enabled investment fund access platform.

- Centrifuge.io has created a fractionalized marketplace to borrow and lend against real-world financial assets such as invoices, real estate debt, and royalties to DeFi.

- Vertalo is actively connecting participants in the digital securities ecosystem regardless of blockchain protocol.

- Securitize provides business with fundraising, liquidity, tokenization and importantly the ability to support the onboarding of smaller investors.

In early 2022, iCapital announced that it would lead an industry consortium to develop a distributed ledger-based solution for the alternative investment ecosystem that will make it easier to acquire and service alternative investments. Creating a secure, shared, auditable record for each alternative investment that will augment the efficiency of the investment creation, management, and exit processes, will eliminate the need for each party to take in data, reconcile it to their records and share new versions of the data with others. The new model will also improve visibility throughout the process and across the value chain.

Given the capacity for improvement there appears to be ample incentive to collectively address issues, including gaining scale and regulatory developments, to realize the large benefits available. Deloitte’s recently released 2021 Global Blockchain Survey reports: “Our 2021 survey finds that global Financial Services Industry (FSI) leaders see digital assets - and their underlying blockchain technologies - as a strategic priority now and in the near future; In fact, nearly 80% of respondents say that digital assets will be “very/somewhat important” to their respective industries in the next 24 months” with asset tokenization cited as an important use case (page 18). “The business of adopting blockchain and digital assets is growing noticeably, as organizations increasingly accept that their current business models are at stake. More than three-quarters of FSI respondents strongly or somewhat agree that their organization will lose an opportunity for competitive advantage if they fail to adopt blockchain and digital assets.” While the impact of blockchain and its ability to tokenize assets is not fully perceived at the moment, major players of traditional finance mentioned throughout this article are starting to adopt the technology given the demonstrable benefits.

Summary

Smaller investors have demonstrated growing interest in accessing quality alternative investments, including private equity, private credit and venture capital, across a range of methods. New, technology-based, platforms are being deployed to allow individuals greater access to alternative investments including venture capital and private equity. The platforms and technologies being developed should also be able to improve liquidity opportunities for individual investors, ultimately increasing the attractiveness of the venture capital and private equity asset classes. Providing more self-directed or guided investment access may allow for greater diversification and for individual investors to express preferred strategies across regions, sectors, stages and ESG/Impact objectives. The concerns raised, including the need for investor education, risk management, and access to quality investments, must be addressed properly to assure successful investment outcomes for individuals. The participation of individuals in these opportunities either through asset managers and investment advisors or in a self-directed or guided manner is at an early stage and represents great potential for further activity.

About the Authors:

David Donahue, CFA, joined Mbuyu Capital Limited in 2015 as a partner. Mbuyu Capital brings the unique investment opportunities offered by African private markets to investors. Before joining Mbuyu, David was Head of Private Equity and Real Estate at Ignis Advisors, responsible for a $1 billion portfolio. Previously, he was responsible for a $2 billion global equity sector portfolio at the Dutch pension fund APG as well as $2.5 billion US equity portfolio manager at a Dutch insurer. David holds a bachelor’s degree in Economics from Boston College, Massachusetts and an MBA, Finance from the Isenberg School of Management at the University of Massachusetts Amherst.

Nina Tannenbaum is Head of Business Operations at Algorand, in which role she actively engages in global ecosystem development, solutions architecture, investments, and strategic projects. With a specialization in alternative investments across institutional finance, sports/media, and digital assets, Nina’s career spans two decades at leading financial institutions, family offices, and FinTechs. She is a professional advisor at the Martin Trust Center for MIT Entrepreneurship; a strategic advisor to DiligenceVault, a digital diligence platform; and a student research advisor to the Isenberg School of Management at the University of Massachusetts Amherst, focusing on the fractionalization and democratization of private markets. Nina is a board member at Columbia University, where she creates financial education and inclusion programs through the Columbia College Women’s Association. Nina holds her BA from Columbia University and an MBA from MIT Sloan School of Management.

Elsie Russell Brown is a technology leader with a decade of experience building FinTech applications from conception to launch. As VP, Technology Product Management and Grayscale’s first technology hire, Elsie leads product and engineering teams to empower confident crypto investing. Previously, Elsie led technology for Brookfield’s Private Fund Business and as a Vice President at Blackstone, she was responsible for overseeing technology for Investor Relations and Business Development. Elsie is the head of technology for NYC FinTech Women, an 8,000+ community in New York City dedicated to advancing women’s careers in FinTech.

Contributors

We are extremely grateful to the contributors that provided insights and updated information regarding developments for this article:

Naveed Ihsanullah, VP of Engineering & Research, Algorand; Nick Veronis, Co-Founder and Managing Partner, iCapital; Kelly List, SVP, iCapital; Emma Murphy, Principal, Niebart Group; William Bell, Managing Director, Strategic Growth, KKR; Charlie von Moll, Managing Director, Bite Investments; Deborah Botwood Smith, Chief Executive Officer, LPeC; Michel Degosciu, Managing Director, LPX AG; Magnus Grufman, Head of Investments, Moonfare; Ed Rushton, Macro Strategist, Optiver; Zach Bouhov; Rei Kule; Cole Lojek; Trevor Roy; Nista Shrestha; Antonio Venturim, and Harrison White.