Recorded Webcasts

Dan Joldzic, CEO of Alexandria Technology and Keith Black, PhD, CFA, CAIA, FDP discussed how machines are interfacing with humans to effect manager selection and private asset secondary sales in this second installment of Turn Text to Alpha. After a quick recap of Part I (https://bit.ly/3r2k8nx), the webinar continued to discuss key questions that sit across technology and finance:

- Can machines actually uncover hidden patterns that escape the human eye and emotions?

- How would the interface between technology applications enhance our ability to pick the best managers and companies?

- What are the limitations on artificial intelligence and other machine learning based models that are most likely to hinder or interrupt results?

- Can AI be used to expedite the secondary sale of private assets?

Just a few years ago, the Financial Data Professional Institute was just an idea. Now, after five exam cycles, there are FDP Charterholders in 41 countries, and the global footprint is growing. CAIA CEO Bill Kelly and Keith Black, PhD, CFA, CAIA, FDP, Managing Director, Program Director, FDP Institute, discuss the curriculum, and why the FDP Institute’s highly specialized body of knowledge resonates with investment professionals.

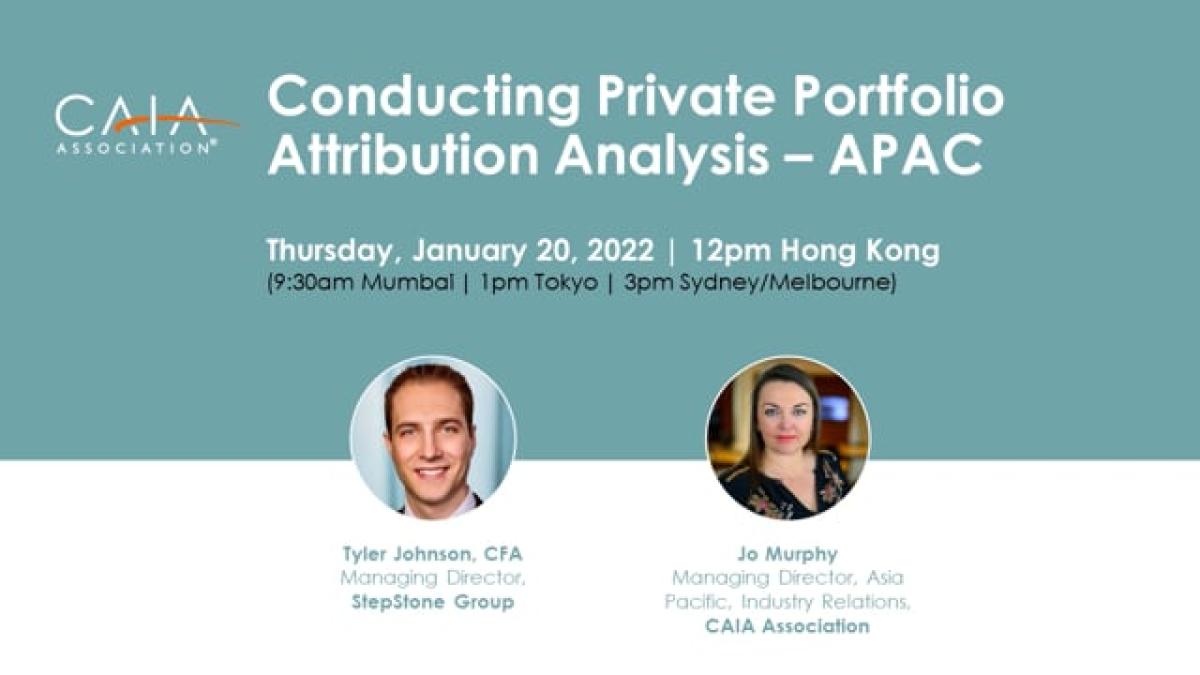

There are many methods for conducting performance attribution with portfolios containing only liquid assets. A lack of periodic asset return data and a clear definition of what constitutes an appropriate market benchmark thwarts efforts to perform similar types of attribution analyses for portfolios of private equity funds (and other illiquid investments). This presentation covered a proposed methodology for decomposing private fund portfolio performance in an article, “Private Portfolio Attribution Analysis,” published in the Fall 2021 edition of The Journal of Alternative Investments.

There are currently over 11,000 cryptocurrencies and digital assets. With many experiencing price volatility of over 100% per year, or five times the volatility of stocks, there is substantial disagreement on how to value these assets. Some valuation models used for traditional equity valuation can be used to price these assets. Investors may also find it useful to understand business models, emerging industries, and oligopolistic models.

There are many methods for conducting performance attribution with portfolios containing only liquid assets. A lack of periodic asset return data and a clear definition of what constitutes an appropriate market benchmark thwarts efforts to perform similar types of attribution analyses for portfolios of private equity funds (and other illiquid investments). This presentation covered a proposed methodology for decomposing private fund portfolio performance in an article, “Private Portfolio Attribution Analysis,” published in the Fall 2021 edition of The Journal of Alternative Investments.

ESG is no longer a mere add-on in a portfolio or investment strategy. For an increasing number of investors in alternatives, a thoughtful approach to ESG issues has become table stakes. As the industry continues to define the role of ESG and develop approaches to measure and analyze the effect of these issues on their portfolios, industry professionals must continue to educate themselves about the key trends and developments related to ESG across alternative asset classes. CAIA, in partnership with Nuveen, hosted a thought-provoking webinar series organized exclusively for the benefit of institutional investors across the world. In this fourth session, we discussed how asset owners can best integrate some of the most material ESG issues into their portfolios, regardless of asset class.

Listen in as Dan Joldzic, CEO & Quantitative Research, Alexandria Technology discusses natural language processing (NLP). NLP techniques can be used to analyze a variety of data sources, including news reports, company regulatory filings and earnings calls, as well as posts on social media sites such as Reddit. The output from these models can be used for stock selection with varying time horizons and degrees of alpha capture. This data can also be used to analyze sentiment regarding the ESG footprint of both public and private companies.

CAIA CEO Bill Kelly talks with Tony Davidow, President and Founder of T. Davidow Consulting LLC, about his new book, “Goals-Based Investing.” In their wide-ranging conversation, they touched on themes and changes Davidow sees in the wealth management advice space going forward, as well as current and future market conditions. As Davidow told Kelly, “I’d argue the next 10 years are going to be dramatically different than the last 10 years.”

CAIA CEO Bill Kelly was recently featured on The Fintech Files podcast, hosted by George Aliferis, where they discussed data and ethics in the investment management landscape. “A hallmark of a true professional, a true fiduciary, is doing the right thing when nobody's looking,” said Kelly, explaining that he added “diversity of people” into his blog’s tagline because it reflects his and CAIA’s commitment to diversity. Click here for the full podcast to hear more on data and ethics in investment management, and how Kelly connects this to the Hippocratic oath and talking Barbie dolls.

In a joint effort, KPMG International, CREATE-Research, and CAIA Association examined the role of capital markets in the transition to a low-carbon world. This report investigated the experiences to date of climate investing and the changes we can expect in the next three years, as we move towards a new investment paradigm. The research includes insights from 90 institutional investors, alternative investment managers, long only managers and pension consultants in 20 countries in all the key regions. This panel discussion focused on the insights, findings, and takeaways gathered from this report. Download the report here.