Recorded Webcasts

A lot has happened in digital assets over the past few months. While broader prices have rebounded after 2022's drawdown, regulatory bodies still maintain disparate attitudes on how this technology should be regulated. Similarly, the ways in which clients can access digital assets continues to evolve, yet differ, around the world. How do these challenges impact the future of the technology, and what are the implications for portfolios? We discussed some of these relevant topics that remain top of mind for investors, discussed some frameworks for adoption in client portfolios, and finished with some vision-casting of where the industry is expected to go over the coming years.

With a total outstanding balance of more than $8 trillion, agency mortgage-backed securities (MBS) represent the second largest segment of the US bond market and the second most liquid fixed-income market after US Treasuries. Institutional investors have long participated in this market to take advantage of its attractive spread over US Treasuries, low credit risk, low transaction cost, and the ability to transact large quantities with ease. MBS are made of individual mortgages extended to US homeowners. The ability for a homeowner to refinance at any point introduces complexity in prepayment analysis and investing in the MBS sector. Traditional prepayment modeling has been able to capture many of the relationships between prepayments and related factors such as the level of interest rates and the value of the embedded prepayment option, yet the manual nature of variable construction and sheer amount of available data make it difficult to capture the dynamics of extremely complex systems. The long history and large amount of data available in MBS make it a prime candidate to leverage machine learning (ML) algorithms to better explain complex relationships between various macro- and microeconomic factors and MBS prepayments.

To support FDP Candidates and those considering the pursuit of the FDP Charter, we offered a brief, live webinar with our Curriculum and Operations team members to help prepare you for your exam experience. We discussed curriculum materials, Learning Objectives and provided a Practice Question review. We went over the exam structure and format, and available resources. In addition, we shared tips to prepare for exam day and what items are permitted during the exam. Formal remarks of the presentation lasted approximately 45 minutes, with 15 minutes of Q&A.

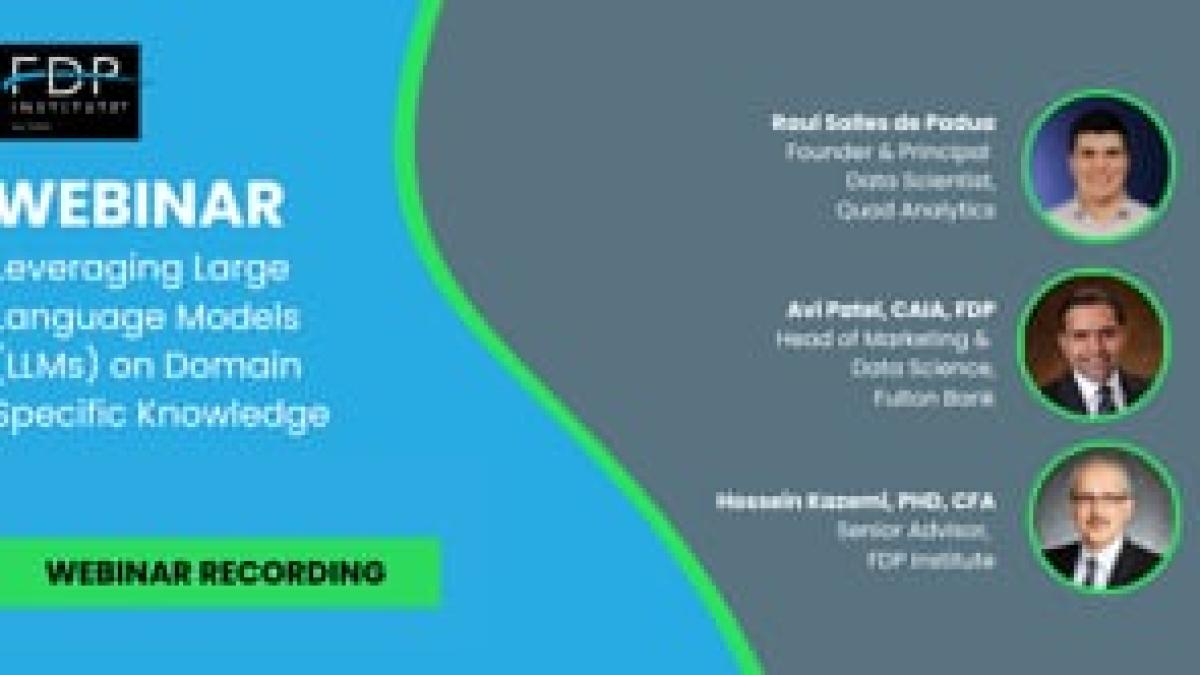

Large language models such as Bard and ChatGPT are rooted in natural language processing models developed decades earlier. How did we get here? This presentation took us through this fascinating journey. Dr. Hossein Kazemi moderated this presentation with Avi Patel and Raul Salles de Padua who took us on a brief journey through the evolution in NLU and NLP, from word embeddings to the current state of LLMs. We shared how to leverage adoption of LLMs, Generative AI capabilities and better understand the LLM-Ops lifecycle. Finally, we demonstrated the art of the possible with LLMs in action.

Didier Rodrigues Lopes, Founder & CEO of OpenBB discussed his journey from the pain points of doing investment research and how this led him to start building his own investment research platform in Python and raising $8.8M to democratize investment research through open source. He introduced the OpenBB Terminal - the open source investment research platform, and some of its capabilities. In addition, he presented the OpenBB SDK which allows programmatic access to the data from the OpenBB Terminal, allowing quants, analysts and developers to build custom tools and dashboards. Dr. Hossein Kazemi, Senior Advisor for CAIA Association and FDP Institute moderated the session and Cordell Tanny, Founder & CEO of Trend Prophets showed how he uses OpenBB to replicate some advanced Bloomberg charting techniques required for macroeconomic analysis.

CAIA LatAm & CFA Society Colombia Present: Elevate your Career in Finance - Unleashing the Power of Professional Designations

Listen in on this lively conversation about the importance and added value of pursuing professional designations. The panelists discussed employer's hiring preferences, trends, personal experiences, and career advice.

In a world where artificial intelligence is becoming complex and gaining influence, creating and using a machine learning model is not only a technical endeavor but also a personal journey of exploration, challenges, and growth. Tom Pickel shared his journey of building a neural network from the ground up. Tom shared his experience in creating a neural network using Python’s basic data science packages (Numpy and Pandas) for trying to predict movements in the stock market. We mentioned loading data from stock markets, creating the Features and dataset, training networks, k-fold cross validation, choosing the best architectures, backtesting, choosing a trading strategy and more. This webinar presentation is intended for anyone who is interested in learning more about neural networks. No prior experience with neural networks is required, and perhaps it will enable participants to embark on their own journey towards developing their own machine learning models.

Alik Sokolov and Kathryn Wilkens discussed the revolution of natural language processing in recent years, and how it applies to various areas of investment management. Our ability to work with unstructured text data, which is abundant in investment management, has undergone several evolutions from the late 2010's: from sequence-to-sequence models for machine translation, to the advent of transformers and transfer learning, to the recent breakthroughs achieved by Large Language Models popularized by Chat GPT. These changes will have a profound impact on investment management, and we will examine several case studies and applications. We also examined the long-term future of various investment and wealth management roles, and especially the long-term impact on ESG and responsible investing.