Recorded Webcasts

Many investors have moved from investing in Private Equity funds to directly investing in Private Equity. What is driving this trend? What is the investment performance for the investors who have moved into direct PE investing? What are the requisites before considering direct PE investing?

The SPAC wave in the U.S has captured the attention of global financial markets. Different exchanges are exploring ways to offer SPAC listing. What must investors consider when investing into a SPAC? How does SPAC compare against traditional IPO and Private Equity?

A conversation between Andy Ross, CFA, FRM, CAIA, Senior Director at Pacific Asset Management and Aaron Filbeck, CFA, CAIA, CIPM, FDP on CLOs. In this conversation, they discussed defining a collateralized loan obligation (CLO), who the players are in in the CLO market, how to evaluate CLOs, current market opportunities, and current trends in 2021.

ESG is no longer a mere add-on in a portfolio or investment strategy. For an increasing number of investors in alternatives, a thoughtful approach to ESG issues has become table stakes. As the industry continues to define the role of ESG and develop approaches to measure and analyze the effect of these issues on their portfolios, industry professionals must continue to educate themselves about the key trends and developments related to ESG across alternative asset classes.

Listen to CAIA, in partnership with Nuveen, on a thought-provoking webinar series organized exclusively for the benefit of institutional investors across the world. In this first session, we discussed the role of data and disclosure as investor interest moves to private capital. We seek to answer the overarching question: what are some of the lessons public market investors have learned that can be mitigated or avoided in private markets?

In this presentation, Aaron Filbeck discussed private equity investments, focusing on venture capital. Aaron provided insight into the life cycle and performance of venture capital funds and presented a framework for the private equity investment process, from the development of portfolio objectives, through liquidity management, and manager selection. Aaron concluded with a look at the risks involved in venture capital investments. Aaron’s presentation was followed by Rebecca who provided a presentation on venture capital updates for 2021. This presentation covered industry AUM, dry powder, fundraising, deals, and investor appetite.

In this webcast, the CAIA Association and State Street Associates discussed biases in private equity valuations. Private equity funds and portfolio company valuation appraisals are often subject to certain biases, which can lead to a smoothed time series of returns and understated risks if adjustments are not made. This discussion examined some of the common biases and how practitioners can adjust for them.

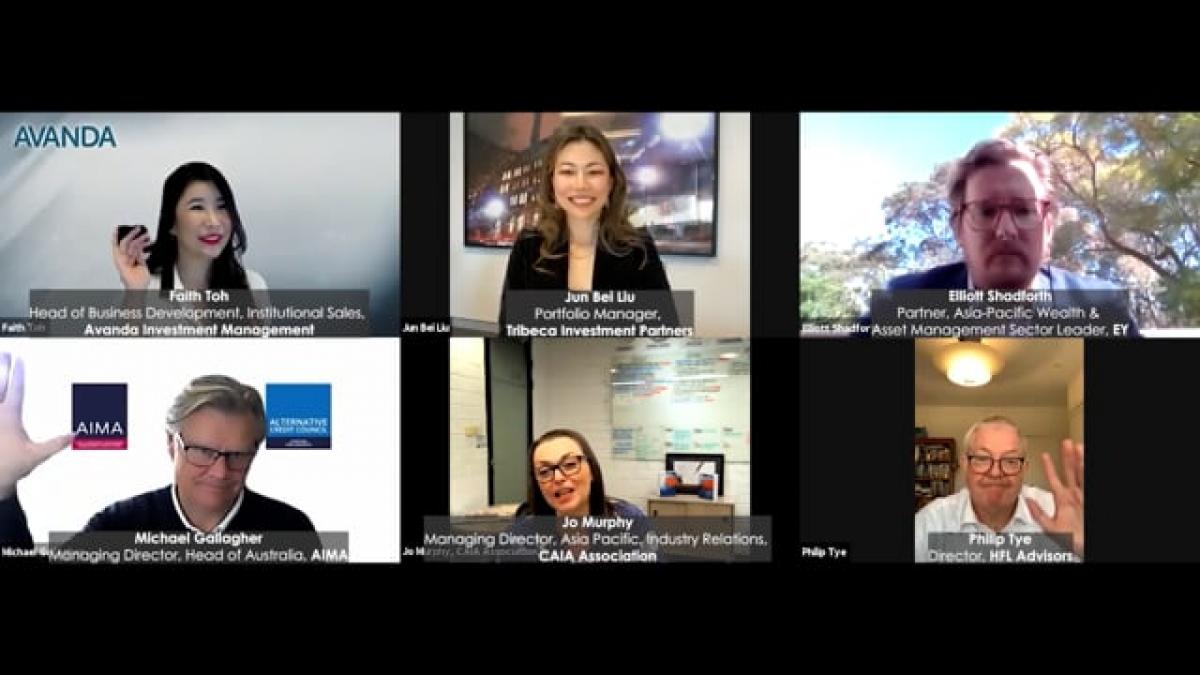

Listen as this group of experts aim to provide interns with a view to different paths a career in this industry can take. The panel discusses both investment and non investment roles in the hedge fund and private credit industry.

Listen to this insightful discussion on the characteristics of hedge funds and an overview of funds by age, domicile, and concentrations across the hedge fund universe. An overview of environmental, social, and governance investing (ESG) will also be shared, along with the history of ESG investing, and much more.

The world of alternative investments continues to grow and change. Nearly US$10 trillion in assets have flowed into the alternative investment industry in the last fifteen years. Now alternative investments are starting to show up in mutual funds and ETFs. What might the future hold?

Description: On average, venture capital and buyout funds experience a performance falloff after seven to eight years, while the cross-sectional dispersion amongst them increases. Join the authors of “The Evolution of Private Equity Fund Value”, published in The Journal of Alternative Investments, as they discussed their research findings, which represents the first large-sample analysis of buyout and venture capital fund values over their lifetimes.

Panelists: Jian Zhang, PhD, CFA, Partner, Investment Strategy and Risk Management, Adams Street, Gregory Brown, PhD, Professor of Finance, Director of the Frank Hawkins Kenan Institute of Private Enterprise, University of North Carolina at Chapel Hill, and moderated by Jack Wu, CFA, CAIA, Director of Content APAC, CAIA Association