Recorded Webcasts

In the latest installment of “This Is Us,” CAIA Association CEO Bill Kelly interviews CAIA Board Member Alexander Ineichen about his new book, “Applied Wisdom: 700 Witticisms to Save Your Assets.” Ineichen, who is the founder of Ineichen Research and Management AG, also discusses current market conditions.

We officially launched CAIA LatAm, CAIA Association's 32nd Global Chapter! Made up of representatives from Brazil, Mexico, Chile, Colombia, and Peru, the Chapter Executive Committee will work to provide opportunities for local CAIA Members in many locations to network, share knowledge, and create an environment that fosters the growth of the local alternative investment industry. The Chapter will also host educational events featuring thought leaders, who will discuss a variety of alternative investment trends and strategies.

CAIA Association CEO Bill Kelly, CAIA Executive Vice President John Bowman, and the LatAm Chapter Committee hosted this special launch event as they outlined their mission and plans for 2022!

Listen in as CAIA Association’s Managing Director, Asia Pacific, Industry Relations, Jo Murphy, and Shreekant Daga, CAIA, CFA, FRM, Associate Director, India Liaison Office, provided an update on the private equity industry and introduced CAIA Association. Further, Wendy Leung, Assistant Director, Asia Pacific, External Relations, at CAIA Association, had a conversation with CAIA Member, Aswini Bajaj, CEO of Leveraged Growth about his CAIA journey.

In this presentation, Keith Black discussed the digital asset and cryptocurrency markets and the innovative solution to build a global, decentralized, and secure network that facilitates payments and other transactions. Keith explored how proof-of-work, such as Bitcoin mining, and proof-of-stake protocols, such as Cardano, are used to secure networks and complete transactions. Behind many of these currencies are real businesses, such as projects built on top of Ethereum smart contracts that facilitate borrowing and lending as well as options and futures trading. Stable coins pegged to USD or EUR can earn yields of up to 7% with minimal volatility. Returns and volatility data were presented, as well as evidence on how digital assets can add return to a diversified portfolio without adding to portfolio volatility. Risks of digital assets were also discussed, including regulatory risks, technology risk, and valuation risk. Keith’s presentation was followed with a discussion with Josh Kernan, who provided an update on digital assets and the current market environment.

ESG is no longer a mere add-on in a portfolio or investment strategy. For an increasing number of investors in alternatives, a thoughtful approach to ESG issues has become table stakes. As the industry continues to define the role of ESG and develop approaches to measure and analyze the effect of these issues on their portfolios, industry professionals must continue to educate themselves about the key trends and developments related to ESG across alternative asset classes. CAIA, in partnership with Nuveen, hosted a thought-provoking webinar series organized exclusively for the benefit of institutional investors across the world. In this third session, we discussed how real assets participants can protect themselves from transition and physical risks associated with climate change.

Listen in as Lydia Ofori, CFA, CAIA, Adam Duncan, and Keith Black, PhD, CFA, CAIA, FDP discuss how machines are interfacing with humans to effect manager selection and private asset secondary sales. The webinar discusses key questions that sit across technology and finance:

• Can machines actually uncover hidden patterns that escape the human eye and emotions?

• How would the interface between technology applications enhance our ability to pick the best managers and companies?

• What are the limitations on artificial intelligence and other machine learning based models that are most likely to hinder or interrupt results?

• Can AI be used to expedite the secondary sale of private assets?

In this presentation, Keith Black discussed the digital asset and cryptocurrency markets and the innovative solution to build a global, decentralized, and secure network that facilitates payments and other transactions. Keith explored how proof-of-work, such as Bitcoin mining, and proof-of-stake protocols, such as Cardano, are used to secure networks and complete transactions. Behind many of these currencies are real businesses, such as projects built on top of Ethereum smart contracts that facilitate borrowing and lending as well as options and futures trading. Stable coins pegged to USD or EUR can earn yields of up to 7% with minimal volatility. Returns and volatility data was presented, as well as evidence on how digital assets can add return to a diversified portfolio without adding to portfolio volatility. Risks of digital assets were also discussed, including regulatory risks, technology risk, and valuation risk.

ESG is no longer a mere add-on in a portfolio or investment strategy. For an increasing number of investors in alternatives, a thoughtful approach to ESG issues has become table stakes. As the industry continues to define the role of ESG and develop approaches to measure and analyze the effect of these issues on their portfolios, industry professionals must continue to educate themselves about the key trends and developments related to ESG across alternative asset classes. CAIA, in partnership with Nuveen, hosted a thought-provoking webinar series organized exclusively for the benefit of institutional investors across the world. In the second session, we discussed how general partners and limited partners can better align themselves around material ESG issues.

In this presentation, Keith Black, PhD, CAIA, CFA, FDP, Managing Director of Content Strategy at the CAIA Association described and compared the many ways that entrepreneurs and their private equity owners can exit their ownership in a private company. While IPOs have declined in importance in recent years, there has been an increase in strategic mergers, financial mergers, and secondary buyouts. More recently, a growing number of companies have sought to become publicly traded through direct listings and special purpose acquisition corporations (SPACs). Keith’s presentation was followed with a discussion with Cameron Stanfill, CFA, Venture Analyst at Pitchbook Data who provided an update on SPACs and the current market environment for exits in public companies.

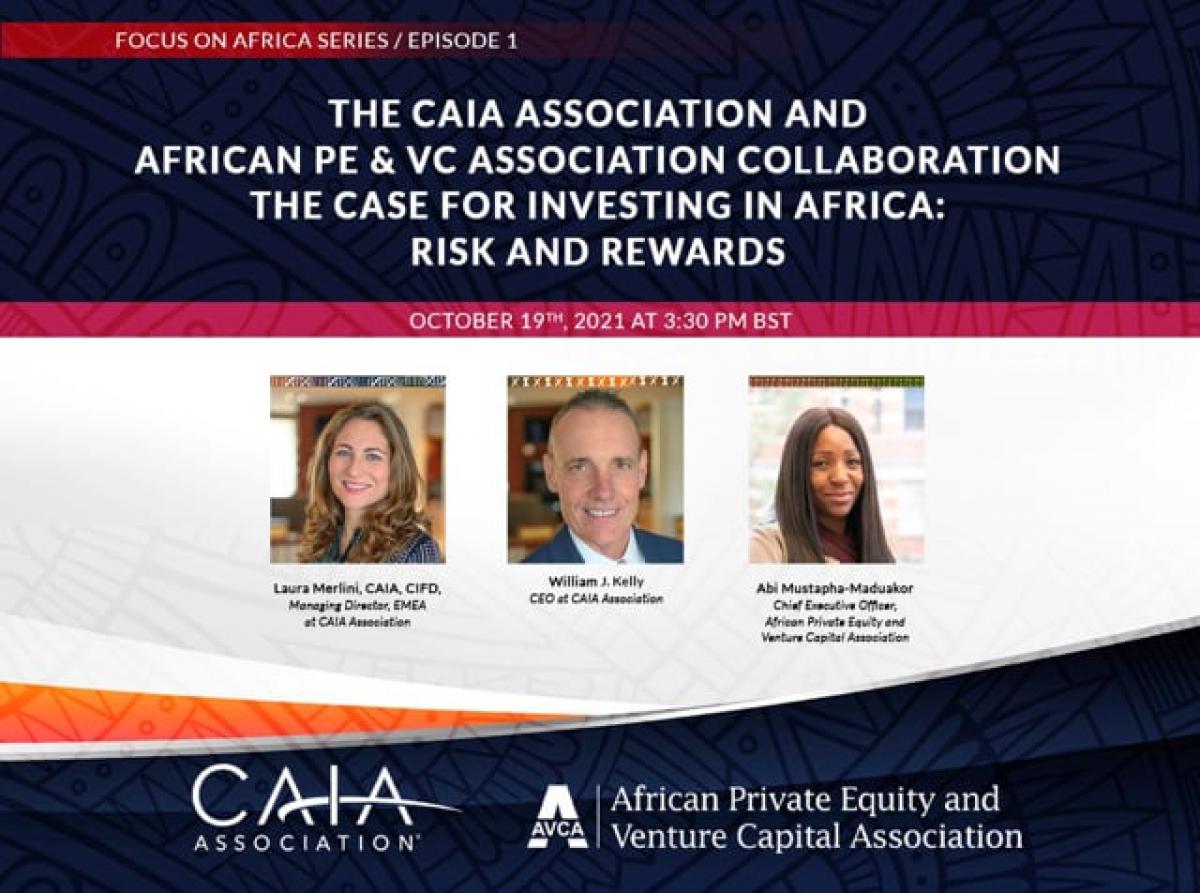

The African Private Equity and Venture Capital Association (AVCA) and the Chartered Alternative Investment Analyst (CAIA) Association hosted a fireside chat and data presentation on private equity (PE) and venture capital (VC) investing in Africa. William (Bill) J. Kelly, President & CEO of the CAIA Association, and Abi Mustapha-Maduakor, CEO of AVCA, discussed the opportunities and challenges that are shaping the direction of private investment in Africa, including technological and digital innovation, currency risk, and the continent’s demographic dividend. As part of the webcast, AVCA’s CEO presented AVCA's latest research and findings from the 2021 H1 African PE Data Tracker, providing a provisional look at investment, exits and fundraising activity in Africa in the first half of the year.